The SWIFT MT910 message is called Confirmation of Credit. To put it briefly, the SWIFT MT910 is sent to an account owner or to a party authorized by the account owner to receive that information. It indicates that funds have been credited to an account. Therefore the name Confirmation of Credit.

We consider the SWIFT MT910 in a given context. It is a confirmation of Credit sent by a correspondent which received a MT202 COV to its customer, the beneficiary institution. However, what we will see applies to other contexts as well since the underlying principles are the same. After this analysis, you should be able to derive the content of SWIFT MT910 in other contexts without problem.

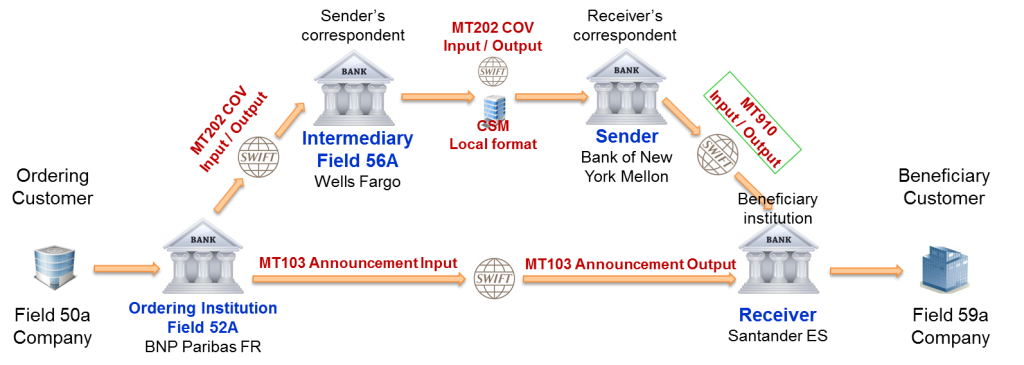

Let me first remind you the context with a picture.

In the last three articles, we did the following (Click on the links below to learn more about a specific topic):

- Detailed analysis of a MT103 announcement sent by the BNP Paribas to Santander

- Study of the SWIFT MT202 COV sent by BNP Paribas to its correspondent

- Examination of the second SWIFT MT202 COV sent by BNPP’s correspondent to Santander’s correspondent

Now we are considering the SWIFT MT910 sent by Bank of New York Mellon to Santander. It is highlighted in the green box above.

The table below contains the fields that are transported in the SWIFT MT910 message. An additional column (comments) provides further explanation, so that it is easy to understand each field and what it is used for.

Explanation Format Comments Sender IRVTUS3N The Sender BIC appears in header block (Block 1) in the MT910 Input and in the application block (Block 2) in the MT910 Output. Note that this field is the same as F54A (Receiver's correspondent) in the MT103 Announcement. Message Type 910 The message type is the second field of the block 2. Receiver BSCHESMM The Receiver BIC appears in header block (Block 1) in the MT910 Output and in the application block (Block 2) in the MT910 Input. Message Text This introduces the Text block (block 4) and specifically the sequence A fields. All the fields below are in the text block of the MT910 message. Transaction Reference Number :20:REFMT910IRVT453 It is mandatory and of format 16x. This is the Sender's Reference specific to this MT910. It is generated by IRVTUS3N. Related Reference :21:103REF405775 It is mandatory and of format 16x. This is the Sender's Reference (:20:) of the MT103 Announcement. This was forwarded as related reference in the two MT202 COV. Account Identification :25:835-162-85 It is mandatory and can be provided in 2 different formats (No letter option and Option P). This is the account number of BSCHESMM that has been credited. IRVTUS3N is the account holder. The first format is chosen here:

No letter option 35x (Account) Date/Time Indication :13D:1808301535-0400 This field indicates the date, time and time zone when the entry is posted to the account, in the books of the account servicing institution.

Date takes the format YYMMDD. Time takes the format HHMM. Time zone comes after the +/- sign (- in this case). 1535 is UTC-4 hours. So UTC is 1935. UTC stands for Universal Time Coordinated. Value Date, Currency Code, Amount :32A:180830USD367574,90 It is mandatory and of format:

6!n3!a15d (Date)(Currency)(Amount)

Note that compared to the MT202 COV, one additional date is added to the value date (180829+1D). Ordering Institution :52A:BNPAFRPP Ordering institution is optional and can be provided in two options A (usual) and D (less common). Option A is chosen here:

[/1!a][/34x] (Party Identifier)

4!a2!a2!c[3!c] (Identifier Code)

This is the same as the Field 52A of the second MT202 COV message.Intermediary :56A:PNBPUS3N The Sender received the funds directly from PNBPUS3N and not from BNPAFRPP. That is why this field is populated. Note also that this field is the same as F53A (Sender's correspondent) in the MT103 Announcement. End of Message Text/Trailer

Read this page on the SWIFT formatting rules and Character sets of MT Messages to get additional information and understand what 16x, 35x and the format of the field options mean.

Narratives and notes on this SWIFT MT910 message

As usual, some narratives and notes are provided about the SWIFT MT910 to better understand its meaning and content. As stated above, the study of this SWIFT MT910 Confirmation of Credit should allow you to easily find out what the content should be in other contexts. So review the table above and read the following very carefully.

Narrative and note 1 (Main purpose of this SWIFT MT910)

Bank of New York Mellon (IRVTUS3N) sends this message to Santander (BSCHESMM) to notify that its account has been credited.

Narrative and note 2 (The SWIFT MT910 is a cover)

Yes you read it correctly, the MT910 is “a cover”. When the Beneficiary institution receives the MT910, it has confirmation that its account has been credited with the funds related to the announcement. So the final beneficiary can be credited as well. No need to receive a MT202 COV. This explains why an announcement can be reconciled with an MT910.

Narrative and note 3 (Related reference in this SWIFT MT910)

The related reference (:21:103REF405775) is the transaction reference (:20:103REF405775) that was generated by BNP Paribas, sent in the MT103 Announcement and forwarded in the two MT202 COV. The receiver can use it to reconcile the cover (SWIFT MT910) with the annoucement.

Narrative and note 4 (Unique End-to-end Transaction Reference not in the SWIFT MT910)

It is a pity that the Unique End-to-end Transaction Reference (UETR) provided in MT103A and MT202 COV is not available in the SWIFT MT910. Since it was provided in the MT103 Annoucement received by Santander, it could be used to reconcile the announcement with the cover if it was available in the MT910. The field 72 could be used to transport the UETR, one might think. Unfortunately the SWIFT MT standard does not allow that. One workaround is to generate the MT910 and convert it into MT199 or MT299 to meet the GPI requirements and guidelines.

This ends our analysis of the SWIFT MT910 Confirmation of Credit. In the previous article, we saw also that the receiver’s correspondent could send a SWIFT MT950 message instead of the SWIFT MT910. What is the SWIFT MT950 message? And what does it contain? That will be the topic of the next article.

Very informative article. Thanks!!

Hi Jean Paul

Should MT910 be subject to real time sanction screening? If so, what is the risk if they are not screened at all?

Thanks,

Luke

can an MT910 be considered as an authenticated message being an MT9XX?

can the beneficiary bank proceed and credit the funds to the final beneficiary without receiving an MT103?

Hi, The MT910 is a confirmation of credit. When you received it, you know your account with the Sender has been credited.

However, it does not contain beneficiary information. So you should receive the MT103 Announcement too to be sure that you credit the funds to the correct beneficiary.

Not sure What you mean with MT910 be considered as an authenticated message. All messages exchanged over the SWIFT network are authenticated.

The question of ‘Authentication’ is a very interesting one actually.

It’s fair to say that all messages exchanged over the SWIFT network are authenticated (through the HSM, for those interested by technical stuff).

Then, comes the weird concept of ‘Authorized’ messages, i.e. those messages that require a SWIFT RMA to be in place between two members before they can exchange such messages. There is a certain amount of confusion between ‘Authentication’, which is native to the SWIFT network indeed, and ‘Authorization’, based on RMA.

Not all messages require Authorization to be exchanged : this is the case of MT910, which can be freely exchanged with no RMA needed. Which is quite ironical by the way, since such MT910 are sent by the account holder, the Correspondent, to the account owner, client of the former. Therefore, the Correspondent and its client have necessarily a RMA in place already, so it’s quite odd MT910 doesn’t require authorization, but this is the way it goes.

To sum it up, most Category 3, 6 & 9 messages do not require authorization (i.e., no RMA), while all other message Categories do.

Finally, ALL SWIFT messages are authenticated, with or without RMA, meaning their integrity and origin are guaranteed by the network itself (i.e. by the security features embedded within the network from end to end).

Thank you very much Olivier for your great contribution!

Hey I have recently started working in a bank. I am responsible for MT910 Swift msgs coming from HSBC.

I am having great difficulties understanding to who I should give credit to since the msg usually comes with amount value date and other information. But i do not understand which account (ultimate beneficiary) it needs to be credited to. Since ordering customer is usually not given and some times its is given but that party do not have any account with us. i m very confused with this. please help

Hi,

You can receive a MT910 on behalf of another party which has given you authorization to receive it.

If not yet done, do read the SWIFT specifications about the MT910. It can be helpful to understand few things.

Is it possible to receive “standalone” MT 910 without MT 103? In what circumstances does this happen? Struggling to comprehend the relationship between MT 910 and MT 103.

Yes it is possible to receive a confirmation of credit, the MT910, without MT103. A bank can request its correspondent to send a confirmation every time its account is credited. The sender may ask the receiver to pay for this service.

Hi

can we accept MT103 as good without MT 910? as u know, some banks are not GPI members, they willing to provide credit confirmation (via email).

tq

Hi Nina,

the answer is yes! MT910 can be used as cover for a cover payment. For a serial payment, the MT103 alone is enough.

Regards, Jean Paul

Please I have a problem. I issued MT103/72,conditional payment but the receiver did not receive it and there fore cannot release my order. I wish to issue MT910. Is it possible he gets this without the MT103/72?

Some correspondants bank send MT202COV to the beneficiary bank instead of MT910 for a cover method payment. So we are receiving the MT103 from the remmiting bank and the MT202.COV from the correspondant.

Hi Jean paul,

if we are to discount an avalized draft which swift we should request from the avalizing bank to confirm.

I want to create MT910 text file but i Have problem with 50a and 52a fields.

How to edit NameAndAddress (second subfield) in 50a?

How to edit Identifier Code (second subfield) in 52a?

Hi Rock,

Q: How to edit NameAndAddress (second subfield) in 50a?

A: It depends on the tools that you use. SWIFT files are txt files. You can edit them with Notepad for example. To provide name and address you can use only options F and K of the field 50a.

Q: How to edit Identifier Code (second subfield) in 52a?

A: Only the option A of the field 52a can be used to provide the identifier code, the BIC of the ordering institution.

I hope this helps.

Hi Jean, kindly clarify a doubt I have regarding the message flows for a simple MT 202 without cover involving 2 finacial institutions, a fund holding institution (e.g central banks) having a settlement account for each of the said finacial institutions and a central processor authorized to instruct the fund holding institution for making fund transfers.

If the instructing finacial institution sends a MT202 to the central processor and the processor proceeses the payment by instructing the central banks….is it necessary for the central processor to forward the MT 202 to the beneficiary bank or the central processor can simply notify the beneficiary bank with a MT910

I apologize for the long narrative. Your help is highly appreciated.

Hi Sanjeev,

What you describe makes me think of TARGET2. And TARGET2 does forward the message (MT103, MT202) to the receiving institution.

That is called a Y-Copy message flow. Theoretically a MT910 could also be used. But the message is forwarded instead.

Hi Jean,

Is Swift MT 910 is an authenticated message.

SWIFT is a highly secure financial communication network. All messages over the SWIFT network are authenticated.

In addition to that a message may need to be authorized before it can be exchanged with a party.

Hi Jean Paul

How does this work when my Bank has to send to a client a SWIFT MT104 to request a payment, and the Client confirms with a MT910 , does my bank have to credit my account on receipt of the MT910 … even before the Client sends the MT103

Regards

Can an MT910 be sent by the Paying Bank (BNP Paribas in the above example) to Santander even before Bank of New York sends it to confirm that they have instructed their correspondent to pay Santander’s USD correspondent? Or must it always be sent by the Bank that holds the account i.e. the correspondent bank?

Hi,

The MT910 must always be sent by the Bank that holds the account.

When the receiver gets the MT910, he is 100% sure that funds were credited on his account.

That is why the standard says that the MT910 is sent by the account holder.

Hi Jean Paul

Should MT910 be subject to real time sanction screening? If so, what is the risk if they are not screened at all?

Thanks,

Luke

Dear Paul,

In the above example Bank of New York opened an account at Santander and they are crediting it.

But what if Bank of New York credit the account Santander opened at their Bank? Should Bank of New York also send an MT910?

Dear Maria,

The account holder sends the MT910 to the account owner if the account owner requests it.

Some account owners may decide to receive only the MT950 account statement.

I hope this clarifies. Let me know if you have further questions.

Hi Jean can you send me the format for MT910 just for information. Thanks

Dear J. P.

After receiving MT 103 Single Customer Credit Transfer(mt 103/202),

what kind of message type does the receiving bank send to sending bank ?

For example : MT199 or MR 799 or Any other type?

Hi Jean Paul,

in case when the correspondent wants to adjust the value date, can they use MT910 to make back value of the previous payment?

regards,

Gulnur

Hello Jean Paul,

Should a 910 be sent on the back credit from a cheque deposited to the client account, or this is this reserved for credits from inwards transfers only.

Post ISO migration, can a camt,054 message be used as a cover like the MT910? Does ISO rules allow such a flow?

The answer is yes. The camt.054 will be used as cover like the MT910.

My correspondent bank does not handle funds anymore which com with MT 910. They are returned instantly to the sending bank. They only handle incoming funds which come with MT103 or MT202.

Good Evening Jean-Paul

Wich type of message the receiving bank must send to sender’s bank after reception of the MT-910?

Who carries the fund in this process, as MT202COV doesn’t carry any fund and MT103A is just an announcement then from where the beneficiary will receive the funds?

Bonjour Jean-Paul,

If a transfer is done from an account in Euro but sent in dollars to an account in dollars, may you let me know what would be the swift messages required for confirmation the money had been appropriately credited to the recepient account ? I understood the initial swift message is a MT 103, but how does it work with the correspondant bank and is there a final confirmation to be done from the payer’s bank to the payee’s bank ?

Bonjour Jean-Paul,

If a transfer is done from an account in Euro but sent in dollars to an account in dollars, may you let me know what would be the swift messages required for confirmation the money had been appropriately credited to the recepient account ? I understood the initial swift message is a MT 103, but how does it work with the correspondant bank and is there a final confirmation to be done from the payer’s bank to the payee’s bank ?

Customer send us swift message the xxx amount is paid to you however bank inform us the fund cover not received hence you account can not be credited. At the end transaction stand null and void stating reason “Unable to locate the MT 910). My question is what is “Fund Cover” and Is it possible that we received only swift message from customer or bank and actual money not received?

Hi Jean Paul – Kudos to your effort in putting up this site.

Have a question on Tag 20 of the MT910. Can there be two or more MT910 messages carrying the same Tag 20 (Transaction Reference Number) value?

hi jean

I asked my exchange to do a wire transfer for me, then he provided me mt 103 from applicant bank and also mt 199 from intermediate bank, but still the beneficiary claimed no received any payment.

what shall I do ?

best regards,

Hi Paul,

Can one use MT199 to send Payment Credit Advice? or must it be via MT910 only?

Regards,

Denis Bieroff

Thank you, Jean.

Why can’t a MT 202 COV get to the Receiver?

Why can a MT 103 get to the Receiver?

Can we credit a fund to the beneficiary where only MT910 is received and no MT103 received? (beneficiary details are available in MT910)

@Jean Paul

How do banks decide whether it has to send a MT910 or a MT202 Cov to the benefeciary bank, is it only on the basis of Nostro-Vostro accounting relationship ?

Also, in case the MT910 is sent, when do we inform the Central bank about this transfer? because if the MT202 cov is sent to other bank it will go through domestic clearing but MT910 wont.

Hello Jean,

Thank you for the use cases.

What is the scenario where we can send MT910 (outgoing) against incoming MT191 Claim request.

I have tried this scenario in both cases with Serial Payment and Cover Payment, however, system is sending MT202.

Please help with the situation when we can send the MT910 message instead of MT202 reply to incoming MT191.

Regards,

Ashok

Félicitation à tous.

Je viens de tomber sur le forum

Sur quels champs on se base pour retrouver le MT103 quand l’on reçoit le MT910 de confirmation?