After the introduction and analysis of SWIFT cover and serial payments, we are now looking at one concrete example of SWIFT MT103 announcement and MT202 cover payment. In the first article of this series, we performed a detailed analysis of a MT103 announcement sent by the debtor bank to the creditor bank. In the second article, we studied the SWIFT MT202 COV sent by BNP Paribas to its correspondent. Now we want to know what after the first SWIFT MT 202 COV is received. How is it forwarded to the next party in the chain? and what is the content of that message? This article will respond to these questions.

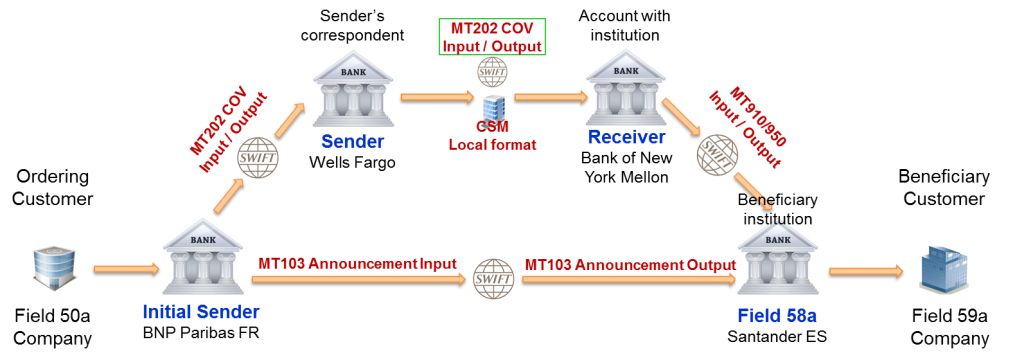

It is worth looking at the picture depicting the messages and the different parties again. It is the same as the one we saw in the previous article but with light differences.

It is important to note that we are now looking at the second SWIFT MT202 COV payment sent by Wells Fargo, correspondent of BNP Paribas (BNPP). Wells Fargo sends it to Bank of New York which holds the account of the beneficiary institution in USD. The sender’s correspondent in MT103A is the sender. And the receiver’s correspondent in MT103A that was the account with institution in the first SWIFT MT202 COV now becomes the receiver.

A brief reminder of the context: A company in France, customer of BNPP in Paris, wants to send payment in USD to another company in Spain, customer of Banco Santander in Madrid. Since BNP Paribas and Santander are not located in the USD currency zones, the funds transfer happens through their correspondent accounts opened with Banks in the USA. In this example, we assume that the correspondent of BNPP is Wells Fargo and the correspondent of Santander is Bank of New York Mellon. BNPP sent a combination of SWIFT MT103 Announcement and MT202 Cover payment messages for the transfer. And BNPP’s correspondent is now forwarding the transfer to Santander’s correspondent.

The table below contains the fields that are transported in the second SWIFT MT202 COV payment message. An additional column (comments) provides further explanation, so that it is easy to understand each field and what it is used for.

Explanation Format Comments Sender PNBPUS3N The Sender BIC appears in header block (Block 1) in the MT202 COV Input and in the application block (Block 2) in the MT202 COV Output. In the MT103 Announcement, it is the content of the field 53A. Message Type 202 The message type is the second field of the block 2. Receiver IRVTUS3N The Receiver BIC appears in header block (Block 1) in the MT202 COV Output and in the application block (Block 2) in the MT202 COV Input. In the MT103 Announcement, it is the content of the field 54A. Validation Flag 119:COV This validation flag is provided the user block (Block 3) and transported end-to-end. It indicates that the message is a MT202 Cover. Unique End-to-end Transaction Reference 121:d85a7574-863a-494d-bfbe-4084bf7704e1 This reference is provided in the user block (Block 3) and transported end-to-end. It is the End-to-end Transaction Reference (UETR) of the MT103 Announcement, that is copied unchanged to field 121 of the cover message. Message Text: General Information This introduces the Text block (block 4) and specifically the sequence A fields. All the fields below are in the text block of the MT202 COV message. Transaction Reference Number :20:202PNBPREF2679 This is the Sender's Reference specific to this MT202 COV. It is generated by the sender PNBPUS3N. Related Reference :21:103REF405775 This is the Sender's Reference (:20:) of the MT103 Announcement. Value Date, Currency Code, Amount :32A:180829USD367574,90 It is mandatory and of format:

6!n3!a15d (Date)(Currency)(Amount)

One day is added to the initial settlement date (180828+1D). Ordering Institution :52A:BNPAFRPP Ordering institution is optional and can be provided in two options A (usual) and D (less common). Option A is chosen here:

[/1!a][/34x] (Party Identifier)

4!a2!a2!c[3!c] (Identifier Code)

The sender populates this field to inform the receiver that the initial instruction came from BNPAFRPP, the Ordering institution. Beneficiary Institution :58A:BSCHESMM This is the beneficiary institution which has a correspondent account in USD with IRVTUS3N. This is the receiver of the MT103 Announcement. Underlying Customer Credit Transfer Details This introduces the sequence B fields of the MT202 COV. Ordering Customer :50F:/01234567890

1/Company France SAS

2/28 RUE DENIS PAPIN

3/FR/CRETEIL 94400 Mandatory like in the MT103. This must match exactly the ordering customer field 50F provided in the MT103A. If not, beneficiary bank (BSCHESMM) rejects the message. Beneficiary Customer :59:/ES6300491800132710387658

Company Spain S.A.

Santa Hortensia 26-28

28002 MADRID

SPAIN Mandatory like in the MT103. This must match exactly the beneficiary customer field 50F provided in the MT103A. If not, beneficiary bank (BSCHESMM) rejects the message. Currency, Instructed Amount :33B:USD367574,90 Optional. When provided, it must match exactly the currency, instructed amount field 33B provided in the MT103A. If not, creditor bank (BSCHESMM) rejects the message. End of message text/trailer

Read this page on the SWIFT formatting rules and Character sets of MT Messages to get additional information and understand what 16x, 4!c and the format of the field options mean.

The third message in our study that is analyzed in detail below is the second SWIFT MT202 COV.

Narratives and notes on this SWIFT MT202 COV message

This SWIFT MT202 cover payment is pretty simple but a careful analysis revealed few interesting things. The following narratives and notes allow to get a deeper understanding of the message content.

Narrative and note 1 (Main purpose of this SWIFT MT202 COV)

The Sender (PNBPUS3N) is instructing the receiver (IRVTUS3N) to debit sender’s account and credit the account of BSCHESMM, the beneficiary institution. As indicated on the picture, this transaction can happen through a local clearing system that interconnects the banks in a country or region. In that case, funds are transferred between banks through the clearing systems like domestic payments. All the information is forwarded to the next party. It is just in a different format.

Narrative and note 2 (Meaning of COV in the MT202 cover payment)

The Block 3 of the message carries a Validation flag (Tag119) to indicate it is a cover payment. That means this MT202 is related to an underlying Customer Credit transfer message. In case there is no underlying customer payment, Banks should use the normal MT202.

MT202 COV has 2 sequences in the message format: Sequence A which contains the MT202 COV payment transmission details and Sequence B which contains the MT103 message details. The sequence B (Underlying Customer Credit Transfer Details) in the MT202 COV must contain at least Ordering Customer and Beneficiary Customer information and must match exactly the ones provided in the MT103 Announcement.

Narrative and note 3 (Unique End-to-end Transaction Reference in this SWIFT MT202 COV)

The MT202 Cov contains exactly the same unique End-to-end Transaction Reference as the MT103 Announcement and the first SWIFT MT202 COV. This shows that even if three payment messages (An announcement and two covers) have been exchanged, it is the same transaction.

Narrative and note 4 (Fields in this SWIFT MT202 COV)

- Sender of 2nd MT202 COV = Sender’s correspondent 53A of MT103 = PNBPUS3N. It holds the USD account of BNPAFRPP.

- Receiver of 2nd MT202 COV = Field 54A (Receiver’s correspondent) of MT103 Announcement = IRVTUS3N.

- Transaction reference (:20:202PNBPREF2679) specific to this SWIFT MT 202 COV is generated by the Sender PNBPUS3N.

- Related reference in MT202 Cov (:21:103REF405775) = Sender’s reference in the MT 103 (:20:103REF405775). It is the same related reference that was provided in the first MT202 COV. It can be used to reconcile the cover with the announcement.

- Field 52A (Ordering institution) is provided by PNBPUS3N to inform IRVTUS3N that the initial instruction was given by BNPAFRPP. Without it, the receiver would wrongly assume that PNBPUS3N is the ordering institution.

- Field 57A (Account with Institution) is not present in this SWIFT MT202 COV – That indicates that receiver Bank of New York is the account holder of the beneficiary institution Banco Santander (BSCHESMM).

- Field 58A (Beneficiary Institution) = BSCHESMM remains the same as in the first MT 202 cover. The funds have the same destination.

Now we are done with the analysis of announcement and cover payments. But other questions still remain: what are the MT910 and MT950 that we see between Receiver and Beneficiary institution? What are these messages used for and what do they contain? These questions will be answered in next articles.

Hello Jean Paul, thank you for writing these series of articles. They are very good documentation and very helpful. I would like to ask two questions related to this article, if possible.

1. “Field 57A (Account with Institution) is not present in this SWIFT MT202 COV – That indicates that receiver IRVTUS3N has an account relationship with the sender PNBPUS3N.” – why does the absence of Field 57A mean that there is an account relationship between Sender and Receiver? I would have thought that it would be a sign of account relationship between Receiver and the Beneficiary Bank (since there isn’t any other Bank to forward the message to, so lack of 57A).

2. I am confused regarding how the transfer of funds happen between Sender PNBPUS3N and Receiver IRVTUS3N. Does the Sender hold the account of the Receiver? Does the Receiver hold the account of the Sender? What is the role of the local clearing system?

Thank you very much.

Hi Oana,

Below the answers to the questions; let me know if things are still unclear.

Point 1: First, a SWIFT message is exchanged between 2 Banks. The sender may have an account relationship with the receiver or not. Serial message are exchanged only between banks that have an account relationship. Second, in the SWIFT standard you read :”When field 57a is not present, it means that the Receiver is also the account with institution.” So the sender would have added it if the receiver was not the account with institution. And the message is a serial message. So sender has account with receiver.

Point 2: It is other way around. The sender has an account with the receiver and is saying to the receiver: Please debit my account with you and credit the account of the beneficiary mentionned in the field 59.” This is how you should understand it. What I show on the picture are the options to send the funds to the receiver. Either the sender sends a MT103 message directly if it has account relationship with the receiver or the sender goes through a clearing system.

I hope it clarifies the things.

BR, Jean Paul

Dear Jean Paul, thank you very much for your prompt answers. I still have some things unclear regarding the points above. If you have the time to look over these questions, it would be really useful for me. 🙂

(Points 1 and 2 are related to same points above)

1. I understand what you said, however, is this a serial payment? I thought it is a cover payment going through a clearing system (if my understanding is correct). Does the Sender have an account with the Receiver? If the answer is “yes”, I think I understood the transfer of funds here.

2. This is to verify if my understanding is correct regarding the transfer of funds if the Sender (Wells Fargo) has an account with the Receiver (New York Mellon):

– Step 1: After the first MT202COV, Wells Fargo debits the account of BNP Paribas and credits its own account. Wells Fargo then sends the second MT202COV

– Step 2: the account of Wells Fargo with New York Mellon is debited and the account of Santander with New York Mellon is credited.

I apologize if I asked silly questions. I still have to read and understand how clearing systems work.

Thank you very much for your support and your willingness to help.

Hi Oana,

There is no silly question. 🙂

Point 1: If we consider this MT202 COV independently of everything else, then it is a serial payment. Sorry if it was not very clear.

Of course the MT202COV is sent as cover for an announcement sent directly to the beneficiary. But considered itself, it is a serial payment.

In this payment, wells fargo is instructing Bank of New York:”take funds from my account or receive funds through the CSM if it is through a CSM. The funds should be credited to the beneficiary. For a serial payment, both banks must be interconnected either directly or through a CSM and that is the case here.

Point 2: Your understanding is correct.

The first MT202 Cov is an instruction From BNP Paribas to debit his own account with Wells Fargo. Funds should be credited to Bank of New York (BNY).

So When Wells Fargo receives the first MT202COV, it debits BNP Paribas account and credit an internal account and then instructs BNY to debit Wells Fargo’s account and credit Santander’s account. If you give me 100 USD, I put it in my pocket. I can ask a friend living 500 Km away who owes me 100 USD to give it to someone. At the end of the day, that someone gets the money and everyone is happy. That is how correspondent banking works.

I hope things are clearer now. No not hsitate if you have additional questions.

Thank you very much, Jean Paul. This made things very clear. I also read in the meantime the articles about Clearing and Settlement, and I understood more about the role of the CSM. Your articles are of great help!

Hello Jean Paul, I just finished the “MT103 Serial payments analysis” articles and I would like to verify a certain thing. I observed that in MT103 and MT202COV the meaning of field 57a is different:

– in (first) MT103 of a serial payment: field 57a (account with institution) is the bank holding the beneficiary’s account; field 56 is the intermediary institution (the correspondent bank of the creditor bank in field 57a)

– in MT202COV payment: field 58a holds the beneficiary bank holding the beneficiary’s account, while the “account with institution”, so field 57a, is the correspondent bank of the beneficiary bank.

Is my understanding right? Thank you so much for all your support!

Hi Oana,

I like your comments because they remind me the difficulties I had whe I started. Keep searching and you will find.

Let’s get back to the field 57a. You are right for the two points 🙂 But I will give additional comments to make the things even easier. 🙂

According to the Swift standard: the field 57 specifies the financial institution which services the account for the beneficiary customer.

The beneficiary customer can be individuals but also financial institutions. MT202/COV is a message used to move funds between financial instituions.

So when using a MT202COV the sender is sending money to the bank which holds the account of the final beneficiary customer. In the MT202 COV, the 57a is the correspondent bank of the beneficiary bank. But since it is a MT202COV, the funds are for a customer of that bank. So the beneficiary bank receives funds on its account with its correspondent and credits the account of the beneficiary it holds. Remember what I said on a previous comment: “If you give me 100 USD, I put it in my pocket. I can ask a friend living 500 Km away who owes me 100 USD to give it to someone. At the end of the day, that someone gets the money and everyone is happy.” That is how correspondent banking works in simple terms.

Thank you very much, Jean Paul, for all your support and clear explanations. I am very grateful! I understood.

Hi Jean Paul,

Whats happening if both of the Initial Sender and Beneficiary Institution have the same USD correspondent ?

Should you send a serial MT103 ?

In which case a MT103 or MT103 + 202cov should be used ? Is there any limitations ?

Hi Mat, 🙂

1 and 2) The sender will just ask its correspondent to debit its account and credit the account of the Beneficiary Institution that it holds. In this case a serial payment will be used.

3) This is not a simple question. Theoretically, either of the methods can be used. American prefer to use the serial method and Europeans the cover method. There are many parameters to take into consideration. But there is one key rule in Europe (We are from Europe): if the initial sender has an account relationship with the receiving institution, a serial method (just a MT103) is used. If not, then a cover method (MT103+MT202 COV) is used. Some banks do not accept the cover method. In that case, the sender has no choice, but to use a serial method.

Let me know if you have additional questions.

Hi Jean Paul,

Thanks for your answer, by the way : happy new year.

I just need a clarification, I’ll try to adapt my question to your Scheme.

For Exemple : A Corporate linked to Swift needs to send USD to a non-resident US beneficiary

1)

CORPORATESWIFT –> BNP FR –> WELLS FARGO –> BNY —> SANTANDER ES —> FINAL BENEFICIARY

In this case I understand that the Corporate will instruct an MT103 to SANTANDER MES and an MT202cov to BNP FR

2)

BNP FR has the same USD correspondent as SANTANDER ES, then we are in the below configuration:

CORPORATESWIFT –> BNP FR –> JPM CHASE NY –> SANTANDER ES –> FINAL BENEFICIARY

Should the corporat send an MT202cov to BNP FR and an MT103 to SANTANDER ES or a serial MT103 ?

Thanks for your Help.

Thank you very much Mat.

I appreciate your message and the exchange we have.

Below are my answers:

1) Corporations do not send MT103. They send MT101.

It is up to the bank that receives the MT101 instruction (BNP in our case) to send MT103 only or to send MT103+MT202 COV.

CORPORATESWIFT –> (MT101) BNP FR –> (MT103 only or MT103+MT202 COV) WELLS FARGO –> BNY —> SANTANDER ES —> FINAL BENEFICIARY

I wrote few articles about MT101. Check them out when you have time.

2) Same remark as above: Corporations do not send MT103. They send MT101.

CORPORATESWIFT –> (MT101) BNP FR (MT103 only or MT103+MT202 COV) –> JPM CHASE NY –> SANTANDER ES –> FINAL BENEFICIARY

In this case also, BNP can theoretically choose to send MT103+MT202 COV too.

I would even say, that is what the sending bank does most of the time. The bank of the beneficiary is SANTANDER ES and BNP does not have an account relationship with SANTANDER ES in USD. If the beneficiary bank would have been JPM CHASE NY, then BNP would have sent a serial payment for sure.

I hope things are clearer. 🙂

Happy payment journey and let’s keep in touch.

Hi Jean Paul,

Indeed that’s an intesting exchange we have, some of the coporates have a NOSU status, meaning that they are Swift participant and holding a BIC code. That’s allowing them to send any king of Swift message to their currencies clearer.

That’s why I was asking you with message the copor should send to its clearer and to the final beneficiary bank if both have the same USD correspondant.

Have a good day.

Hi Jean Paul,

Thanks for your interesting and educational articles. I have a question regarding this scenario (apologies if it’s an obvious one).

Theoretically, Santander ES could hold multiple US Correspondent banking relationships (e.g. Bank of NY Mellon could also be Bank of America).

1.) How is the routing of this payment decided at the point where BNP send the MT103/202COV?

2.) Is it possible that BNP do not know who the receiver’s correspondent is when the MT103 is sent and they send MT202COV and MT103 without this information?

Thanks,

Steven

Hi Steven, Thank you for reaching out.

Let me try to answer your interesting questions.

1) Banks exchange information about their correspondents in different currencies in SWIFT MT670 and MT671 Messages. These messages are called Standing Settlement Instructions (SSI) and stored in Payment engines Databases. Santander would say in a SSI:”If you want to send me USD, please send it to my correspondent BNY.” When BNP sends the MT103/202 to Santander, the correspondent of Santander in USD is picked from the database and the messages enriched. To keep things simple.

2) Personaly, I have never seen a case where the sender does not know the receiver’s correspondent before sending the payment. As far as I know, if the sender does not know receiver’s correspondent, he will try to find it out either through services provided by SWIFT or may request the receiver directly to share its correspondent information. If other people have seen something different, please do react to this.

Back to what you wrote about multiple correspondents. Yes Santander can have multiple USD correspondents. In SSI, it usually provides the preferred correspondent to receive funds. But when sending funds, Santander can choose to settle the payment through the one and the other correspondent in the USA. For example, it can choose to send payments above certain amount to a specific correspondent and payments below that threshold to another.

I hope this help. Please let me know if you have additional questions.

Hi Jean Paul,

Thank you for this invaluable resource! I have been looking at a self-study course provided by SWIFT for MT202COV in which the kind of scenario you present here is covered (though your presentation provides much better detail around what is going on).

In their course, they expanded this scenario to also show a situation where the MT103 announcement does not go direct to the beneficiary, but goes in a chain 1) where 57a in sequence B is also used and 2) where 56a and 57a in sequence B are also used. There is no explanation around this (I have asked their support team but got no answer so far). It’s left me rather confused – I understand the principles of using these in the serial method but what is the need when MT202COV cover payments are settling the funds transfer? If there are multiple MT103s being used, how does this impact the set-up of the MT202 COV messages given the values will be changing as the MT103 chain progresses?

Can you shed any light?

Hi Mark, Thank you for your comment! Your question is a tough one, but I will try to answer it.

In some cases the sender may not be able to reach the beneficiary bank directly over the SWIFT network. What I have often seen is the case where the beneficiary has a not connected BIC (Those BIC with 1 at the position 8). Exchange over the SWIFT network must go through a participant with a live BIC. The live BIC receives the announcement and the cover and after that it can forward the funds to the beneficiary over an internal network, generally with a normal serial MT103.

Let’s say you have a Bank with a not connected BIC that is itself serving another small bank. Then the not connected BIC Bank will play the role of an intermediary institution. The funds will first move from the live BIC to the not connected BIC and then from the not connected BIC to the small bank.

Another case is a bankgroup where the SWIFT communication is centralized with the main office for example. Sending banks send funds to the main office with MT103A and MT202COV and the main office forwards the funds to subsidiaries and subsidiaires to branches.

I hope your main question is addressed. Hear you soon.

Hi Jean

I am a consultant in payment domain with one of the IT companies. I have a few questions for your inputs

1. In SSI sometimes you have more than 2 parties (Ie, Owner BIC, Intermediary1, Intermediary2 and Receiver correspondent).

In above case if i have taken this route to send a MT103 with cover payment. Obviously i will send 202cov to my correspondent. But what is the market practise for sending mt103, is it send to Intermediary 2 or Owner bic (beneficiary customer’s bank)

2. For example If there are multiple SSI records for a bank for a currency and one is preferred but the sender itself is in one of the parties (Either intermediary or correspondent) in a non preferred route. Is it not obvious to send the payment through the other route

Case 1.

Santander – beneficiary bank

HSBC – Intermediary

Chase – Correspondent

Above is preferred

Santander – beneficiary bank

HSBC – Intermediary

BNY – Correspondent

Santander – beneficiary bank

BNY – Intermediary

Meryll lynch – Correspondent

Incase if BNY is the sender which is the route it has to consider to send the payment (though it is quite theoretical)

2. Will there be cases where sender doesnt maintain a RMA authorisation with its correspondent for mt103.

I mean if we are going to validate RMA during payment creation itself in a backend application (not swift rma application) is it right to validate with AWI only incase of cover payments.

Hi Prudhvi,

Thank you for your comment and questions. Sorry for taking a long time to respond.

For my readers, I want to first say few things: SSI stands for Standing Settlement Instructions.

SSI information is sent by a party 1) to inform other parties how to send him funds in specific currencies or 2) to inform other parties how to send funds to another party. In the SSI, you usually find the correspondent of the receiver (the beneficiary) and potentially intermediary 1 and Intermediary 2. In short, If you want to send USD to Deutsche Bank, SSI tells you which bank in the USA is the correspondent of Deutsche Bank and if you need to go through intermediaries to reach that bank. Feel free to add other information. I will write specific articles about SSI. Now back to your questions.

Q: What is the market practice for sending mt103, is it send to Intermediary 2 or Owner bic (beneficiary customer’s bank) ?

A: It depends on one important thing in Cross border payments: Account relationship. If the sender has account relationship with the beneficiary customer’s bank, he will send the Cover directly to that bank. If not, he sends it to the intermediary that will forward the funds to the beneficiary customer’s bank. But then he must have an account relationship with the intermediary. At the end of the day, funds must reach the destination. If you mention INT1, INT2 in the SSI. It is not mandatory to use them. If I find another path using directly the account with institution or using only INT2 and the account with Institution, it is fine. The main thing is that the funds get to the destination.

Q: For example If there are multiple SSI records for a bank for a currency and one is preferred but the sender itself is in one of the parties (Either intermediary or correspondent) in a non preferred route. Is it not obvious to send the payment through the other route.

A: When multiple SSI records are available, the receiver is giving you options. You may choose the one or the other. Routing algorithms are complex in Xborder payments and many parameters must be considered. But one principle is: as sender take the shortest path for you. It is totally fine if you do not take the preferred route. If you do not take the preferred route and the beneficiary gets the funds even faster, he will not complain. 😊

Q: Case1 – Incase if BNY is the sender which is the route it has to consider to send the payment (though it is quite theoretical)

A: Below is the path to be taken clearly. It is much shorter than the preferred route. The funds will reach the beneficiary faster. The way to make the beneficiary happy is to take this one. 😊

Santander – beneficiary bank

HSBC – Intermediary

BNY – Correspondent

Q: Will there be cases where sender doesnt maintain a RMA authorization with its correspondent for mt103.

A: As far as I know, in this context, RMA is a must and the sender must set up RMA with the receiver first.

I hope this clarifies. Let me know if you have additional questions.

Please tell me more about AWI. I do not know what it is.

Hi Jean,

Appreciate your help,

With respect to your answer for sending mt103 with cover,

If sender (remitter’s bank) has direct relationship with beneficiary’s bank, will there be a case where cover is also sent. Usually in those cases only mt103 will suffice.

Incase of an intermediary between receiver correspondent and beneficiary’s bank and if the payment is sent in a cover mode. What should be the receiver in the header of mt103 is it intermediary’s bic or beneficiary’s bank bic. As per my understanding from the examples given in standards intermediary will be receiving mt103 and awaits cover from its correspondent and subsequently forwards the mt103 or a credit notification to beneficiary bank on successful credit of beneficiary banks account.

Usually 202 cov flow will stop at 54a or 55a, then last reimbursing bank will send a 910 notification to intermediary (if there is one) In this case if mt103 is directly sent to beneficiary bank somewhere it is not making sense on how intermediary will do the accounting only with a credit notification sent.

*AWI is just ‘account with institution’ I am referring to.

Hope I am not burdening with seemingly repetitive questions

Thanks

Prudhvi

Hi Jean

Hope to find you bit free to answer

This is regarding Tag 72 in MT202 Cov. Can the bank copy the details captured in mt103 to MT202 Cov, as in most of the cases mt202 cov is automatically generated when application is sending mt103 in cover mode and all the details of mt202 cov are derived from mt103.

Will there be any case where bank has to capture different details in mt202 cov and mt103 in tag 72

Hi Prudhvi,

I have been very busy these days.

The answer to your question is Yes. If we consider the specifications of MT202 COV, the field 72 is present in the Sequence B Underlying Customer Credit Transfer Details.

In the sequence B, only ordering and beneficiary customer informations (Files 50a and 59a) are mandatory. Other fields are optional. So the bank may provide them or not. But in case the bank provides any of them (the field 72 for example), then it must be the exact match of the field present in the MT103 Announcement. In case of mismatch, some banks reject the covers.

To your question: Will there be any case where bank has to capture different details in mt202 cov and mt103 in tag 72? The answer is NO. Either the bank puts the same 72 in the MT202 COV as in the MT103 or it leaves the field empty. I am talking about the Sequence B. In the sequence A of the 202 COV, you have a field 72 where specific sender to receiver information related to the Cover can be put.

I hope this helps. If you have further questions, please let me know.

Best regards, Jean Paul

Hello Mr Jean Paul

I have a question my company want to have an investment business with anther company / ( bank ) but the bank insist that before they can transfer funds to us ( mt103 ) transfer we our beneficiary ban must establish RMA with his sending bank. Can you explain to me why this is it necessary for our beneficiary bank to establish RMA with the sending bank ? And also can you explain to me how cover payment will be executed in this scenario because they want to do mt103 not mt103/202 COV. Is it possible without 202 COV? I will appreciate your help so much.

THANK YOU

Hi Jean Paul,

Thanks for this information. I would like to ask you about the second example that was provided by Mat. Can the Sender and Receiver be the same bank (to your example is JPM CHASE NY as only one correspondent bank) both for Serial and Cov Payment? I have seen examples from other source that there is no sender and receiver as two separate banks.

Hi Jean Paul, what is the industry norm where the cover amount received on the MT202cov is less than the amount on the MT103. Possibly where an intermediary bank used may have deducted charges. Is there a standard or rule regarding this scenario? If so can you refer me to that standard. Thank you

Hi Linda, As far as I know, you cannot receive a MT202 COV where the amount is lower than in the MT103 announcement.

In fact, it is forbidden to take any charges from the MT202COV. If a correspondent needs to take charges, they will ask the sending bank to pay through MT191 or they will debit their account directly depending on the agreement they have. I hope this helps.

Sir what are pacs004,pacs009,pacs008 messages are they same as my 103,202 messages

Sir if a bank receives a fund in mt103 and bank failed to apply and want to return ,so what is the best way to return the fund

Hi Jean Paul thank you appreciate your response. That is my understanding, thank you for confirming it

Do MT202 COV and MT205COV get generated for Local Country Payments ?

If I am sending USD to US based bank from a Canadian Institution should I be sending this as a MT103 serial or a MT103 direct with MT202COV?

Example

ABC company wants to pay DEF company that holds their account with Citibank NY (for USD my bank holds their USD account with Wells Fargo) would the payment be sent as MT103 serial i.e. account with Citibank NY, intermediary Wells Fargo NY OR should I be sending MT103 direct to Citibank NY, and send a MT202 cov to Wells Fargo credit Citibank NY?

Hello,

We Offer SWIFT MT760 (BG/SBLC) MT799 Block Fund, MT103, BANK DRAFT, BCL, LC, MTN, DTC, MT103 Cash transfer /Collateral, EUROCLEAR and Telegraphic Transfer (TT).

N/B : Provider s Bank move first.

Contact me if you are in need of the above mentioned.

Thanks,

Name: Paul Harrison

Email: paulharrison809@gmail.com