The Bank of International Settlement (BIS) defines settlement as an act that discharges obligations in respect of funds or securities transfers between two or more parties. Thus settlement is the funds transfer that is carried out by one party to fulfill his obligations towards the counterparty in a financial operation. The settlement must be performed after bilateral or multilateral clearing to actually move the funds. In payments, there are basically two types of settlements: gross settlement and net settlement.

A gross settlement system is a system in which the settlement of funds transfer occurs individually after each payment transaction is processed in the system. Banks generally use this type of system to exchange urgent transfers or large amounts transfers. If the funds are not available, the transfer cannot be executed. However, when the funds are available, the instructions are executed almost instantaneously. That is why these systems are called RTGS, which stands for Real-Time Gross Settlement System. “Real-time” means that fund transfer happens right away if funds are available. In addition, when a fund transfer is made between two accounts at the central bank, it becomes final and irrevocable immediately after the transfer is made. The risk of default is therefore eliminated.

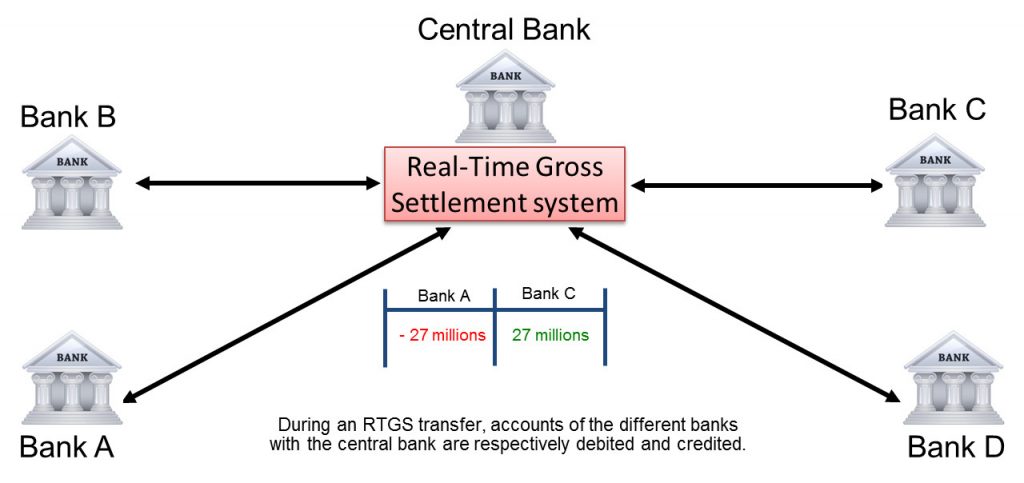

An RTGS system is a critical infrastructure for a country’s economy since it connects all the (participating) banks and facilitates the fast transfer of funds among them. RTGS systems are usually operated by the central bank of a country or monetary zone. Remember that the central bank plays the function of “Bank of banks” as overseers of the banking system. The following picture illustrates the connections of banks to an RTGS. After the processing of each transfer, accounts of instructing and receiving banks with the central bank are respectively debited and credited.

Things are a bit different in a net settlement system. First, transactions are exchanged among participants without transfers of funds. Then the multilateral netting happens at specific time(s). The obligations are netted among all the participants and the multilateral net settlement positions are calculated. The net settlement position is the sum of the value of all the transfers a participant has received during a certain period of time less the value of the transfers made by that participant to all other participants. If the sum is positive, the participant is in a multilateral net credit position; if the sum is negative, the participant is in a multilateral net debit position.

Some time is needed to compute the net positions, send the information to the banks and proceed to the transfer of funds. This inevitably adds delays in the actual moving of funds. To reduce the delays and improve the liquidity in the overall system, many settlement cycles are carried out during the day after related multilateral clearings. If a participant wants a transaction to be settled at a specific time, it has to send that transaction before the cut-off time for that settlement cycle. The clearing system communicates the cut-off times of settlement cycles to all participants and the information about the settlement times. So each participant is aware that transactions that reach the CSM after the cut-off time for a specific settlement cycle cannot be taken into account. They may be taken into account in the next settlement cycle depending on the CSM rules.

Please refer to the previous article to see a picture of the multilateral clearing system and get more detail about it.

Several multilateral clearing systems may exist in a country or region, but there is only one RTGS which, as mentioned above is operated by the central bank. Those multilateral clearing systems belong to the so-called ancillary systems. In the USA, the RTGS is Fedwire. CHIPs, Checking, ACH and Cards Systems are multilateral clearing systems for which settlement takes place in Fedwire. The Eurozone countries have one RTGS : TARGET 2. However, in each Eurozone country, many multilateral systems are available. You can read the last part of the first article again where different high and low-value payment systems of a few countries are mentioned.

Banks can participate in clearing or settlement systems as direct or indirect participants. What does it mean? And what are the difference between direct and indirect participation? That will be the topic of the next article.

For your information, we have created an online course where Clearing and Settlement and other important notions like Payments Systems Models, The Four Corner Model, Payment messages standards, Payment processing value chain, Basics of domestic and international payments, … are presented and explained in a very simple manner. Click here and get an overview of the Payments Fundamentals Course.

Sir,

Please add the link of the next article which one should read post this article

Hi,

Thanks for the remark.

Done now. when I will have time, I will review my posts and add those links to ease the navigation for my readers.

Very informative article. So,

“CHIPs, Checking, ACH and Cards Systems are multilateral clearing systems for which settlement takes place in Fedwire.”

Do you mean that for any number of clearing houses the actual settlement takes place at the only RTGS in a country? Could you clarify a bit on this?

Eg. The banks communicate with ACH to do the clearing, and immediately after they contact the RTGS that will do the settlement inside the central bank or is it different than the central bank itself?

Thanks

Hi Jean,

All the payments related articles provide a clear understanding of the concepts. Your style of writing is lucid. Thanks for sharing your knowledge!

Could you please let us know the accounting entries made by a bank in a net settlement scenario?

A outward remittance transaction – Accounting entries recorded by the core banking system of the bank a)while the payment instruction is issued b) after clearing and c)after settlement. Many thanks!

Hi Kusuma, Thank you for your appreciation.

I would love to help you with accounting entries (a key topic in payments and it takes time to really explain how it works), but right now I am very busy.

So I recommend you to read the chapter 6 of the book I wrote about SCT if you have it.

Now that you know my style, I think you will not be disappointed. If you don’t have it yet, you can buy it on my website (PDF version) or on amazon.

For now, this is the best thing I can do for you. In the future, I will write few articles about accounting. But I do not know yet when that will be possible.

Best regards,

Jean Paul

[…] Settlement: https://www.paiementor.com/clearing-and-settlement-mechanisms-settlement/ […]

[…] Payment Settlement […]

Hi JP,

thanks a lot for this article about CSM.

now that I have gone through all of these…I am confused between clearing system does(netting and coming with final position) AND what does net settlement does(again netting)? can you pls explain the difference pls? Many thanks in advance.