In the previous article, we introduced the Standby Letter Of Credit (SLOC) and looked at the steps of its issuance and notification. The next question now is what happens after. In this article, we will see how it works.

In summary, there are two possibilities:

-

The Standby Letter of Credit is not put into play. That means that the importer has paid the exporter after receipt of the invoice (Simple collection).

-

The Standby Letter of Credit is put into play (or called on). That means that the importer has not fulfilled his obligations and the beneficiary (the exporter) has not received the funds in due time. The exporter therefore presents the Standby Letter of Credit to the importer’s bank so that payment is effected.

When the Standby Letter of Credit is not put into play

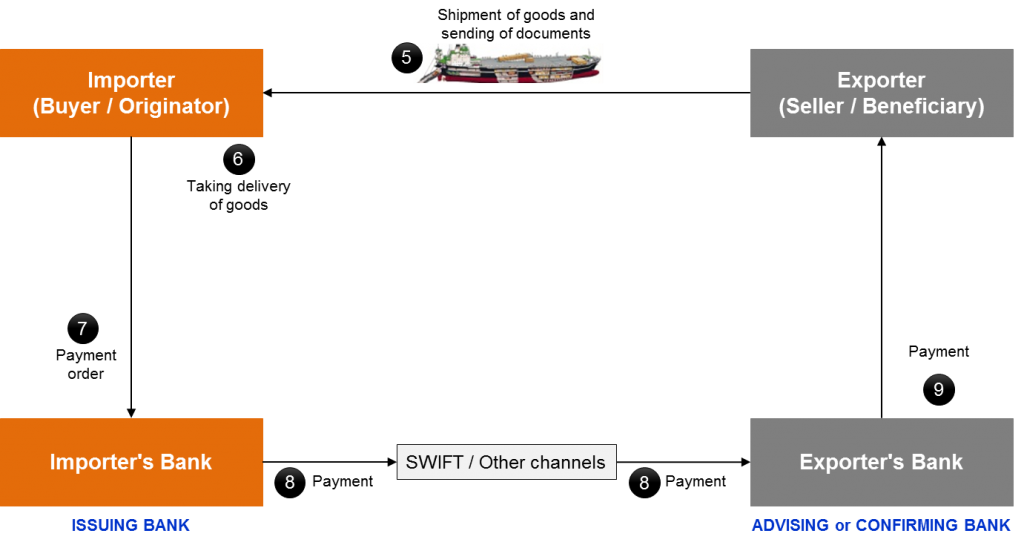

In case the Standby Letter of Credit is not put into play, it is equivalent to a simple collection (or payment against invoice) as you can see in the following diagram.

We will not detail the steps for the simple collection since that payment technique has been analyzed in depth in a previous article. However, take note of one specificity in step 5: the shipment of goods is done with the sending of documents. These are the original documents. The importer retrieves the original documents and uses them to clear the goods. As a consequence, the exporter is no longer in possession of the originals of these documents.

It is strongly recommended that the importer keeps the proof of payment of the goods. That is the reason why the bank issuing the Standby Letter of Credit often requires its customer to settle the goods through it. Thus she has proof of payment and can present it if ever the exporter claims to have not received the funds by bringing into play the Standby Letter of Credit fraudulently or improperly.

When the Standby Letter of Credit is put into play

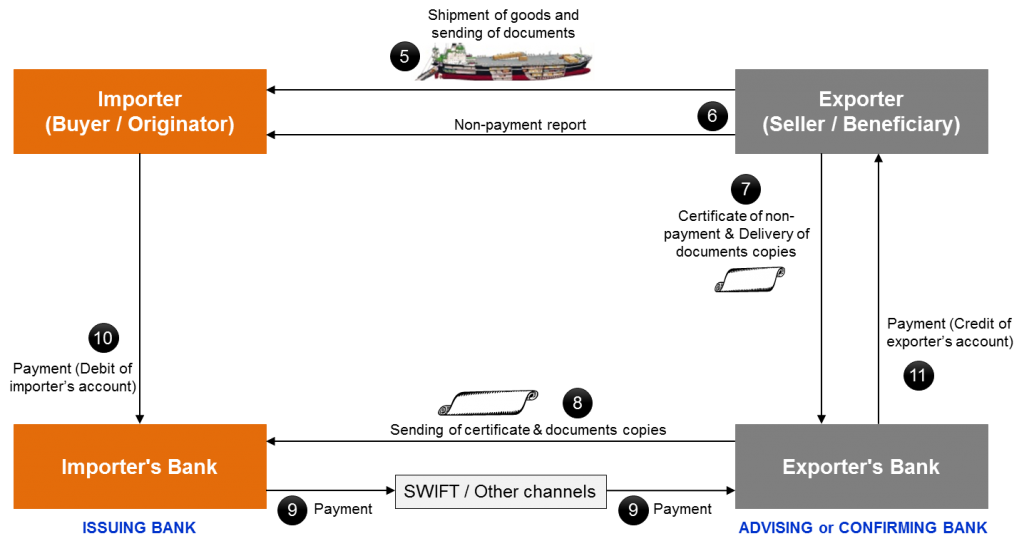

We will now focus on the process of a Standby Letter of Credit when it is put into play. The following diagram presents the main steps.

5. Shipment of goods and sending of documents

The exporter ships the goods according to the terms agreed in the contract and all the necessary documents for payment and customs clearance. The documents transmitted are the original documents.

6. Non-payment report

The payment period expires and the exporter still does not have his money. He contacts the importer to inform him that he still has not received the expected funds and that he will call on the guarantee. In reality, the exporter has no obligation to contact his client. He can directly transmit the information to his bank. However, he will generally contact the importer, who may have given a payment order in the meantime, in order to maintain good business relations.

7. Certificate of non-payment and Delivery of documents copies

When the exporter has decided to activate the Standby Letter of Credit, he must complete a certificate of non-payment and return it to his bank as well as copies of all documents required for the payment. Remember that when shipping the goods, the exporter has sent the originals of the documents. He can therefore only present the copies. The certificate of non-payment is very important. It legally binds its signatory if it misuses the guarantee offered by the Standby Letter of Credit, especially in the case where it has already received the funds from the importer. The bank must analyze the documents and check their apparent conformity and completeness.

If the exporter’s bank has confirmed the Standby Letter of Credit, then it will pay the customer directly. In the diagram above, the exporter’s bank is an advising bank, not a confirming bank. This is why the payment is not made upon delivery of the documents, but only after sending the documents to the issuing bank and receiving the funds from that bank.

8. Sending of certificate and documents copies to the importer’s bank

The non-payment certificate and all the documents submitted by the exporter are forwarded to the importer’s bank. At the reception, it will also check their completeness and apparent compliance before proceeding to release the funds.

9. Payment

Payment is generally made by issuing an MT202 or MT103 transfer via the SWIFT network.

10. Payment (Debit of the importer’s account)

The importer’s account is debited for payment. When issuing the Standby Letter of Credit, the bank obtains from its client the authorization to debit its account for the payment of the Standby Letter of Credit. This allows the bank to limit the risk of loss in case of default of its client.

11. Payment (Credit of the exporter’s account)

The exporter’s bank makes the funds available to its client after receipt. That simply means the exporter’s account is credited and he is informed.

This ends our analysis of the Standby Letter of Credit when it is put into play. Important to keep in mind is that the Standby Letter of Credit is equivalent to a payment insurance. It is requested by the exporter to deal with an outstanding payment. It is putting into play requires the submission of copies of all documents requested in the Standby Letter of Credit. In fact, the Standby Letter of Credit belongs to international bank guarantees that will be examined in future articles.