Documentary collection is one of the common payment techniques used in international trade to facilitate import/export operations. In this post, we provide the definition of a documentary collection, present the key players and the related process steps.

Before starting our analysis, take note of this interesting remark: documentary collection belongs to payment techniques that require banks involvement. Banks are key players in the process as we will see later.

The previous payment techniques that we considered, payment against invoice and cash on delivery, can be performed without intervention of any banks. That is why they are less expensive and more risky. The documentary collection is more secure than these two payment techniques, but it is not the most secure payment technique.

What is a documentary collection?

A documentary collection is a trade transaction in which the seller (or exporter) instructs his bank to forward documents related to the export of goods to a buyer’s bank with a request to present these documents to the buyer (or importer) for payment, indicating when and on what conditions these documents can be released to the buyer. In the process, the exporter hands over the task of collecting payment for goods supplied to his bank.

The exporter or seller is the originator of the documentary collection. He entrusts to his bank the commercial documents that represent the goods along with the instructions relating to the modalities of delivery of these documents to the importer. The documents may or may not be accompanied by a bill of exchange to be accepted by the importer.

When we talk about documentary collection, it is the processing of documents by the banks according to the instructions received. This is not as one might think of the evocation of the word cashing, a payment or a payment advance by a bank.

The documentary collection can take two forms:

-

Documents against payment (D / P) also known as Sight Draft or Cash against Documents (CAD): The bank releases the documents to the importer only after immediate payment. This type of documentary collection is safe for the exporter but if the buyer refuses documents and merchandise, he has little recourse and can not do much.

-

Documents against acceptance (D / A): The bank releases the documents to the importer only after he accepts one or more bills of exchange, promising to pay for the goods at a future date.

The documentary collection is less secure than the documentary credit (that will be examined later). The exporter’s bank does not commit to pay the amount due (in particular when the importer takes possession of the goods after acceptance of a commercial paper) and the exporter bears the consequences in case of default. The Bank is therefore only the agent of its client, the exporter, who remains responsible for the debt.

Main actors involved in the documentary collection

The documentary collection involves four main actors in its simplest model : The exporter and his bank on one side and the importer and his bank on the other side. This certainly reminds you the Four Corner Model and we see that it is also a great tool to analyze payment techniques. The exporter’s bank is also called remitting bank. The importer’s bank is also called presenting or collecting bank.

The exporter

It is the originator of the documentary collection. He originates the process through his bank to which he gives the documents and a letter of instructions stating under which conditions the importer will take possession of them.

The exporter’s bank

It is the remitting bank because it is in charge of transmitting the documents received from her client to the presenting / collecting bank.

[box type=”note” size=”large” style=”rounded”]The Remitting bank is the bank that, in a documentary collection, forwards a seller’s shipping documents to the presenting / collecting bank and receives the payment from the collecting bank on behalf of the seller. It is called remitting bank primarily because it remits the documents (habitually through national or international shipping and courier delivery services).[/box]

The importer’s bank

The presenting / collecting bank is responsible for presenting the shipping documents and collecting the funds from its client, the importer. This bank is usually the correspondent of the exporter’s bank in the country of the importer.

[box type=”note” size=”large” style=”rounded”]The presenting / collecting bank is the bank that, in a documentary collection, presents the documents received from the remitting bank to the buyer and collects the payment from him. It is called collecting bank primarily because it collects the funds.[/box]

The importer

It is the buyer of the goods shipped. He pays the invoice amount or signs a bill of exchange. In exchange, his bank gives him the documents that will allow him to clear and take possession of the goods.

How the documentary collection works

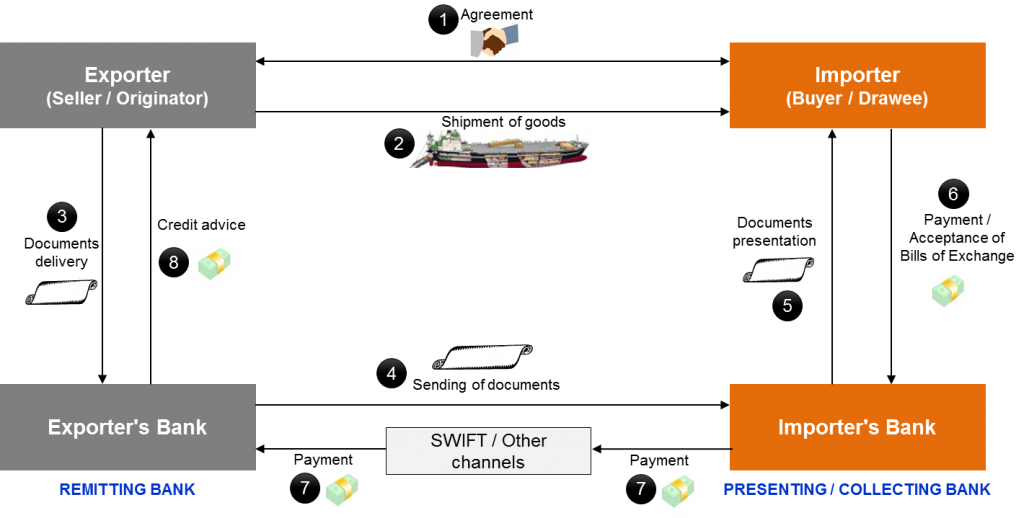

The following figure depicts the main process steps of a documentary collection, from the agreement between exporter and importer until the exporter receives the payment for the goods shipped.

We will now detail one by one the different steps of a documentary collection.

1. The agreement between the exporter and the importer

This step is very important for the success of the whole operation. It is in the contract where the two parties agree the terms of the transaction: the goods, transport and shipping, delivery times, documents to be provided by the buyer, the payment technique (in this case the documentary collection), the payment instrument, what to do in the event of litigation (Non payment, problems with the merchandise, etc.).

It is strongly recommended for inexperienced ones to look for the support of professionals of international trade. Even if forms exist, it is not always easy to fill them out and the omission of an important point can put the whole operation in question. The exporters should get in touch with his bank during this phase and not after the signing of the agreement. Banks can provide them valuable advice in legal, logistical and financial terms for the smooth execution of the transaction.

2. Shipment of goods

The exporter ships the goods as agreed in the contract. He receives from the carrier documents proving the take-over and shipping.

Several types of goods can be distringuished:

-

consumer goods that may or may not be perishable

-

goods that can be incorporated into another that will be used for the manufacture of another product.

-

industrial machinery

-

asn.

The type of merchandise influences shipping conditions and times. In addition, it is important to clarify the responsibilities between the parties. This prompted the International Chamber of Commerce to create the Incoterms (International Commercial Terms) in 1936. These are international rules that facilitate communication and the distribution of roles and responsibilities between the parties involved in the transaction.

3. Delivery of documents

Once the goods have been dispatched, the exporter collects all the documents mentioned in the contract and hands them over to his bank with a letter of instructions. The documents that make up the documentary collection are called shipping documents. There are among others:

-

commercial documents: invoice, packing list, certificate of origin, etc.

-

technical documents: certificates of analysis, sanitary or phytosanitary issued by public authorities; certificate of control and surveillance issued by specialized companies (Bureau Veritas, SGS, Intertek, LLoyds, etc.).

-

transport documents: bill of lading (B/L or BoL), AirWay Bill (AWB), SeaWay Bill (SWB) …

-

financial documents: commercial paper and other instruments used to obtain the payment of a sum of money.

All documents in the instruction letter must be given to the bank. Otherwise, it may refuse to be in charge of the payment collection.

4. Sending of documents

After receiving the documents, the remitting bank verifies that they correspond to those listed in the instruction letter. Note that the bank is not responsible for verifying the documents’ authenticity, even if it can report any defect or problem detected. In the case of a missing document, it must notify its client, the exporter.

If the documents are complete, then the bank sends them to its correspondent in the country of the buyer by simple, fast or express mail (UPS, DHL) according to the instructions given by the customer. For simplicity, we have assumed that the correspondent of the remitting bank is the importer’s bank. It should be noted that this is not always the case.

5. Presentation of documents

The importer’s bank notifies his client upon receipt of the documents. It does not give him the documents, but tells him what he must do, so that they can be released to him: immediate payment or acceptance of a bill of exchange.

6. Payment / Acceptance of Bills of Exchange

In accordance with the instruction letter and the agreement concluded, the client can:

-

either pay the invoice and any commissions from his bank to take possession of the documents. For this, he uses a payment instrument such as a credit transfer or a check with its variants (certified check, bank check). A foreign exchange transaction is often required to obtain foreign currencies such as the dollar or the Euro.

-

or accept the bill of exchange(s) transmitted with the documents. In this case, the payment will be collected at a later date. It is quite rare to draw sight bills in international trade.

7. Payment

This is the settlement of the documentary collection. The payment must be done with an instrument of payment (To know the difference between technique and instrument of payment, read this article ). The importer’s bank sends the funds collected from its client to the remitting bank in the vast majority of cases via the SWIFT network (MT202 or MT400).

An important remark must be made here: the fact that the importer has paid does not guarantee that his bank will pay the remitting bank immediately. Sometimes getting the necessary foreign currency for the interbank settlement can be quite complicated and add extra time.

8. Credit Advice

The exporter’s bank receives the funds and credits his client’s account. Then, it sends him a credit notice to inform him of the availability of funds on his account.

SWIFT Messages exchanged for a documentary collection

The SWIFT category 4 messages (part 1) are used for documentary collections. We presented and examined each of them in a previous article entitled Collecting Bank and Remitting Bank in SWIFT Category 4 Messages. I refer you to that article to read and learn more about this interesting topic.

To summarize, let’s look at the main advantages and drawbacks of this payment technique.

Advantages and drawbacks in using a documentary collection

A documentary collection presents three main advantages:

- It is simple and easy to handle administratively compared to letters of credit.

- The exporter can retain title to the goods until payment or acceptance is made.

- It allows to collect the payment faster than with open account terms (when a bill of exchange is not required).

There are drawbacks in using a documentary collection, particularly for the exporter (seller).

If the importer (buyer) refuses or is unable to pay, the seller has three options and they can be painful and very costly:

- Option 1: Find another buyer.

- Option 2: Pay for return transportation

- Option 3: Abandon the merchandise.

The documentary collection is pretty risky for the exporter. But there is a solution to better secure the payment for both exporter and importer. It is called the documentary credit and will be the topic of the next article.

Hi ,

I like your detailed knowledge on the payment system . Mind blowing!

Can you please suggest how can I get more info on SWIFT MX XML Validation understanding?

Thanks in anticipation

Hi, The SWIFT MX validation is based on the ISO 20022 standard. My suggestion is that you read the ISO 20022 Message Definition Report of the message(s) you are considering. They contain precious information about the content and the validation of messages. These documents can be downloaded for free from the ISO 20022 Website. If you have any problem finding them, just tell me which messages you are interested in and I will share the link to the MDR when possible.

Hi Jean,

what is the difference between MT and MX mesages and in which sitauation which message is used

SWIFT MT is based on the standard ISO 15022 MT which relates on flat files and tags. SWIFT MX is based on the standard ISO 20022 which relates on XML files and messages elements. The latest standard ISO 20022 is very rich and allows to carry a lot of information in the messages. SWIFT MT is going to be replaced by SWIFT MX in the coming years. In terms of usage, both standards can be used in the same situations. For almost each MT message, you have a corresponding MX message.

Hi Jean, i want to know when the collecting bank sends the MT400 message? is it at the date agreed upon or there is any communication from the remitting bank to say that the u send the payment now?

Hi Prasad,

To get the answer to your question, I refer you to this article. In case, you have further questions, reach out!

Hi Jean,

look I have an issue with my supplier.

I have issued a Purchase order and the payment term is Cash against shipping documents and the problem is that the goods have arrived at the port like 7 days ago and the documents not yet.

my worry is the delayed will make me pay demurrages and so on.

how can I pass this cost into his account as he is responsible for such delaying .

Thanks

can documentary collection improve the cash flow?