Documentary credit, not to confuse with documentary collection, is the most used payment technique in international trade. It is therefore of particular interest for trade professionals. What is a documentary credit? How does it work? Who are the main actors involved in a documentary credit process? Read on to get the answers to these questions and much more.

Definition of the documentary credit

Documentary Credit is a payment technique whereby a bank commits itself, on behalf of its client (the importer), to pay to a beneficiary (the exporter) within a fixed period, the price of goods / services against the delivery by the exporter of previously agreed and compliant documents proving the value and shipment of the goods / services.

The Documentary Credit is used when the transaction amounts are very high or when one party has doubts about the morality or solvency of the other. It provides security for both the exporter and the importer. The seller (the exporter) receives an advance assurance of payment upon presentation of documents listed in the agreement, and the buyer is assured that the bank will not pay unless the seller has submitted all the documents strictly complying with the documentary credit. The credit worthiness of the importer is substituted by the guaranty of a bank (usually his own bank).

Documentary Credit, also called a Letter of Credit, is subject to the Uniform Rules and Practices of the International Chamber of Commerce. The term “Letter of Credit” or the abbreviation “L/C” is predominantly used in the USA while Europeans prefer to use “Documentary Credit” or the abbreviation “D/C”.

There are many types of documentary credits. In its main forms, a documentary credit may be revocable or irrevocable, notified or confirmed.

-

- the revocable documentary credit: It may be amended or canceled any time by the importer without the approval of the exporter. Or the importer’s bank may cancel its commitment before the goods are shipped. Given the sums generally involved, the risk for the exporter is significant (Production of goods that he will not be able to ship because the client or his bank has retracted). This explains why this form of documentray credit is almost never used in practice.

- the irrevocable documentary credit: The bank of the importer makes a firm commitment to pay. This type of documentary credit cannot be changed or canceled without the agreement of all parties. The exporter considers the irrevocable documentary credit as an order confirmation. He can start manufacturing the goods because he is assured of being paid by the importer’s banker if he meets all his commitments.

- the notified documentary credit: Notifying a documentary credit is informing its beneficiary, the exporter, that it has been issued in its favor. This notification is made by a bank (called the notifying bank or advising bank) located in the exporter’s country. It may be the exporter’s bank, but it is not always the case. When the documentary credit is notified, only the banker of the importer is committed to pay. The notifying bank credits the exporter’s account after receipt of funds from the importer’s bank.

- the confirmed documentary credit: This type of documentary credit contains a guarantee on the part of both the issuing and the notifying banks to make the payment to the seller if the terms of the documentary credit are met. Confirmation is only added to irrevocable documentary credits. The bank that gives the second guarantee is called the confirming bank. If he wants a confirmation, the applicant (the importer) must state this expressly in his documentary credit application. The confirming bank assumes the credit risk of the issuing bank as well as the political and transfer risks of the importer’s country. The confirming bank is usually the correspondent of the importer’s bank located in the country of the exporter. Without confirmation of the documentary credit, the notifying bank just forwards it to the beneficiary without taking on its own commitment.

Main actors involved in the documentary credit

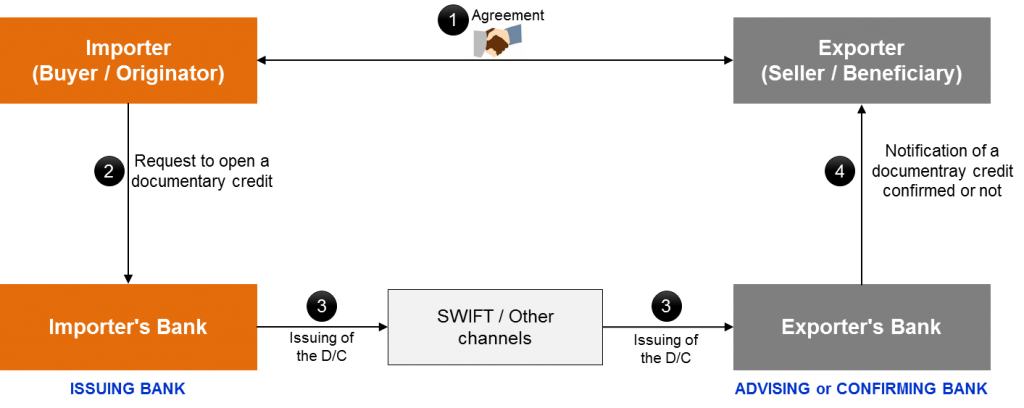

The documentary credit involves in its simplest form, four main actors (Yes, the Four Corner Model again): The importer and his bank on one side and the exporter and his bank on the other side. The importer’s bank is the issuing bank. The exporter’s bank is the notifying bank. It can be the confirming bank if it confirms the Documentary Credit.

The importer

It is the buyer who gives the instructions for opening the Documentary Credit. He is the originator of the documentary credit.

The importer’s bank

It receives instructions from the importer, the client, and opens or issues the documentary credit. That is why it is called the issuing bank.

The exporter’s bank

Located in his country, it is the bank that notifies the exporter, the beneficiary, upon receipt of the documentary credit and:

- either transmits it to him, without making any commitment. In this case, it is called the notifying bank.

- or confirms it by agreeing to add its payment commitment to that of the issuing bank. It is then called confirming bank.

Note: The importer’s bank prefers to do business with a correspondent bank in the country of the exporter. And the exporter may not be the customer of that bank. So it is not mandatory for this bank to be the bank of the exporter.

The exporter

It is the beneficiary of the documentary credit. He is the seller in favor of whom the documentary credit is open. To receive payment, he must prove compliance with his obligations by submitting all the required documents in the documentary credit to his bank.

Issuance and notification of the documentary credit

The steps required for opening and notifying a documentary credit are shown in the diagram above. Each step is examined in detail in the following.

1. The signature of the contract between the exporter and the importer

This step is very important for the success of the whole operation. The two parties agree the terms of the transaction in a contract: the goods, transport and shipping conditions, delivery times, documents to be provided by the buyer, the payment technique (in this case the documentary credit), the payment instrument, what to do in case of dispute (Non payment, problems with the goods, etc.).

It is strongly advised to seek the support of professionals of the international trade to avoid the many pitfalls and make a good and fair deal for all the parties. Even if forms can be used, it is not always easy to fill them out and the omission of an important point can put the whole operation in question.

It is also strongly recommended for both parties to get in touch their banks during this phase and not after the signature of the contract. Banks can provide them with valuable advice for the smooth execution of the transaction in legal, logistical and financial terms.

2. The request for the opening of a documentary credit

The importer asks his bank to open a documentary credit whose beneficiary is the exporter. Banks usually have many forms that the importer must complete and sign to formalize their application. In some cases, an opening application letter may be sufficient. If the documentary credit can refer to the contract, it is important to note that the bank is not bound by the terms of the contract. It must only follow the instructions given by the customer in the application form and nothing else.

After receipt of the request, the bank conducts a thorough examination of the client’s situation. The bank may feel that the transaction is too risky and reject the request. Otherwise, it may ask the client to make an advance deposit for the opening of the credit or give him a payment term on his usual line of credit.

3. The issue of the documentary credit

The importer’s bank issues the documentary credit in accordance with the application received from his client. When credit is irrevocable, this step puts all the mechanics in motion. The bank can no longer retract and it commits to pay the beneficiary against the delivery of the documents listed in the documentary credit.

The issuance of the documentary credit is usually done by transmission of an MT 700 message if both banks are connected to the SWIFT networks. Otherwise, it is done by encrypted telex or by mailing a standardized completed form of the International Chamber of Commerce. The sending of the MT 700 is the preferred solution because of the security and speed offered by the SWIFT network.

4. Notification of documentary credit confirmed or not

After receipt of the documentary credit, the correspondent of the importer’s bank can add its confirmation. , that is to say commit, as the issuing bank, to make the payment under the conditions defined in the documentary credit. For simplicity, we consider that the exporter’s bank is the correspondent of the importer’s bank. But it’s not always the case.

In any case (confirmation or not), the correspondent notifies the exporter that a documentary credit is opened in his favor. He hands over the original in paper format.

In the next articles, we will see what happen after the exporter receives the notification 1) from the notifying/advising bank and 2) from the confirming bank.

Hi, Can u please suggest a Trade finance book to understand it clearly along with ur site.. i am working on it now and want to understand in more detail

Very useful informations

Very nice and detailed explanation

Glad that I found this blog. Very nice explanation.

Had a task to complete this morning on documentary credit but was hearing the term for my very first time.

thanks very much

This was great! Thank you for posting such a clear explanation. I finally understand this topic more without any uncertainties.