Get an overview of payments systems models and specifically the open loop models: that is the first strategy to build strong foundations and understand cross border payments faster. As announced in the previous article, we will now look into it in detail.

Payments systems in all countries in the world operate essentially on two models: The open loop models and the closed loop models. In the following, we will focus on open loop models because they are by far the most widespread models and the ones that can be used to study any payment instrument.

Open loop payments systems models

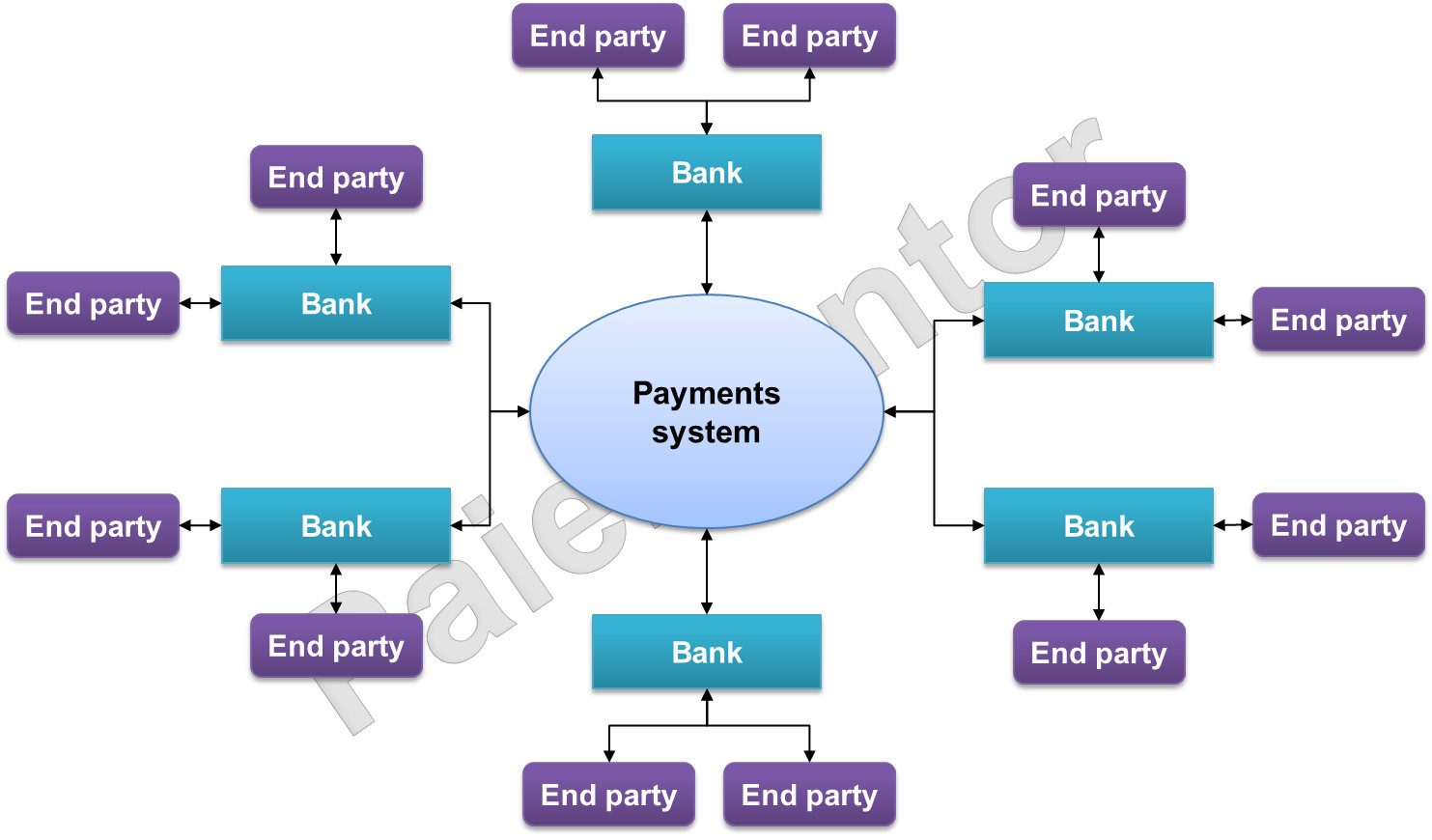

The following picture shows what an open loop model looks like.

An open loop payments system can be compared with a hub-and-spoke model. The system is connected to Banks, Payments Services Providers (PSP), Depository Financial Institutions (DFI) or similar which act as intermediaries between end parties and the payments system. And the banks are connected to end parties, the senders and receivers of funds, on one side, and to the payments systems on the other side. So there is no direct connection between end parties and the payments system.

The payment instructions and information are sent from an end party to its bank or PSP, then from that bank to another bank through the payments system and finally the receiving bank delivers the payments to its end party customer. Open loop models yield the great advantage of allowing banks to transact with each other without direct relationships. When a bank joins the system, it can exchange transactions with all the banks that are already in the system and vice versa.

So to summarize: In an open loop system end parties can send funds to one another without having direct relationship to the same bank. All end parties are in a way connected to each other through the payments system and the intermediary banks.

You may wonder what is inside the payments system. How is it made up?

Anatomy of a payments system

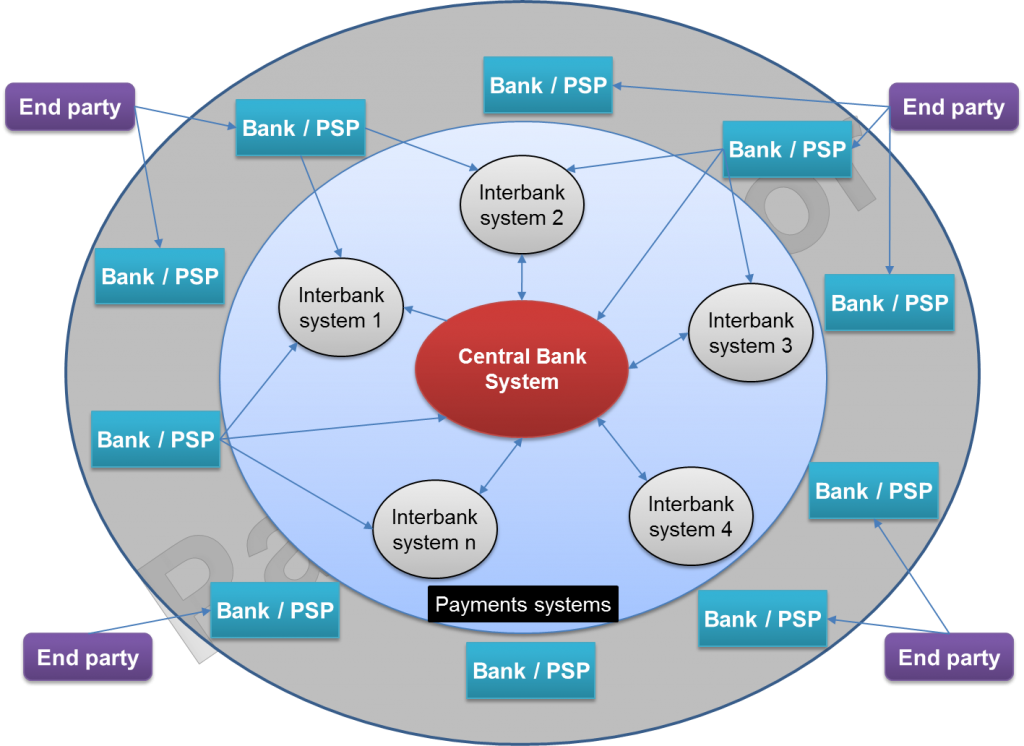

Consider the next picture carefully.

Payments systems are composed of many interbank systems and a central bank system(s) in the middle. All the interbank systems are connected to the Central Bank system. The Banks are connected to one or many interbank systems and but always to the central bank system. On the picture, some arrows are missing just for the sake of clarity. In reality each bank is connected to the central bank systems and to many interbank systems.

Interbank systems allow banks to exchange payments instructions (without immediate transfer of funds) and clear them according to a defined frequency, in general daily. But this can happen many times during the day. The transfer of funds is carried out only after the (multilateral) clearing. And that actual transfer of funds is what is called settlement.

Banks may also exchange payments with immediate transfer of funds. In this case, they will go through the central bank system(s) also called Real-time Gross Settlement System.

This brings us to two topics that are fundamental in payments: clearing and settlement. If you want to have more information about those topics, you can read this article and the next one available on this blog. You can also download a guide for free from this website. See the widgets on the right of this page.

Payments systems operate in a single country and are denominated in the currency of that country. They are also subjects to rules either defined by the government or by the banking community. All end parties and Banks must comply with the rules if they want to become participants of the payments systems.

We are getting to the point. To understand cross border payments, you need to look at the payments systems at country level first, because a cross border payment must go through at least two payments systems in two different countries or monetary zones. Even if the currencies are different, there are many similarities when you consider payments systems at country level. In all countries, you find central bank systems, interbank systems, standards for message exchanges, protocols exchanges and so on.

As already said, the open loop model is by far the most widespread in the world. So it is worth spending time studying and analysing it to understand the payments systems in your own country and other countries. That is why cross border payments is in general easier for people who have already worked on domestic payments. They have had the time to study the key concepts related to domestic payments and since these concepts are almost the same in other countries, that is pretty helpful.

Payments systems in France for credit transfers

Let’s look at one example to make the things more concrete: the payments systems in France for credit transfers. I chose France because it is the country where I currently live. You can do the same for your own country.

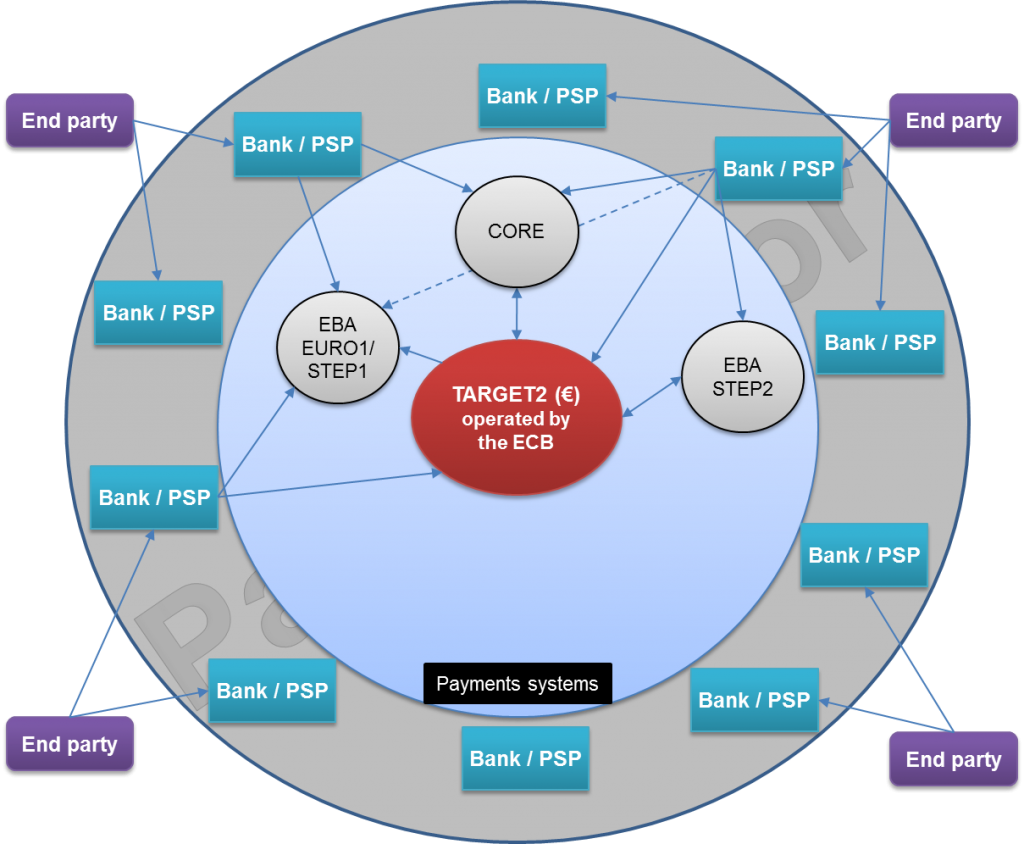

This is obviously an open loop model. Banks are intermediaries between the payments systems and end parties.

The Central bank system is TARGET2. It is an RTGS system that Banks use to settle funds transfers almost instantaneously provided funds are available on debtor bank’s account with the Central bank. We also see three interbank systems: EBA EURO1/STEP1, EBA STEP2 and CORE. They are all multilateral clearing systems. It means that instructions are exchanged among banks without transfers of funds. The funds transfers happen after multilateral netting or clearing.

EBA EURO1/STEP1 is used for high value funds transfer. The instructions are exchanged in SWIFT MT formats. And EURO1/STEP1 implements many rules for better risk and liquidity management. EBA STEP2 and CORE are used for retail payments or low value payments in ISO 20022 formats, the message standard upon which the SEPA Credit Transfer scheme is based. CORE stands for COmpensation REtail. Each interbank system has own cut-offs and implement standards for message exchanges, protocols exchanges. The cut-off is the time before which an instruction must reach the interbank system, so that it can be considered in the next clearing or netting cycle.

France belongs to a monetary zone, the Euro zone. EBA systems, CORE and TARGET2 are all denominated in Euro. If a Bank in France wants to send or receive USD or JPY, it is not possible through these systems. How then do French banks send and receive funds in different currencies? This brings us to the strategy number 2 that will be discussed in the next article: Grasp the principles of Correspondent Banking and account relationships between banks located in different currency zones.

On the table below, you see 3 useful resources that I used to prepare this article. If you want to deepen the topic of payments systems, then those books are worth reading. My affiliate links are provided.

| The chapter 2 of the book payments systems in the U.S. is about payments systems overview. It presents some of the concepts that I introduced in this article. Even if the whole book is about payments systems in the U.S., you can find a lot of things that are applicable to the payments systems in the country where you live. A really great book! Personally, I have read it completely twice and I constantly refer to it. | |

| This book, payments systems, is the most complete book I have ever read on payments systems. It handles topics like payments systems architecture, payments systems typology, risk management in payments systems and much more. A must read book if you are a payments professional. | |

|

Les systems de paiement (in French) is simply the french version of payments systems. However, it was written few years before the english version. So the english version is more up-to-date. But the french version remains a masterpiece. |

Hi JP,

By looking at the payment model of France i could see both the interbank system(EBA STEP1,STEP2/ and Central Bank system(TARGET) are provided by Europan Board association . So is CORE only the system they were using for clearing and settlement of payment before esistance of EBA. Or there were some other CSM’s

CORE is the system used for retail payments. It was introduced after SEPA to handle files in XML formats and provide better services.

EBA systems were already in place before SEPA. And before SEPA, there were systems for High Value payments like PNS and TBF.

So the payments market infrastructures evolved quite a lot with the SEPA project.

Hi Jean,

Great article! Can you please give an example with one case? Say Bank A wants to transfer money to Bank B.

So Bank A initiates the transfer, send the message via EBA to Bank B. When Bank B recieves the message, it registers it and after the final netting, money is transferred. This is pretty clear. But how does the actual transfer of money happen? Is it ledger of Bank A to ledger of EBA to ledger of Bank B or does it have anything to do with Target2? If not, then where exactly does Target 2 come in to the picture?

Thanks already!

[…] case you have not read the introductory article and the article about the first and second strategies, I strongly recommend you to read them so that you can easily connect the […]

Hi JP, I loved the content on your blogs, very well structured and explained nicely.

[…] Cross Border Payments 1 […]

What are the 3 book names mentioned above?