SWIFT Serial and Cover payments originate from the two methods that are used to settle transactions in correspondent banking: The serial method and the Cover method. What are these two methods and how do they work? In this article, we will first describe shortly how each of the methods works and then we will make a detailed analysis of each method.

Serial and Cover payments in a Nutshell

This is shortly how each of the methods works.

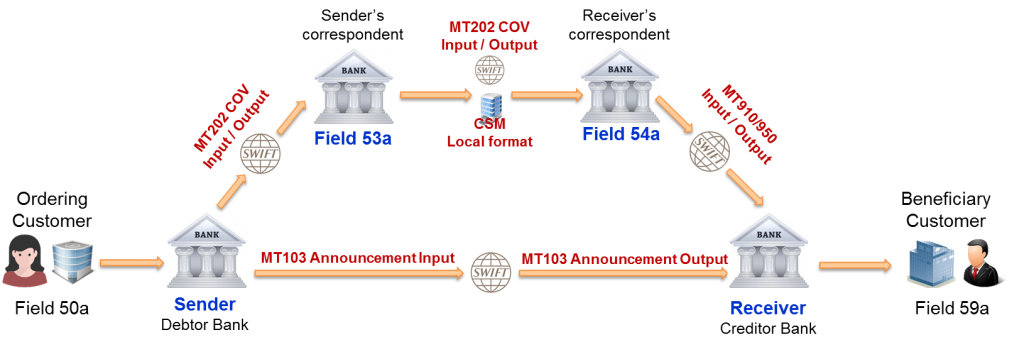

Cover method: two messages are initiated by the sender to settle the funds. One message is used to inform the creditor bank that funds are coming. It is called an announcement. The other message, called cover message, moves the funds between correspondent accounts.

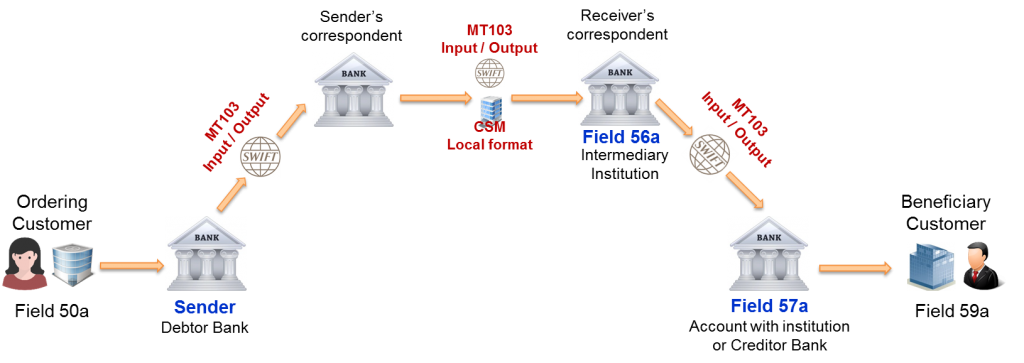

Serial method: Only one message is initiated by the sender to settle the funds. That message moves from one party to the next in the payment chain until it reaches the beneficiary bank.

Serial and Cover payments analysis – The cover method

When the cover method is used, the party (usually a bank) that transfers the funds, initiates two payments: an announcement (MT103 Announcement for customer transfers or MT202 Announcement for financial institution transfers) and a cover (MT202 COV). The picture below illustrates messages sent for a customer transfer. For a financial institution transfer, an MT202 announcement would be exchanged between the debtor bank and the creditor bank.

The announcement is sent to the beneficiary bank to announce that funds are coming for a specific beneficiary. The announcement does not carry the funds. It just informs the bank of the beneficiary that 1) funds are coming, 2) for which beneficiary and 3) the correspondent (of the beneficiary bank) that will receive the funds. That is why it is called an announcement.

The cover payment (MT202 COV) is sent by the sender to its correspondent. This is the message that really moves the funds. With the MT202 COV, the sender says to its correspondent: “Please debit my account that you hold and credit the beneficiary bank’s account with its correspondent.” Note that the correspondent of sender and beneficiary are located in the same country or monetary zone. So this payment may go through a local clearing system and not through SWIFT as you can see in the above picture.

Most of the time, the announcement is created and sent before the cover. But it is theoretically possible to do the opposite. On the receiving side, the announcement almost always reaches the creditor bank before the cover. But it happens that the cover arrives before the announcement and that should always be foreseen in a xborder payment processing software.

When the beneficiary bank receives the announcement, it might already credit its customer even if the funds (the cover) have not arrived yet. It depends on many criteria. Among others there are:

- the level of trust that it has in the circuit used to transfer the funds – A bank may decide to systematically wait for the cover if the transfer is in a specific currency for example.

- the amount of the transfer – Payment above a certain threshold will be credited only after the cover is received.

- the party initiating/receiving the funds – how good is the relationship of the bank with that party

- and so on.

Why do we have MT910/950 between the receiver and its correspondent?

I made this choice because most of the time the MT202 COV stops at the receiver’s correspondent since its holds the settlement account. The settlement account is simply the account of the beneficiary bank where the funds should be credited. The receiver’s correspondent does not send an MT202 COV to the receiver, but rather sends a SWIFT MT910 (Confirmation of Credit) or a SWIFT MT950 (Statement Message) to inform the receiver that the amount of the cover has been credited to his account.

The receiver then reconciles the announcement with the MT910 or MT950 and can consider that the related funds are received. As said above, the beneficiary account can then be credited or if it has already been credited (when the announcement arrived), the transaction can just move from pending to processed status.

The cover method is the prevailing settlement method in Europe. For that reason, it is sometimes referred to as the European method. The serial method that will be considered in the next paragraph is also called the American method. It is the preferred settlement method in the USA.

Serial and Cover payments analysis – The serial method

When this method is used, the party (bank) that transfers the funds, initiates only one payment: the MT103 serial for customer transfers or MT202 serial for Financial Institution Transfer. The picture below illustrates messages sent for a customer transfer. For a financial institution transfer, an MT202 would be sent instead.

The funds move from one party to another until it reaches the final beneficiary. For a customer payment, the sender sends an MT103 serial to its correspondent. Its correspondent debits its account and transfers the funds to the intermediary institution, the correspondent of the beneficiary bank most of the time. The intermediary institution in its turn credits the account of the creditor bank. And finally, the creditor bank credits the beneficiary account.

Note that in the SWIFT MT103 Serial Message, the fields 56a and 57a are used while the fields 53a and 54a are used in the MT103 Announcement Message (cover method). As mentioned above, intermediary institution and receiver’s correspondent are usually two names to designate the thing. The account with the institution is the bank that holds the beneficiary account, so just another name for Creditor bank. Remember the fields differences, but more important the principle: Sender and receiver located in different currency zones send or receive funds through their correspondents.

Movements of funds between correspondent accounts in the same country or the same monetary zone can happen through local clearing systems. SWIFT is not mandatory even if it might be used as well. What is mandatory is that the funds move. :-). The method to move the funds is at the discretion of the sending bank.

In conclusion, we see that SWIFT Serial and Cover payments play a key role in correspondent banking. I hope this article is helpful for you to understand how they work. If you still have questions, just leave a comment below and I would be happy to answer and support you.

Hi JP,

As usual a very nice illustration from your end. Can we also document in the financial world which all geographies use serial and who use cover and if so why one choses one over another.

kind regards

Sudip

Hi Sudip,

Thanks for your comment. I take note of your points.

I will try to cover them in future articles.

Best regards,

Jean Paul

Hi Paul,

Please help me with the below doubt :

Is there any advantage/ disadvantage between using a serial or a cover payment method?

Wow, that’s nice and clear analysis. Your website helps me a lot since I only started with payments recently.

Hi Jul,

Thank you for your comment. It encourages me to continue in my endeavour.

Subscribe to the newsletter to get regular updates.

Hi jean.

What if 53/54 are the same swift? How would that work for a cover cover payment?

Hi Emad,

that means both sender’s correspondent and receiver’s correspondent is the same bank.

In that case you will have only 53 in the MT103. Upon receiving MT202 COV, the correspondent will just debit the sender’s account and credit the receiver’s account. Then the correspondent will send the confirmation.

Hi Jean Paul,

Many thanks indeed for the very informative articles.

Just with regard to the above, is Field 53A used in the case of the Serial payment?

Is it soley geography that determines if acover message is used instead of a serial message.

Thanks in advance, regards, Barry

Hi Barry,

thank you for your interest. When Field 53A or 53D (Sender’s Correspondent) is used, the sender is saying to the receiver that money will come through his correspondent. It is therefore not a serial payment. The option B of field 53a, (so the field 53B) is used when the sender has many accounts with the receiver and wants a specific account to be debited.

Now second question: Is it soley geography that determines if acover message is used instead of a serial message?The anwser is no. The cover method is also called European method because it is the prevailing settlement method in Europe. A serial method is called American method because it is the prevailing settlement method in the USA. But they are many other parameters. A bank can decide to settle payments with a correspondent only via the serial method. In this case, it will never send a cover payment to that correspondent. A correspondent may not accept the cover method too. Senders must then send only serial payments.

I hope this helps.

Jean Paul

What type of message is used for domestic clearing between two direct participant

Hi Jean,

In the serial method, why the Receivers correspondent did not use MT910 or MT950 to inform the Creditor bank about crediting it’s account at Receivers correspondent bank.

Is it because MT103 itself is sufficient?

In the serial payment, the MT103 reaches the beneficiary bank. So no need to receive MT910 or MT950 to know that your account with the correspondent has been credited.

Hi JP. Is it still possible to generate a MT910 in this case?

Many thanks indeed Jean Paul for your prompt reply. Regards, Barry

Hi,

Do you have any idea when do we used tag 54 in MT202?

HI Shashi, I just realized that I missed your comment. I am very sorry for that. The reason for using the Tag 54 in the MT202 is the same as for using it in the MT103. Please read my article about SWIFT MT103 202 Cover payment analysis. BR, Jean Paul

Do MT 103 Cover always uses Tag 53 and Tag 54 and MT 103 Serial always uses Tag 53 and Tag 56 to represent sender correspondent and receiver correspondent ? Or any of the pair of tags can be used in either message to represent the same.

The answer to your question is yes. You cannot use any pair of tags in either message.

MT 103 Cover always uses Tag 53 and Tag 54. And MT 103 Serial always uses Tag 56 and Tag 57.

When you use Tags 53 and 54, it means you are settling through correspondents. If you do not want to settle through correspondent, the only option is to use tags 56 and 57. I hope it clarifies.

What is the difference between Intermediary bank and correspondent bank?,

Hi Jean, one basic question. What determines at the debtor bank side to send the payment as a direct cover or a serial payment?

Hi Srini,

There are a lot of parameters to consider. One of the key parameter is the account relationship between the sending bank and the beneficiary bank.

If they have an account relationship, the sender will send a serial payment. If not, it is a cover payment and the transaction is settled through the correspondent that holds the sender’s nostro account.

Appreciate the quick reply! Thanks Jean!

Hi Jean Paul,

i didin’t quite get you when you said “If they have an account relationship, the sender will send a serial payment. If not, it is a cover payment and the transaction is settled through the correspondent that holds the sender’s nostro account.”, because even if it is a serial payment, the funds ARE flowing through the correspondent banks that are holding the Nostro accounts of sender and receiver, right? Or am I missing something here?

Hi Sashank,

Thanks for your comment! You are right funds always flow through the correspondent banks. The beneficiary bank can be the sender’s correspondent itself. In that case the sender just needs to send a message to its correspondent and requests him to debit its account and credit the beneficiary. Even if the sender does not have an account relationship with the beneficiary bank, he can still choose the serial method. In the article, you have exactly the same banks for the serial and the cover payments. It is just the method that is different. And that sentence means the sender will very likely choose the serial method (a direct payment) if he has an account relationship with the receiver. I hope this clarifies.

I am not getting your point Jean,

If debtor is having direct account relationship with the creditor bank then the above pciture of serial method is confusing , where i can see debtor is sending message to correspondent and not to creditor bank.

can you please explain ?

Hi Jean,

Your blog is a jewel for a beginner like us, you have explained things in simplified language with very good examples. Thanks a lot !

Thank you very much. I am getting my job done. 🙂

Hi Ash,

Thanks for your comment.

In the example provided in this article, there is no direct account relationship between Sender and beneficiary. It was just to illustrate a point. Please read all the other articles about Cross border payments, particularly the 4 key strategies to understand cross-border payments and things sill be clear for you.

Hello thank you for your precious work. I have a question, on MT103 for CHAPS payment in GBP for both A and what happens when in field 57A sort code is written correctly but because of a system error banks identifies that creditor Bank is a different institution. Then on 59 shows beneficiary bank account, will funds still arrive ? Thanks

Simply superb ..thank you …a hard topic explained so easily

Hi Jean ,

Happy New Year and thanks for the one of the best article regarding cover and serial payments , i need to clear some doubts …

Sender correspondent is stored in which field in case of serial payments.

Hi Jean,

Can a MT202 be send between two banks in the same country..? Is it mandatory, as they could also settle the same through the local clearing.?

Looking forward to your response.

The answer is YES. RTGS systems usually process MT202 from one bank to another located in the same country. In Europe, you have the clearing system EBA/EURO1 which process MT202 too. And Two German/French/Italian banks can exchange MT202 through EURO1. But Banks would use it if the destination bank is not reachable through a local clearing. Going through a local clearing is the most common and cheapest way to settle the funds. Let me know if you have additional questions. 🙂

Just to understand generally In which cases the destination bank is not reachable in the local clearing..?

As I said, banks are normally reachable through the local clearing. But there are cases where a bank (usually an indirect participant) may not be reachable. One example: A bank with small volumes of transactions may make the choice to be reachable only through EURO1 or TARGET2 (the Europe RTGS). These banks are very few, but they exist. In the reachability check, you should always foresee the case where a bank is not reachable through the local clearing. I hope this helps.

In a MT103 message, how do we differentiate & identify whether this MT103 is serial or cover ?

Is there any field identifier

There is no specific Tag in the MT103 telling you it is a serial or cover message. The receiver must analyze the message content to find out if it is a serial or a cover.

In general, you have fields 53 and 54 in a cover message while in a serial message fields 56 and 57 are used. But you may receive a serial message with field 53B.

So the content of the message must be analyzed.

Hi Paul ,

This is the best article I have ever found on Internet for Payments , u r really doing an awesome job for helping people to get clean and clear picture on Payments , thnks

keep doing this good works

Thank you for your appreciation. 🙂

Hello thank you for your precious work. I have a question, on MT103 for CHAPS payment in GBP for both A and what happens when in field 57A sort code is written correctly but because of a system error banks identifies that creditor Bank is a different institution. Then on 59 shows beneficiary bank account, will funds still arrive ? Thanks

What does the term means , Direct debit or Direct debit authorizations w.r.t Swift Payments

Not sure I get your question. In Swift, you have the MT104 that is used as direct debit involving customers and the MT204 that is used for direct debits between financial institutions. Those messages are initiated by the creditor provided he has an authorization from the debit party to debit his account. I hope this helps.

Yes Got it ,thanks Paul …

Hi Paul,

Nice article. Really worth reading. Thanks for sharing your knowledge.

I have a basic question: What are the benefits Cover method has over Serial method. As per my knowledge

– Overall cost reduction

– Early credit to privileged Customer (by satisfying set of rule)

However I heard there are some benefits in terms of Nostro recon. Do you have any details around it?

Hi Ozhakkan, Thank you for your nice comment!

What you say is correct

– overall cost reduction, because Intermediaries tend to take charges on the serial MT103.

– Yes accounts of privileged customers can be credited before the cover is received and that value-added service is very appreciated.

As far as I know, there are benefits with regards to Nostro reconciliation for the receiving party, specifically the manual reconciliation.

The cover payment is credited on the receiving bank’s Nostro account. And the receiving bank usually gets a MT910/MT950.

A payment operator can easily investigate and follow the payment. You have the announcement and the cover for the same transaction.

For a serial payment, the receiving bank gets just one MT103. It does not know anything until the MT103 arrives.

To finish, let me mention another benefit: better liquidity forecast and management.

When some banks receive the announcement, they credit the liquidity forecast account.

You cannot do that for a MT103 serial since you do not know that the payment is on the way.

Best Regards :-), Jean Paul

Thanks alot mate. Make sense!

Hi Jean,

Would it be fair to say that a 103 announcement will at least have a 53 present if not any other correspondents?

Thanks.

Hi Sai,

That is correct since at least one correspondent must be present in the announcement. And in this case, both the sender and the receiver of the announcement have the same correspondent.

Best regards, Jean Paul

I have searched many places but no presentation as clear as this one. Thank you.

Thank you for your appreciation! Have you joined the newsletter?

Hi Jean-Paul,

I believe I have pretty much understood how MT202COV/MT103 work.

What is somehow more confusing for me is how does it work for MT202 covered by another MT202 payment. I refer to SWIFT Standards’ Message Reference Guide for Category 2, describing the usage rules for field 53 of a MT202, which states :

QUOTE

USAGE RULES

When the Sender instructs the Receiver to transfer funds between two accounts owned by the

Sender and serviced by the Receiver, this field must be used with option B to identify the account

to be debited.

In those cases where there are multiple direct account relationships, in the currency of the

transaction, between the Sender and the Receiver, and one of these accounts is to be used for

reimbursement, the account to be credited or debited must be indicated in field 53a, using option B

with the party identifier only.

If there is no direct account relationship, in the currency of the transaction, between the Sender and

the Receiver (or branch of the Receiver when specified in field 54a), then field 53a must be

present.

When field 53a is present and contains a branch of the Sender, the need for a cover message is

dependent on the currency of the transaction, the relationship between the Sender and the

Receiver and the contents of field 54a, if present.

A branch of the Receiver may appear in field 53a if the financial institution providing reimbursement

is both the Sender’s correspondent and a branch of the Receiver, and the Sender intends to send a

cover message to the branch of the Receiver. In this case, the Receiver will be paid by its branch in

field 53a.

In all other cases, when field 53a is present, a cover message, that is, MT 202/203 or equivalent

non-SWIFT, must be sent to the financial institution identified in field 53a.

When field 53B is used to specify a branch city name, it must always be a branch of the Sender.

The absence of fields 53a and 54a implies that the single direct account relationship between the

Sender and Receiver, in the currency of the transfer, will be used.

The use and interpretation of fields 53a and 54a is, in all cases, dictated by the currency of the

transaction and the correspondent relationship between the Sender and the Receiver relative to

that currency.

UNQUOTE

What’s puzzling to me is the sentence

“In all other cases, when field 53a is present, a cover message, that is, MT 202/203 or equivalent non-SWIFT,

must be sent to the financial institution identified in field 53a.”

which seems to infer that an Institution can send a MT202 to another Insitution even if they have no account relationship ? Meaning, if I understand well, that this pattern would be the equivalent of MT202COV/MT103 but when the beneficiary is a bank whose account is held at the Receiving Institution.

I would be interested of having your own understanding of such pattern, as I feel it’s very unusual since in most cases, for purely interbank payments, a ‘serial’ method will be used, i.e. each Institution will send a subsequent MT202 to the next Institution (if any) in the payment chain, until it reaches the beneficiary Institution’s account holder. Have you ever encountered such pattern of what looks like a 202/202 cover method ?

Thanks for your blog !

Hi Olivier, Thank you for your appreciation. I read your comment carefully.

In summary, your question is about MT202 Announcement and the related Cover. It is unusual as you say because the serial method is used most of the time, but it does exist.

And yes I have encountered it. The principle is quite similar to the MT103 Announcement except that only financial institutions are involved in the transaction.

An MT202 Announcement is sent directly to the Bank holding the account of another bank. And A cover is settled through correspondents.

Now think about this: What makes a MT103 or MT202 an announcement? There is no flag inside telling you that it is an announcement.

So it is Receiver who identifies the payment as an announcement based on its content, typically when the sender has no direct account relationship with the receiver and fields 53a (not option B of course) / 54a are present. For me we should just think of a MT202 annoucement like an MT103 announcement. The underlying principle is the same.

I hope this clarifies. Let me know if you have further questions.

Thanks for your explanation, this confirms my initial understanding, and I agree the way the 202 will be processed by the receiving bank depends on the existence of a direct account relationship, or not, betweeen the Sender and the Receiver.

Having said that, I tend to believe this is a fairly unusual pattern and the general rule for purely interbank payments is the ‘serial’ method.

Knowing that even for corporate payments, it appears that the serial 103 method is now also the preferred one (rather than 202COV/103), the main reason for that being the increased scrutiny about RMA relationships, and the fact that most banks now try to limit the number of RMA they have with each other, for KYC reasons.

Hence, with no RMA in place, you are not able to send a 103 to the beneficiary’s account servicing Institution, leaving no other choice than a serial 103 method.

Plus the process of an ‘announcement’ payment message depends pretty much on the contractual provisions of the Agreement between the client and its account servicing Institution, leading sometimes to a certain level of confusion (e.g. on whether the beneficiary’s account will be credited upon receipt of the announcement, or only when the funds have effectively been received by the account servicing Institution).

One last high-level question : would you agree to say that two banks will exchange MT202 or MT103 if and only if, either :

– they have a direct account relationship with each other, or

– the Receiver is the account servicing Institution of the final beneficiary ?

Best regards !

Hi Olivier,

Thank you for your comment! I see that you are really on top of this topic.

I agree with you that using a MT202 Announcement is an unusual pattern. Interbank payments are performed with the serial method most of the time.

Concerning your question, I guess you are refering to the MT103 and 202 Serial.

My understanding is that serial payments move from one bank to another, the two having an account relationship in the currency of the transfer. So sender and receiver involved in a serial payment must have an account relathionship. Can a Bank send a serial payment to another bank that is the account servicing Institution of the final beneficiary even if both do not have an account relationship? I do not see how the money would flow. Therefore my answers to your question:

would you agree to say that two banks will exchange MT202 or MT103 if and only if, either :

– they have a direct account relationship with each other, or – [YES] Absolutely.

– the Receiver is the account servicing Institution of the final beneficiary ? [NO] I do not see how the funds will flow if sender and receiver do not have an account relatinship. It is needed to move the funds.

Please share your opinion and again, thank you for your insight!

BR, Jean Paul

Hello,

Maybe I was not clear enough.

In a 202COV/103 pattern, the Receiver and the Sender of the 103 don’t have account relationship with one another, but the Receiver holds the account of the beneficiary. The funds will move through the asscociated 202COV.

But my point was to say that a 103 will ever be exchanged between two institutions if and only if :

– they have a direct account relationship with one another or,

– the Receiver is the account servicing institution of the beneficiary

Regards,

Thank you Olivier for the clarification. I understand that you were not refering to serial payments only.

Your statement is therefore correct. Thank you again for your contribution.

Hello Mr.Olivier Happy New Year. Good luck and success in business. My receiver is ready to work with the Company.CCMF LTD HSBC Germany or Commerzbank out Germany.I am waiting for your prompt reply with respect Vladimir Markin ,my e-mail petroorex@gmail.com,Whatsapp +79500474443

Hello Mr. Olivier, Happy New Year. Good luck and business success. My receiver is ready to work with the company CCMF LTD HSBC Germany or Commerzbank out Germany Waiting for your prompt reply with respect Vladimir Markin, my e-mail petroorex@gmail.com, Whatsapp +79500474443

Hi Paul,

i saw a incoming message ,it’s

1) 52A and 53A same BIC contains Head Office BIC of Sender Bank

2) 54A hold a different bank BIC

could you please explain about this

Hi Vimal,

It is always easy to say what is happening when you have only one part of the information. Do you have a BIC11 somewhere?

I understand that the sender is the same as what you have in F52A and F53A. So the sender does not need a correspondent for the transfer. Therefore the sender puts his own BIC in the F53A of the announcement. It is a case where sending bank and receiver’s correspondent are located in the same monetary zone. 54A, the receiver’s correspondent, holds the account of the receiving bank in the currency of the transfer. It is the account that will be credited with the cover message. The receiver is in another monetary zone. I hope this helps. Let me know if you have additional questions.

Hi Paul,

Sender is releasing a serial MT103 (field 57 was used) but receiving bank has received an MT910 instead from the intermediary bank. Is this normal or the intermediary bank has done a mistake?

How the cash could be credited into the final beneficiary account, does the ordering bank need to send a separate MT103 announcement to the receiver bank to further credit to beneficiary account?

Hope you could help!

Hi Paul, tks for your article, very clear.

Maybe you can help me with this situation, i work as financial advisor at BNYM (Bank of New York Mellon), i need to receive a payment and they are asking me if i can receive through mt104.

We always provide mt103 mssg consirmation for payments, but im not sure if i can receive through mt104.

Thanks for your advise and help!

Juan

Hi Juan, sorry for the late reply. The MT104 is a Direct Debit Message. What they are asking you is that you send a MT104 to debit their account and credit your account.

Before initiating an MT104, you should have a formal authorization from them that you are allowed to debit their account. That authorization should be sent to the bank holding the account to be debited. Otherwise, your payment may be rejected. It is easier to receive funds through MT103 than with MT104. I hope this helps.

Hi Paul,

First of all thanks so much for your excellent presentation which makes my life much easier!

I am dealing with cross-border banking payment everyday and recently I have come across some new terms would like your help to answer:

1. What is the different between MT103/202 and Mt103-202?

2. What is MT103/202 automatic download and manual download? And what’s the criteria to perform such operation?

Thanks and regards,

Dear Paul

I’m interested in Euro payments and how SEPA systems interact with non EU debtor and creditor banks.

Let’s assume:

Debtor bank is non EU and holds a correspondent account with EU Bank S

Debtor bank wishes to send €100k to Customer of EU CREDITOR Bank R

Non EU Debtor Bank wishes Bank S to complete the payment to Bank R using one of the SEPA ( NON SWIFT ) systems.

QUESTION: what instructions must DEBTOR BANK give to his Correspondent Bank S?

Hi William,

I think you understood already how things work. The Debtor bank will send a MT103 announcement to the EU Creditor Bank and instruct its EU correspondent through a MT202 COV to make to move the cover. Even if the correspondent has recieved a MT202 COV, it can use a local clearing or settlement system to move the cover. I hope this clarifies. Please let me know if you have further questions.

hi Paul,

Nice and informative article!

I have the following query:

Can the originator bank send a serial to its correspondent which then sends MT103 and MT202COV to the subsequent parties? I.e, can the senders correspondent convert a serial MT103 inward to a cover outward when forwarding to its correspondent and the beneficiary bank? Or should the message chain maintain serial method till the end?

Thanks!

Girish

Hi Girish,

Thank you for your appreciation.

The answer is Yes. A sender may not be able to find the whole chain up to the beneficiary. He will forward the MT103 to his correspondent that will take care of finding how to settle the payment. The correspondent can then use a serial or a cover method for the settlement.

Regards, Jean Paul

Hi Paul,

Thanks for the clarification!

regards

Girish

Hi Jean Paul,

Thanks for the clarity & useful description. I have a question though…:

What is the correct Msg Type to be used when you move liquidity from ‘NostroBank A’ to ‘NostroBank B’, when both involved (bene&rem) accounts are held in the name of same (the remitting) institution, and when the purpose of the liquidity movement is to fund a bulk payment instruction going out from ‘NostroBank B’.

What msg type must remitting institution send to ‘NostroBank A’:

• Is a single MT202 sufficient, as this is between own accounts(?), or

• Are multiple MT202COVs required, due to the actual purpose being credit transfers?

Thanks & regards Jesper

Hi Jesper,

Thanks for your appreciation and for reaching out.

If I understand correctly, the first transaction involves only financial institutions and sender and receiver is the same. You can use MT200 or MT202.

What happens later does not matter. If you have other questions, please let me know.

Thanks, Jean Paul

Hi Paul,

Re-reading your articles (repetita juvant), I always “map” them to my actual job. I work in a cash management team, customer services, daily following the process of payment. Regarding cover method, I have to say that we only receive MT202.cov from our correspondent, no MT910 nor 950. Probably it is an agreement with the correspondent, to receive one instead of the other.

Best Regards

Alberico

Dear Alberico,

Thanks for supporting me and thanks sharing your experience. So I note that for a cover payment, your correspondent always forwards you an MT202 COV when your account (with your correspondent) is credited. Any idea why your bank made that choice?

Best Regards,

Jean Paul

Hello Jean Paul,

I’m sorry to contact you as well about this matter but I’m still a bit confused by what you mean by “account relationship with the receiver”.

If the sender bank has an account relationship with the reciever why are correspondent banks being used in either method (serial or mt103+mt202COV)?

Is it because the sender and reciever banks are in different countries with different currencies?

for example: if following the request of their customer a french bank needs to send EUR to a chinese bank/beneficiary client a correspondent will have to be used correct? but under which method? MT103+MT202COV or just via a MT103 serial?

What if we are talking about a EUR payment between two clients of two french banks located in france? If the sending bank has a relationship with the reciever will correspondents still be needed? Or will the sender credit the receiver directly?

Apologies if my questions are not clear but I’m having a bit of difficulty understanding when to use a MT103 + MT202COV vs a MT103 serial and your help would be greatly appreciated

ps: forgive my poor english, it is not my native language

Hi Ana,

Thanks Ana for your effort and your comment! It helped me to clarify few things.

In Cross border payments, funds always flow through the correspondent banks. The beneficiary bank can be the sender’s correspondent itself. In that case the sender just needs to send a message to its correspondent and requests him to debit its account and credit the beneficiary. But even if the sender does not have an account relationship with the beneficiary bank, he can still choose the serial method. In the article, you have exactly the same banks for the serial and the cover payments. It is just the method that is different. And that sentence means the sender will very likely choose the serial method (a direct payment) if he has an account relationship with the receiver.

To your question: if following the request of their customer a french bank needs to send EUR to a chinese bank/beneficiary client a correspondent will have to be used correct? but under which method? MT103+MT202COV or just via a MT103 serial?

The answer is either method can be used.

1) Cover method: the french bank sends an announcement to the chinese bank and a cover to the correspondent of the chinese bank in Europe

or 2) The french bank sends just one MT103 serial to the correspondent of the chinese bank in Europe and the correspondent forwards the payment to the chinese bank, the final beneficiay bank.

Thanks again for reaching out! No need to be sorry about your english. I could understand your comment without problem.

Best regards,

Jean Paul

What could be the cause of delay mt202 if mt103 is confirm

My bank sent me a confirmation verbiage of mt103 from the sender and as at now my bank says they are still waiting for my202 from the sender

It’s been a month since the confirmation of mt103

Please I need an answer because I think something is wrong somewhere

Thank you

Hi,

Many reasons could cause the delay of a swift message: incomplete information, wrong routing, compliance checks, …

If all goes well, the MT202 COV should arrive pretty quickly. With SWIFT GPI, both messages are received within few hours.

One month is too long. Something is wrong. Your bank can and should ask the counterparty what is wrong. Good luck!

How long does it take to confirm mt202C between the sender and the receiving bank if mt103 is confirmed

Hello Jean Paul,

Do you have any idea about Third Reimbursement Institution (TAG 55) and how does it work as part of MT103.

Regards,

Rinesh karthi.N

Hello jean when a bank send a MT103 to receiving bank and MT202C to corresponce bank if the receiving bank have effected the payment to benef without cover who is the responsible as correspondence bank has not covered to receiving bank.benef bank have to check their account with correspondence bank before the payment? Rgrds

Hi, The receiving Bank is responsible for crediting its customer. In case the receiving bank has credited the customer and has not received the cover, it can still debit the beneficiary account and take the money back as far as I know (provided the funds are still available of course). The customer would not appreciate it. If it is criminal activity and the customer has disappeared with the funds, the receiving bank is left holding the bag. The only way to get the money back is to contact sending and intermediary banks to see where the funds are. So before crediting (while cover is still underway), the bank should be almost 100% sure the cover will be credited. Only the bank can know how reliable a settlement path is. In case of any doubt, it is better to wait until the cover arrives.

Thank you so much yr kindly reply.

B.regards

Hello jean

when a bank send a MT103 to receiving bank and Cover to corresponce bank if the receiving bank have effected the payment to beneficiary without cover who is the responsible as correspondence bank has not covered to receiving bank.

beneficiary bank have to check their account with correspondence bank before the payment?

That case, what is the senders bank responsibility?

İf cover banks want to request charge back

Which bank must be pay?

And what is international law number refer to this?

.

I am awaiting your reply urgentrly

Regards

Hi, The receiving Bank is responsible for crediting its customer and it must make sure the cover has arrived or will arrive before doing that.

In case the receiving bank has credited the customer and has not received the cover, it can still debit the beneficiary account and take the money back as far as I know (provided the funds are still available of course). The customer would not appreciate it. If it is criminal activity and the customer has disappeared with the funds, the receiving bank is left holding the bag. The only way to get the money back is to contact sending and intermediary banks to see where the funds are. If the sender can prove the money was sent, there is nothing the receiving bank can do against him.

So before crediting (while cover is still underway), the bank should be almost 100% sure the cover will be credited. It is an important responsibility of the receiving bank. Only that bank can know how reliable a settlement path is. In case of any doubt, it is better to wait until the cover arrives.

Now if the cover banks request charge back, it is the beneficiary customer who can accept to send the funds back. So the beneficiary bank should contact his customer and get his approval.

I do not know any law about that; I respond by experience.

I hope this helps. Thanks for your great questions.

Thank you so much

Regards

hello Sir Jean Paul

Do you have the sender of 104 mt 950

Direct or direct debit

method ??

Hi, No we do not offer that service. The purpose of the website is to help people understand payments. And for the moment, we do not accept any advertising of publicity on the website. Thanks for your understanding.

I must say this is the best site to understand SWIFT payments.

Hi Jean Paul,

Thank you for an amazing article series, very enlightening – there is nothing else like it online!

For what you call ‘exotic’ currencies, in particular INR which is restricted, could a Serial method work?

The RBI proposes two models for cross-border transfers, but they both seem to describe exclusively a cover transfer method to me: https://www.rbi.org.in/scripts/NotificationUser.aspx?Mode=0&Id=11144

Any insights would be very much appreciated.

Hi Jean,

thanks a lot for the great explanation. Helps me a lot.

Keep up the excellent work.

Greetings from Germany

Martin

Thank you Martin for the kind words.

I really appreciate your message.

Receive my warm greetings too.

Hi Jean,

Thanks for sharing the detailed knowledge. I have a question regarding the statement :

“When the beneficiary bank receives the announcement, it might already credit its customer even if the funds (the cover) has not arrived yet.”

As bank is not received the fund (COV has not arrived yet). In that case which Account will be Debited?

Hi Jean,

Just my curiosity, may I know how will the sender’s bank settle the funds with its correspondent ? is it done by something like nostro/vostro accounts ? I know this may be out of scope for you article, but I would like to have a full picture of the bank’s operation, appreciate if you can reply.

Very Nicely described.

Along with this article, the comment section is equally informative with nice real world problems and clarification.

Great work!

Hello Jean,

Thanks for the information regarding serial and cover payments.

My question is about use of T53 and T54. In which scenario, We will use T54 while sending a payment.

The F54 is the receiver’s correspondent. If the Sender and the receiver do not have the same correspondent, then the sender populates F53 with its correspondent and F54 with the receiver’s correspondent. Let me know if you have further questions.

Thanks Jean for the prompt reply.

But I believe we won’t be maintaining the receiver’s correspondent information. We will be having only our correspondent details in the transfer currency. Please let me know if its making sense.

Hi,

Banks do keep receiver’s correspondent information that they receive from SWIFT.

When you compute the settlement path, you need both sender’s and receiver’s correspondent in some cases.

Hi Jean,

May I know the MT104 swift procedures, is it the receiving bank send to sender bank byMT104 first then the sender bank send the funds to receiving bank by MT103? I have some confused. Thanks

Hi Francis, the MT104 is a pull payment. So the sending bank is the creditor bank and the receiving bank is the Debtor Bank. Click on this link and read the article. You will understand. Thanks

hi Paul, your explanation is very well written and thank you very much.

My question is how I can identify between inbound payments to bank (receipts) and payment which need to be sent out to other bank.

Is my below understanding correct?

For MT103/202: If Field 53A & 53B is present and Field 54 doesn’t exist then process the message as Receipt (inbound payment – crediting into my bank books).

If Field 53 & 54 is not present, then that message is a Payment Instruction for outbound?

Hi Jean,

For a serial payment initiated by ordering bank and having 3 or more intermediaries to reach Beneficiary bank, can you tell me how 103 message needs to be constructed ? I mean which all intermediaries would be part of 103 message as at a time we can maximum map 4 participants in the chain.

Hi there!

Please do clarify can a financial institution send MT103 Serial Payment to the Bank without involvement of any correspondent bank because Both FI & Bank have RMA.

Thanks in Advance

George

Hi George, the answer to your question is YES. If both banks are in an account relationship, no need to go through an intermediary. Please check this article.

Hi Jean,

Please do clarify can a financial institution send MT103 Serial Payment to the Bank without involvement of any correspondent bank because Both FI & Bank have RMA. Does RMA qualify for ACCOUNT RELATIONSHIP??? Please clarify.

Thanks

Bis

Hi Bis,

RMA does not qualify for ACCOUNT RELATIONSHIP. RMA is the service where the receiving bank specifies which message types the sending bank is allowed to send / or where the sending bank checks before sending a message if the receiver has authorized it. And that no matter if both are in an account relationship or not. ACCOUNT RELATIONSHIP is when one bank has opened an account with the other. It can be unilateral or bilateral. You can read more about account relationship in this article.

All the best,

Jean Paul

Hello Jean,

Just once question, when there is Cover payments where we send both (103+202COV).

Then how to analyze that 202 Received is of that particular 103.

what i mean to ask is that , will there be any tag like SenderReference or some thing else which would be common in both paymets type.

Regards,

Gaurav

Hello,

The answser is yes. If the related message of a MT202COV is an MT 103 Single Customer Credit Transfer, the field 21 of MT202 COV will contain field 20 Sender’s Reference of that MT 103.

Hi sir Jean

First of all big thanks for wonderful service you are renderjng educating on international payments. I am part of intraday liquidity team which does bcbs248 reporting. I want to understand what all products qualify for intraday bcbs248 reporting. For example we don’t report trade export transaction in our reports. Can you pls help me understand

Hi,

I have heard about the bcbs248 reporting. But unfortunately I have not worked directly on it. If someone else could help, that would be very much appreciated. Thanks in advance.

Ah okay .Many thanks for your revert 🙂

Warm regards

Guru

Can you please share a session on continuous linked settlement systems and how different are they from normal clearing and settlement systems sir

thanks

Guru

Hi, We take note of the request and will try to handle it if possible in the future. CLS systems are fascinating topics in payments. 🙂

Many thanks sir 🙂

Hi Jean, great blog you have here!

can you specify the Intermediary bank in a Serial method payment (MT103)? in other words, instruct the payment not to route through the sending bank’s default intermediary bank, instead nominating another sole intermediary bank?

thanks

Sarah

Hi Sarah,

thank you for your interesting question. It is theoretically possible, but for that the instructing party needs to know to which intermediaries the sending bank can route the payment and must choose one of those intermediary banks. And obviously the sending bank must have implemented the function to route a payment only to a specific intermediary. Note that the sending bank can only go through a bank it has an account relationship with and the instructing party cannot request the sending bank to use any intermediary bank. I hope this helps.

Hello paul,

that was a great article, just a small doubt as we use tag 57 for the receiver correspondent , what is the tag used for senders correspondent,

regards,

N Krishna Kiran.

Hi Kiran,

As you can see on the picture, field 53a is used for sender’s correspondent field 54a is used for receiver’s correspondent. Field 57a specifies the financial institution which services the account for the beneficiary customer.

Best regards,

Jean Paul

Hi Paul,

Very nice article. Neat and Clean. I have one query as below, Please help me clarify

In Serial or cover method , how are MT103/MT202V initiated if sending bank is not connected with SWIFT

Hi Simi,

Thank you for your comment! To send MT messages, a bank must be connected to SWIFT.

A small bank not connected to SWIFT may use services of a bigger bank connected to SWIFT to send cross-border payments.

Hi Jean,

is there different cost structures between the two types of messages and if so what would be the cheaper option?

thanks

Hi Nikkie,

The answer is Yes. It is usually cheaper to send a payment through the Cover method (MT202 COV + MT103 Announcement) than through the serial method (MT103 serial). There is no charge Tag in the MT202 COV.

Sender’s Charges and Receiver’s Charges are available in the MT103. Intermediaries usually take fees for processing MT103.

Excelent article, the best in the web, much appreciated for a legal work on MT103 payment. I might have to ask you a question or two as you seem to be the expert on these matters

Thank you very much Leticia for your comment. I am glad to see that the blog is useful for people.

Hi Jean, as always, really useful pages. I do need clarity on one thing: how can i reconcile the MT103 announcement to the MT910 from my correspondent bank? thinking of the scenario where it is a common amount?

Hi Mike, thank you for your comment. Please go through this article. The field 21 (related reference) of the MT910 contains the reference of the MT103 Announcement. You don’t reconcile based on amounts.

Hello Jean

Can you inbox me , I would like to know how receive funding through mt104 payment. I wonder if I can use your payment platform.

Hi Jean, thank you for the wealth of knowledge you unpack here for newbies like myself. I come here regularly to learn something new about payments.

My question might be unrelated to serials and covers in this context. It is around debit authorization setup.

I am trying to understand the business scenario for payments in which debit authorizations are required, and how do they work?

Many thanks

Hi Paul,

I have a question.

I am transferring an amount from India to US via UAE. Both the sender’s correspondent and Receiver’s correspondent banks are in UAE.

could you explain me for a Serial payment what are the different payment messages that will flow with a diagram and where would SWIFT network be used. Also how would the message transaction happen between the corresponding banks in UAE. Also if you could explain a bit on the accounting entries and settlement.

Hi, Please read the articles about SWIFT MT103 serial payment analysis and SWIFT MT103 202 COV Payment analysis. Then let me know if you have further questions.

Hey JP.

1. What does it mean when the receiving bank receives the MT103?

Does it mean they have been credited already?

2. How can you tell if the received the MT103 via serial or cover method?

Hi Jean,

Thanks for amazing article, I really understand a lot about payments by reading your article.

I have a question though, in practical scenario does 53, 54 and 56 appear in any single message (103or 202 or 202cov)

Also, do you have any article/blog where I can go through ISO20022 for payments?

Hi Pearl,

Thanks for your appreciation! Look at the picture very carefully. In Cover method, Fields 53 and 54 and used for correspondents. While in serial method, you use the field 56 and 57.

For ISO 20022, It is a broad topic. I handled that in depth in my book about SEPA Credit Transfer since all SEPA payments rely on the ISO 20022. If you don’t want to wait for too long, get a copy of my book. I am too busy right now and it is more and more difficult to find time.

Thanks for your understanding!

Thanks for reply.

That means 53,54,56 can never appear in a single message. Is my understanding correct?

Hi Jean,

You have illustrated it so clearly and in simple words. Thanks. I wanted to know the benefit of Cover payments over serial. I understand that cover payments are quicker and gives Bene bank the time to arrange funds in high value payments, however are there any other benefits other than these?

Thank you for your appreciation. Well another benefit is that you are sure the beneficiary bank will receive the total amount sent as no charges can be taken from the MT202 COV.

Hi Jean,

Thank you for this wonderful article.

I have a query.

Internally backs will have many capabilities to perform before the transaction got settled.

Example say debit party identification, credit party identification, routing, settlement and so on.

When routing and settlement capabilities are done, it means we are informing system how to move funds from our back to next back say through mechanism/ correspondent bank.

when funds actually posted after clearing and settlement?Is it immediately after settlement is done or it will wait for message release date and time and then post the funds?

Hi Jean,

When MT103 Cover always uses Tag 53 and Tag 54, then in 202COV, the same fields 53 & 54 can be used to mention the correspondent banks. Then what is the purpose of field 56a in MT202COV Payment

Can you please clarify when field 56a is used in MT202COV payment

Hi Guru, in the MT202 COV, the same tags 53 and 54 are not used in the MT202 COV to mention correspondent banks. Look at the picture again. The F53 of the MT103 is the receiver of the MT202 COV.

For the fields 56, it reads in the standard: “This field specifies the financial institution through which the transaction must pass to reach the account with institution” So in case there is no direct way to reach the receiver’s correspondent and you need to go through an intermediary, then the F56 should be used. This is seldom in practice.

I hope this helps.

Many thanks Jean. Sorry for delay. I didn’t get a notification. Thanks.

Jean,suppose we receive MT202 to process.can we credit customer funding account with cover fund received in nostro.Could you please tell me about the Nostro balances to maintain for settlement. major reasons for overdraft in Nostro. Difference between pacs 009 and mt202

Hi Avik, Not sure I get your question. If you are asking if the MT202 can be used as an announcement, the answer yes. In that case, you get the cover through a MT202COV. For nostro balances, you have to ensure there is sufficient funds on them to settle your transactions. Overdraft should not go beyond what is agreed between a bank and its correspondent. Pacs.009 is the equivalent of MT202 in the ISO 20022 standard. So both are used for the same purpose, but the pacs.009 can bear a lot more information than the MT202.

Hi – Could you tell me which field in the pacs.009 (header or document)confirms that the underlying pacs.009 is a pacs.009 COV message. How to differentiate between a pacs.009 and a pacs.009 cov

Hi, the answer is in the Settlement Method. For a cover payment, it must take the value COVE.

Hi Jean Paul, Could you please confirm on the conclusion belowin relation to the SWIFT fields knowledge

1. Sender is the payer/ ordering customer (field :50A, F or K Ordering Customer (Payer/Sender) )

2. Originator is the Sender’s institution (field : 52A or D Ordering Institution (Payer’s Bank))

3. Processor is the intermediary institution (field :56A, C or D Intermediary (Bank) )

4. Acquirer is the Recipient’s institution (field : :57A, B, C or D Account with Institution (Beneficiary’s Bank))

5. Recipient is the Beneficiary (field :59 or 59A Beneficiary )

Hello Jean, Thank you so much for this article. Very helpful and clear.

Is there any blog where ou explain about how these codes/messages look like?

I am looking to expand my knowledge in payments and would like to start from sratch.

Please suggest any links/articles.

Thanks in advance.

Hi Sitaram, there are many other articles on this blog. Please go through them.

hi Jean,

This really puts it straight.

Thank you for sharing the knowledge which i find is rare.

1 questions on below

The funds moves from one party to another until it reaches the final beneficiary. For a customer payment, the sender sends an MT103 serial to its correspondent. Its correspondent debits its account and transfers the funds to the intermediary institution, the correspondent of the beneficiary most of the time. The intermediary institution on its turn credits the account of the creditor bank. And finally the creditor bank credits the benificiary account.

Please confirm if my understanding is correct? in case f more than 3 parties:

so correspondent bank

dr senders ac

cr intermediary(correspondent of account with institution)? 56a or why woulnt it not credit 57a directly?

at intermediary bank

sees mt103 and the fund in account that belongs to 57a?

cr A/C with institution 57a ? and then credit 57a real time?

at A/C with institution 57a

sees the fund belong to bene 59

sends mt910,

cr bene? 59

if i dont include the second part where at the intermediary bank ac with inst 57a is credited, then how is 57a supposed

hey JP,

i tried reading this again, so cover and serial, the parties explained here are the same. only difference is the names the number of messages and parties who receive the message.

however if the receiver bank JPM and its bene is in USA and receives eur funds from BNP france thru correspondent citibank. – can you please explain this

what i understand is –

bnp sends msg to citi usa

citi usa debits bnp and credits bene account at JPM (though Interbanks or central banking right?)

does it need to have an account with JPM or it sends the money through cm/interbank

-can citi usa directly send money to beneficiary’s account account or it has to send to jpm bank account first and then jpm credits that to bene?

If a Bank has Fiduciary deposit clients where they typically pay the clients via 202, could they alternatively pay them via 103?

Hi Jean , Basic question sorry if its naive from my end.

I read that in some cases apart from the debit confirmation MT 012 sent from Central Bank, the RTGS system

can also send MT 900 (debit)/ 910 messages to the is this so ?

I was under the notion that MT900/MT910 statements are always sent by an Correspondent Bank to Account owner correct?

When i checked the definition of MT910 . It never says as a “Message from Correspondent Bank to Account Owner ” but always mentions from the Account servicing institution to account owner.

Can a central Bank be called an Account servicing institution ? as all Banks maintain account with central Ban

Rephrasing above as sentence due to typo from mobile. excuse.

To rephrase , can a central Bank RTGS system send a MT 900 or MT 910 messages in local currency to domestic bank ?

Are there any EOD Statement messages sent from Central Bank indicating the Balances maintained by Bank with them?

Regards

Guru

Hello Jean,

Though reading this blog multiple times. Still wander to understand the purpose of both serial and cover MT103

What will be the advantage out there since both meet the customer needs. At what point we suppose to use serial and why. similarly for Cover.

Sorry to bother! Kindly help me to understand

Good day Jean,

We have raised a question with our technical team and wonder if you are aware of fields within an MT103 which would allow one to specify the first intermediary to be used by the sender’s correspondent.

I have referred back to your articles on MT103 and MT202COV numerous times.

I absolutely love the clarity of the explanations, the examples and the diagrams.

Such a gold mine.

Not usually a commenter but felt compelled to leave a message to thank-you and let you know that your work is much appreciated and has been extremely helpful for me in understanding the payments world better.

Many thanks again,

Franklin

Thank you very much Franklin.

I am glad the content is valuable.

Regards, Jean Paul

Hi Jean. I just wanted to leave you a comment here and encourage you to keep going with your articles and expand on your work. You are doing a fantastic job!

Hello Sir,

On which criteria operator will decide from Serial and cover method of payment.

Are there any rules to use these methods?

Hello Jean,

Just wanted to say that your Paiementor blog has been invaluable for me in my various roles.

and i have a question about payments whici i hope you can answer?

My question is that does a correspondent only send an MT202Cov to the Ben correspondent?

The MT103 is sent by the sending bank direct to the Receiving bank right?

Is there any reason why the sending bank correspondent will have to/need to also send a MT103?

Not sure if my understanding is wrong or something.

Will apprecaiate a response. Many thanks!

[…] introduction and analysis of SWIFT cover and serial payments in the latest Flash Funds Pro V11.09 provided us with a good foundation to move further. We can now […]

In 202COV message , there is tag 57A ( account with institution)and tag 58A(beneficiary institution) . What is difference between these . Generally I see only 58A comes in 202 C . In any scenario both the tag comes together in message .

57a: This field identifies the financial institution which will pay or credit the beneficiary institution.

58a : This field specifies the financial institution which has been designated by the ordering

institution as the ultimate recipient of the funds being transferred.

Hello,

We offer Swift MT760 BG/SBLC, FC MTN, BCL, DTC, KTT, EUROCLEAR, Bank Draft, Letter of Credit (LC), MT103 Etc.

N/B : Provider’s Bank move first.

Let me know if you have any need for the above offers.

Email : richardhugo1973@gmail.com

Name: Richard Hugo

Hi Jean,

Awesome content, crisp and Clear.

have 1 doubt. couldnt able to understand the benefit of Cover over the serial. Mentioned as cost will differ, however payment is flowing the same way in both the cases only difference is sending an announcement to Bene Bank thats it. question is how it would reduce the cost at correspondent banks?

also wanted what is A, B, C and D in the Tags.

Hello Jean

Does this Direct- serial and cover payment only works in case of Cross border or do they also work in case of Domestic like In case of Real time Payments?

Because correct me if i am wrong, i think like Real time payments happens inside the country, so Banks will always have accounting relation ship if they meed to use Serial

Likewise all banks in one country are linked with central bank so they will have RMA with other banks so they includes COV payments as well

Please answer this one