We begin our analysis of payment techniques with the payment against invoice or simple collection. This technique involves requesting the payment of exported goods against a simple presentation of the commercial invoice. The importer is supposed to be paid upon receipt of the invoice (and possibly all documents enabling him to clear them), not after receipt of the goods. In the following, the terms “payment against invoice” and “simple collection” are used interchangeably.

The payment is made according to the deadlines agreed between the two parties. The payment instruments used to settle the transaction can be a credit transfer, a cheque or a bill of exchange (also known as a draft).

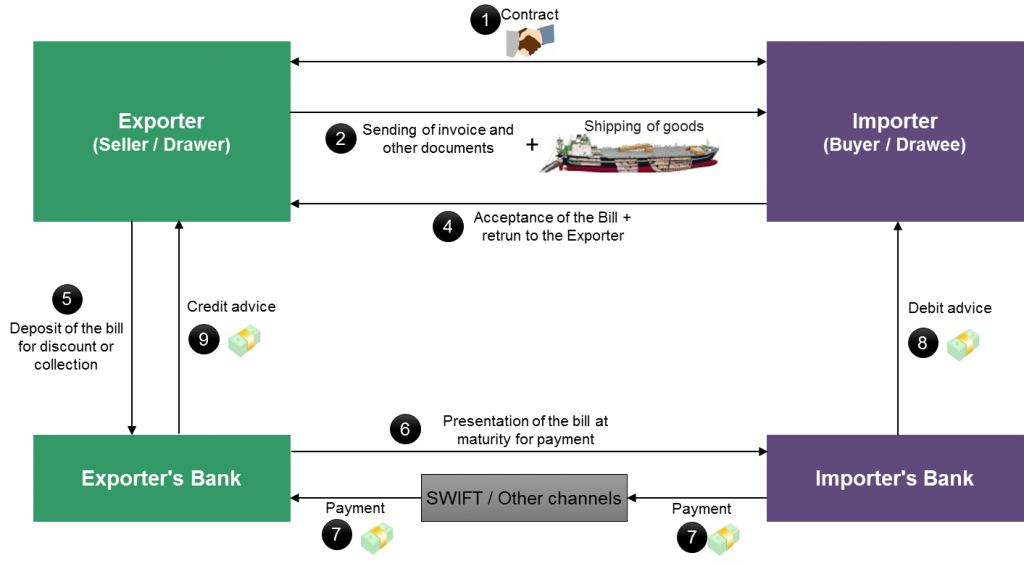

The importer settles the amount due immediately if the payment must be done at sight or later if the payment is deferred. In the case where the payment is to be made by bill of exchange, the exporter transmits it with the invoice to the importer who must accept it. The drawer and beneficiary of the bill is the exporter. The drawee is the importer. After accepting the bill, the drawee must return it to the drawer who then deposits it to his bank for discount or collection.

While payment against invoice has the advantage of being fast and administratively simple, it does not offer any security in case of litigation issues. The buyer can unilaterally modify the terms of payments. Instead of paying as soon as the invoice is presented, he can decide to wait for the arrival of the goods and their customs clearance. And in the worst case, he may not pay at all.

This technique is therefore not suitable for international trade and especially when the parties do not know each other very well. Payment against invoice is only recommended when the business relationship between the two parties is stable and there is mutual trust. When purchases of goods or services are made between a parent company and its subsidiary, for example, simple collection is sufficient since the risk of not being paid is very low.

It is important to note that the actors involved in payment against invoice are the exporter and the importer. Their respective banks may not be involved at all. An importer may well settle his supplier with a Western Union remitance. But in the majority of cases, he will request his bank to transfer funds to the beneficiary.

Payment against invoice with a transfer

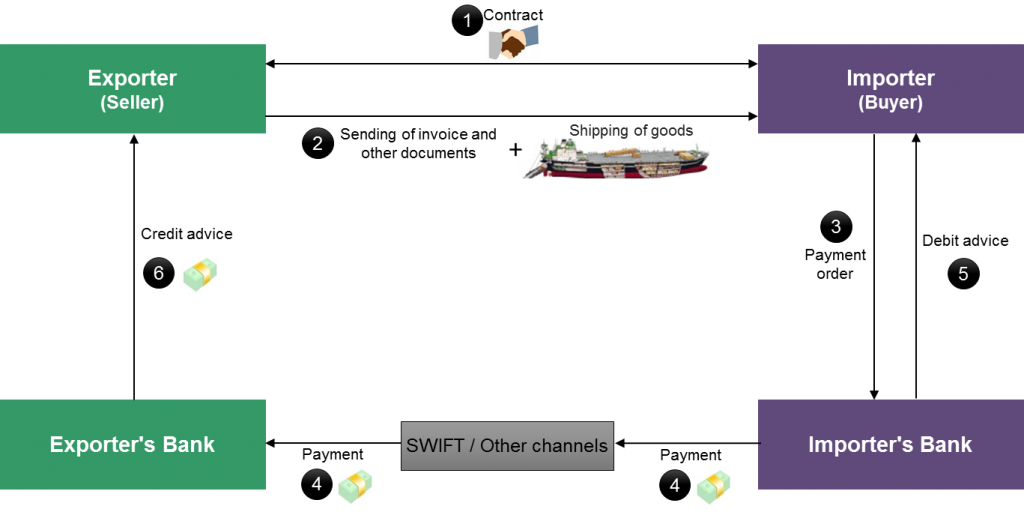

The following diagram shows the different steps of a payment against invoice process, when the importer pays by transfer.

1. The contract

It is always advisable to establish a contract where the commitments of both parties are clearly defined even if the exporter wants to be paid by simple collection. This will at least prove non-compliance with the commitments of either party and win a case in court if the party who considers himself a victim decides to sue.

Unfortunately, experience shows that those who choose simple cashing, do not “bother” to establish a contract. They believe it is a waste of time and money and blindly trust the importer. These are people who are often inexperienced in international transactions and who are not necessarily aware of the risks they are taking. International trading experts therefore strongly recommend never to do that.

2. Sending of invoices and other documents and shipping of the goods

The exporter can send the invoice by mail only and send the other documents (including transport and shipping documents) with the goods. Or he can send the invoice and all the aforementioned documents by mail.

The importer is supposed to pay on receipt of the invoice, so before receiving the goods. But the reality is often different. Very often, even if it is prohibited, he will wait for the arrival of the goods and even perform their verification.

Shipment of goods can be done before or after the invoice and documents are sent. there are no specific rules with that regard. Mails take less time to reach their destination than the goods, so the importer will receive the invoice and documents first in the vast majority of cases.

3. Payment order

After receipt of the invoice, the importer requests his bank to debit his account and transfer the funds to the exporter if they agreed on an immediate payment. The importer must therefore have the precise bank details of the beneficiary and know in which currency the transfer is to be made.

4. Payment

It is the transfer of funds by the bank of the exporter. Things are simple if the two banks have an account relationship (They are correspondents). In this case, it is enough for the debtor’s bank to make an MT103 / MT202 in favor of the beneficiary’s bank. Otherwise, the importer’s bank must make the transfer to its correspondent in the exporter’s country and request the funds to be transferred to the exporter’s bank that will credit his customer account. Read the articles about cross border payments if you want to learn more about this topic.

5. Debit advice

The importer is informed of the debit of his account by his bank.

6. Credit advice

The exporter is informed of the credit of his account by his bank.

Payment against invoice with a bill of exchange

If the payment is to be made by bill of exchange, additional steps will be required to cash the funds as we can see on the following picture.

We will not detail each step of the transaction. The important thing to remember is that the importer must accept the bill of exchange and send it back to the beneficiary. And the exporter can deposit the draft to his bank for discount or collection. At maturity, the exporter’s bank will present the bill of exchange to the importer’s bank for payment.

A Payment against invoice with a cheque is quite similar. After receiving the invoice, the importer issues a check and sends it to the exporter. And the exporter deposits it to his bank for collection.

That is the end of this post about simple collection or payment against invoice. The next post will be about the payment technique called cash on delivery. Do not hesitate to leave a comment or a question.