As we saw in a previous article, the SEPA Credit Transfer Rulebook obliges the scheme participants to exchange exception messages (the r-messages) during specific timeframes in the interbank space. The scheme does not say how many days before settlement a credit transfer can be forwarded to the clearing system. In the customer-to-bank space, the scheme does not mention any period during which payment orders must be sent to the originator bank. When can each message be exchanged in the customer-to-bank space or in the interbank space? This article will reply to this question by considering all the messages and what is commonly done in practice.

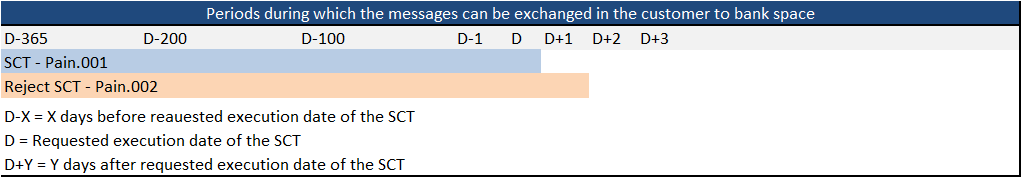

Periods during which the SCT messages can be exchanged in the customer-to-bank space

In the SCT customer-to-bank space, we have 2 messages: Pain.001 and Pain.002. Remember that the pain.001 is sent by corporate customers (or equivalent) to their banks and the pain.002 is received by them from their banks. The payment orders must reach the bank on time in order to be executed on the date requested by the customer. But how much time before? It is an agreement between the bank and the originator. The rulebook does not say anything about it. In practice, some banks accept to receive orders from their customers up to one year before the requested execution date. A payment order received before the requested execution date is just kept until the requested execution date, at which it is executed. In case, an order cannot be accepted because it is incomplete (missing or wrong information), the originator bank will reject it and must inform the originator. This is a legal requirement by the way. In general, the originator is informed immediately through a pain.002 message or other means as agreed between him and the bank. The reject message must be sent at the latest on the next day. The rulebook says: “ ‘Reject’ messages should be transmitted on a same day basis and must at the latest be transmitted on the next Banking Business Day.”

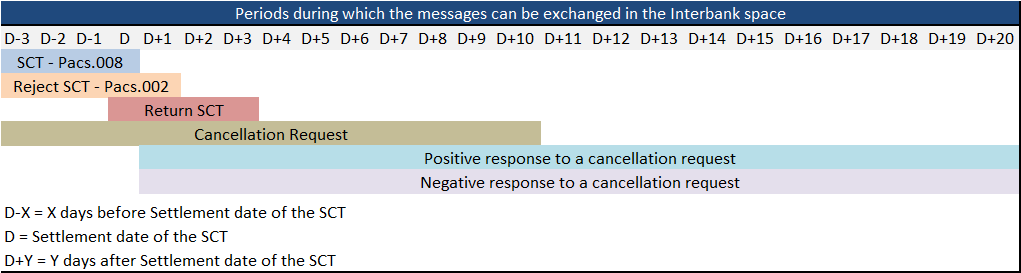

Periods during which the SCT messages can be exchanged in the interbank space

Now let us look at the periods during which the different types of messages can be exchanged in the interbank space. Those periods are visible in the diagram below where we have a timeline beginning at D-3 (3 business days before the settlement date) and ending at D+20 (20 business days after the settlement date).

You may wonder why we start at D-3. The reason is simple. Some ACHs allows the participants to transmit pacs.008 messages up to three business days in advance. The originator bank can therefore send the pacs.008 message for the Clearing and Settlement of SCT up to three days before settlement to the settlement date. In practice however, the pacs.008 message is forwarded to the CSM on settlement date or the day before. The reason is simple. The debtor bank executes the payment order and debits the customers before transmitting the message to the CSM. And it can debit the customer only on settlement date or the day before. It cannot debit the customer 2 or 3 days before. That would be against the rulebook which defines the SCT Maximum Execution Time to one banking business day: “Originator Banks are obliged to ensure that the amount of the Credit Transfer is credited to the account of the Beneficiary Bank within one Banking Business Day following the point in time of receipt of the Credit Transfer Instruction in accordance with the provisions of the Payment Services Directive.”

In case the CSM cannot process a message, it will send a reject SCT to the debtor bank. This is generally done in the seconds following the reception of the SCT messages even if the SEPA rules allow the CSM to reply at the latest one day after it got the SCT. A reject SCT can therefore be sent from three days before settlement to one day after requested settlement.

When the beneficiary bank receives an SCT that cannot be credited to the customer account, it can return the money immediately, but at the latest three business days after the settlement. So the return SCT can be initiated and transmitted from D settlement date (after receiving the SCT) up to D+3.

The cancellation request can be sent as soon as possible after the SCT was sent, but at the latest 10 business days after the settlement of the SCT. If a recall is sent before the settlement, i.e. between D-3 and D before settlement, the CSM can cancel the SCT at the reception of the cancellation. That is what the PEACH STEP2 does. It does not forward the credit transfer and the recall to the beneficiary bank. It just informs the debtor bank that the cancellation of the original transaction was successful. If the SCT has already been settled, the CSM cannot cancel it. It has to forward it to the beneficiary bank which will then take the decision to respond positively or negatively.

The positive and negative response to cancellation request must be sent by the beneficiary bank as soon as possible but at the latest ten business days after the reception of the cancellation request message. So if the beneficiary bank gets the recall message exactly ten days after the settlement of the SCT, it can reply ten days later, which makes 20 days after the settlement of the SCT.

For your information, I have published a book about SEPA Credit Transfer where one full chapter is dedicated to the messages exchanged in SEPA Credit Transfer Scheme.

Below are the links on amazon.

Kindle edition |

Paperback edition |

You can download the sample for free. Here is the link to download the sample of the SEPA Credit Transfer eBook.

You can buy the ebook and get a free access to a content rich webinar on this page.

After this brief presentation, it is now time to go through each message that appeared in SEPA Credit transfer EPC books and look at their meaning. In the next articles, we will first consider the messages used in the customer-to-bank space.

After receiving PACS.008, what’s the max allowed time window by which the creditor agent can credit the beneficiary account?

Thanks.

Hi,

According to the Payment Service Directive, funds must be made available to the beneficiary on the settlement day.

There is no float on for the beneficiary bank.

Hi Jean,

Can you please explain what is interbank space? and how pacs008 message can be rejected in the interbank space? and in which scenario pacss08 will be rejected via pacs002 ?