The series of articles about strategies to understand how cross border payments work is coming to the end. The introductory article and the article about the first, second and third strategy contain valuable information to connect the dots. It is strongly recommended to read them to get the overview and a better understanding of this article.

This article is about the fourth strategy to understand how cross border payments work: study the basics of Foreign Exchange markets and how banks use them. After looking at currency quotations, we will see that banks belong to major players in the FX markets and then explain what bid rate, ask rate and currency tenor are. In the last paragraph, we will see when banks trade in the FX market and why. Let’s begin.

Currency quotations

The foreign exchange market, simply called FOREX, is the place where supply and demand of currencies meet. A transaction in the FOREX market always involve the buying of one currency and the simultaneous selling of another currency. That is why currencies are always quoted in pairs. An FX rate quotation (e.g. EUR/USD or USD/EUR) expresses the amount of money that can be bought of a certain currency in terms of another currency.

In the quotation EUR/USD = 1.1635

- EUR is Base currency. The currency that is actually traded in exchange of USD. If you buy EUR/USD, you get USD and give EUR. If you sell EUR/USD, it is the opposite. You give USD and receive EUR.

- USD is the Quote currency or Price currency. The currency that is used to determine the base currency value.

- 1.1635 is the Quote itself. It shows the amount of quote currency units needed to acquire one unit of the base currency. In this case, 1.1635 USD are needed to acquire 1 EUR. This quote tells us that EUR is stronger than USD because it is greater than 1.

Direct Quotation / Direct Currency Quote

A direct currency quote is a currency pair in which the domestic currency is the quoted currency. For example, if EUR is the domestic currency, a direct quote would be 0.8632 USD/EUR. It means that 1 USD will purchase 0.8632 EUR. With direct quotation, people are interested in knowing how much of local currency can one unit of foreign currency purchase. The direct quotation is the preferred method for americans.

Indirect Quotation / Indirect Currency Quote

In the indirect quote, the foreign currency is variable and the domestic currency is fixed at one unit. The indirect quote for the previous quote would be the inverse (1/0.8632), 1.1584 EUR/USD, which means with 1 EUR, you can purchase 1.1584 USD. With indirect quotation, people are interested in knowing how much of foreign currency can one unit of local currency purchase.The indirect quotation is the preferred method for europeans.

[box type=”note”]In summary, a price or quote currency is always the second currency quoted in a currency pair in forex. In a direct quote, the quote currency is the domestic currency. In an indirect quote, the quote currency is the foreign currency.[/box]

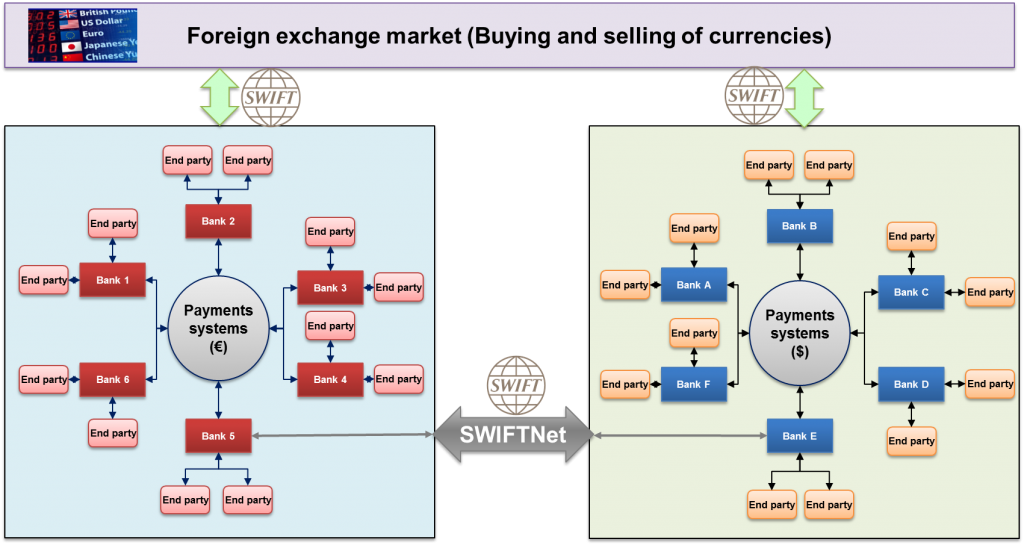

To trade currencies, banks need to access the foreign currency market.

Banks and the FX markets

The banks in the different countries belong to the main players of the FX market. They access the market to trade the currencies on behalf of their customer or for themselves.

As we can see on the picture above, Banks mainly use the SWIFT network as well to transmit orders to the FX market in faster and secure way. We meet SWIFT again :-). When a foreign currency is bought or sold, the correspondent account of the bank in that currency is debited or credited. This is a key point. Before a bank trades a foreign currency, it must have an account in that currency. It does not credit accounts in own books with funds in foreign currency. That would correspond to putting money into a black hole :-).

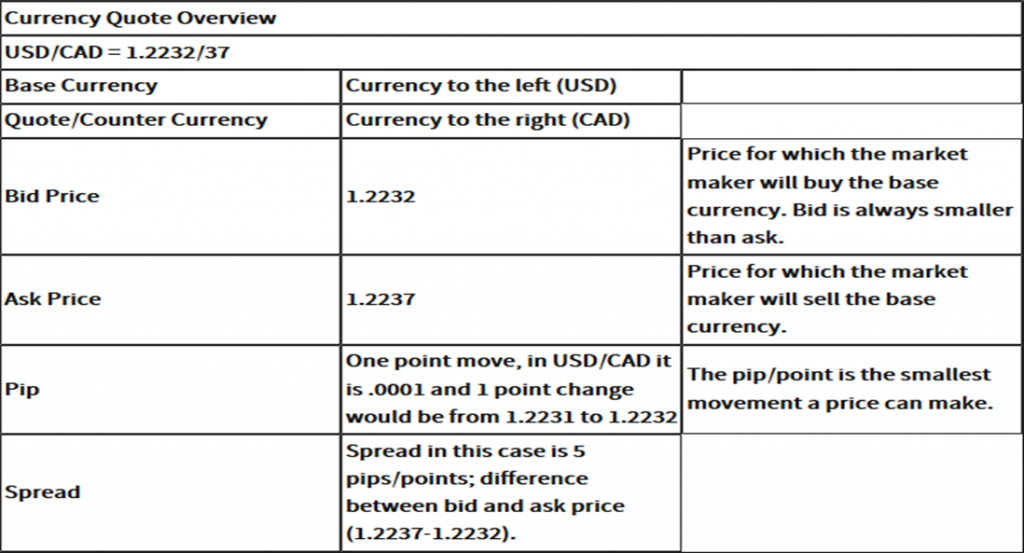

Banks make money on the FX markets by “playing” with the exchange rates. They buy at bid rate and sell at ask rate. There are always bid price and ask price for a currency pair. The difference between ask and bid price is called the spread. The below currency quote overview for USD/CAD illustrates these concepts.

Let’s now take a closer look into Bid and Ask rates.

Bid rates and ask rates

A currency pair has two rates (or prices): the bid or buy rate also called ask or sell rate. A bank or any dealer always buys at a lower rate and sells at a higher rate. Otherwise, it will soon be out of business. :-).

Now consider the following very carefully.

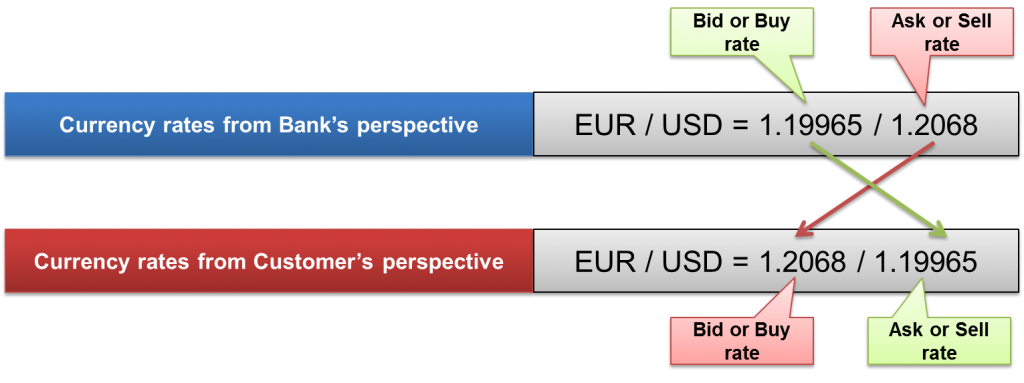

[box type=”info” size=”large” style=”rounded”]When you look at rates, it is always important to understand from whose perspective you are looking at them. [/box]

Below is a picture to show you why it is so crucial.

Bid rate is lower than Ask rate for the bank. But for customers, it is exactly the opposite. The customer buys at a higher rate and sells at a lower rate. Bank and customers transactions are always symmetrical. When the customer sells, the bank buys. And when the customer buys, the bank sells. The bank therefore always makes money, no matter if the customer is buying or selling. The margins that a bank makes on FX transactions may vary with the different types of customers. After a currency trading deal, the customer does not get the funds right away. This brings us to another key concept in FX: the currency tenor.

Currency tenor

The currency tenor is the period of time until the FX Deal is settled. After a trading, the funds are not transferred immediately. The settlement, the actual transfer of the funds involved in the transaction, happens at the currency tenor. The tenor indicates the date at which a foreign currency is available for the buyer or taken away from the seller. The tenor takes 3 values: today, tomorrow and spot with the following meaning.

- Today: If the trading is carried out today before the FX cut-off time, the settlement happens today.

- Tomorrow: If the trading is carried out today before the FX cut-off time, the settlement happens tomorrow.

- Spot: If the trading is carried out today before the FX cut-off time, the settlement happens in two days or more.

Remark: the FX cut-off time of a day D is the time after which the bank moves to the next day (D+1) and cannot accept transaction anymore for the day D. If the FX cut-off is 14:00 for example, all orders arrived before 14:00 will be accepted for today. But the orders arriving after 14:00 cannot be accepted for today anymore.

Only few currencies can be traded and settled on the same day. That is the case for major currencies (In the second article, major, minor and exotic currencies are presented.). For the majority of currencies, the settlement happens one or two days after the trading day. It is important to note that the same currency can be traded with today, tomorrow or spot rate.

When do banks go to the FX market?

Banks do not send orders to the FOREX Market everytime a customer instructs them to perform a transaction in foreign currency. That would be too costly and inefficient. Instead of that, Banks collect all the FX instructions until a point in time and then looks at the FX account position to determine if they need to buy the foreign currency (In case there is too little on the account) or if they need to sell it (In case there is too much on the account).

There are four major things that can impact the position of an FX account (let’s take a USD account for example):

- Customers instruct the bank to send USD which results in the debit of its USD correspondent account.

- Bank receives USD on behalf of a customer and this results in the USD correspondent account being credited

- Bank pays in USD for its own operation (USD correspondent account is debited)

- Bank receives USD for its own operation (USD correspondent account is credited)

Every transaction impacts the correspondent account and the related mirror account. Mirror accounts were introduced in the strategy #2. Mirror accounts and statements provided by the correspondent banks are useful for the treasury to get a precise view of the situation.

At specific time (once a day in general), the treasury department looks at the position of the USD correspondent account. Has it received enough, too much or too less USD today to cover the debit transactions? Depending on the answer, the bank will go to the FX market and buy or sell USD.

[box type=”info” size=”large” style=”rounded”]The treasury department does the same exercice for all currencies in which the bank holds a Nostro account.[/box]

Exception to the above stated rule

In some cases, a bank may immediately access the market and trade a currency. It will not wait until the time where the treasury looks at the currency account positions. That is the case generally for unusually high amount transactions.

Let’s take an example. A corporate customer wants to pay 10 millions USD to a supplier in the USA. The bank may go directly to the FX market and buy USD because the transaction amount is very high and funds may not be available on the USD account to cover the transaction.

This ends the series of articles about strategies to understand how cross border payments work. Did you notice that we have not looked into one single SWIFT MT message yet? But we have laid the foundations to understand them easier and faster as we will see later. I hope you enjoyed reading them as much as I enjoyed preparing and writting them. Like this page, subcribe to the newsletter and share the articles.

Lovely article…the order of events, the narration and example…Perfection

Thank you so much

Good read. Thanks for the effort.

Thank you Sachin. Great to see that the effort is useful.

Hi Paul, in the “Currency Tenor” paragraph there is, probably, a mistake. The “Tomorrow” tenor value claims: “If the trading is carried out today before the FX cut-off time”, it should be “If the trading is carried out today after the FX cut-off time” 🙂

Again thanks for this articles. I am currently on a difficult “training-on-the-job” in a stormy cash deparment but my knowledge in the “wonderful world” of payments is starting, pratically, from scratch 🙂

If you will open a “Q&A” space on your blog I have some questions in the queue!

Dear Alberico,

Thank you for reading carefully. I checked it again. It is not a mistake, it is correct.

Since the tenor is tomorrow or D+1, the transaction must be executed the day before and before the cut-off. If the transaction is executed after the cut-off, the settlement will happen 2 days later since after the cut-off, you are tomorrow.

When the tenor is 2 days or D+2, the transaction must be executed two days before and before the cut-off too.

I hope it is clear now. If not, let me know. I can draw a picture if necessary.

You are probably suggesting to open a forum. It will come in the future. For now, if you have question, you can use the contact form and I would be happy to help.

Best regards, Jean Paul

As always you are right 🙂 My mistake was reading the tenor value from the point of view of the time of arrival of the instructions of payment. If the message arrives today (T) but after the cut-off then it will be processed in T+1. I should re-reading carefully 🙂

This is simply fantastic – this whole 4 strategies..so articulate and perfectly explained. Thanks so much for these articles.

Thank you for your appreciation!

Hi Paul,

Excellent article. Really helpful in understanding basics of forex.

I had a couple of questions, can you please have a look:

1. As per my understanding ask rate is the rate at which once can buy base currency. Customer always pay higher ask rate and received lower bid rate. But the figure which explains the bid rate/ask rate from the perspective of Bank/Customer depicts a lower ask rate (1.19965) and a higher bid rate (1.2068). Doesn’t this mean that customer can buy USD at 1.19965 and see them at 1.2068?

2. The summary section for direct quote/indirect quote mentions that for direct quote, price currency would be the foreign currency. Shouldn’t the price currency be domestic currency for direct quote?

Dear Shijil,

Nice to hear from you. Thanks for your appreciation.

1. I have a Mnemonic Method to remember this. Bid = Buy and Ask = Sell.

The ask rate is the rate at which the currency is sold. In payments, prices are set by the bank. The bank buys from the customer (not from the FX market) at 1.19965 and sells to him at 1.2068. If the bank sells at 1.2068, the customer buys at that rate. The Bank determines the currency prices and always makes money.

So first consider what the bank does and I think it will ease the understanding.

2. Not sure to which section you are referring to. I wrote this : “A direct currency quote is a currency pair in which the domestic currency is the quoted currency.” Domestic currency = Price currency. So What you say is totally correct. I think I say the same thing in the article.

Looking forward to hearing from you.

The series of articles about cross border payments are very helpful to me. Thanks a lot!

I am happy to see that you like the articles. Keep reading the blog and you will save precious time in your payments journey!

Really comprehensive introduction. Thank you for such a great sharing!

Happy to read that! Thank you for your appreciation.

Hi Jean,

Excellent series! Gem of a website! Not just this series but all articles are top-notch!

You’re doing a great service to the world by sharing your knowledge in such a curated and open manner. No words are enough to thank you for your time, efforts and patience.

Really appreciate this! Hats off!

Regards,

Ani

Thank you very much Ani for your appreciation!

Good to have all important aspect covered at one place.. thanks for the article.

Dear Jean-Paul,

I have only just discovered your site, which looks great however you might confuse some people when you explain BID/ASK prices since you do the one thing that never happens via. exchanging places for the prices; the BID price is always on the left and the ASK on the right. The difference is that for the customer, they must apply the BID price when they sell the BASE currency and the ASK price when they buy it. As a consequence, a base currency exporter (in your example a Eurozone one) will always look at the ask price, whereas the BASE currency importer (in your example a Eurozone one) will look at the BID price.

All the best

Wonderful articles Jean and very well articulated to explain things at a high level even for a layman 🙂 Thanks a ton for your efforts!!

Thank you very much for your appreciation.

Explaining things is an Art , and you have mastered it .Thanks for such a simple and clear explanation.

Looking forward to learn a lot from you

Really insightful article brother.

I had a question when the treasury department settles the debit USD balance in the mirror account from buying from the foreign exchange market. How does the fund settle in the corresponding bank account in the foreign country when the treasury team is trading in the forex market in the home country?

Nice and easy read .. your great summary & explanation.

One question on the Currency quotation example mentioned :

In the quotation EUR/USD = 1.1635

EUR is Base currency. The currency that is actually traded in exchange of USD. If you buy EUR/USD, you get USD and give EUR. If you sell EUR/USD, it is the opposite. You give USD and receive EUR.

Just a bit confused here …

Since the buy and sell are on the base currency, If you buy EUR/USD you should get EUR and give EUR and opposite for a sell – correct ?

[…] Cross Border Payments 4 […]

Today: If the trading is carried out today before the FX cut-off time, the settlement happens today.

Tomorrow: If the trading is carried out today before the FX cut-off time, the settlement happens tomorrow.

Spot: If the trading is carried out today before the FX cut-off time, the settlement happens in two days or more.

–> Seems like 1st 2 lines are same. Kindly cross check