When you begin your journey in payments, you can easily feel overwhelmed because of the many types of payments and payments systems available out there. How to easily understand what they are and how to differentiate them?

In this article, we revisit one key concept and explain the differences between SEPA Payments, UK Faster Payments and SWIFT Payments.

The key concept is about the categories of payments. Payments can be grouped in two categories: Domestic and International Payments.

Domestic and International Payments

A domestic payment is an electronic funds transfer that is carried out in the same country or the same monetary zone (Country and monetary zone can be used interchangeably in this article). And the transfer is in the currency of the country. Domestic payments share the same market infrastructures. They go through clearing and settlement systems that support the currency of that country and are under the supervision of the central bank of that country.

Everything else is an international or cross border payment. A cross border payment involves at least two countries or monetary zones. The currency can be:

- the one of the Sending party (Example: a AUD Transfer from Australia to UK)

- or the one of the receiving party (a GBP Transfer from Canada to UK)

- or any other currency (a USD Transfer from UK to China)

UK Faster Payments and SEPA Payments

UK Faster payments are used for rapid fund Transfer in GBP between two accounts located in UK. A faster payments cannot happen between UK and Germany or between UK and Denmark. It is one method to transfer funds in the UK. It has become the standard because it allows to transfer funds in a matter of seconds. Another method is the BACS payment. But BACS transfers take three (long) days and Faster payments were introduced to provide a better alternative.

What about SEPA Payments?

SEPA payments are transfers in Euro between accounts located in the SEPA Area. The SEPA Area is a monetory zone with currently 36 countries. As said above, these countries share the same market infrastructures that support Euro and are under the supervision of the European Central Bank.

In this article you find detailed information about SEPA Schemes and Payments Instruments.

At this stage we understand that UK Faster payments and SEPA are domestic payments.

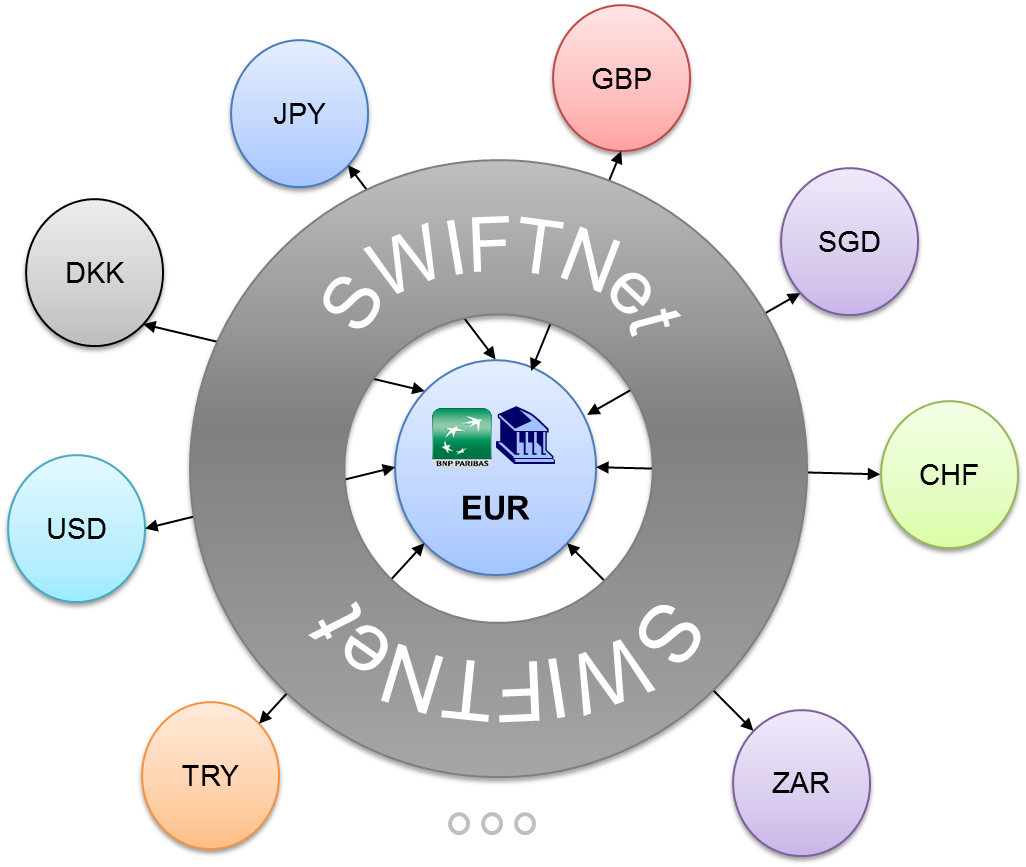

SWIFT Payments

Now let’s consider SWIFT. SWIFT is a network that facilitates the cross border funds transfer. Many believe SWIFT is a payment system, but that is not the case. SWIFT does not hold any accounts nor any funds. SWIFT operates a global network interconnecting financial and non-financial institutions and allowing them to exchange payments messages and instructions in a secured way. The funds are kept on bank accounts. The SWIFT messages do not carry the funds. They are standardized instructions saying what should happen with the funds. You can see SWIFT like a network interconnecting the market infrastructures of all the monetary zones in the world.

In this blog, there are five detailed articles about SWIFT. Read them if you want to understand more about SWIFT. I think it is a good reading since we received excellent feedback.

- 4 key strategies to understand how cross border payments work

- Strategy #1 to understand how cross border payments work

- Strategy #2 to understand how cross border payments work

- Strategy #3 to understand how cross border payments work

- Strategy #4 to understand how cross border payments work

In summary, UK faster payments and SEPA Payments are domestic payments used respectively in UK and in the SEPA Area. SWIFT is a global network used for the secure exchange of payment instructions between the different monetary zones. SWIFT is not a payment system. It provides standards to improve the communication in the financial industry and facilitates cross border payments.

Thanks JP for a crisp overview about the various faster payments schemes. Please help us understand Faster Payments UK further w.r.t. the message types used and payments flow in your upcoming blogs.

Cheers and keep enlightening us 🙂

Thank you Praveen. I really appreciate your encouragements! 🙂

Thanks JP Sir ,could you please provide us more detail about faster payment in UK which messages basically use in that and complete flow

Dear Jean Paul

Kindly explain me more about the SWIFT.COM payment please!

I wonder what is MT103/202COV? Why do funder need to use it for their fund transfer?

Hope you detail and reply me.

My regards

You are the best author I’ve ever met, the articles are very informative and comprehensive ! I am working in a company which provides payment hub solutions for banks, you helped me so much to understand the business I am working in.

Thank you very much for your appreciation!

awesome

Thats a fantastic article JP. It’s nice, short, crisp and precise to the point.

People new to payments should find it very easier.

Hi Paul, this article definitely gives me a bigger picture and better clarity in the Domestic and Cross border payments.

Thanks a ton for helping us in our learning journey.

Thank you! I am happy things are clear for you now.

Very Very clear articles and videos’ that you publish. Please keep helping us like this by publishing such articles 🙂 🙂

Thank you very much Krithika. I appreciate your comment. 🙂

What is SEPA B2B and Core??

SEPA Direct Debit Business to Business and SEPA Direct Debit Core

Please read this article.

good article, It helped to fill few gaps in my understanding. thanks

Thank you very much for your appreciation!

Hi,

Can you please tell, how Dispute, Cancellation of payment or Recall works? And Can you explain about Payment engine like Global Pay Plus (GPP) on this?

Regards,

Bibhas

Please read this article.

Hi JP,

Thank you very much for this article. Really helps a lot.

Can you also share the message which are transferred between the banks in the UK FPS and BACS?

Thanks in advance.

Hi Venkat, There are few articles on this blog where messages exchanged in the SEPA schemes are presented. SEPA uses ISO 20022 messages and FPS and BACS are moving to the ISO 20022 standard.

If you understand the messages exchanged in SEPA, you will easily understand the rest. For messages exchanged in BACS, I refer you to the following documentation.

For FPS, you need an account on their platform.

Can you please give a idea on chaps payment in UK and also confirm chaps can be used for cross border payment?

I am working with a bank and about to give interview for job change. Your article is really helpful for me to actually understand the concept now.

Can you write an article with everything from scratch on SWIFT payment and how it works. Also could you refer me any website which could help me in understanding these payment systems from testing perspective as I am supposed to test these systems.

Nice to read the articles are helpful. There are many articles on the blog explaining how SWIFT messages work. Just go through them. 🙂

can we initiate a SEPA payment using the SWIFT message? Like using MT101?

TARGET2 can be used for cross border payments?

The answer is yes. A SEPA payment is independent of the format. It can be initiated with a SWIFT Message, an edifact message and so on.

Dear Jean Paul,

Do you have an idea of what percentage of GBP transfers are made via SWIFT and what percentage via Faster Payments? GBP is not as popular as USD and I am trying to figure out if GBP is only used in the UK or is there a large enough percentage of transfers around the world via SWIFT?

Thank you so much!

Hi Cheslav, Unfortunately I do not have the answers. Check general statistics about USD and GBP transactions. In general USD represents about 40-50% and GBP about 7% of the total transactions on the FOREX. It gives an idea. However, GPP is only used in the UK. Please read strategy 2 to understand how cross border payments work.

I hope this helps.

Really Liked your way of explanations.

Thanks JP. I found many of your blogs were simple to understand. Personally I worked in payments industry quite long back and a very good opportunity knocked in front of me for better role in this industry. I went through SPA and SWIFT blogs of yours and actually it helped to me to crack the interview. I was able to recollect all the required information from your blogs.

If possible can you please provide information on admin, echo, remittance messages.

Keep up the good work.

Cheers!!!

Thanks Jean for this short and crisp article that makes things clear for newbies in payments like me.

I have two questions though:

1. When we have Faster Payment established now, why is BACS still the most preferred way of payments domestically.

2. How does Wise (formerly transferwise) make international payments without SWIFT Codes. Do they use some other payment method?

Every time i come across this site i learn some thing new. thanks a lot jean for putting so much effort to make payments easy for everyone

Hi JP,

I learnt payments from your site, thank you very much.

Please do you have any log on Fedwire?

Hi Jean,

Thanks for sharing imp summary to understand the fundamentals in such simpler way.

{Jean Paul August 10, 2020 At 8:21 pm

The answer is yes. A SEPA payment is independent of the format. It can be initiated with a SWIFT Message, an edifact message and so on.}

One question here when you say SEPA payments are format independent, does it mean MT103 equivalent to Pacs.008 SCT can be sent to EBA? Not sure if EBA can understand the file format except ICF.. SCF etc ? Or may be you are referring RTGS payments to Target 2.

Please help me to understand thanks.

Receiver or Mandate needed for MT103 direct cash transfer

Ratio:

Receiver:45%.

Mandate: 10%

Sender: 45%

First trenche: $1 million dollars

Total amount: $100 million dollars

Please note: Senders only need real and genuine Receiver and Mandate (USA, Canada, China, Singapore, Malaysia, Indonesia, South Africa, Philippines, etc)

Interested receiver must send CIS for due diligence after that receiver will be sent the DOA contract.

Message on email: witchapastang@gmail.com