Another prominent payment technique used in international trade is the Standby Letter of Credit. What is a Standby Letter of Credit (SBLC)? How is it different from a Letter of Credit? How do issuance and notification of a Standby Letter of Credit work? … This article provides the answers to these questions.

We already know what a Letter of Credit is. It is another naming for the documentary credit that was analyzed in the preceding articles. The key to understanding this payment technique is therefore the word Standby. In the Cambridge dictionary, it reads about that word:

- Something that is always ready for use, especially if a regular one fails.

- When a person or a thing is on standby, they are ready to be used if necessary

A Standby Letter of Credit is therefore a Letter of Credit that is ready to be used if required. Now let’s consider its definition.

What is a Standby Letter of Credit?

The Standby Letter of Credit (SBLC) is a guarantee issued by the importer’s bank, in favor of the exporter, for an amount agreed at the signing of the commercial contract. It provides a guarantee to the exporter that, if due to any circumstances, the importer is unable to pay, then the bank will make the payment.

The Standby Letter of Credit is used as an insurance against the risk of non-payment. It is intended for preventing contracts from going unfulfilled in case the importer declares bankruptcy or is unable to pay for goods or services provided. Like an insurance, a Standby Letter of Credit is not put into play when everything goes well. However when a bank issues a SBLC on the request of a business, it proves that the business’ credit quality and repayment abilities to some extent.

The Standby Letter of Credit was created in the United States to circumvent US banking legislation that prohibits banks from issuing guarantees and surety bonds. Only insurance companies or similar companies are legally allowed to issue them in the USA. The US banking system has circumvented this prohibition by issuing guarantees requiring the submission of certain documents to make them work.

There are two types of Standby Letters of Credit: Performance SBLC and Financial SBLC.

-

A Performance Standby Letter of Credit is issued to ensure that nonfinancial contractual obligations are performed in a timely and satisfactory manner. These obligations can be related to the quality of work, amount of work, delivery time, asn. In case they are not met, the bank will pay the beneficiary in full.

-

A Financial Standby Letter of Credit, on the other hand, is issued to ensure that financial contractual obligations are fulfilled. That means the importer pays on time provided he has received all the goods and/or services from the exporter, the beneficiary of the SBLC. But a Financial SBLC can also be in favor of the exporter’s bank. Standby Letters of Credit are financial most of the time.

The standby letter of credit is often preferred over a documentary credit because it presents some advantages for both parties:

- The administrative formality is simple and not very constraining

- It allows fast and direct shipping of documents to the buyer without going through the banks

- It is adapted to all incoterms including those of the D group related to the deliveries. We will get back to Incoterms in the future.

- If it is not enforced, its cost is less than that of a Documentary Credit

- It can come to fruition in a few hours

-

etc.

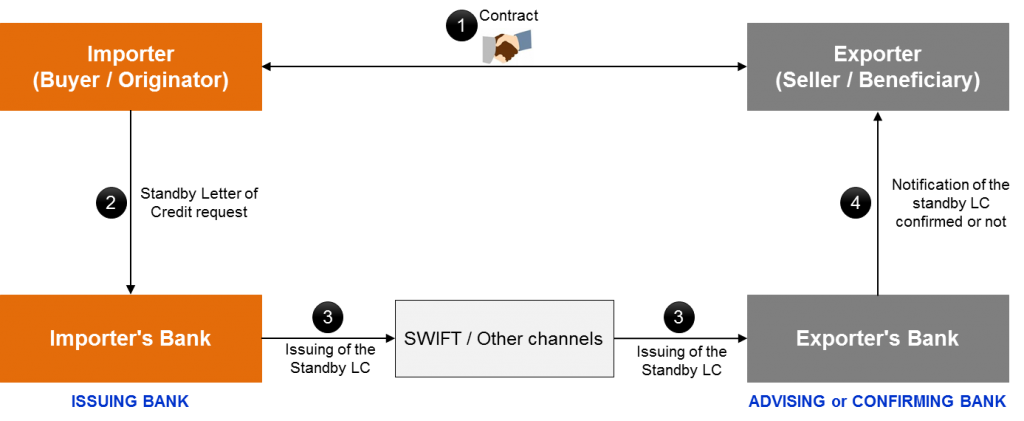

We will now consider how the issuance and notification of the standby letter of credit work. The diagram below shows the steps involved in issuing and notifying a Standby Letter of Credit. The parties involved in a SBLC are the same as the ones involved in a documentary credit. I am sure you recognize the Four Corner Model :-), our main tool to analyze payment instruments and techniques.

We consider each step in the following:

1. The signature of the contract between the exporter and the importer

This step is very important for the success of the whole operation. The two parties agree on the terms of the transaction in a contract: the goods, transport and shipping arrangements, delivery times, documents to be provided by the buyer, the payment guarantee (In this case the standby letter of credit), the payment instrument, what to do in case of dispute (Non-payment, problems on the goods, etc.).

Companies are strongly advised to seek the support of international trade professionals to avoid mistakes. Even if forms exist, it is not always easy to fill them out and the omission of an important point can put the whole operation in question.

Furthermore, it is also strongly recommended for both parties to get in touch with their banks during this phase and not after signing the contract. Banks have experience in international trade and can provide valuable advice for the smooth execution of the transaction in legal, logistical and financial terms.

2. The standby letter of credit request

The importer asks his bank to open a standby letter of credit in favor of the exporter. He hands out a letter of order to the bank where he precisely states the terms of the SBLC. It must, among other things, list the documents to be submitted by the exporter in the event of the SBLC being brought into play. The bank is very strict with the formalism of the demand. If the SBLC can refer to the contract between importer and exporter, it is important to note that under no circumstances is the bank bound by the terms of the contract.

After getting the request, the bank carries out a thorough examination of his client situation. The bank may consider that the risk is too high and reject the request if it thinks that its client will not be able to pay in case the SBLC is put into play. Sometimes the bank may require his client to block some or all of the funds or to provide collateral in other forms. If the request is accepted, the bank informs the client by mail or other means.

3. The issuance of the standby letter of credit

The importer’s bank issues the standby letter of credit in accordance with the request received from his client. The issuance of a SBLC is usually done by the transmission of a SWIFT MT 700 message if both banks are connected to the SWIFT networks. Otherwise, it is done by encrypted telex or by mailing a standardized form of the International Chamber of Commerce previously filled in. The sending of the MT 700 is the preferred solution because of the security and speed offered by the SWIFT network.

4. Notification of the standby letter of credit confirmed or not

The correspondent of the importer’s bank after getting the SBLC may add its confirmation, that is to say, commit, as the issuing bank, to make the payment under the conditions defined in the SBLC. To keep things simple, we consider that the exporter’s bank is the correspondent of the importer’s bank. But it’s not always the case.

In any case (confirmation of the SBLC or not), the correspondent notifies the exporter that a standby letter of credit is opened in his favor. He transmits the original in paper format.

As stated above, the SBLC is not intended to be used if everything works as expected. It can happen though, that the payer is unable to fulfill his obligations. In that case, what does the beneficiary do? In the next article, we will see how a standby letter of credit is brought into play.

When is a Swft 720 or 760 used in the process. It is my understanding that the Swift 760 realy blocks the SBLC into place.

Can the issuing bank monetize the sblc on the beneficiaries behalf in the event that the seller needs to purchase the goods to send to the buyer? Would the issuing bank ask for collateral from the beneficiary or seller in this instance.

Hello,

We offer Swift MT760 BG/SBLC, FC MTN, BCL, DTC, KTT, EUROCLEAR, Bank Draft, Letter of Credit (LC), MT103 Etc.

N/B : Provider’s Bank move first.

Let me know if you have any need for the above offers.

Email : richardhugo1973@gmail.com

Name: Richard Hugo

Hello,

We offer Swift MT760 BG/SBLC, FC MTN, BCL, KTT, Bank Draft, Letter of Credit (LC) , MT103, swift GPI Automatic cash Transfer, and Etc.

N/B : Provider’s Bank move first.

Let me know if you have any need for the above offers.

Thanks

Name: Richard Hugo

Email:richardhugo1973@gmail.com

WhatsApp: +44 7435 167289