In this article, we will look at the second strategy to understand how cross-border payments work: Grasp the principles of Correspondent Banking and account relationships between banks located in different currency zones.

In case you have not read the introductory article and the article about the first strategy, I strongly recommend you to read them so that you can easily connect the dots and understand cross-border payments.

This is probably the most important of all the four strategies because at the end of day, payments is about moving funds and in cross-border transfers, funds move through correspondent accounts. So grasping the principles of correspondent Banking and account relationships is absolutely essential. In this article, we will first look at payment systems in two countries. Then we will see how banks access systems of foreign countries. After that, we will analyze the account relationship and correspondent network. Then we will look at the different currencies and how they are grouped. We will conclude by looking at how banks use correspondent accounts with concrete examples.

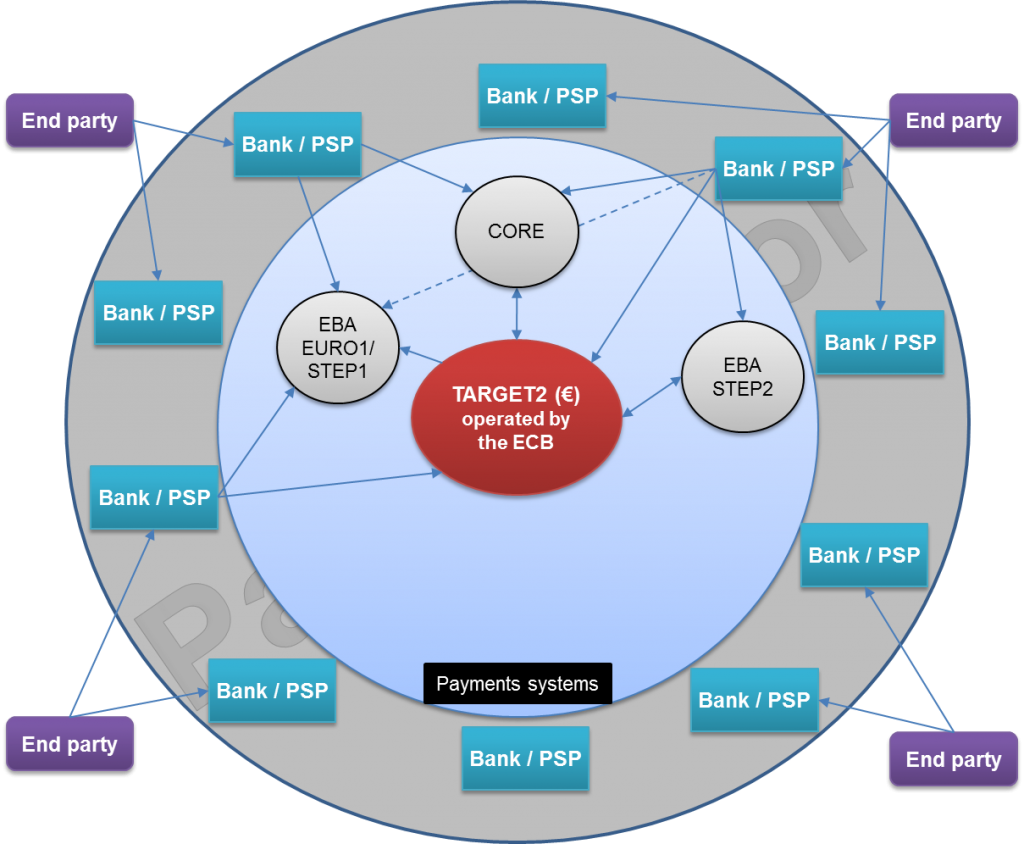

Payments systems model for Credit transfers in France and the USA

Let’s start with the payment systems model for Credit transfers in France that we saw at the end of the previous article.

France belongs to a monetary zone, the Eurozone. EBA systems, CORE and TARGET2 are all denominated in Euro. If a Bank in France wants to send or receive USD or JPY, it is not possible through these systems. How then do French banks send and receive funds in other currencies? To understand how they do that, let’s first consider the payment systems for credit transfers in the USA.

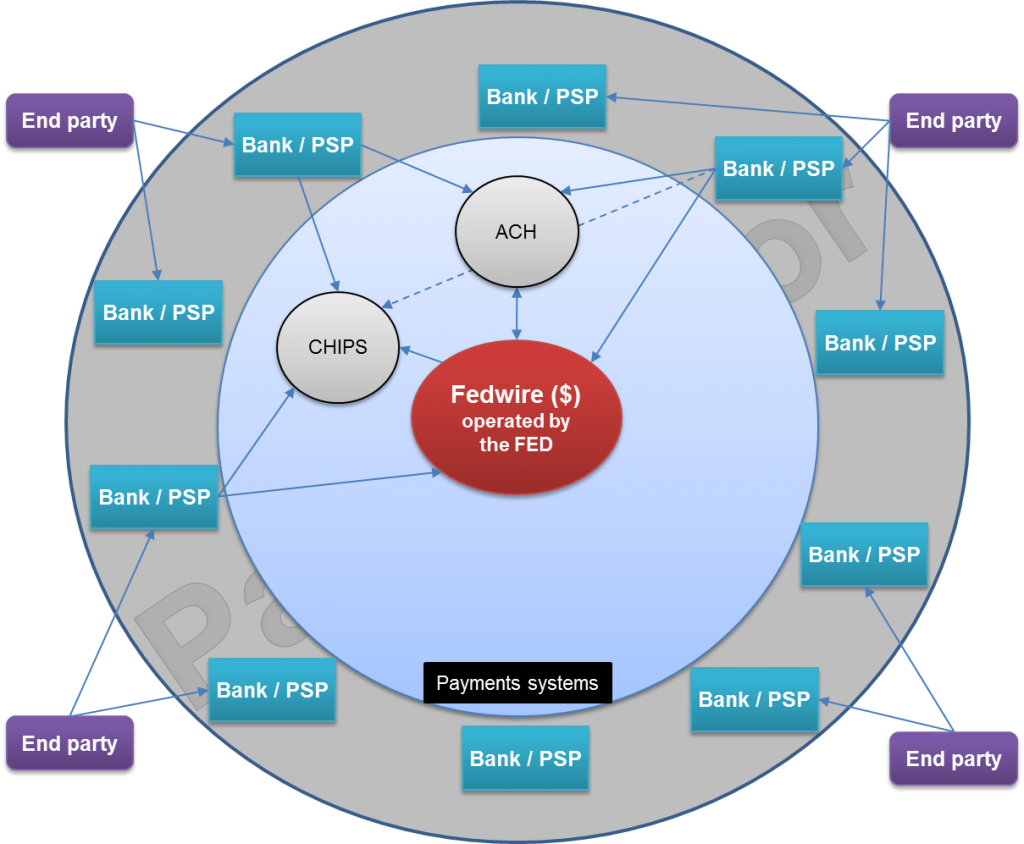

This is a very simplified way to represent the payments systems in the USA. But this representation is enough for our needs.

As I said in the previous article, open loop payment systems are the most widespread in the world and they have many similarities. Payments systems for credit transfers in the USA provide an interesting proof. We see one RTGS system, Fedwire, which is operated by the Federal Reserve, the central bank in the USA. We also see two multilateral clearing systems: one is CHIPS which is used for high-value payments and the other is ACH, which is used for retail payments. These systems are all denominated in USD. Impossible for a bank to send or receive another currency like EUR or JPY through one of them. In a certain way, we can say that these systems know only the US Dollar. And like Banks in France, Banks in the USA do need to send funds in other currencies than the local currency. Banks do share the same needs in both countries.

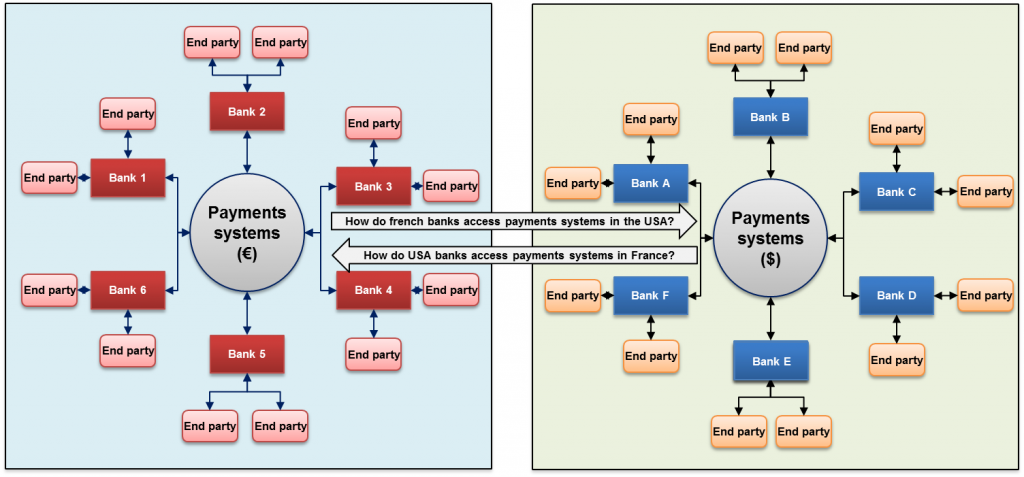

Now let’s look at two payment systems located in two different countries: France and USA.

If a French Bank wants to send or receive US dollars, then it needs to get access to the USA payments systems. The same thing applies to a US Bank. If it wants to send or receive EUR, then it needs to get access to the EUR payments systems. And how do they do that? Simply by becoming a customer of a Bank located in the monetary zone that they want to access. A bank, customer of another bank? This may sound weird for beginners. But that is the case. Look at the next figure that introduces correspondent account relationships.

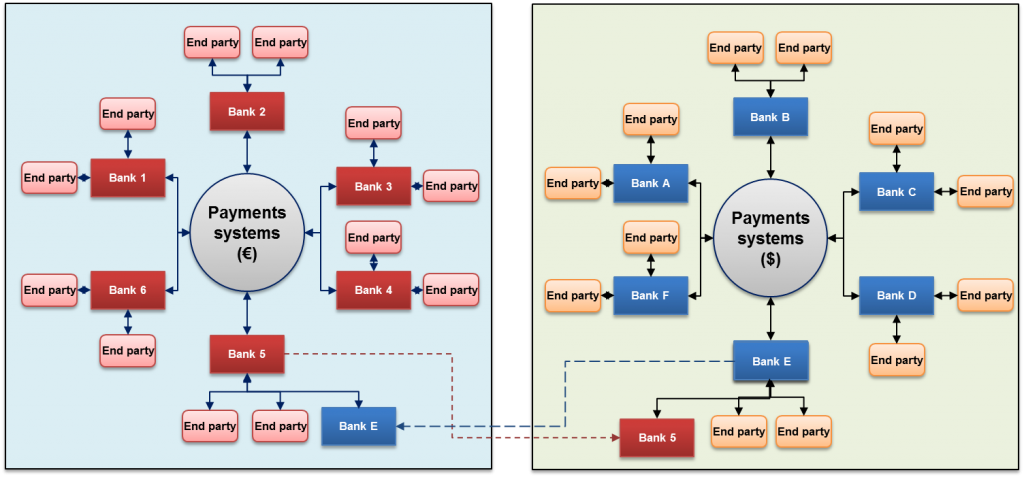

Correspondent account relationships

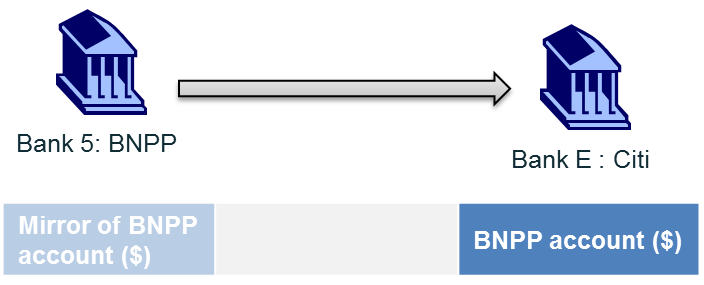

The French Bank (Bank 5 on the picture) asks a US bank offering correspondent account services to open an account for itself. The US Bank (Bank E on the picture) may do the same, but it is not mandatory. We see on the picture that Bank 5 becomes an end party of Bank E and Bank E becomes an end party of Bank 5. (It is assumed that Both Bank 5 and Bank E offer correspondent account services).

[box type=”tick” style=”rounded”]Before opening an account, a bank must perform a vetting or KYC (Know Your Customer) process to check the identity and background of its future client and assess potential risks of illegal intentions for the new business relationship.[/box]

When the French bank opens an account with a bank in the USA, both banks enter into what is called a correspondent account relationship. The bank in the USA becomes the correspondent of the French Bank in USD currency. The account is opened in the book of the bank in the USA, but it is the account of the French bank.

Unilateral and bilateral account relationship

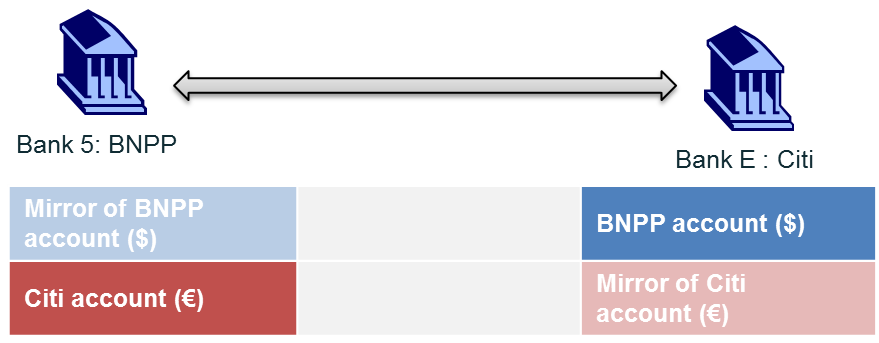

If Bank 5 opens an account with Bank E, but Bank E does not open an account with Bank 5, then both enter into a unilateral account relationship. The relationship is unilateral because there is only one account opened. If each bank opens an account with the other then they will enter into a bilateral account relationship.

Now let’s consider the unilateral account relationship and its main characteristics.

Citi calls the BNPP account that it holds Vostro account. BNPP its account at Citi Nostro account. Note that it is the same account, but considered from different perspectives.

BNPP does open an account in his own book: the mirror account. The mirror account is there just to follow what is happening on the real account and manage liquidity. It does not contain real money. The BNPP account with Citi may receive thousands of accounting entries. Why is it called mirror account? Because the account entries on the real account and on the mirror account are of same amount, but opposite signs. If the real account is debited, the mirror account is credited and vice versa. We will get back to this later.

[box type=”info” style=”rounded”]In many payment engine softwares, the mirror account is called Nostro account instead of mirror Nostro. The Nostro account is always in the books of the correspondent bank, never in its own books. So a bank does not debit or credit its Nostro account. Its correspondent bank does.[/box]

Now let’s consider the bilateral account relationship and its main characteristics.

BNPP calls the account of Citi in its book Vostro account and its account at Citi Nostro account. Citi calls the account of BNPP in its book Vostro account and its account at BNPP Nostro account. BNPP opens the mirror account of its account at Citi in its own books. Citi does the same for its account with BNPP. Important is to note that the same account are called Nostro or Vostro. It depends on the perspective of each bank.

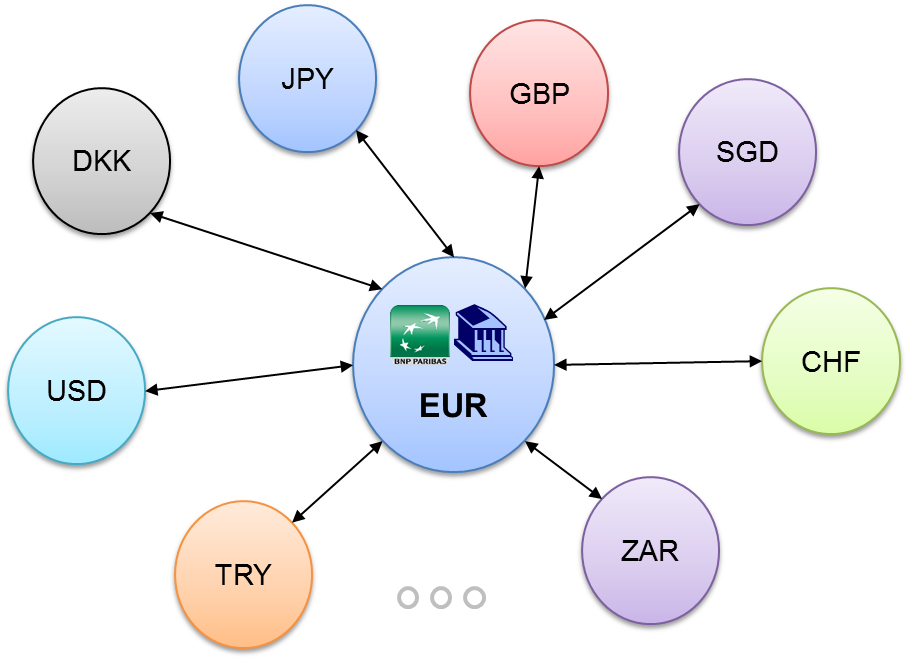

The correspondent network

In the example above, we considered the setting up of an account relationship between two different monetary zones. A bank must do the same for all the currencies where it wants to have a correspondent account. There are around 180 currencies in the world. One of the first decisions a bank must make in cross-border payments is to determine the currencies it will handle. Like individuals and companies, a bank may open many accounts in the same currency.

[box type=”info” size=”large” style=”rounded”]The total number of currency accounts that a bank possesses in different currency zones is its correspondent network.[/box]

Currencies are not equal and are in general classified in three groups, decided by the trading volumes, liquidity and availability of the currencies: major currencies, minor currencies and exotic currencies (Source – forextraders.com)

Major currencies

These are the most traded currencies in the world: USD – U.S. Dollar, EUR- European Union Euro, JPY- Japanese Yen, GBP – U.K. Pound Sterling, CHF – Swiss Franc.

The banks offering cross-border payments services will always have Nostro accounts in all major currencies.

Minor currencies

They are classified into two groups : Commodity Currencies (AUD – Australian Dollar, CAD – Canadian Dollar, NZD – New Zealand Dollar) and Scandinavian Currencies (DKK – Danish Kroner, NOK – Norwegian Kroner, SEK – Swedish Krona)

The banks offering cross-border payments services usually have Nostro accounts in all minor currencies.

Exotic currencies

This group consists of all the currencies not belonging to the other two groups. But it is important to understand that these currencies are called exotic because of the lack of liquidity in their foreign exchange markets, not because of the country’s location or size. Lack of liquidity means simply that you cannot buy or sell the currency whenever you want.

Exotic currencies include among others: BRL – Brazilian ReaL, CLP – ChiLean Peso, CNY – ChiNese Yuan, HKD – Hong Kong Dollar, INR – INdian Rupee, KRW – South Korean Won, MXN – MeXican Peso, RUB – Russian Federation RUBle, SGD – SinGapore Dollar, TRY – Turkish lira, ZAR – South African Rand.

A key factor to consider about an exotic currency is its convertibility, or the ability to easily change that currency into another one. There are fully convertible (e.g. MXN), partially convertible (i.e. INR) and non-convertible currency (e.g. CLP). The convertibility of a currency evolves. It is not static.

This is where you see differences between banks. In general, they will have correspondents in all fully convertible currencies. But they will choose to have correspondents only in some of the partially and non-convertible currencies.

Usage of the correspondent accounts

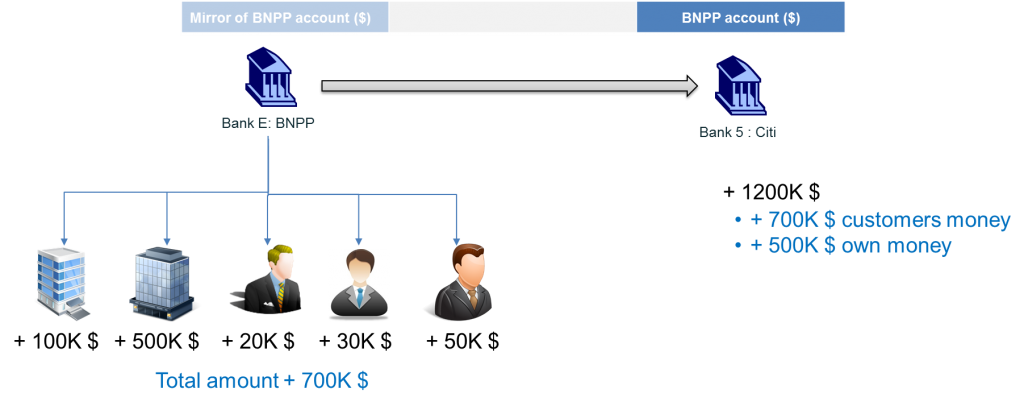

After opening a Nostro account with a correspondent, a direct deposit is required to credit the account. In a future article, we will see in detail how this happens. For now let’s consider, the account is opened and credited. How then will the Bank use its Nostro account and for what purpose?

The bank obviously puts own money on its Nostro account. But the bank also puts the funds of its customers who have accounts in the same currency on the same nostro account. There is a key rule in cross-border payments which states:

When a customer opens an account in USD Dollar with BNPP, BNPP opens an account in its book in USD. But the (real) funds are kept on the Nostro account(s) in the USA. Again a Bank may open many accounts with the same or different banks in USD. If a customer or BNPP wants to transfer funds to a party in USD, BNPP will instruct the correspondent (Citi) to debit its account and credit the beneficiary account in the USA. On the other hand, if BNPP or one of its customers receives funds, then the BNPP Nostro account(s) in the USA will be credited. For customers, BNPP will ultimately ensure that the amount credited/debited is reflected on the customer account.

Let’s take another example: If BNPP sends USD to a German Bank (Deutsche Bank), BNPP will instruct its correspondent to debit its Nostro account and credit Deutsche Bank’s account with its correspondent in USD, so the account of another Bank in the USA. And if Deutsche Bank sends USD to BNPP, Deutsche Bank will instruct its correspondent in the USA to debit its Nostro account and credit the account of BNPP with Citi. These transfers will go through payment systems in the USA like other domestic transfers.

Now that we understand correspondent banking, account relationships and how accounts are used, the time has come to look at SWIFT and SWIFTNet; not to consider the message types :-), but to get the big picture. Why is the SWIFT Network so crucial and why are standards needed? The next article will provide answers to these questions and much more.

Amazing..very nicely put

Very informative. I have been searching something like this for many years and finally my search ends!

Thank you. I am glad you finally found what you have been looking for. 🙂

can you explain about the Switzerland bank payment methods

Thank you very much. Really helpful.

However I hear a lot about loro account. Could you please give me a short explanation?

Thank you again

Dear Jean,

Amazing work you are doing. I will be purchasing your SCT book soon. This is the kind of information every payments professional was looking for

Dear Vishwa,

Thank you for your nice comment and appreciation. My goal is to help as many as possible and make their payments journey easy.

I am very happy you find my content valuable. I will send you a email about the book.

Phenomenal article! Thanks 🙂

What about writing a blog on Ripple?

Thank you. 🙂 I started with traditional payment instruments and systems. The time will come to write about Cryptocurrencies and Blockchain. Be patient.

You can subscribe to the newsletter to get regular updates. 🙂

Thanks a million Jean, this is very useful, I like the way you articulated here….you have made it very interesting to read and with diagram…Great Job

Thank you Swapnil for your appreciation. You see I deliver my promise. If you follow my blog, you will acquire payments easier and faster. 🙂

Dear Jean,

Thanks for such an informative article. One query. Your diagram and description says that “When a customer opens an account in USD Dollar with BNPP, BNPP opens an account in its book in USD. But the (real) funds are kept on the Nostro account(s) in the USA.”

How does it take place? How can bank credit the Nostro account based on the credit in the savings/current account? Funds will be credited to Nostro account only when customer initiates funds transfer, right? and Bank will pass the accounting entry in its own books as Debit Customer account Credit Nostro Mirror.

Can you please clarify this?

Dear Dangare,

Thanks for your appreciation. I will try to answer your question. Let’s assume you open an account in USD with BNPP in France.

To credit your account, you can either buy USD (against EUR) or receive it from someone.

In any case, you provide the account where the funds should be credited (IBAN and BIC of BNPP).

The sending USA bank sees that the beneficiary Bank BIC is BNPP. So it will look for the correspondent of BNPP in the USA and sends him the funds to credit BNPP account.

However in the MT103, the beneficiary customer (you) is mentionned. The USA correspondent of BNPP after crediting BNPP account, informs BNPP with a MT103 for example that funds are for you. Your account with BNPP is then credited. But the real funds are with the correspondent of BNPP in the USA.

Thank you Jean!

Regards,

Milind

V cool explanation

Thank you very much

This clarifies my doubt as well thanks JP

Dear Jean,

I have a question pertaining to the below sentence from your response to Milind:

“The sending USA bank sees that the beneficiary Bank BIC is BNPP. So it will look for the correspondent of BNPP in the USA and sends him the funds to credit BNPP account.”

Do you maybe know how sending USA bank looks for the correspondent of BNPP exactly? Using sample from your article, how can it know that correspondent of BNPP is Citi and not any other bank in USA?

Regards,

Marcin

Hi Marcin,

Banks exchange information among themselves called Standing Settlement Instructions (in SWIFT MT670 and MT671 Messages) where they provide information about their correspondents in the different currencies. That information is stored in payment engines Databases and used to find out to which correspondent to send USD for example for a specific bank.

Let me know if you have additional question.

Regards,

Jean Paul

Thank you, Jean!

Regards,

Marcin

Hello JP,

I have one doubt in case of a customer who is holding USD account with BNPP bank.

Is it a mirror account of Nostro account of customer/BNPP which is with City. If yes will it hold the $ amount as a +ve balance when customer received fund in USD in its corresponding USD account with BNPP.

Thanks and Regards,

Pranil

Great stuff, one basic question on correspondent banks. Can the correspondent bank of the originator be in the same country as the originator and same goes for the beneficiary?

eg- Bank A in SG wants to transfer payments to US –

approaches a local correspondent bank XYZ who has a bilateral relationship with correspondent bank ABC in USA in turn beneficiary bank’s MNM correspondent bank –

so XYZ and ABC will maintain nostro/vostro accounts – is that correct?

But is the bank XYZ called as correspondent bank or intermediary bank for bankA’s perspective since they are in the same country?

Thank you! The answer to your question is yes. What you describe is common in practice.

Small banks use services of large banks which have a large correspondent network to settle transfers in foreign currencies.

Setting up and maintaining a correspondent network is costly and time consuming. So large banks can offer services to smaller banks to make some revenues. Like any customer, a small bank in SG can open an account in currency with a large bank in SG that has a correspondent in the USA. However, as explained in the article, the funds (USD) are kept on an account in the country of currency (so in the USA). To credit the USD account of the small bank in SG, you have to send money to the large bank in SG and for that, the account of the large bank in the USA must be credited. But the ultimate beneficiary will be the small bank.

In cross border transfers, the large bank is usually referred to as intermediary bank. But strictly speaking it is the correspondent bank of the small bank. Correspondent is used for banks located in the foreign currency zone.

Can you explain difference between NOSTRO/ NOSTRO Mirror & Vostro/Vostro Mirror..

Are nostro and nostro mirror maintained in same or different currencies..

Per my understanding by substantiating with an example:-

HDFC Bank in Mumbai wants to make a Cross border payment to Bank of America US..

As HDFC Bank has a NOSTRO account denominated in USD currency hence it does the payment..

However to have records of this transaction its own book of accounts, HDFC has a NOSTRO Mirror account in INR currency.

This is my understanding.

Kindly confirm if you concur on same..

Hi,

Let’s consider two banks: Bank A has opened an account with Bank B.

The Nostro account of Bank A is in the book of Bank B, but the mirror Nostro is in the book of Bank A.

The mirror Nostro does not hold any funds. It is just an account opened by Bank A to easily follow what is happening on the real account with Bank B.

If I refer to your example, HDFC can have a NOSTRO Mirror account in any currency, but the currency chosen will be the currency of the real account, so USD in this case.

It does not matter really what the currency of the mirror nostro is. What matter is the currency of the real account, the Nostro account.

A mirror gives the faithful image of a person or a thing, but it is not the real person or thing. Similarly, a mirror account gives the image of an account, but it is not the real account itself. However, if you know what is happening on a mirror account, you can easily deduce what the movements on the real account should be.

I hope this clarifies.

Hi Jean,

Assuming that a Indian bank Nostro mirror is maintained in USD, could you explain what accounting entries are passed in each stage of FX Deal.

Example: ABC Company in India is importing goods from XYZ and wants to settle his client in USA for USD 1000000 in 1 Month time.

Assume that XYZ is maintaining its account with JPMC Bank and SBI has correspondent relationship with JPMC Bank.

ABC Company will enter into forward deal with SBI Bank.

Client: ABC Company

Respondent Bank: SBI Bank

Correspondent Bank: CITI Bank

Beneficiary: XYZ Company

Spot Rate: USD/INR = 70

1 Month Forward Rate: USD/INR = 70.50

Hi Narendra,

Thank you for your interest and comment!

There are a lot of things to address in your question: accounting principles, correspondent relationships, FX and Forward contract.

I will get back to you when I can find time to address all that.

Hi Jean,

May I know if you have published any books yet? If so, I will be searching for them on amazon. Could you please send me the list of your publishment if any? Thanks for the This is this wonderful piece of information on the topic of correspondent bank.

Steven

Hi Steven,

Thank you for your encouraging comment! Up to now, I have published one book about domestic payments in Europe: the SEPA Credit Transfer. The feedback is awesome and I am planning to write other books. I will definitely write one book on Cross border payments. So you can get only the SCT book now. Again thank you. When I read such comments, I understand that what I do is helpful to people and it keeps me going.

HI sir

This is waqas and i have some issue related to nestro transaction i transferred some amount in germany bank with the help on my local euro account in my country after that it has credited in my german bank Account and now bank asking some more charges and also saying we will reverse this transaction if not paid charges amount. so the question is that once my germany account is credited and i have received email confirmation too from bank. do they have right to reverse this transaction from my germany account.

kindly clear my points.

i will be very thanks full to you.

best regard

waqas bhatti

Hi jean,

could you please explain the CHAPS payment flow with examples .

like file format,

message format and all

Hi Jean,

Great article! Been very useful in understanding the correspondent bank concept in great detail!

I have a question please – Customer X who has a USD account with Bank A based in France has requested for withdrawal of his funds in physical cash in USD. Since the customer’s deposit is in the US, how will Bank A address this request? Look forward to your reply. Many thanks for your time!

Regards,

Kusuma

Hi Kusuma,

I see you have been reading many articles. I am happy you love the content.

Back to your interesting question.

Although Bank A is in France, Bank A has some amount in USD (Cash) to meet the demand of customers who want to withdraw USD in Cash.

To determine the amount in USD to have in cash, the bank makes an estimation based on the customer demands in a timeframe.

How does the bank get USD? Two main possibilities:

1 – You have people coming to France with USD and who want EUR. The bank sell them EUR against USD.

2 – The bank can get USD (Cash) against EUR from another bank in France, a subsidiary of an american bank for example.

So Bank A will give cash to the customer and debit the corresponding amount from the customer USD account.

Cash is really another fascinating topic in payments. This reminds me how much work I still have to do to explain all this. 🙂

Let me know if you have further questions.

Hi Jean ,

Awesome article . Could you please help in liquidity management as well . If you can post a video for liquidity management in banking system and how funding/defunding happen .

Thankyou

Hi Shivam,

Thanks for the appreciation. I take note of the question and will try to handle it if possible in the future.

Regards, Jean Paul

Hi Jean,

The information provided here is crisp, simple and very clear to understand the basics.

I have few question related to Mirror Nostro.

1. As you said that the mirror Nostro is the reflection of the actual Nostro,

How and when these transactions get updated in the mirror nostro?

Ex: If there are 100 transactions in a day in the USD Nostro account, how do they get updated? Does that happen once in a day or once per every transaction? Is there any feed that flows from Corresponding bank either per each transaction or for all transactions in a day?

2. There is a mention about standing settlement instructions(MT670 and MT671).

When are these instructions setup? At the time of initiating a transaction? Or at the time of opening a Nostro account?

Hi Satish,

I am glad you liked the article. Now your questions:

1. The answer is the updates happen once per every transaction. Let’s consider Bank A and its correspondent. The correspondent is the account holder. When the Nostro account is credited, an information is sent to the Bank A (e.g. MT910 or MT950). Bank A uses that information to update the mirror Nostro. On the other hand, when Bank A gives an instruction to its correspondent to debit the nostro account, it updates the mirror nostro right away. The entries on the accounts are always of same amount and opposite signs.

2. A bank sets up an SSI after opening a Nostro account. That information is used by the counterparties to determine how the transaction will be routed until it reaches the Nostro account.

Best regards, Jean Paul

Hi Jean,

Thanks for the explanation. I still have some doubts of standard settlement instructions.

As you said

2. A bank sets up an SSI after opening a Nostro account. That information is used by the counterparties to determine how the transaction will be routed until it reaches the Nostro account.

Also it was communicated in the above thread that

Banks exchange information among themselves called Standing Settlement Instructions (in SWIFT MT670 and MT671 Messages) where they provide information about their correspondents in the different currencies.

Taking the same example you provided above.

Let’s assume you open an account in USD with BNPP in France. To credit your account, you can either buy USD (against EUR) or receive it from someone. In any case, you provide the account where the funds should be credited (IBAN and BIC of BNPP). The sending USA bank sees that the beneficiary Bank BIC is BNPP. So it will look for the correspondent of BNPP in the USA and sends him the funds to credit BNPP account.

q1: Is it that the bank in USA looks at the SSIs provided by other banks in USA and determines the bank that is correspondent of BNPP? If so, then there can be multiple USA banks acting as correspondents of BNPP, So how the exact correspondent is determined?

q2: Do all the banks exchange SSIs among themselves irrespective of whether or not they have direct relationship with each other? If yes, is this information exchanged via some kind of a network where all the banks should be part of?

Hi Satish,

Sorry for taking so long to respond. I have been very busy these days.

Answer to q1: In correspondent banking, a bank notifies all institutions of how it expects payments in foreign currecies to be settled. So the MT 671 message is forwarded to all SWIFT institutions. It is therefore BNPP which broadcasts the information about how it wants to receive USD. BNP may have many correspondents in USD and provides them all in the SSI. Up to the sender to choose among them. If you have three banks accounts and one is credited, you have received the money anyway. The account does not matter that much.

Answer to q2: Each bank broadcats its SSIs through the SWIFT network to all SWIFT institutions irrespective of whether or not they have direct relationship with each other.

Once the SSI is received, it is stored because it might be used someday. Before exchanging any message, banks must first go through the RMA process as usual.

Thank you for the great questions. If you have further questions, do not hesitate.

Best regards,

Jean Paul

Hi Jean,

Thanks for your detailed explanation. This information is really and hugely helpful. Appreciate your time and efforts for sharing such valuable information. Thanks a lot.

Do banks maintain separate Nostro accounts for Funding and Settlement? If so,

How are these Funding and Settlement Nostros are connected in a particular transaction(Trade or Forex etc.)?

and

How are they different from the Nostro that has been discussed here?

Thanks again in advance.

Hi Jean,

Thanks a lot for your time and effort utilized in creating such articles that are extremely useful for beginners to payments domain like me.,

I have a question regarding the Nostro mirror account.

As per this article, the accounting entries on the real account and on the mirror account are of same amount, but opposite signs. If the real account is debited, the mirror account is credited and vice versa.

Could you please elaborate on how and why the OPPOSITE SIGNS and the actual concept behind this ?

Thank you.

Hi Sainath, The concept of mirror lies in the opposite signs. It is a very powerful concept in accounting in general. It is long to explain how it works. Sorry. In the future I will write an article about it. But If you can’t wait, I recommend you buy and read the chapter 6 of the book I wrote about SEPA Credit Transfer. You get step-by-step explanations of double entry principle, mirror accounts, Nostro/Vostro accounts, and so on.

All the best, Jean Paul

Nice presentation with examples and images. Appreciated for sharing your knowledge and experience to all.

Thanks again

Hi JP,

Such an informative article about Cross border. Thanks a lot for sharing this info.Can you also add accounting entries involved in the cross border transaction (may be with a basic example) to be clear on how the accounting entries look like.

Hello Jean-Paul,

great article, thanks. You mention when a nostro account is open it needs to be credited, which is obvious; it can be by bilateral agreement that both bank feed their respective nostro account but it could be that you have a unilateral agreement, then how do you credit your nostro account?

Reference to your article above:

“a direct deposit is required to credit the account. In a future article, we will see in detail how this happens.”

thanks

Hello Vincent, 🙂

Thank you for your nice comment! Because of many projects, I have not come yet to the writing of that article. Thanks for reminding me.

I will notify you when the article will be available.

Best Regards,

Jean Paul

Hi Jean,

Thanks a lot for such a informative article. Worth reading 🙂

Regards,

Ankur

Nice Article, you made it so simple to understand such a complex topic.

Very Nice article. Thanks a lot Jean. In this article you mentioned that you have explained how for the first time the Nostro account is credited. Where can I find information on that. Also you mentioned that more on Nostro Mirror accounts. Can you send links for those please. thans again

Hi Vinay,

It is still coming. You will receive a notification when it is online. Please subscribe to the newsletter if not done yet.

Hi Jean,

Hope you are well and what your explanation is gold. your articles have given answer to most of my confusions.

However, 1 question-

If BNPP sends USD to a german Bank (Deutsche Bank), BNPP will instruct its correspondent to debit its Nostro account and credit Deutsche Bank’s account with its correspondent in USD, so the account of another Bank in the USA. And if Deutsche Bank sends USD to BNPP, Deutsche Bank will instruct its correspondent in the USA to debit its Nostro account and credit the account of BNPP with Citi. These transfers will go through payments systems in the USA like other domestic transfers.

so at

CB Citi USA:

debit bnp Nostro account

Credit who ?

-db’s correspondent in USA? (mt103 has what DB’s correspondent or DB?)

eg-suppose DB’s correspondent in USA is UBS. it will credit UBS? UBS does nt have to do anything here right?

and then send mt103 to DB to debit its correspondent bank UBS and credit is customer-in UBS nostro books

a little clarity would be appreciated, please

Hi Nikhil,

You get it. In your example, Citi USA, will credit the account of DB with its correspondent in the USA, so UBS.

And that will be done in one step through the domestic payments systems in the USA. The sender of MT103 finds out who is the correspondent of DB in the USA and enrich the payment accordingly.

Amazing content well put and easy to understand!

[…] payments work is coming to the end. The introductory article and the article about the first, second and third strategy contain valuable information to connect the dots. It is strongly recommended to […]

Hi there Jean,

Amazing content you have put out, but I do have one thing that is unclear to me which I might have overread (in your article and the comments).

Another article stated that nostro/vostro accounts don’t hold any ‘dormant funds’. Isn’t this false?

Lets say we have bank USA and bank DB.

Bank USA opens a an account in EUR at DB (nostro) which automatically would create a vostro account for bank DB at the bank USA in USD. This would enable cross border payment through SWIFT right? Isn’t it true that when the bank USA opens a nostro account in EUR at bank DB with 1 million EUR reserved at bank DB, there will be created a vostro account in USD at bank USA that equals 1 million in EUR. So bank DB would hold approx. 1,19 million USD at bank USA through a vostro account right?

If this situation above is correct, doesn’t this mean that the money IS reserverd for cross border payments and are in fact ‘dormant funds’?

I would love to hear your thoughts on this, since I couldn’t find a lot about nostro/vostro account regardings if the funds are actually reserverd or are a some sort of debt?

If the situation above is described correct, doesn’t this mean that the money IS reserverd or pre-funded for cross border payments and are in fact ‘dormant funds’ until these funds are addressed for a cross border payment(s)? – edit

[…] case you have not read the introductory article and the article about the first and second strategies, I strongly recommend you to read them so that you can easily connect the dots and […]

Hi,

I am bit confused by your last two examples –

-When a customer opens an account in USD Dollar with BNPP -> what is the base currency BNPP operates in ?

if its USD, then why would BNPP deposit customers money in a nostro acct.. If it is Eur – how can a bank open a customer account in foreign currency ?

2. Let’s take another example: If BNPP sends USD to a German Bank (Deutsche Bank) – again, what is te base currency of BNPP ??

This whole article talks about cross border payments – so i am assuming that BNPP is euro

[…] Cross Border Payments 2 […]