Trade Finance is a very broad topic (about 1.5 billion results on google). Since Trade and payments are closely interlinked, it can be interesting to take a closer look at it. Furthermore, we have studied cross border payments in the last weeks. What we learned should help us to understand trade finance faster, at least the payments aspects. This article is about Trade Finance basics. After defining trade and trade finance, we look at the four corner model applied to trade. The final part is about payment instruments and payment techniques and the differences between them.

Trade finance basics: What are Trade and Trade Finance?

Trade refers to the act or process of buying and selling goods and services at either wholesale or retail, within a country or between countries. Domestic trade takes place inside the same country. We talk about foreign or international trade when at least two countries are involved.

When the trade happens inside the same country, the involved parties are subject to the same law and usually accustomed to the same practices. That is why domestic trade is less complex and risky than international trade. Since international trade takes place across borders, companies and people involved are unlikely to be familiar with one another and there are various risks to deal with like payment risk, country risk or corporate risk.

Trade finance represents monetary activities related to commerce and international trade. At the end of the day, payments are made in exchange of goods and services. The importer wants to pay only if he is sure to receive the goods or has already received them. The exporter wants to receive the payment after shipping the goods and not after they have arrived at destination. Their needs are different and even opposite. Trade finance provides solution to address them and much more. A bank may make a loan to the exporter on the basis of the export contract. Third party companies can provide other important services for trade like product certifications, insurance, transport and so on.

Trade finance therefore includes several activities. We can cite, among others: export credit, factoring, inspection and certification, issuance of letters of credit, insurance, lending and transport. All the players work to achieve the main goals of trade finance: 1) remove the payment risk and the supply risk, 2) provide the exporter with accelerated receivables and the importer with extended credit.

Trade finance basics: the Four Corner Model

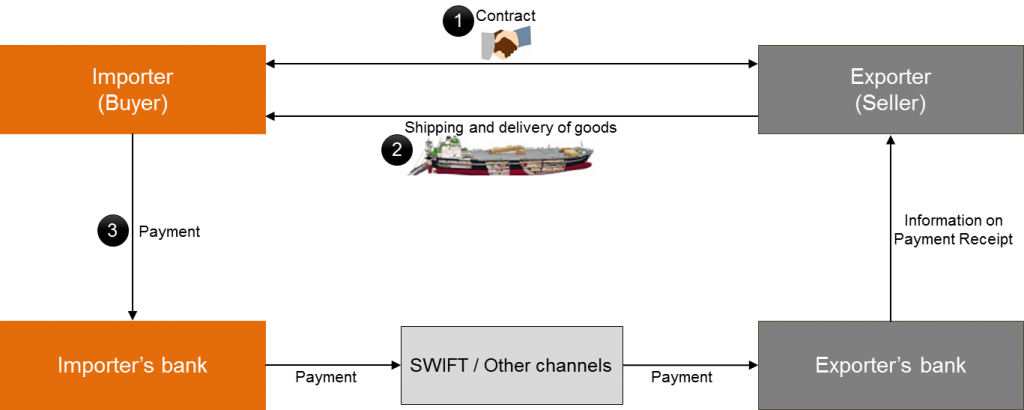

To understand how Trade works, we will start with the Four Corner Model. Yes! It is applicable to trade as well. Another proof, as I always say, that the Four Corner Model is one of the most powerful tool to analyze models or systems in which the parties exchange payments. It should be noted that, in this case, the model for trade is very simplified and realized with the perspective of highlighting how the payment flows. Starting from the Four Corner Model, we will present the main actors of Trade and few fundamental concepts.

On the picture, we see on the left the importer or buyer and his bank; and on the right the exporter or seller and his bank. The numbers in the diagram indicate the three important steps in an international transaction: 1) The contract 2) The shipping and delivery of goods and 3) The payment

1. The contract

In an international transaction, the importer and the exporter must agree on their mutual obligations. The contract must provide the law that will apply in the event of disputes between the parties. It may be the law of the buyer’s or seller’s location or an independent law.

In some cases, the contract may provide for the application of private international law, including Incoterms. Incoterms is the contraction of International Commercial Terms. These are standard terms used to define the “rights and duties” of buyers and sellers involved in international and domestic exchanges. The applicable regulations are enacted and published by the International Chamber of Commerce in Paris. The latest regulation, effective January 1, 2011, is Incoterms® 2010.

2. Shipping and delivery of goods

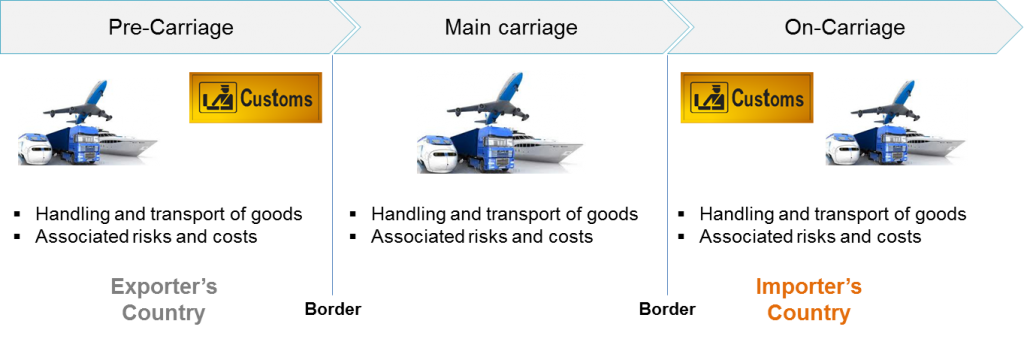

The shipping and delivery of goods is essential for the realization of the transaction. But the carriage of goods from the exporter’s country to the importer’s country is a long process and subject to many hazards. It can be divided into three main stages visible on the following picture:

- Pre-Carriage is the transport that is carried out before the container is loaded on the ship

- Main Carriage is the transport that is carried out while the container is on board the ship

- On-Carriage – The transport that is carried out after the container is discharged from the ship

One key point to understand in trade finance basics is that storage and handling must be done at all stages of the carriage. These services are not free and must be paid by either party according to the terms agreed in the contract. Customs fees are also required for shipping and receiving. Then there is risk of damage or theft of goods. To limit the risks, the parties take out insurance and use more or less sophisticated payment techniques. This brings us to the third step.

3. Payment

Regarding the payment, one might think that it is only about the importer paying the amount due to the exporter using an international payment method. The reality is a bit more challenging because locations are different and the amounts involved are sometimes very high. The importer wants to ensure that the exporter has fulfilled all its contractual obligations before paying. As for the exporter, he wants the importer to pay before taking possession of the goods. In addition, he wants in some cases to guard against any risk of non-payment.

To overcome these problems, there are two main solutions: Securities for payment and Payments guarantees. To help you grasp Trade finance basics, we give an overview of what they are and how they work in the following.

3.1 Securities for payment

A security for payment is a technique that requires the buyer to pay the transaction amount to obtain all necessary documents to take possession of the goods. Without these documents, it is impossible for him to clear and take possession of the goods. The seller is therefore almost certain to be paid when using a security for payment.

International banking networks support and handle the securities of payment and charge fees to their customers for the services provided. There are two main securities for payment that will be discussed in detail in future articles:

- The documentary remittance, also called documentary collection, whose originator is the exporter.

- The documentary credit, whose originator is the importer.

3.2 Payment Guarantees

Payment guarantees are based on insurance mechanisms. They are used to compensate claims, unpaid in this case. International Guarantees can be issued in three different legal forms:

- Sureties

- Stand-by letters of credit

- First demand guarantees

Now let’s consider the relationship between the two banks and specifically how they exchange payment orders. The vast majority of cross border payments are made by instructions and information exchanged over the SWIFT network. Foreign eXchange (FX) transactions may be required when the parties involved in the transaction are located in countries that do not use the same currency. In any case, the buyer’s account (the importer) is debited and the seller’s account (the exporter) is credited. Between the two, a lot of things happen. If you want to learn more about cross border payments, read the article four key strategies to understand how cross border payments work.

Trade finance basics: differences between payment instruments and payment techniques

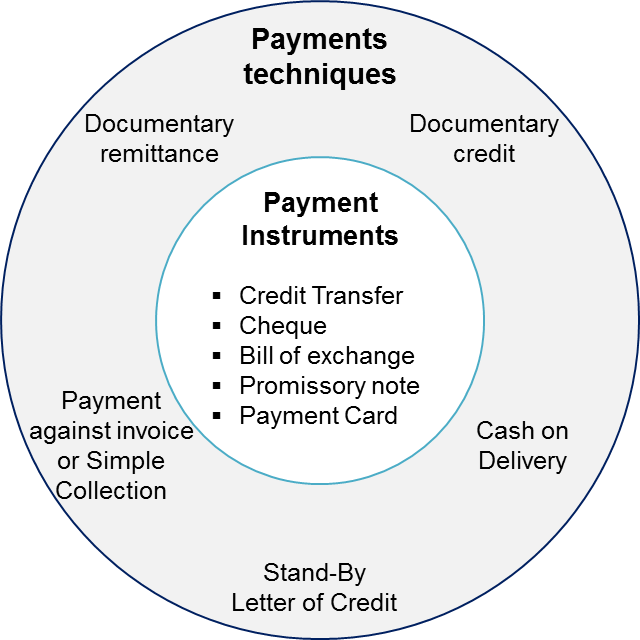

To quickly master the trade finance basics, it is important to make a clear distinction between payment instruments and payment techniques. The purpose of this paragraph is to explain what they are and highlight the differences.

In simple terms, a payment instrument is used to transfer funds from the payer to the payee: the debit of the payer’s account and the credit of the payee’s account. A payment technique is intended to ensure that all conditions are met for the payment to be made. We also talk about payment security technique. The primary purpose of a payment technique is to prevent and avoid non-payment. A payment technique includes the payment instrument as we can see in the diagram below. The inverse is not true. When the parties (importer and exporter) sign the contract, it is preferable to indicate which payment technique and which payment instrument will be used to avoid misunderstandings and disappointments later.

As example, a documentary remittance can very well be used with a transfer or a check or bill of exchange as a payment instrument. It all depends on what has been agreed between the parties. In the following we take a closer look at payment instruments and then at payment techniques.

Payment instruments

A payment instrument is the physical or electronic form that serves as payment support. It is the monetary vehicle that cancels the debt contracted with the creditor. The main payment instruments used internationally are: transfer, check, bill of exchange, promissory note and payment card. All those payment instruments are familiar to us and their use at the national level is quite simple. But when they are used for payments abroad, some precautions are necessary.

The payment card is mainly used to purchase samples of a product when the importer or his representative is in the country of the exporter. It has the advantage of allowing an almost instantaneous transfer of funds. Its use is often restricted because of the associated limits.

If there is no amount limit (only the available balance on the drawer’s account) to the issue of a cheque, that payment instrument is almost never used because of the very long processing times in cross border transactions.

The credit transfer is by far the most widely used means of payment by businesses in trade. Nowadays, international transfers take multiple days because they have to go through many banks and payments systems in multiple countries and sometimes require an FX transaction when the sender account currency is different from the beneficiary account currency. But things will certainly change in the future. SWIFT has launched an initiative called GPI to speed the settlement of cross border transfers (same day). Ripple is providing a service to settle cross border payments in few seconds. We are eager to see how things will evolve.

Finally, the negotiable instruments (bills of exchange and promissory notes) are not used that much because of the regulatory requirements that vary when one moves from one country to another. It is therefore necessary for the contracting parties to agree on the regulations to be applied in case of litigation. And that does not simplify things when there are already a lot of problems to solve.

[box type=”note” size=”large” style=”rounded”]Payment instrument = means of payment to transfer funds from the buyer to the seller and thus cancel the debt.[/box]

Payment techniques

Payment techniques refer to the methods used to activate the payment method provided for in the contract. They are related to the organization and the security of the settlement and the speed with which it will be realized. Thanks to payment security techniques, the exporter ships the goods with almost certainty of being paid. The importer can only take possession of the goods in exchange for an instrument of payment.

The complexity of a payment technique increases with the level of security desired by the exporter. The more secure the technique, the more sophisticated and costly it will be to implement. A payment technique cannot apply to all situations and must be chosen on a case by case basis.

A payment technique provides security for both parties and not just one.This is why the banks of each party charge fees when using a payment technique. This reinforces the importance of writing down in the contract which technique and which instrument will be used. There will be financial consequences on both sides.

Payment techniques are used almost exclusively in international transactions. They include: simple collection, cash on delivery, documentary remittance, documentary credit and its variants, the Stand-By Letter of Credit.

It is not mandatory to use a payment technique in international transactions, but it is strongly recommended to guard against risks. And they are quite numerous. The use of payment instruments or techniques depends on the degree of trust between the importer and the exporter. If the degree of confidence is high, a payment instrument will generally suffice. Otherwise, it is recommended to take a safety net, a payment technique.

In conclusion, the difference between payment instruments and payment techniques is ultimately pretty simple and can be summarized as follows:

-

A payment instrument is a mean of payment for the transfer of funds that cancels the debt with the creditor.

-

A payment technique includes payment instruments and its main purpose is the security of the payment.

We have reached the end of this interesting article about trade finance basics. We can now build upon these basics and learn more complex things. Do not hesitate to leave a comment to share any remarks or ask any questions you may have. The next article will be about the simple collection or payment against invoice.

Brilliant, as usual

Thank you very much Alberico. 🙂

Hello .. Thank you detailed articles on trade.

My query is, In trade finance with which instrument trade will start? Is it through letter of credit or through bank guarantee.?

Hi,

It depends on many factors. There is no rule. The more security both parties want, the more sophisticated the payment techniques will be.