In the previous article, we started our analysis of payment techniques with the payment against invoice. In this post, we consider another payment technique called Cash on delivery or Cash against delivery.

In Trade Finance, Cash On Delivery (COD) is a payment technique in which “Cash” is collected by the carrier upon delivery of the goods. The carrier therefore plays the role of a financial intermediary. It ensures the collection of the payment and its repatriation to the exporter.

Railway companies, postal services companies and other carriers agree to collect the funds on behalf of the exporter for a fee. The cost of cash on delivery varies according to the weight of the goods and the country of destination. The charges are usually low when compared to the amounts billed for other payment techniques.

It is recommended to use this technique when the goods are of small quantity and if the exporter is sure that the buyer will accept the goods. Unless business relations between the two partners are stable, the Cash on delivery should not be used.

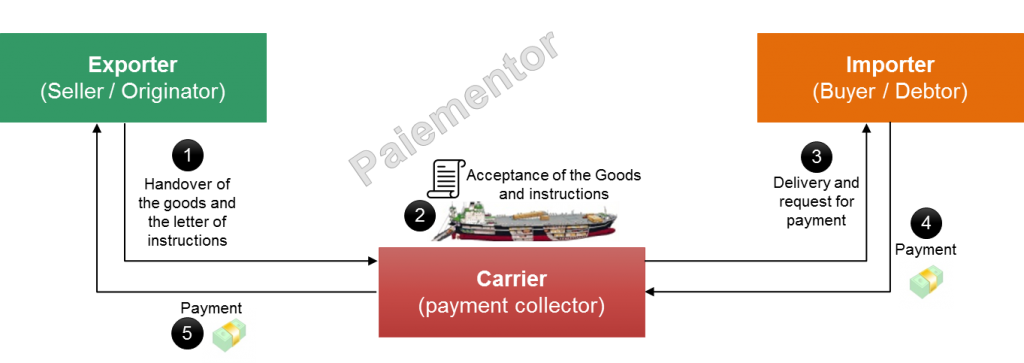

Cash on delivery: the main players and how it works

There are three main players in the cash on delivery process: the exporter, the carrier and the importer.

1. Handover of the goods and the letter of instructions

The exporter hands over the goods to the carrier with a letter of instructions indicating the amount to be paid by the importer for delivery of the goods and possibly the means of payment to be used (cash, cheque, bill of exchange, etc.). So cash on delivery does not necessarily involve hard cash.

2. Acceptance of goods and instructions

The carrier’s main responsibility is to move the goods from the shipper (the exporter) to the buyer (the importer). In addition to that, he must formally accept the exporter’s instructions regarding the collection of the payment. The mention “Cash On Delivery (COD)” must appear expressly on the agreement of carriage between the carrier and the shipper. The carrier has the right to refuse this mention if he wants to limit his services to the transport of goods only. The mention “Cash On Delivery” on the invoice given to the carrier does not constitute proof that cash on delivery has been agreed between the two parties.

Once the carrier has accepted the exporter’s instructions, he becomes responsible for collecting the payment of the goods. In case of delivery without claim of the agreed amount, he is indebted to the exporter.

3. Delivery and request for payment

The carrier delivers the goods to the importer and at the same time requests the payment of the invoice. The payment of goods on delivery is indivisible. Partial delivery of the goods (with partial payment) by the carrier is prohibited. He must deliver it in full and claim the full amount due.

4. Payment (to the carrier)

Unless otherwise agreed by both parties, the amount payable must be in the currency of the country of delivery. The importer usually pays in cash or by check. If the exporter wants the payment to be in cash, he should get the agreement of the carrier. Some carriers do not accept payments in the form of coins or notes. In many countries, payment in cash is not allowed above a certain amount. The carrier must therefore ensure that it complies with local legislation.

In case of payment by cheque, there are two possibilities:

-

the cheque is issued to the order of the carrier who will collect it and then pays the exporter

-

the cheque is issued directly to the order of the exporter. The carrier then just needs to forward it to the beneficiary.

5. Payment (to the exporter)

The carrier pays the exporter after collecting the funds on delivery. In case of payment by cheque, there is a risk of non-payment. This risk, contrary to what one might think, is borne by the exporter and not by the carrier. If he follows all the instructions, the carrier is not held responsible in case of non-payment of cheque. And he does not have to check that there is sufficient funds on the bank account of the importer. For this reason, it is advisable to require a certified cheque or a bank cheque to protect against the non-payment risk. When a certified cheque or bank cheque is required by the exporter, the carrier commits a fault if he accepts a simple cheque.

The importer’s, the carrier’s and the exporter’s banks may be involved in the collection circuit if the payment is made by check. But their role is limited to the transfer of funds and they have no other responsibility like in other payment techniques that are examined in future articles.

In conclusion, Cash on delivery is a simple payment technique. It incurs many risks and should be used only if both partners know each other very well and for small amounts. The next article will be about the payment technique called documentary collection.