Cross border payments are perceived as one of the most complex topics in payments. And that is true to some extent. It involves many countries and currencies. And the transactions usually go through tens of systems in interbank networks, Banks and Corporations. When many start in Cross border payments or when they are introduced to it, the tendency is to directly go through the SWIFT standards and start looking at message types like MT103 or MT202 that are used for cross-border payments.

After working with many consultants in business requirements, design and testing, my view today is that this is not the right approach. It is not the path of least resistance simply because many crucial things that must be understood, are not presented in the SWIFT standards. I had to struggle with cross border payments myself. But with the time I discover 4 key strategies that I think can help you to avoid the frustrations and the pains I had to go through. Today I am starting a series of articles, where I will share these key strategies in a structured way with my readers. What I want to share with you is the result of many years of studies and discussions, the result of my own experience with consultants that I worked with.

I want to show you, what I consider to be the path of least resistance, when it comes to growing yours skills in cross border payments. I am convinced that this approach is easier and brings results faster. Once you grasp these principles and strategies, you will see that cross border payments are not as complex as you may think and you will be able to analyse many scenarios and cases that you will encounter in your projects with confidence. At least you will be able to ask the right questions. And if at the end of an article, you have any question or remark, just leave a comment or send me a mail through the contact form available on the blog.

Before I dig into each of the strategies, let me briefly summarize what they are.

The 4 key strategies to understand how cross border payments really work are:

Strategy #1 – Get an overview of payments systems models and specifically the open loop models

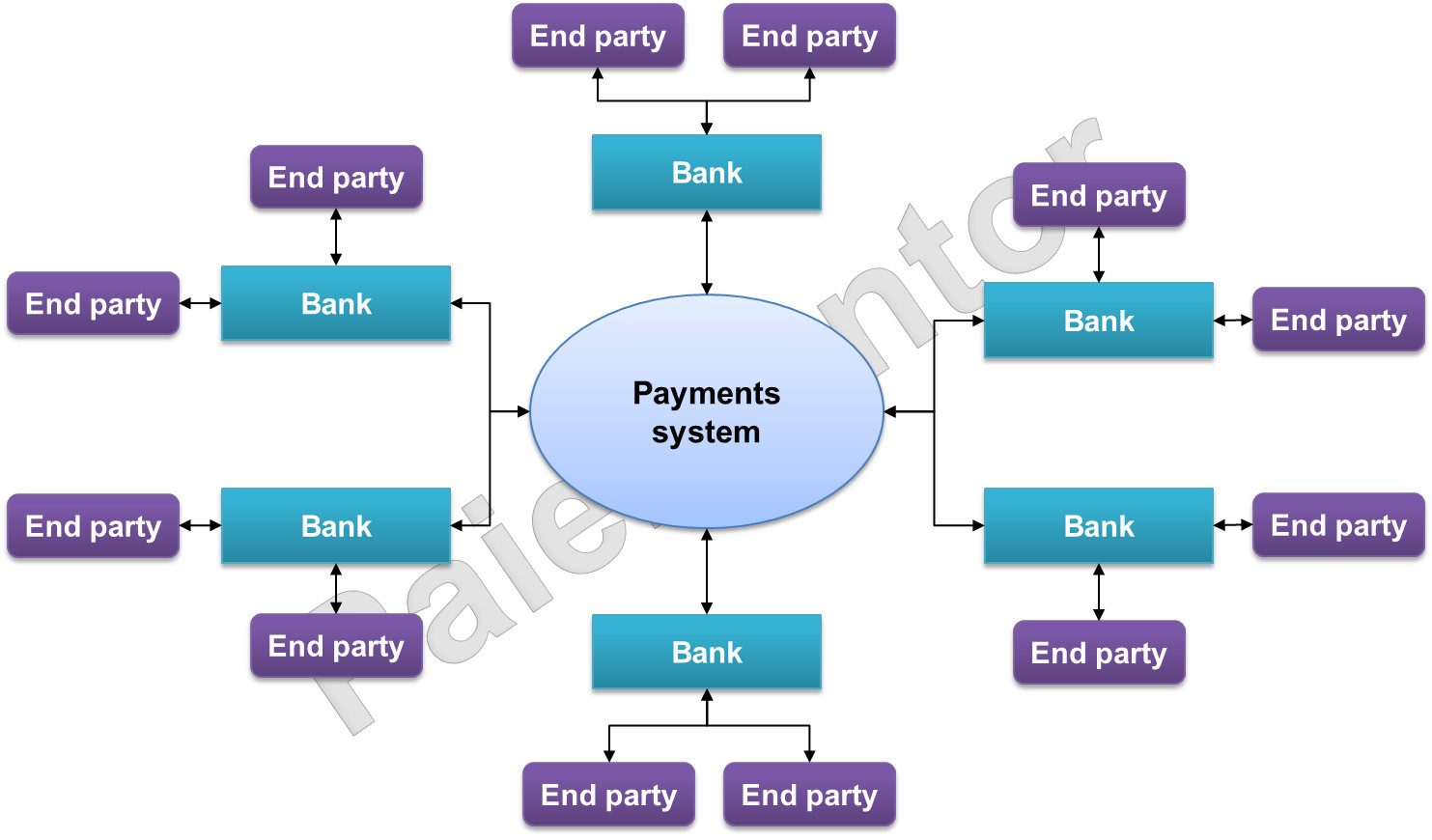

Many people working in payments have never really considered payments systems models. If that is your case, then I strongly recommend you to pause and take a look at payments systems models. They are the foundations, the basis upon which to build our payments knowledge. In payments, it is crucial to get an overview of payments systems models and specifically the open loop models because they are the prevailing models in all countries. So once you understand the underlying concepts, you can easily analyze the payments systems of any country.

Strategy #2 – Grasp the principles of Correspondent Banking and account relationships between banks located in different currency zones

You have probably already heard that Banks settle cross border payments through accounts open with correspondent banks in the different countries. What does it mean exactly? What is correspondent banking? What is an account relationship and how does it work? These are important questions to answer before you start looking at SWIFT MT messages. I think this is probably the most important of all the strategies. Take time to really study this article when it will be available. You can subcribe to the newsletter to be informed when the related post will be published.

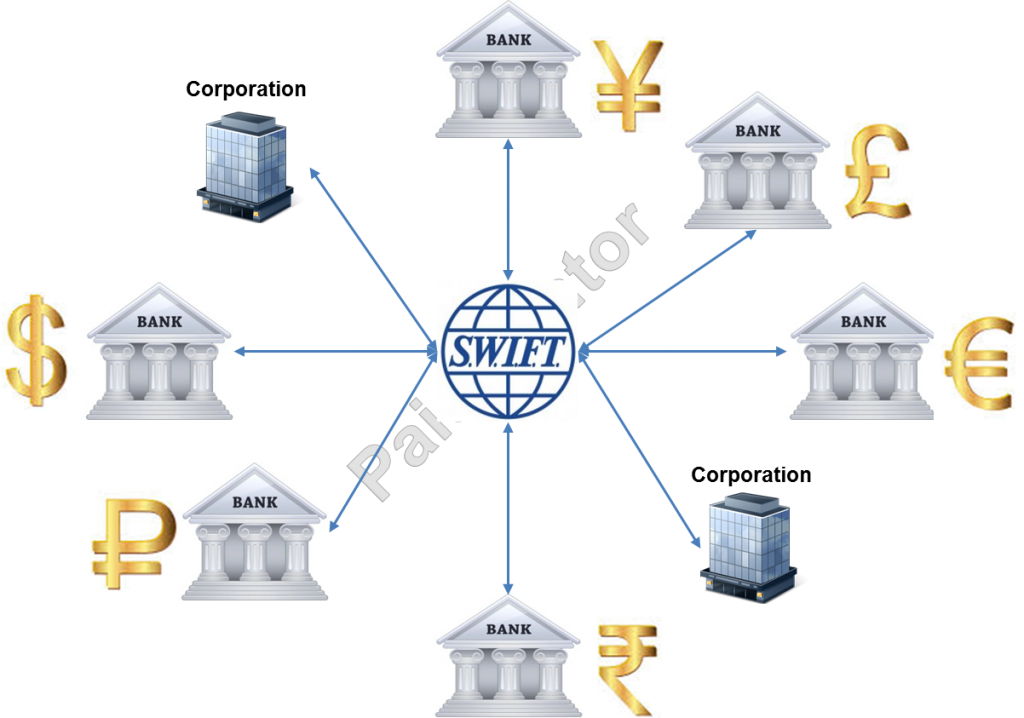

Strategy #3 – Understand the role of the SWIFT Network and the SWIFT standards

SWIFT is by far the largest player in payments globally. It owns the network called SWIFTNet, which enables banks and corporations to exchange payments information faster and in a secure way. Why is that network so crucial? And why are standards needed? You will have answers to these questions and much more in this third strategy. Furthermore, SWIFT has a fascinating story and it is interesting to see how the SWIFT project evolved. More in this post.

Strategy #4 – study the basics of Foreign Exchange markets and how banks use them

The foreign exchange market, simply called FOREX, is the place where supply and demand of currencies meet. Forex trading consists in the buying of one currency and the simultaneous selling of another. That is why when trading currencies we always see them quoted in pairs. The FOREX is subject to certain rules that have an influence on the way currencies pairs are traded. In addition, currencies are not equal. There are major, minor and exotic currencies. How do all this impact the way X border payments are processed? In this part, you will have the introduction that will help you connect the dots easily.

The next article will be about the first strategy to easily understand how cross border payments work: Get an overview of payments systems models and specifically the open loop models.

Do not hesitate to share any comment or remark you may have on this exciting topic. If we can improve the ways payments is taught and help others save precious time and reach their goals faster, then every contribution is appreciated. If you knows books that are worth reading, please do share them with your review if possible. Many readers of this blog are interested in books that matter. Thanks in advance 🙂

Great Going JP 🙂 Love your content.

Thanks Rouble! I am happy to see that you love the content. This topic is pretty interesting, so I am preparing future articles.

very informing and helpful

thanks

Thank you Hesam

Hi Jean,

Currency never leaves its home country. So, when two countries are establishing relationship through banking for the very first time, how is nostro account of one bank funded?

Hypothetical example as below-

India and Australia are establishing a banking relationship through Bank A and Bank B respectively.

Bank A has opened nostro with Bank B. How bank A funds its nostro in Bank B with Australian Dollars?

Because there is no other bank from India present in Australia?

Regards,

Milind

Hi Milind,

Great question! Actually, the answer is very simple. It has to do with how the FX market works.

Bank A purchases AUD from the FX market against INR and says to the counterparty: Here is my Nostro account with Bank B. That is the account that should receive the AUD.

So when the deal is settled, the nostro account of Bank A is credited.

When banks purchase foreign currency, they provide their Nostro account with their correspondent and that is where the funds are credited. Otherwise, they would just loose the money. It will go into a blackhole 🙂 Let me know if it is unclear.

I hope this helps.

Regards,

Jean Paul

Hi Jean,

Thanks for the answer.

But I have a doubt 🙂

When you say, bank provide Nostro account with its correspondent when it purchases foreign currency, it inherently means that the banks from two countries have already established relationship.

Scenario which I would like to know is there is no relationship at all between banks of two countries and it is first time they are establishing that.

From your first 2 sentences, it appears that bank A purchases AUD from bank C which belongs to country Singapore. Bank C (Singapore) and Bank B (Australia) already have a banking relationship. So bank C credits nostro of bank A in bank B.

But then how were the first time relationship between A & C or B & C established?

Apologies, if I am making it unnecessarily complicated. 🙂

Regards,

Milind

Hi Milind, 🙂

No problem. I will try to explain and clarify.

Let’s assume you are a bank in India and you want to receive AUD. The first thing you must do is to contact a bank in the country of AUD. If the bank offers correspondent account services, they will open your account first with 0 funds on it. It may be a temporary account. In any case, they will provide you the account information that you will use in your FX transaction. It is the account that will receive the funds when the FX deal is settled. So you must set up a relationship before you can do any FX deal. There is no choice.

For A & C or B & C, same process as above. You need to get an account first. But if you already have an account with one Bank (First Bank) in the country and you are opening an account with another bank (Second Bank), you can just instruct First bank to debit your account and send the funds to Second Bank. No FX deal needed since you have AUD already.

Let me know if you have further questions.

Regards,

Jean Paul

Thanks a ton Jean for reply! This is clear now. 🙂

Great article. It was really helpful for me in understanding the payment system.

Good Article 🙂

The article is brilliant. It very clearly explains the cross border payment to me.

Thank you Madhu!

Thank you so much for your valuable information. I just failed examination which is hold by our bank. It was about cross border payment. Now, I am studying for re-testing. Next time, I hope I will comment a/b “good news”.

Hi, I hope you got your examination the second time.

Very informative and insightful article, I feel this information is really important for everyone to have idea about. In fact payment options and how to make payments ,the procedure and options, payment gateways when doing an export business is also something people have very little knowledge about. This could be something your viewers might me interested in.

Hi, i have a question regarding cross border transfer through wire transfer services such as Citi Bank WorldLink Transfer.

Say Party 1 in counrty 1 orders wire transfer to send some USD to party 2 in country 2 where the currency in use is not USD.

The ordered bank has its branch in country 2 also and provides equivalent local currency in account of party 2.

The question is whether bank in country 2 will recieve the USD in its nostro or not?