In this article, we will look at push and pull payment transactions, two key concepts in payments. At first, let’s consider the definitions of the words pushing and pulling. Pushing means exerting a force on somebody or something in order to move it away from oneself. Pulling is applying force on somebody or something also, but in order to cause movement towards oneself. So both pushing and pulling require the usage of force, however the direction of the movement is different. In push and pull transactions, the force is “applied” when the originator sends a message and the direction of the movement is determined by the way money flows.

Below is the video I made on push and pull transactions.

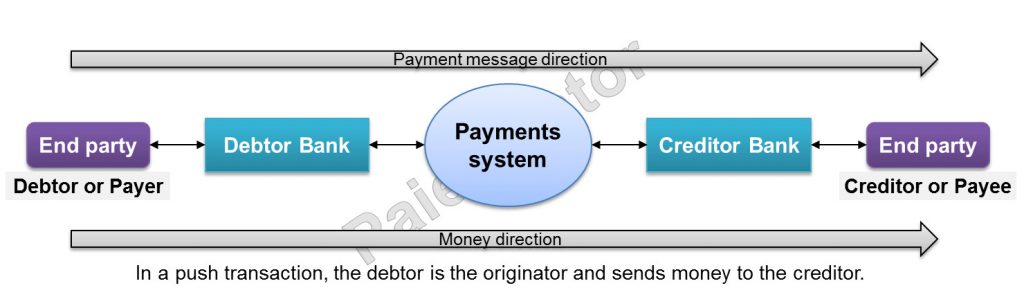

A payment transaction involves two end parties: a debtor whose account is debited and a creditor whose account is credited. The payment message for the transaction may be initiated by either of the end parties. Read the next paragraphs to understand how push and pull transactions work. Look at the pictures carefully.

Push transactions

The diagram below depicts a push transaction. You can see how the payment message flows and how the money flows.

A push transaction is initiated by the debtor to send money to the creditor. The payment message flows from the debtor to creditor as well as the money. In the payments system, the Debtor bank is debited while the creditor bank is credited. The debtor bank takes that money from its customer and the creditor Bank credits his customer’s account with the funds received from the payments system. Examples of push transactions are SEPA Credit Transfer, Wire Transfer, Direct Deposit (also called Direct Credit) for payroll for instance, etc. In each case, the debtor instructs his bank to send money to the beneficiary.

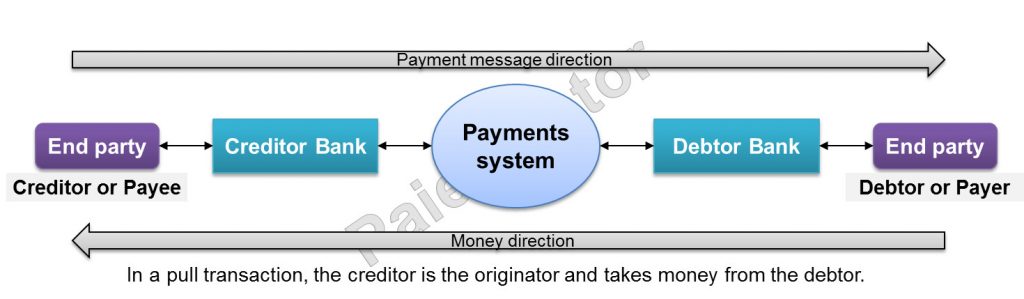

Pull transactions

Now let’s consider pull transactions. The below picture depicts how they work and the difference with push transactions.

A pull transaction is initiated by the creditor to take money from the debtor. The payment message flows from the creditor to the debtor. However, the money flows in the opposite direction. In the payments system, the Debtor bank is debited while the creditor bank is credited. The debtor bank takes that money from its customer and the creditor Bank credits its customer’s account with the funds received from the payments system. Examples of pull transactions are SEPA Direct Debit, Checks, Card payments, etc. In each case, the creditor instructs his bank to collect money from the debtor. When a merchant deposits a check, he is instructing his bank to collect funds from the check writer. Pull transactions are therefore also called collections.

Another important feature of pull transaction is the authorization that the creditor must get from the debtor to collect money from the debtor’s account. That explains why a check without signature cannot be collected and why a PIN code is needed for a card transaction, to name two examples. Obtaining debtor’s authorization is an important regulatory requirement for creditors in many countries today.

[box type=”note” style=”rounded” icon=”Summary”]Depending on the payment instrument, the originator may be the debtor or the creditor. When the originator is the debtor, the transaction is called a push transaction. He is sending money to the other party, the beneficiary. When the originator is the creditor, the transaction is called a pull transaction. The originator is taking money from the other party, the debtor.[/box]

Non-sufficient funds risk for push and pull payments

Push payments are less risky than pull payments. In a push payment, the transaction is initiated by the party who has the money and wants to send it. The bank checks if there is sufficient funds on his account before executing the transaction. In case of non-sufficient funds, the transaction will not be accepted for execution. As a consequence, when a push transaction is executed, the beneficiary is almost certain that he will get his money. It is said that push payments do not bounce.

Pull payments are much riskier since they are initiated by the creditor. The Bank executing the transaction, does not know if the debtor account (with debtor bank) has sufficient funds. In case there is non-sufficient funds on the debtor account at due date, the payment will be rejected and the creditor will not get his money (at least not that time). It is said that pull payments bounce.

Card transactions are the exception. But this is possible because in card networks, there is a message called the authorization which ensures that there are sufficient funds on the debtor’s account when the transaction takes place at the merchant’s. When the merchant initiates the pull transaction later to collect the funds, he is almost certain that funds are available. It is said that card transactions are guaranteed pull transactions.

This ends our analysis of push and pull payment transactions. Now think of the payment instruments you know and ask yourself if it is a push or a pull transaction. Do it before our next post which will be about another fundamental concept in payments: The four corner model applied to SEPA Credit Transfer.

Thankful for your post. Been helpful for a project I’m working on.

A bit of a typo under the examples of PULL payments where I read PUSH instead of PULL.

Hi Daniel,

thank you very much for your careful reading. I corrected the typo.

Hi,

Do you know of a bank that can do a pull transaction? We have been working with several banks and they agree to do a pull and at the last minute, they are either unsure of how to do it, or insist on a push transaction.

Thank you,

Cindi

Great explanation. Very helpfull.

I would also suggest adding real example for more understanding.

Thanks for your remark. I take note of it.

Thank you Paul……..can you give us an example of Pull vs push in Mobile Payments or digital payments?

Hi Robert, First please let me underline that Pull and Pull payments are not linked to any technology. It describes how the instruction and the funds move. With your mobile you can initiate either push or pull payments. Usually, you have a wallet on your mobile, where you store either your card or your account information and maybe some money (Paypal for example). There are many possibilities:

1- If you have money on your paypal account, Paypal debits funds from that reserve directly and sends it to the beneficiary. That is a push transaction.

2- You can send money using your card information. Card transactions are guaranteed pull transactions. Paypal checks that you have enough balance and credits the beneficiary right away. But your bank account is debited only one or two days later.

3- The transaction can be initiated directly from your bank account (Credit Transfer). It is a push transaction. Your account is debited right away and the money moves to the beneficiary through an ACH transfer for example. This option (Paypal does not use it yet, but will probably do in the near future) will become common in Europe in the coming years as a consequence of the PSD2.

4- …

You see there are many possibilities and it is not that easy to categorise a payment as push or pull when it is initiated from a mobile.

I hope this helps.

I am direct to seppa receiver sender most be top bank worldwide,it can only be wire transfer for more info , should contact me directly via email:calif.fx1@gmail.com

Whatsapp: +393512004772

Regards

Calif

Dear Sir,

I am looking at Push and Pull transaction from the perspective where the customer is only able to move fund between his mobile wallet account and his bank account. That means he can move fund from his bank account to his mobile wallet and vice versa. I will like to know the risk associated with these transactions and how they can be mitigated.

Regards,

Hi, Not sure I get the point. These are transactions initiated by the customers to move funds between his own accounts. Push transactions should be enough. Transactions should be initiated from wallet account to bank account when there are sufficient funds on the wallet. And Transactions should be initiated from bank account to wallet account when there are sufficient funds on the bank account.

Also ganz ehrlich so einen beschissenen kauderwelch habe ich noch NIE gehoert

im zusammenhang von einer erklaerung..voll unverstaendlich und fuer leihen komplizierte angelegenheit

kein Bankname wer so etwas macht..Dann von Taschenkonto zu seiner bank obwohl es um etwas ganz anderes geht..

[…] Push and Pull Payments […]

Food afternoon ,I’ve failed to receive ma money on ma account ,I sent ma money using ma line ti ma account but am seeing a msg of pull n push wats this ,is ma money taken or wat