On-us transactions represent a significant part of transactions processed by banks. They can be classified in two groups: Intrabank and Intrabankgroup transactions.

The word Intra is a prefix meaning “within something, inside something, on the inside”. An intrabank transaction is a transaction exchanged inside or within the same bank. An intrabankgroup transaction is a transaction exchanged inside or within the same bankgroup. An intrabankgroup transaction can also be seen as an interbank transaction between two different banks of the same bankgroup. To avoid misunderstandings when using the term “on-us”, it is important to clarify if you are at bank level or at bankgroup level.

The exchange of on-us transactions does not require going through a CSM. They may go through a CSM, but it is not mandatory. This article is about on-us transactions at bank level. The next article will be about on-us transactions at bankgroup level. Transactions that do not fall under Intrabank and Intrabankgroup transactions are logically called “off-us transactions”. These transactions must be exchanged through a clearing system since the beneficiary bank is outside the bankgroup. There is no other option.

In the following paragraph, intrabank transactions will be discussed in detail.

Intrabank transactions

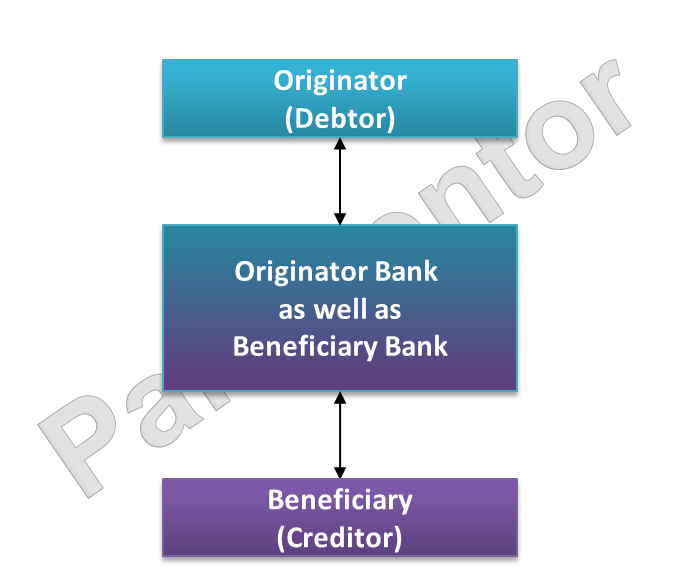

Intrabank transactions occur when the intermediary bank is the same on both sides of the credit transfer. Both debtor and beneficiary are customers of the same bank which holds both their accounts. Consequently the debtor bank the same as the creditor bank. And in this case, there is no clearing needed and the transaction is settled directly through an internal book transfer. The bank debits the originator account and credits the beneficiary account. These transactions can be executed much faster than the ones which have to go through the clearing and settlement process in a CSM.

Now, look at the model for the intrabank transfer. There is one big box in the center that represents the bank playing the role of both originator bank and beneficiary bank. In a way, this shows that the bank sends the transaction to itself. The originator and the beneficiary are connected to the big box since both are customers of the bank.

The bigger the bank, the larger the customer base and the higher the percentage of on-us transactions because the probability of having transactions between the bank customers increases. Some customers have multiple accounts (current accounts, saving accounts, etc) and need to move funds from one of their accounts to another. They initiate intrabank transactions for that purpose as well. As a matter of fact, the number of intrabank transactions between accounts of the same customer is much higher than between accounts of two different customers in a bank.

Intrabank transactions must be considered carefully in a payment project. Their settlement through an internal book transfer makes them really specific.

On-us transactions at bankgroup level bring other challenges. We will take a closer look at them in the next article.

Do we have any standard messages for Intrabank book transfers (ON-US) ?

Same standard messages are used for Intrabank book transfers. For the SCT, it is the standard ISO 20022.

Different standards for interbank and interbank transactions create many many problems on the long term.

What are the standard ISO 20022 messages exchanged in SEPA DD if it is On-us transaction?

[…] Intra Bank Payments […]