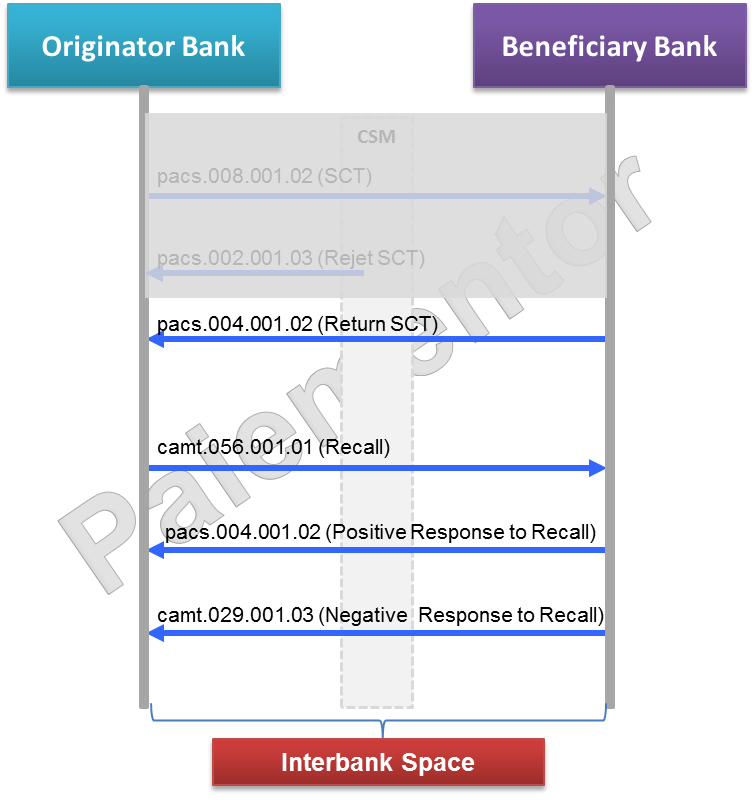

In this article, we continued our analysis of the SCT interbank messages. The previous article was about the pacs.008 and pacs.002 messages. The pacs.008 is used to transfer funds from Originator Bank to Beneficiary Bank. The pacs.002 is initiated to reject credit transfers that a CSM or Bank cannot process. As said in the previous article, one message (pacs.008) is used to move the money, but many messages are needed to handle the exceptions. Therefore the pacs.004, camt.056 and camt.029 are all exception handling messages. Let’s consider them now.

Pacs.004.001.02 (Return SCT)

The Payment Return message is used to undo a payment previously settled. When a bank receives a pacs.008, it should process it and books the money to the beneficiary account. But what if the beneficiary closed his account two days ago? What if the account does not exist at all in the Bank? In those cases, the bank will not be able to credit the account. According to the SEPA rules, the beneficiary bank must return the money to the originator Bank. Besides the reasons mentioned above, there are numerous reasons why a bank might have to return the money. In any case, it will use the pacs.004 message to do that. The return has its own settlement date, the date at which the money will be paid back to the originator bank. The reason for returning the funds is indicated by a code in the return message.

A bank can only return the money that it has previously received. So the payment return message is initiated and sent after settlement. The SEPA rules oblige the Beneficiary Bank to send the Return message to the Originator Bank at the latest three Banking Business Days after Settlement Date. The underlying principle is that money should be return as soon as possible to the originator.

Camt.056.001.01 (Recall SCT)

The Debtor Bank makes use of the recall message to submit cancellation requests to the Beneficiary bank. But why would a Debtor bank want to cancel a previously sent credit transfer (pacs.008)? Several reasons exist. The credit transfer can be sent two times because of a human error for instance. Or a technical error may cause the sending of erroneous pacs.008 messages. In both cases, the debtor will try to get his money back by sending a cancellation request. Please notice that a cancellation request message does not move money. It is not a booking message and therefore there is no settlement date in the camt.056 message.

According to the SEPA rules, the originator bank can send the cancellation request up to 10 days after the settlement of the credit transfer message. After reception of the request, the beneficiary bank has two choices: to accept or to refuse.

Remark: In the 2017 SCT Rulebook, the Request for Recall by the Originator was introduced and will enter into force as of 18 November 2018. It allows the debtor under certain conditions to claim the funds reimbursement of a settled credit transfer up to 13 months after settlement.

Pacs.004.001.02 (Positive Response to Recall)

The positive response to a recall is sent by the beneficiary Bank, when it responds favorably to the request of the originator bank to cancel the original payment. The name of this message is familiar to us. We saw before that the Payment Return message, which is used by the beneficiary bank to return funds when they cannot be credited to the beneficiary account, is also a pacs.004. The positive response to a cancellation request is a payment return. But in this case the return is not made because the money cannot be credited. The funds are returned because the originator bank has requested to have them back. The beneficiary account has been credited and it has to be debited in order to give the funds back. In most countries, the law obliges beneficiary banks to explicitly get the consent of their clients before returning the funds. The bank must get the customer approval before returning the funds and that may take few days.

The positive response message is a return message with the particular reason code FOCR (Following Cancellation Request). A reason code indicates why the beneficiary bank returns the funds. For a positive response to a cancellation request, the only reason code allowed is FOCR. If there is another reason code in the pacs.004, it is considered a normal return, not a positive response to a cancellation request.

According to the SEPA rulebook, the beneficiary bank can send the positive response to a cancellation request up to 10 business days after the reception of the cancellation request message.

Camt.029.001.03 (Negative Response to Recall / Resolution of Investigation)

The negative response to a recall is sent by the beneficiary Bank, when it responds unfavorably to the demand of the originator bank to cancel the original payment. The negative response, also called resolution of investigation, informs the debtor bank that his request has been rejected and therefore it will not get the money back.

The camt.029 is not a booking message. It means that there is no movement of funds associated with it. It just gives the information that the beneficiary bank or the beneficiary refuses to give the money back.

According to the SEPA Business rules, the beneficiary bank can send the negative response to a cancellation request up to 10 business days after the reception of the cancellation request message.

For your information, I have published an ebook about SEPA Credit Transfer where one full chapter is dedicated to SEPA Credit Transfer messages. It is available in the sample that you can download here. If after reading it you are interested in the rest of the book, you can purchase the full version. Here is the link to download the sample of the SEPA Credit Transfer eBook.

Can bank process an incoming PACS004 message with different amount or with different UTR number from the original PACS008 or PACS009 message .

This seems to be a test case, But ,is there any implications or regulatory document for these kindly of questions.

I am not sure to understand the question. Do you mean an incoming pacs.004 where the amount is different from the one present in the original pacs.008 or where the transaction reference of the pacs.008 was altered?

Yes, you got it right.

If any alteration is there is PACS004 , Should bank process this transaction or how should we go abt it?

pls suggest.

Hi Vamsi, you are certainly talking about an incoming Pacs.004. When the bank receives it, the money will be credited on its account since the CSM processes and forwards it. Let’s say you receive it and there are issues when processing it, then you have to put the money somewhere anyway. You cannot return a pacs.004. So a manual process will be required here to send the money back (these are very rare cases so OK with manual process). I will answer to François too.

Hi Vamsi,

On a previous project, I had to design a R-transaction process.

The R-transaction is processed by the bank

as long as the OriginalEndToEndIdentification (PACS.004 Index 3.7 match with the PACS.008 EndToEndIdentification.

The rest of R-Transaction information is not used.

Regards,

François.

Hi Francois,

So, R-transaction will be processed only if PACS.004 message is matching with corresponding PACS.008 message , But here , What would happen to PACS.004 message which is altered (manually/Technically) ,

How should system behave, Whether system should accept payment like PACS.009 message or Message should be failed at CBS(Core Banking System).

Since u have mentioned return would not occur in case of mismatch.

Even if the incoming Pacs.004 does not match for any reason, you have to process it anyway (See a previous comment). I am talking about the incoming pacs.004 of course. For outgoing, no need to send it. Very easy. But when you receive an incoming pacs.004, you receives money. So you have to do something with it. I hope this clarifies.

Thanks a lot Jean Paul for clarification.

Hi Both,

François is right with the principle but I think it is another field that is used.

The message element used for reconciliation by banks is OriginalTransactionIdentification. OriginalEndToEndIdentification is used by corporations.

How Debtor notified ? when Debtor bank get resposne for Camt056 as Pacs004 or Camt029.

Is it Pain002 or Camt054 in Pacs004 and Camt029

Hi,

is it possible to send another CAMT.056 about same payment after I received CAMT.029?

Thanks,

Davide

Hi,

I would say it depends on your payment engine. But the answer according to the rulebook is NO, because the process ends when the negative answer is received.

Payments software engines usually do not allow to initiate a recall a second time after a negative response. I hope this helps.

but wouldnt it be able to send another camt.056 ?

case:

1st camt056 by Bank — negative answer camt.029

2nd camt056 by RFRO- postive answer pacs.004

both for same incoming pacs.008

Hi David,

Interesting case. According to the current rulebook, I would say this possibility should not be ruled out.

If I receive two camt.056 on the same pacs.008, it means a mistake was made on the debtor bank side. That can of course happen and I think processes should be designed accordingly.

When I wrote this article, only camt.056 by Bank was available. 🙂

Hi Jean Paul, thx for your answer.

I can confirm now that this is possible.

We received two camt.056 for same pacs008. If first one is answered negatively the second can still be answered positive.

Cheers

Hi David, thanks for sharing the information.

Hi,

I want to understand how to map a incoming CAMT 029 message to already processed PACS 08 & CAMT 056 messages?

What I changes are required to make in CAMT 029 with regards to PACS 08 & CAMT 056?

Please suggest.

BR,

Jayant

Hi Jayant, Thank you for yoru interest.

In the camt.029, you have fields like Original Transaction Identification, Original End To End Identification and others that contain information present in the pacs.008 and camt.056 (the camt.056 has the same). They can be used to map a incoming CAMT 029 message to already processed PACS 08 & CAMT 056 messages. Read the SEPA implementations guidelines and look for fields in the camt.029 whose names begin with Original. 🙂 I hope this helps.

Excellent post.

Hello Jean,

what if camt.056 fails schema validations or content validation? Can we send the CAMT.056 failure via pacs.002 or it has to be camt.029 always.

I am talking about cancellation message flow is, OriginatorFI1 -> FI2 – > CSM -> Benebank->Bene. For example if camt.056 fails at FI2, what FI2 should return to FI1 camt.029 or pacs.002.

Hi Robby,

You are asking a very interesting question. According to the rulebooks, only the beneficiary bank can send a reply to the actual camt.056 request, so a pacs.004 for positive response or a camt.029 for negative response. The intermediary financial institutions solely check the correctness (technical and functional) of the camt.056. They are not allowed to send a reply to the request. So the answer to your question is FI2 should return pacs.002 to FI1.

Kind regards,

Jean Paul

Thank you so much Jean. It helped.

Hello. How, then, the initiator of the camt.056 FI To FI Payment Cancellation Request know that the message was rejected at some intermediate point without reaching the recipient of the message?

thanks

Why can’t they use PACs.008 instead of PACs.004? What is the advantage of PACs.004 that you can’t achieve using PACs.008? Can’t the fields in PACs.008 be used instead of introducing the new payment workflow unnecessarily? Perhaps this more of a CSM question. Any advise and clarification is much appreciated

Hi Peter,

That is how the standard ISO 20022 and I would say, payments messages standards in general, work. Each message is used for a specific purpose. The pacs.004 is used to return the funds sent with a pacs.008. You have additional fields in the pacs.004 particularly the return reason code that you don’t have in the pacs.008. Furthermore, with that logic (I am pushing further), we would have one single message for every possible situations. That would probably make the things much more complicated than necessay I think. Using different messages enhances the communication and makes the processing easy.

Considering that the CAMT.056 and CAMT.029 have no fund movements associated to them, in the case that a received CAMT.056 is answered using a CAMT.029, is it possible to later on send a PACS.004 (as a payment return and not as a Affirmative Answer to a Recall) related to a credit transaction which was requested for recall in the already answered CAMT.056?

Hi,

The rulebook does not say: “in case you have already sent a negative response, you cannot send positive one or you cannot return the funds”

So the answer is YES. A pacs.004 return can be sent provided you are still in the allowed timeframe.

In many payment engines I have seen, you can still send the pacs.004 FOCR even if the camt.029 was sent before.

Hello, what happens if a pacs.008 is returned as pacs.004 but the debtor´s bank account has been closed in the meanwhile? Does the same rule as for the pacs.008 apply, namely that it will be returned with another pacs.004?

Hi Guiliano,

The answer is NO. The scheme does not allow to return a pacs.004 with another Pacs.004. In case the Debtor’s account has been closed, the debtor bank keeps the funds anyway and should try to find another way to credit the customer, for example by sending the funds to his new account.

How the PACS.004 will be processed against already processed PACS.004 which was rejected by EKS STEP2?

Can you tell me what changes we need to do in 1st PACS.004 so it will be rejected by EKS STEP2

Hi,

A pacs.004 is not rejected with a pacs.004 but with a pacs.002, a payment status report.

Hi Jean,

I am trying to debulk RSF file for Instant SEPA for reconciliation purpose. I need to identify whether PACS004 (return payment) encapsulated in PACS002 structure within RSF is inbound or outbound. Can you tell me how can i do that ? I am aware that debtor BIC and creditor BIC can help me understand direction of payment but not sure in case of PACS004 whether debtor and creditor BICs are swapped ? I mean my ask is what field in RSF PACS002 structure will tell me whether PACS004 is inbound or outbound for my bank. Thanks in advance.

I would refer to the BAH: Business Application header to understand if the PACS is incoming or outgoing.

The Business Application Header is a header that has been defined by the ISO 20022 community, that can form part of an ISO 20022 business message. It gathers together, in one place, data about the message, such as which organisation has sent the business message, which organisation should be receiving it, the identity of the message itself, a reference for the message and so on.

Hi Jean,

During return of CT in pacs004, how de calculate amount when charges are included ? OrgnlIntrBkSttlmAmt, Chrgs, RtrdIntrBkSttlmAmt. Please provide the tags with sample amount. Do add if I missed any other Amt tags

Thanks

Hi Thavasi,

In the normal return of SCT, no charges can be taken. For the return as positive answer to a Recall (ie, Reason Code is ‘FOCR’), the Returned Interbank Settlement Amount

is equal to the ‘Original Interbank Settlement Amount’ less the ‘Amount’ under ‘Charges Information’.

BR, Jean Paul

Hi Paul,

What will happen if bene bank respond to a CAMT056 request 10 days after the settlement of PACS008 ?

Hi San, in the new SEPA Rulebook, it reads : “The Beneficiary Bank must provide the Originator Bank with an answer to a Recall within 15 Banking Business Days following the receipt of the Recall from the Originator Bank.” So it is 15 Business days now. A response after 15 days is too late and the CSM might reject the transaction. But in general, CSM do not enforce this rule and let the transaction go through to the debtor bank.

Sir if we have a sender’s correspondent ,can we send pacs004 to the correspondent,or do we need to send the pacs004 to the sending bank

Hello, Great work!

May i know why we dont have a rsf file for SEPA CT?

Hi Raaj, sorry for responding so late. What does RSF stand for? Could you please elaborate?

Result of settlement file.

May i know whether we can recall a Cancellation message? or cancellation for a notice to receive message?

Hello,

Does the ebook already talk about Direct Debits? Or is it solely on Credit Transferts?

Thanks much! Good day

Hi Benjamin,

thanks for connecting. The ebook is about Credit Transfers. But it does contain many concepts applicable to both credit transfers and direct debits that can be beneficial to you as well. There is a 30-day money back guarantee if you buy the ebook from my website. So there is no risk for you.

In case you need additional information, let me know. Thanks.

Hi Jean,

Little off the topic question but maybe you have an answer..

In the following SEPA rule, just one transaction is allowed within the group header of FITo FICustomerCredit TransferV02.

SEPA Usage Rule(s) : The number of transactions is limited to one.

ISO Name : Number Of Transactions

ISO Definition : Number of individual transactions contained in the message.

XML Tag : NbOfTxs

Type : Max15NumericText

Pattern : [0-9]{1,15}

In regards to other clearing houses than sepa ones, how many individual transactions a message could contain? other clearing houses like: Target2, CHAPS etc?

Thanks

Hi Deepak,

You are probably referring to the SCT inst interbank specifications. In the classic SCT, the number of transactions is not limited to one.

For the CSM, Clearing houses exchanging MT messages stick to the SWIFT rules. Other CSM generally accept batch files which contain multiple transactions.

I hope this helps.

Hi Jean,

What will happen if there was a fat finger error while sending pacs.004? Below is the example:

1. Originator sends EUR 40000 to Beneficiary using pacs.008

2. Originator sends a recall of EUR 40000 using camt.056

3. Beneficiary agrees to refund using pacs.004 but due to “fat finger” error by Operations, sends only EUR 4000 instead of EUR 40000

4. Can the Beneficiary send another pacs.004 to refund remaining EUR 36000?

Regards,

Rushikesh

Hi, according to the SEPA Rules, fees can be taken when responding to the recall positively.

Of course, It should be fair.

In general, the end user specifies only the fees and they are automatically taken from the amount.

I have personnaly never seen the case where the interbank settlement amoount is input the end user.

SEPA Scheme does not allow to send two positives responses for the same recall.

In case of the problem you describe, the payment engine might consider that the response was already given and not allowed to respond again.

The debtor bank would probabley contact the beneficiary bank to clear the situation.

Is PACS009 applicable in SCT OR SDD Space ? Is it the case that PACS009 is only applicable for High value payments – The reason i am asking is i never see pacs009 mentioned for low value payment schemes like Sepa or ACSS ( In canada) ,but i always see the pacs009 usage guideline mentioned for RTGS schemes like TARGET2 OR LVTS (in canada).

Is it always the case that PACS009 comes into picture only for rtgs or high value payment schemes ?

Hi Jean,

on pacs.004, do the roles of parties get swapped i.e. debtor on pacs.008 becomes creditor on pacs.004?

Many thanks,

-Ravi

Hello Sir ,

Do you have any book on SEPA Direct Debits ? if yes, then please help to provide the name/link to buy.

Hello ,

First of all ,very nice and helpful site !

I would like to ask if it is possible to send a camt.056 for pac.004 ? The case is : Recieved PAC 008 -> Returned payment Pac004 by mistake -> camt.056 to pac.004 was not succesfull . Any ideas how the pac 004 could be recalled?

Thank you ,

Regards

Hi Jean Paul, in SCT instant scheme, with the start of Target2 (TIPS), is it possible that a PACS.008 cleared on EBA (RT1) will be returned with a PACS.004 sent to TIPS ?

can Camt.056 also sent for onus transactions?

Hi Jean,

Is there a possiblity to revoke pacs.004 using camt.056 ?

Thank you.

No the scheme does not allow that. You cannot send a request for cancellation on a pacs.004.

Hello

How can we recall or cancel pacs004 send by mistake

How can we cancel or Revoke Pacs004

Hi Jean,

Hope you are doing well. II wanted to understand the use cases of answer to a recall instruction.

1. If bank gets debit authority from client , return message pacs.004 can be sent to originator.

2. If debit authority is not approved from client , camt.029 will be sent to originator.

Queries:

1. with in 15 days of getting recall instruction, No debit authority is received from client, but client has approved for debit after 15 days, then can we return the money to originator with a pacs.004 after SLA?

2.Does ST2 clearing has any check on SLA of pacs.004 received from beneficiary of pacs.008? Or after SLA also clearing forwards it to bene bank?

3. if with in SLA , debit authority is not received and bank has sent camt.029 already and after SLA clients provides approval to debit his/her account ,can pacs.004 be initiated again after camt.029?

4. Can a bank return fund by initiating a new pacs.008 in SEPA ? If yes, what all can be the cases?

In earlier thread it was stated by David that CAMT.056 initiated by RFRO. Could you please elaborate what does RFRO stands for and what is the actual business scenario in which RFRO will send the CAMT.056?

Hello,

What is the difference between :

CAMT.054 and PACS.04

I saw they are about the return payement but have you got more informations please ?

Thank

Hi jean,

Can you please tell is pacs004 that is return of funds is allowed in EBA guideline without a recall(camt56) in case of completed incoming pacs 008.

Like according to my understanding if a payment (incoming pacs 008)is completed then return (pacs 004)of payment is not possible unless a recall (camt56) is received