The introduction and analysis of SWIFT cover and serial payments in a previous article provided us with a good foundation to move further. We can now consider concrete examples of SWIFT MT103 202 cover payments, see which parties are involved and the content of the messages that they exchange.

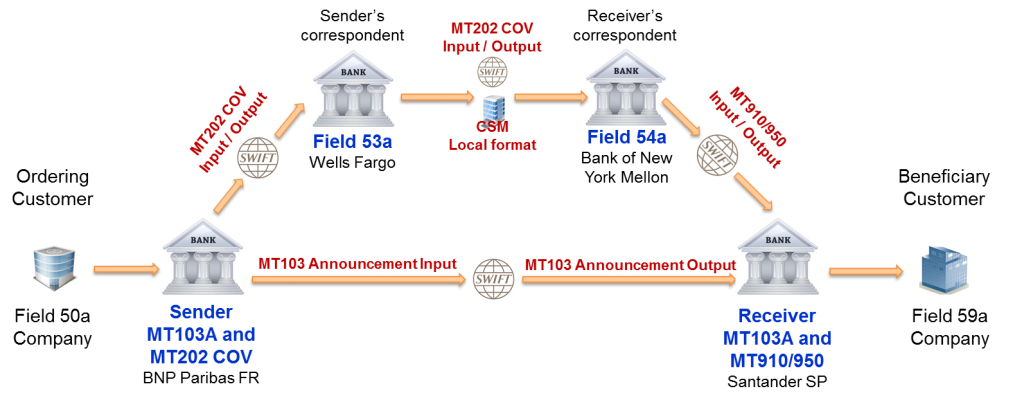

In this article, we will perform a detailed analysis of a MT103 announcement sent by the debtor bank to the creditor bank. Let’s first look at the picture depicting the messages and the different parties.

On the picture, Input and output messages are highlighted to make you aware that the message sent, is not exactly the same received by the receiver. The output messages that SWIFT sends to the receiver, have slightly different formats (See block 1 and block 2 definitions) than input messages.

What you see on the picture is a payment that a company in France, customer of BNP Paribas in Paris, wants to send to another company in Spain, customer of Banco Santander in Madrid. The payment is in USD currency. Since BNP Paribas and Santander are not located in the USD currency zones, the funds transfer happens through their correspondent accounts opened with Banks in the USA. In this example, we assume that the correspondent of BNP Paribas is Wells Fargo and the correspondent of Santander is Bank of New York Mellon. In any case, BNP Paribas sends a combination of SWIFT MT103 202 Cover messages for the transfer.

[box type=”info” size=”large” style=”rounded”]Major Banks in general create subsidiaries in other currency zones that they use as correspondents. Santander for instance would use Santander New York instead of Bank of New York as correspondent.[/box]

The table below contains the fields that are transported in the MT103 announcement message. An additional column (comments) provides further explanation, so that it is easy to understand each field and what it is used for.

Explanation Format Comments Sender BNPAFRPP The Sender BIC appears in header block (Block 1) in the MT103 Input and in the application block (Block 2) in the MT103A Output. Message Type 103 The message type is the second field of the block 2. Receiver BSCHESMM The Receiver BIC appears in header block (Block 1) in the MT103A Output and in the application block (Block 2) in the MT103A Input. Unique End-to-end Transaction Reference 121:d85a7574-863a-494d-bfbe-4084bf7704e1 This reference is provided in the user block (Block 3) and transported end-to-end. Message text This introduces the Text block (block 4). All the fields below are in the text block of the MT103 Announcement message. The MT103 and the MT103 announcement contains exactly the same fields. Sender's Reference :20:103REF405775 It is mandatory and of format 16x. Bank Operation Code :23B:CRED It is mandatory and of format 4!c. Instruction Code :23E:PHOB/+34.91.397.6789 It is optional and of format :

4!c[/30x] (Instruction Code)(Additional Information)

Code PHOB means Phone Beneficiary. With this code, the sender requests the beneficiary bank to advise/contact beneficiary/claimant by phone when the funds will be received. Value Date, Currency, Interbank Settled Amount :32A:180828USD367574,90 It is mandatory and of format:

6!n3!a15d (Date)(Currency)(Amount) Currency, Instructed Amount :33B:USD367574,90 Normally optional in the standard. It must be provided because country code of Sender is FR and country code of receiver is ES. See Rule C2.

Format 3!a15d (Currency)(Amount) Ordering Customer :50F:/01234567890

1/Company France SAS

2/28 RUE DENIS PAPIN

3/FR/CRETEIL 94400 Ordering customer information is mandatory and can be provided in three different formats according to the options A, F and K. Option F is chosen in this case with format:

35x (Party Identifier)

4*(1!n/33x) (Number/Name and Address) Sender's Correspondent :53A:PNBPUS3N Correspondent of sender (BNP Paribas). Sender has an account in USD with PNBPUS3N. Receiver's Correspondent :54A:IRVTUS3N Correspondent of receiver (Santander). Receiver has an account in USD with IRVTUS3N. Beneficiary Customer :59:/ES6300491800132710387658

Company Spain S.A.

Santa Hortensia 26-28

28002 MADRID

SPAIN Beneficiary customer information is mandatory and can be provided in three different formats: No letter option, Option A and Option F. No letter option is chosen in this case with format:

[/34x] (Account) here in IBAN format

4*35x (Name and Address) Details of Charges :71A:SHA It is mandatory and of format 3!a. It can take 3 values: BEN, OUR and SHA. SHA means charges are shared between Ordering and beneficiary customers. End of message text/trailer

Read this page on the SWIFT formatting rules and Character sets of MT Messages to get additional information and understand what 16x, 4!c and the format of the field options mean.

The first message in the combination (of SWIFT MT103 202 Cover) that is analyzed in detail below is the MT103 announcement.

Narratives and notes on this SWIFT MT103 announcement message

As usual, there is a lot to say about this SWIFT MT103 announcement message. The following narratives and notes allow to get a deeper understanding of the message content.

Narrative and note 1 (Main purpose of this SWIFT MT103 announcement)

The Sender (BNPAFRPP) is informing / announcing to the Receiver (BSCHESMM) that funds are coming for a specific customer. The funds will be credited on receiver’s USD account with its correspondent IRVTUS3N.

Narrative and note 2 (Presence of fields 53a and 54a in this SWIFT MT103 announcement)

The presence of the Tags 53A and 54A indicate that there is no account relationship in USD, the currency of the transaction, between sender and receiver.

Field 53A indicates the Bank which is to provide the funds to the Receiver on behalf of the Sender.

Field 54A is the receiver’s correspondent, the Bank that will receive the funds on behalf of the Receiver.

Sender’s correspondent bank does not have account relationship in USD with the Receiver (BSCHESMM), therefore, Receiver’s correspondent bank must be added to the chain (54A:IRVTUS3N).

Narrative and note 3 (Absence of fields 52a and 57a in this SWIFT MT103 Announcement)

There is no ordering institution (52A) in the message. So the ordering customer is customer of the Sender.

There is no account with institution (57A). It means that the Beneficiary customer account (:59:/ES6300491800132710387658) is hold by the receiver.

Narrative and note 4 (The charges)

Details of charges (Tag 71A) is SHA. The charges are shared between Ordering and beneficiary customer. Sender pays charges to ordering bank. Beneficiary pays charges to receiving and other intermediary banks.

This ends our analysis of the MT103 Announcement. We made an important step. But that is just one message in the combination of SWIFT MT103 202 Cover. You certainly want to look at and analyze the MT202 COV message as well. That will be the subject of the next article.

Thanks for your articles, I find them very well explained.

I’m working on a project related to SWIFT messages and I have a few questions:

1. In this example, who is deciding which correspondents to use? E.g. how did BNP knows that Santander has a correspondent in US? And is it the case that there are maximum 2 correspondents in the chain of payment?

2. Are there any way to determine whether a MT103 message is an cover announcement or serial message based on some fields?

Any reply is appreciated, thanks in advance!

Best Regards,

James

Hi James,

Thanks for your interest. Your questions are interesting. 🙂

1. Routing in Xborder payments is pretty complex. I will just give you a hint here.

It is called Standing Settlement Instructions. Banks do share information about their correspondents in specific messages (MT670 and MT671).

Information extracted from those messages are stored in payments engines and use among other for routing.

Check the SWIFT documentation about these MT670 and MT671. It can help.

2. The answer is unfortunately no. One principle for cover and announcement in Europe is: When the bank have direct relationship with the receiving bank, a serail payment is used. If not, it is a cover payment. It is by processing the payment that you find out where the funds should come from and then deduct if it is a cover or a serial. Read the article about serial and cover payments if not done yet.

I hope this helps.

Br, Jean Paul

Hi Jean,

You mentioned “When the bank have direct relationship with the receiving bank, a serial payment is used. If not, it is a cover payment”.

In this statement, are you referring to BNPAFRPP (sender) and BSCHESMM (receiver)?

If No, then which banks are you referring?

If yes, then the question is, even this payment scenario you showed is also possible serially as well as you showed in serial part 1/2/3.. In this case, what is the key factor which determines whether to go for cover or serial?

I hope I was able to put my thoughts clearly to you. Appreciate your response.

Hi Shadab,

Yes I am referring to BNPAFRPP (sender) and BSCHESMM (receiver).

If they have an account relationship in the currency of the transaction, no need to go through a correspondent.

BNPAFRPP can just ask BSCHESMM to debit its account and credit the final beneficiary account.

But since in this example they do not have an account relationship, they need intermediary to settle the transaction.

Now when you do not have an account relationship with the receiver, you still need to choose between serial and cover method.

What will determine the choice? Agreement with beneficiary bank, practices in your region, …

In the USA for example, Serial method is the standard. But in Europe it is the cover method.

There are many paramters to take into account.

I hope it clarifies a bit.

BR, Jean Paul

Hi payment by 103 from europe and confirmation by 199 intermediary bank in usa going to china is that correct or it has to be confirmation by 202

Hi Thomas,

Is it a serial or a cover payment? MT199 is usually used to ask a question about a message, not to send a confirmation.

Waiting for your answer.

Jean ,suppose bank A sends MT103 to bene bank B. AND BANK B FAILS TO APPLY. if bank B send s mt 103 back to sender bank A to return funds.what will happen.will the funds get returned ,

Hello All,

I have one question as how we can analyze that 202 cover has bee sent for respective 103.will the reference be same for both statements. Or what will be the common. Between two.

Hi, The Field 21 (Related Reference) of the MT202 COV contains the Field 20 (Transaction Reference Number) of the MT103 Announcement.

In the standard, you read this in the usage rules: If the related message is an MT 103 Single Customer Credit Transfer, this field 21 will contain field 20 Sender’s Reference of that MT 103.

bros please send me message on this email for more information and business discussion ,,,,am african man too

Hi Jean, please can you help me understand a how a MT202COV payment works with an example.

2. How are cross border payments handled? Does this require a MT103 and a MT202COV

Hi Pinnaak, Please read this article.

Does the Federal Reference Number have to start with the date the transfer was made? or does it not matter much?

Hello

Is it true i must pay exchange currency if someone is sending me money from oversea?

Dear Sir.

We need to get MT103/202

A contract is needed

Thank

Sergey Sarkissov

asltd2010@gmail.com

Hi Jean,

Thanks for your reply. So I suppose the whole route from the ordering FI to beneficiary FI is determined by looking up sort of a directory? And the maximum number of correspondent banks is then 2? or there can be more?

James

You are right on both questions. 🙂

Directories are used to determine the route.

As far as I remember (not 100% sure so someone can comment on this): in SWIFT messages, you can have one intermediary for serial payments and up to two for cover payments.

However (this is my experience), there are cases where more than 2 intermediaries are determined after applying the routing algorithm.

The transaction then goes to repair and someone fixs it manually so that it becomes compliant.

I hope this helps.

Jean Paul

Hi Jean

This is a really helpful article, although I am still rather confused.

I actually have a few questions with regard to fund redemption. Say for example a client is based in Hong Kong and invested into two USD money market funds (offshore), with two different fund managers and they wanted to place a redemption trade on both funds. They place a redemption order at 12.05pm HKT (on their Bank A cash account),

1) would this trigger an MT103 to the funds directly? how would that work diagrammatically?

2) does the FED need to be open in order for the MT202 to be issued by the correspondent bank

3) is there any way that the correspondent bank of one of the fund managers would be able to process the MT202 quicker than the other or before the FED open (i.e. an early batch run processing for Asia time) to make sure that funds get credited same day in Hong Kong?

4) under what scenario would a bank credit a clients account immediately based on the MT103 rather than awaiting the MT202?

5) How would a transfer agent factor in all of this?

Sorry thats a lot of questions! I hope it makes sense, as I’m quite baffled!

Hi,

I am not an expert in fund redemption. The article is about transfer of funds between banks through the correspondent banking network.

Let me try to answer your questions.

1) To transfer the funds, an payment order must be executed. I can’t tell you when it is triggered. The process might require other conditions to be fulfilled.

2) The answer here is clearly no. There are 2 possibiliites here: Either a MT202 is issued and sent to the next bank (sending bank has an account relationship with receiving banks) or a payment message is exchanged through a local clearing system and settled in Fedwire.

3) I would say it depends on when the order is received. Usually the bank that executes the order indicates by when the order should reach the bank and how long it needs to credit the beneficiary account.

4) Trust. The bank knows the customer and the correspondent particularly if they have been in business for long. He can credit the customer before the funds arrive.

5) If a transfer agent comes in, he will probably receive the funds before giving them to the ultimate beneficiary and take a commission.

I hope this helps.

Jean thanks a lot for the articles.Very well explained.

Can you please help me to understand the concept of F52.

1. When will F52 come in picture & when it wil not?

Explanation with a example will really help me to get my concepts cleared

Hi,

thanks for your appreciation. It is pretty simple to understand when F52 is present. Here is what you read in the SWIFT standards about F52: This field specifies the financial institution of the ordering customer, when different from the Sender, even if field 50a contains an IBAN. So F52 is populated when the sender of the message is not the ordering customer Bank. When F52 is not in the message, it means that the sender is also the bank of the ordering customer. I hope this helps.

Hi Jean,

I need to talk to you personally through email urgently

Sir. One account transfer from us bank to germany another bank account via 103 202 swift transfer. Last Saturday they send but still not recived in reciving account . Sir can u give any help this transaction. U say yes ill give all details sir very urgent thank uu

Dear Sir,

I have a customer who made me a 103dowload payment, I have copies of SWIFT 799/103/202, but this money never got me on my company account, and he is telling me that a bank officer needs to download the funds, I do not know what to do my bank says that the money does not see them in the SWIFT system, HOW CAN I CHECK AND WHAT I SHOULD DO.

I have a customer who made me a 103dowload payment, I have copies of SWIFT 799/103/202, but this money never got me on my company account, and he is telling me that a bank officer needs to download the funds, I do not know what to do my bank says that the money does not see them in the SWIFT system, HOW CAN I CHECK AND WHAT I SHOULD DO.

Please educate me how does this manual download work

Kindly answer this question if possible as I need to know how this manual download work for MT103 Download Payment

thank you so much for your fantastic and clear explanetions!

Hi paul,

When the beneficiary bank reciever recieves the MT103 but didnt recieve the 202 will there be a issue in crediting the funds to the beneficiary account. How to recieve the MT 202 to the beneficiary bank?

Hi John, the answer to your question is clearly Yes there is an issue. The MT103 does not carry the funds. It just announces that funds are coming. If the MT202 COV is not received, it means the funds have not arrived yet. Some banks know their customers and might credit the funds upfront. But that is not systematic. The standard process is to wait for the MT202 COV to come and then to credit the beneficiary customer.

There are primarily two scenarios wherein beneficiary bank would provide upfront credit to beneficiary prior to receiving funds themselves within MT202 COV message.

1) As we all know there are two broad categories of payment systems basis settlement mechanisms i.e. Gross & Net Settlement.

In payment systems where Settlement mechanism is performed in Real time & independently for each transaction (i.e. in Gross) those systems are referred to as RTGS systems.

In payment systems where Settlement mechanism is performed in batches by grouping multiple transactions then only Net amount post deducting amount that our bank owes to other bank (i.e. Net amount) is settled & these are mostly low value system. For e.g. NEFT in India

Now one of scenario wherein beneficiary bank would provide upfront credit to beneficiary prior to receiving funds themselves within MT202 COV message would be in a system referred to as “RTFS” i.e. Real Time Final Settlement system.

Examples of such systems are :- a) IMPS in India

b) CHIPS in USA

c) LVTS in Canada

d) NPP in Australia (LV)

e) Faster Payments in UK (LV)

2) The Second Scenario where beneficiary bank would provide upfront credit to beneficiary prior to receiving funds themselves within MT202 COV message would be Relationship that particular bank may have with that customer & also banks’s internal policies (customer service vis-à-vis risk prioritization).

Hope this helps.

Hello

I have a couple questions in regards to MT103/202 access to fund collection – i am aware we would have to utilise a terminal but which one in order to access this?

Hi Paul,

Can you guide me on the mapping to mt202 COV for below 2 scenarios. A quick reply is highly appreciated

1. 53a, 54a and 56a , 57a in MT103 and

2. 53a, 54a, 55a, 56a and 57a in MT103 (rare case but possible)

My assumption is as below for mapping in MT202 COV. please let me know if i am correct

1. receiver, 56a, 57a and 58a

2.receiver, 54a, 56a, 57a and 58a

Thanks

RSR

Hi Prudhvi,

Thanks for reaching out! I have a problem with the info you provided.

In MT103, you can either have 53a / 54a / 55a if it is an annoucement. Or you can have 56a /57a if it is a serial.

You cannot have all of them as far as I know. So please check your scenarios again.

Regards,

Jean Paul

Hi Paul,

I know its not a typical scenario.

I will encounter this issue if i am populating all the parties from SSI, at max it can have 3 parties to reach beneficiary institution. Now i am having sender , sender corresondent, 3 parties (correspondent and intermediaries from SSI) and benificiary’s bank.

And suppose if i am sending this message in cover mode. my mapping would be atleast assuming to be

sender

53a – Sender correspondent

54a – Correspondent (of intermediary 2)

55a – Intermediarr 2

56a – Intermediary 1

57a – beneficiary bank

This is the only way for me if i want to populate all the parties (else i have to ignore Intermediary 1)

Nice discussing with you, as always

Ping me even if there is any other way to contact your or speak to you

Hi Jean,

How you Payment Instruction and Settlement Notification happens in this Direct and Cover Payment?

Your answer will be much Appreciated.

Hello need SWIFT Software to flash a bank account , i will be very great if you can response as soon as possible

I need a software that can be used to flash Account in a any particular Bank to receive SWIFT telegraph of Incoming Funds.

I have one simple question. Is it possible to receive an MT103/202 swift transfer in Kenya.

Hi, Yes. It is possible to receive MT103/202 everywhere in the world.

The Receiving bank should be participant of SWIFT and there are many banks in Kenya that are live on the SWIFT network.

So not sure, what you are asking exactly.

Hello Jean, I would like to know why huge payments from Europe to Africa requires the banks exchanging keys on SWIFT and talking about manual SWIFT download.

Kindly explain.

Hi, The exchange of keys through the SWIFT Relationship Management Application (RMA) is pre-requisite for the exchanges of messages over the SWIFT network. Pertaining to manual SWIFT downmoad, I do not know what it is. If you find the answer, please do share it with the community. Thanks.

Hi Jean,

I continue the question you answered above, does MT-999 for exchanging key needed before MT-103? for example let say Sender bank has no relationship with Receiving bank before, so do they need to do a key exchanging first before sending MT-103 or Sender bank can directly execute MT-103?

Has MT-999 ever needed for any reason in conducting MT-103?

I hope you would explain this matter when you have time.

Best regards

sir

I want m.t 103.202

I have a lot of similar work

Please communicate Alwatsab

.00011211373701

Hi, do you mean examples of MT103 and MT202? You can download an example of MT103 from this article.

hi, i have any questions?

i want MT 103/202

I Needed examples

please help me

its import for me

Hi, You can download an example of MT103 in this article.

Good day Jean Paul.I have a very urgent request,Need receiver in France must have Agri-Cole account with the capacity to receive $10B

Contract will immediately be provided after receiver provides CIS

25% receiver

5% commission to share 2.5% each side

70% sender

Real money MT103

Then after receiver provide CIS

We will provide official contract with commission agreement etc

So after this is signed you guys provide CIS we confirm if account is strong enough to receive the

$10B

Then we issue final contract with commissions agreement

Done deal!

MT103 Swift transfer..

Send your email

KEEP ON LIVING IN A FOOLS PARADISE.

Does Receiver Correspondent ( Tag 54 ) always have Cover Message either with MT103 or MT202 ( Announcement)

hi,

can any body help how to download funds from mt103/202 to my business account as i got all codes with me,when i spoke to my bank they said in india there is no manual download process.pls help some one who can do this work i can share some percentage

info.jerrychris@gmail.com

seydisow2015@gmail.com

Hi,

I have a question….

I got a swift from my client and it says FIN 103 SINGLE CUSTOMER CASH TRANSFER…. is that the same as SINGLE CUSTOMER CREDIT TRANSFER….

i dont know anything about this so if you can help … thanks

Hi, Yes it is the MT103 SINGLE CUSTOMER CREDIT TRANSFER. Read the blog and you will learn about it.

Hi Jean Paul,

im assuming you work for a bank…. I have a very large client that needs to process DTC’s and MT-103-202 transactions. I would like to see if we might be a fit, can you please call me or text me at 805-907-8703 ask for Alan

-Thank you

i have a swift message from HSBG for another bank at a caiman, who transfers is an off shore and who receives is also. how can I replace the recipient, because he owes me the money he is receiving?

Impossible to replace the recipient once the payment has been sent over the SWIFT network.

The only option is that the recipient sends you the money after his account is credited.

Hello,

If bank is located in EU and want to send USD to US, why it is not allowed to send USD to US with cover? Banks in US usually cancel cover and inform that they are not able to forward cover to other US bank. Why it is like that ?

Dear Jean Paul,

Excellent article in understanding the how the cover payments work. You are doing a great job with the lucid explanation of the concepts involved.

Had a doubt regarding foreign bank maintaining subsidiaries in the Other currency Zones, to facilitate the transfer process. As you correctly mentioned Santander for instance would use Santander New York instead of Bank of New York as correspondent.

The question is Santander New York mandated to sent MT103/MT202 via the swift network when they can directly sent the another means of messaging (Internally used with in Santander) for communicating the credit details? Will this not save the costs involved?

Hi John, Thank you for your comment.

You are completely right that instructions can be sent through a secure internal network, in general a hub set up by the bank.

This would not go through SWIFT and the bank will save some costs indeed.

To keep things simple, banks would also send the instructions internally using the SWIFT MT format.

So it means, you can send SWIFT MT format without going through the SWIFT Network. That is pretty common in practice.

Hi, Paul. I also read a SWIFT 103 saying FIN 103 SINGLE CUSTOMER CASH TRANSFER in head block, I wonder if it’s allowed to use word CASH instead of CREDIT here according to SWIFT rules. Thanks

I have a page where you find all information about Header information. Are you referring to a specific field in the header block?

Dear Mr. Jean Paul,

Please contact asap about MT 103 / 202. Please contact asap. Thanks.

Dear Mr. Jean,

Could you possibly advise about MT103/202 SDD b2b manual download.

I am quite confused, what manual download represent in this transaction of funds, and I can’t find appropriate answer online.

Kind Regards,

Milos

Hi, I do not know what the MT103/202 SDD b2b manual download is unfortunately. Sorry.

Hi Mr. Paul,

I have a question regarding MT 202.

Is it possible to issue a MT 202 for payment of a contract and add a condition on it?

I mean Can we issue a conditional MT 202 to account of a company and only after receipt of a specific document, for example in our case after receipt of Bill of Lading, the money be received in their account?

and May I know how long does it take for the money to be transferred by using MT 202?

Hi,

As for as i know, the answer is no. Once the MT202 is issued, the beneficiary should be credited.

Documentary remittances and credits are used to put a condition on a payment. But other types of SWIFT messages are used for that, not the MT202.

Please Mr Paul what is the right steps to initiate a manual download wire transfer and the basic details? Thanks

greetings of the day,I am the direct mandate to provider for financial instrument such as BG/SBLC DTC IPIP/MT103 GPI CASH TRANSFER,

My provider is RWA to swift via GPI Only to serious receivers We able to transfer via GPI provided the account is GPI compliance in which case you will have to provide us with the account GPI code

Emil: douglasadams756@gmail.com

WhatsApp 447947737071

WE ARE SENDER GROUP IN USA, EUROPE

1 bank guarantee and standby letter of credit

2. Mt103 / Gpı Cash Transfer

3. Mt103 / Gpı One Way

4. Tt Trn Wıre Transfer

5. Mt103 / Gpı Manual Download

6. Mt199 (Gpı)

7. Mt103 Cash Transfer

8.Mt103 Cash Transfer Non Kyc

9. Mt103 / 202 Wıre Transfer

10.Mt103 / 202 Cash Transfer

11.Mt103 Sıngle Cash Wıre Transfer (One Way)

12.Mt103 Sıngle Customer Credıt Transfer

13.Mt103 / 202 Nostro Manual Download

14.Tt Wire Transfer By Trn System

15.Alıance Lite 2

16.Iban To Iban

17.Sepa

18.MT799

19.MT760

CONTRACT email me

now at douglasadams756@gmail.com

WhatsApp+447947737071

send your email

I have receivers that can receiver server to server and other types of transfers. Very large amounts are accepted and procedures are straight-forward. Transactions can be completed in days following compliance approval.

dannyaz017@gmail.com

WhatsApp: +1.646.831.8008

Hi Jean there was one question asked in one of the interview like 53a and 54a of Mt103 is mapped into which tag of mt202cov.

Dear Jean Paul,

I recently received an MT103 GPI manual download swift copy. In field F77B it says Non Operative. I would send you the copy of this swift if I have your email address. Is there anything like Non Operative in Swift Messages please???

■ Lisa entrusted CHINA MINSHENG BANKING CORP.LTD., SHANGHAI with the transference of USD 3,500 to her husband(Jack)’s A/C No. 123456 in Bank of America, Hong Kong on Dec. 22nd 2006, Lisa’s passport number is V631006, charges by beneficiary.

■ CHINA MINSHENG BANKING CORP.LTD., SHANGHAI makes the transfer via The City Bank, New York Branch.

■ Please send two SWIFT:

■A: MT 103 to Bank of America, Hong Kong

■ B: MT 202 to The City Bank, New York Branch.

(Additional information:

■ Remitter’s reference number/receiver’s reference number: pay/001

■ Bank operation code: CRE

I

|

FRESH CUT BG/SBLC /SWIFT MT103/202 GPI/ MANUAL DOWNLOAD/ DIRECT CASH TRANSFER AVAILABLE

I am the direct mandate of a genuine provider for Fresh Cut Bank Instrument BG/SBLC/MT103/202 For Sale And Lease At Purchasing 40% + 2% Leasing Fee At 6% + 2% and other financial instruments, at reasonable prices, Issuance by top AA rated Bank in Europe, Middle East.

Contact Name: WRIGHT

📧 wrightrobinson916@gmail.com

📞 +447451238797

WhatsApp :+447451238797

Dear wring Robinson

I have strong receiver in the Europe and middle eastern pls contact with me this is my WhatsApp number 0097470488088

thanktyou

Hi Jean Paul:

I have a question regarding a MT103 single customer credit transfer. Can this SWIFT be used to simply block funds for a trade or other purposes or is it an actual transfer of funds from a sender to a receiver? Thank you.

What would be an equivalent message of MT 202 COV in fed wire?

Hi Jean Paul,

I have a question : what is the difference between Swift MT103-202 Manual Download and Swift MT103-202 SPP Direct Debit Protocol ? because our company got a contract with such a fund receipt transaction system. Thanks a lot.

Dear MR jean paul

Good day I’m kemal I need speak with you regarding mt103 202 cover. GBI SPLC work also I have wery strong receiver this is my WhatsApp number 0097470488088 can you contact with me or you can send me your WhatsApp number thanks

Hello,

We offer Swift MT760 BG/SBLC, FC MTN, BCL, DTC, KTT, EUROCLEAR, Bank Draft, Letter of Credit (LC), MT103 Etc.

N/B : Provider’s Bank move first.

Let me know if you have any need for the above offers.

Email : richardhugo1973@gmail.com

Name: Richard Hugo

We offer SBCL, MT760 BG/SBLC, FC MTN, BCL, Letter Of Credit (LC) MT103 Etc.

N/B : Provider’s Bank move first

Let me know if you have any need for this above offers.

Email: adamsjone376@gmail.com

Skyoe: live:.cid.d86264dad6442f00

Receiver or Mandate needed for MT103 direct cash transfer

Ratio:

Receiver:45%.

Mandate: 10%

Sender: 45%

First trenche: $1 million dollars

Total amount: $100 million dollars

Please note: Senders only need real and genuine Receiver and Mandate (USA, Canada, China, Singapore, Malaysia, Indonesia, South Africa, Philippines, etc)

Interested receiver must send CIS for due diligence after that receiver will be sent the DOA contract.

Message on email: witchapastang@gmail.com

Dear Jean,

I have a very urgent case that requires your expert view. Our client may need to appoint an expert witness on a remittance dispute.

Could you please contact me by WhatsApp +852-92695955 so that I may send you the relevant paper for review.

In short, I would like to know the exact meaning of ACSP/G000 i.e. whether such codes refer to the transfer status from the remitting bank to the US correspondent or from the US correspondent to the payee’s bank. Both the remitting bank and the payee’s bank maintain an account with the same US correspondent bank.

Look forward to receiving your early reply.

Best regards,

KT

i am a receiver of GPI payment from China.

I can do

1. Swift GPI MT103 cash transfer

2.L2L

3.S2S

4.IBAN to IBAN

5.MT103 TT

6.SBLC

7.CURRENCY EXCHANGE

and so on,

please contact me via email kimhanson@163.com for more information.

also do swiping card 101 or 103

*Receiver or mandate is needed*

*For a (MT103/SWIFT/199/Non-GPI/Semi automatic)*Direct transfer*

*The deal worth $500million* *USD*

*First trenche :$100million USD*

*Second tranche $150million* *USD*

*Third Tranche $250million USD*

*Receiver from:Any country 🇯🇵🇸🇬🇸🇦🇮🇳🇲🇾* *🇭🇰🇮🇩🇦🇪🇨🇳🇲🇦🇶🇦🇺🇲🇩🇪🇬🇷* *🇨🇦🇦🇺🇨🇷🇰🇷🇪🇺🇨🇼🌎*

*Sharing Ratio 45%/10%/45%*

*Interested receiver must send* *CIS for due diligence after that* *receiver will be sent* *the DOA contract dm me* *on my WhatsApp* +54 9 11 6106-4500