Traditional payment systems operate essentially on two types of models: open loop models and closed loop models. In this post, we will present each of the models with their advantages and drawbacks. Understanding how these models work is crucial for the analysis of payment systems. So read the following very carefully.

Open loop models in payment systems

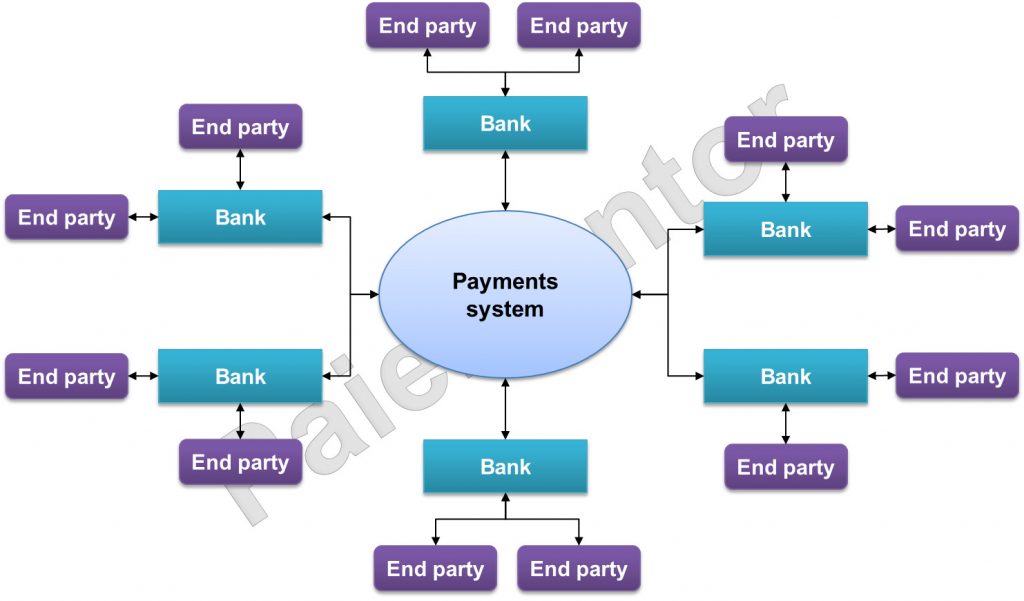

Open loop systems can be compared with a hub-and-spoke model. The system is connected to Banks or similar institutions which act as intermediaries. And the banks are connected to end parties, the senders and receivers of funds. There is no direct connection between end parties and the payments system. The picture below depicts an open loop payment system.

The payments are sent from an end party to its bank, then from that bank to another bank through the payments system and finally the receiving bank delivers the payments to its end party customer. Open loop models yield the great advantage of allowing banks to transact with each other without direct relationships. When a bank joins the system, it can exchange transactions with all the banks that are already in the system and vice versa. This allows open loop systems to scale rapidly.

In an open loop system end parties, therefore, send funds to one another without having a direct relationship with the same bank. All end parties are in a way connected to each other through the payments system and the intermediary banks.

As we saw in the previous article, Banks that join a payment system are bound by the rules. Since they are independent entities, each bank has its own project and timelines to implement these rules. In general, they have a period of many months and sometimes even years to become compliant. The implementation of new rules takes time in the open loop model. This is one of the drawbacks of these models. And even worse, banks may have different interpretations of the same rule with various implementations as a result.

Visa and MasterCard are examples of open-loop systems. If you possess either of these cards, you got it from your Bank and not directly from Visa or MasterCard. Your Bank is the intermediary between you and those payment systems. Merchants that accept Visa or MasterCard do not join them directly either. They have to sign a contract with a Bank which a member of Visa or MasterCard. Thus banks are always playing the role of intermediaries between end parties.

For the transfer of funds, banks join payment systems at the national or regional level. The bank customers cannot join these systems directly. In fact, many are not even aware of their existence. Customers send and receive payments through their bank, the intermediaries between them, and the payments systems. Interbank payments systems for Credit Transfers, Direct Debits, and Checks are open loop systems. you may now wonder which payment instruments are processed in closed loop payment systems. Just read on.

Closed loop models in payment systems

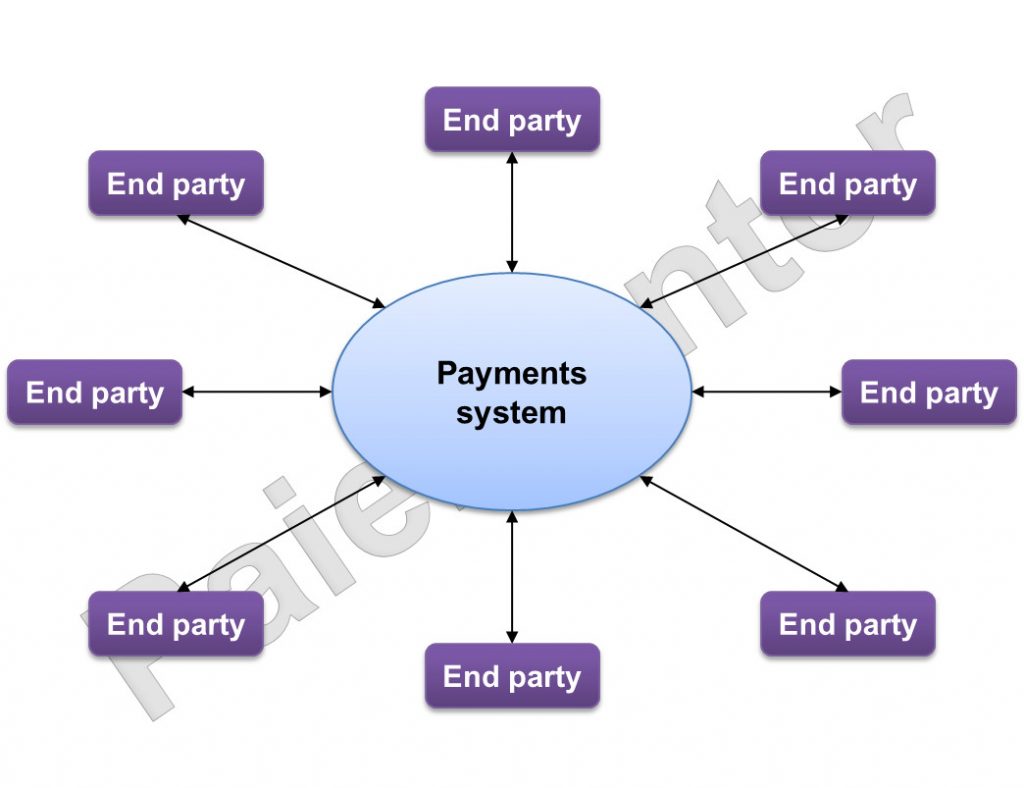

Closed loop payments systems connect end parties directly to each other without banks as intermediaries. The end parties, merchants, and consumers, join the payments system directly.

As we see on the above picture, there is no intermediary layer. The architecture of closed-loop payment systems is therefore quite simple. End parties must both join the payments system before they can transact with each other. It can be considered as a centralized system with one entity operating it. Changes and new services can be implemented and delivered pretty fast to all the end parties. This is an advantage of these models.

The initial American express network is an example of a closed loop system. Future cardholders fill in a form a send it directly to American express. The merchants that want to join the system must do the same. Both merchants and consumers deal directly with American Express. Paypal operates a closed loop payments system. To pay with his PayPal information (email and password), a consumer first has to register with PayPal. And merchants can accept payments via PayPal only if they join the system. It is interesting to note that both AMEX and Paypal heavily rely on open loop systems to transfer funds to their end parties.

The closed-loop payment systems do not grow as rapidly as open-loop systems because merchants and consumers must join the system itself. This may sound a bit counter-intuitive. But it comes from the fact that setting up a distribution network to address consumers directly is expensive and takes time.

In an open loop payment system, customers of the systems are the banks that distribute the payment instruments-related products to their own customers, the end parties. In closed loop systems, customers are the end parties. That makes a big difference in the end in terms of growth.

Hi Jean,

Thank you for this informative article!

I just have one question regarding the below sentence that was mentioned under “Closed loop models in payment systems” (Third paragraph, last sentence).

[“It is interesting to note that both AMEX and Paypal heavily rely on open loop systems to transfer funds to their end parties.”]

My understanding was that AMEX and Paypal both operated a closed loop system. How does the open loop system come into play here?

Apologies for my lack of understanding but your help is much appreciated!

Thank you in advance!

Len

There is a great dependency for settlements between the customer and merchants happens accordingly to finalise the transaction. Settlements between merchant and consumer ultimately relies on the the indirect dependency of the open loop model where the bank plays an indirect role between merchant and consumer.

In the case of digital currency, trade happens only when a user has that certain crypto coin. Would that process now fall under the closed loop payment system since it has not been regualted under the Banks act, and only specific issues of the coin will accept crypto currency for trade?

How efficient are the settlement on the closed payment system than the open. Since it deals with the consumers directly?

Are closed loop payments system found in African countries, as compared to the open loop system. In percentage rate what is the difference between the two in terms of growth. Both open loop and closed loop has got its own advantage towards customer service which is good for the transfer of funds and settlements.

[…] Payment System Models […]