Before considering the differences between SEPA Direct Debit Core and SEPA Direct Debit B2B Schemes, it is worth reminding ourselves what a scheme is. The European Payments Council (EPC) defines a scheme as following: “A payment scheme is a set of rules which Payment Services Providers (PSPs) have agreed upon to execute transactions through a specific payment instrument (such as credit transfer, direct debit, card, etc).” EPC schemes are made up of three major elements:

- A rulebook – This document describes the rules that all parties must comply with to accept, process and exchange the SEPA payments.

- The Implementation Guidelines (IGs) – They provide the definition of the messages used to transport payment information and enable transactions. SEPA IGs are based on ISO 20022 standards.

- The Scheme Management Internal Rules (SMIRs) – This document explains the Scheme management roles and responsibilities and the processes related to the maintenance and evolution of the schemes.

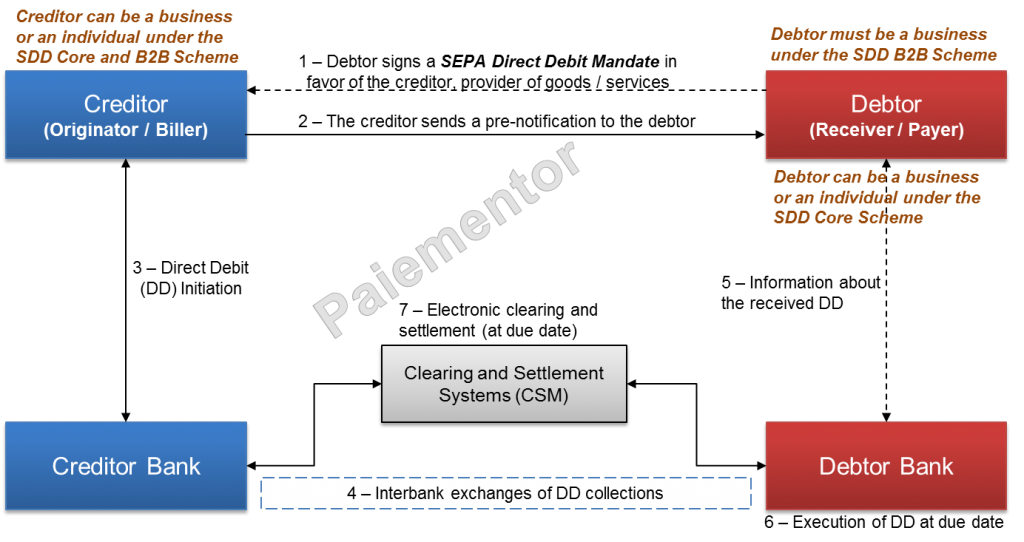

There are two SDD schemes: the Core Scheme and Business-to-Business (B2B) Scheme. The payment system model under which both operate is the well known Four Corner Model.

The table below provides a summary of the main differences between the SEPA Direct Debit Core and SEPA Direct Debit B2B Schemes.

| Areas of differences | SEPA Direct Debit Core Scheme | SEPA Direct Debit B2B Scheme |

| PSPs Participation | Mandatory – all PSPs must adhere | Optional – only the PSPs that choose to become members |

| Creditor | Business or individual | Usually Business, but it can be individual |

| Debtor | Business or individual | Only Business Debtor must be informed by his bank that he will be debited under the B2B scheme and that there is no refund right after execution. |

| Mandate circulation and management | - Debtor signs one Mandate and sends it to the Creditor only - Creditor is responsible for mandate management | - Debtor signs two copies of the mandate and sends one to the Creditor and one to his Bank (Debtor bank) - Creditor is responsible for mandate management |

| Mandate control by Debtor Bank | Optional – The debtor bank does not have a copy of the mandate and is not obliged to check its validity during processing | Mandatory – Debtor bank must have original copy of the mandate and checks mandate validity at reception of collections |

| Submission times | - First, one-off and recurrent SDD at the soonest 14 calendar days before due date - First, one-off and recurrent SDD at the latest 1 business day before due date | First, one-off and subsequent SDD at the soonest 14 calendar days and at the latest 1 business day before due date. (No difference with SDD core now, but they used to be different in the past) |

| Debtor’s refund rights and timelines | - No-questions-asked refund : Up to 8 weeks after SDD execution - Refund for unauthorized transaction: up to 13 months after SDD execution Remark: Debtor Bank can return SDD up to 5 days after settlement. | - No refund right after SDD execution if the transaction was authorized - Refund for unauthorized transaction: up to 13 months after SDD execution - SDD can be rejected before due date or be returned up to 3 days after settlement |

The majority of the rules in two SDD schemes are common as one can expect. Rules that must be observed by scheme participants can be found under the chapter 4 Business and Operational Rules of the rulebooks available on the EPC website. If you find other differences while reading the rulebooks, please let me know. I will update the above table and share it with others. 🙂

So far, we have presented the Four Corner Model for the SDD, analyzed the Credit driven Mandate Flow and Debit driven Mandate Flow for the SDD and presented the two SEPA Direct Debit Core scheme and the SEPA Direct Debit B2B scheme and their main differences. We can now move to the next questions: which messages are exchanged between SDD schemes participants? How do they relate to the ISO 20022 standard? That will be the topic of a next article.

“Optional – The debtor bank does not have a copy of the mandate and is not obliged to check its validity during processing”

“Mandatory – Debtor bank must have original copy of the mandate and checks mandate validity at reception of collections”

Its hard to understand why the core scheme does not require the debtor bank to check the validity of the mandate relating to creditor payment demands ? YET this is mandatory for the the B2B scheme ?

CORE scheme debtors are open to fraudulent extractions – much more than is the case with B2B

Appreciate your input

PS – love your book, very readable and informative

Hi Kane,

Thanks for your nice comment. You are completely right when you write:”CORE scheme debtors are open to fraudulent extractions – much more than is the case with B2B”. But remember that in the SDD Core Scheme you have a No-questions-asked refund that you can do up to 8 weeks after SDD execution. In the SDD B2B scheme, the No-questions-asked refund is not possible. So in the SDD Core Scheme, your account would be debited even if you never signed any mandate while in the SDD B2B Scheme your bank will reject the SDD since it never receives any mandate from you. The Refund for unauthorized transaction (up to 13 months after SDD execution), is a complex process that may take up to one month to get the funds back. In the meantime, a company may become insolvent. Amounts in the SDD B2B schemes are higher than in the SDD Core schemes. The EPC made the mandate mandatory to provide more security to businesses.

Best regards,

PS: I am happy you find my book readable and informative. Could you please leave a comment amazon? I would really appreciate.

Thanks very much for your clarification Jean Paul – however if I may pose a couple of follow-ups.

Firstly, why does the EPC not provide the same protection from fraud for CORE users as B2B users ?

Secondly, my interpretation of the 13 month rule is that reimbursement of fraudulent extractions can only be claimed up to a maximum of 13 months AFTER the claim has been made by the debtor victim. So, if a CORE debtor does not detect illegal extractions for say 20 months, the maximum remboursement possible is 13 months – leaving the CORE debtor sort of 7 months remboursement.

Hard to understand this unjust imposition on CORE users – given that, as you say, the exposure to fraud is consciously permitted by the EPC platform creators ?

Hi James, 🙂

Thanks for your comments. Here are my replies:

Question 1 – In payments like in many areas, there is a tradeoff between risk and the cost to protect against the risk. My guess is that for SDD Core, it is more risky but costs less to protect aginst the risk. While in the B2B, leaving the same risk would have been too costly. So proection is stronger. Remember that the amount is higher in B2B payments.

Question 2 – The rulebook says:”The claim must be sent by the Debtor at the latest 13 months after the debit date of the disputed Collection.” So if a debtor detects illegal transaction after 20 months, it is too late. You have up to 13 months after the debit of your account to claim the funds back.

I love your questions. If you have additional questions, do not hesitate.

Hello Jean Paul, does the creditor have to be registered to do business (be a EURO resident) in Europe, in order to participate in the B2B scheme? I have a US company who wants to collect via credit cards with a SEPA creditor identifier. But it sounds like the business would have to be registered in a EU country in order to do this, is that correct?

Hi,

No the creditor does not have to be registered to do business in Europe. The Creditor, european company or not, must open a EUR account with a Bank located in the SEPA Area and should obtain a creditor identifier as requested in the SEPA SDD Schemes. So it is enough for the US company to contact a Bank in Europe and open an account in EUR. The bank in general helps the company to get the Creditor Identifier.

BR, Jean Paul

Hi Jean Paul. A follow-on from an earlier question. As you might have gathered I have had a bad experience with using my banks SEPA small payments service, and its CORE delivery platform.

Not to go into detail – I was one of the SFAM mobile insurance scam victims. While my bank were completely satisfied that I was a victim (specifically, when they researched SFAM creditor bank, the bank could not produce any mandates to back up the fraudulent DD extractions from my account).

On this basis, they refunded my immediately but, MINUS 1800,00 Euro fraudulent extractions which took place 13 + months after I flagged the problem.. Its the 13 MONTH RULE.

I have been researching this, and have discovered the following information in the EBA latest docs. – which indicates to me that, by EBA standards, I should not have been penalized by this 13 Month rule.

Would appreciate your opinion.

================================================================

Below is an extraction from this EBA documentation:

‘ The payment service user shall obtain rectification of an unauthorized or incorrectly

executed payment transaction from the payment service provider only if the payment service

user notifies the payment service provider without undue delay on becoming aware of any

such transaction giving rise to a claim, including that under article 89, and no later than 13

months after the debit date. THE TIME LIMITS FOR NOTIFICATION LAID DOWN IN THE

FIRST SUB PARAGRAPH DO NOT APPLY WHERE THE PAYMENT SERVICE

PROVIDER HAS FAILED TO PROVIDE OR MAKE AVAILABLE THE INFORMATION ON

THE PAYMENT TRANSACTION IN ACCORDANCE WITH TITLE III

===============================================================

Best regards, James Kane

Hi James,

Thank you for your comment. It is an interesting case and it is the first time I see the consequence of the 13 Month rule so clearly.

So if I understood correctly, you discovered the scam many months after. The bank refunded only the debits that occured in the last 13 months, and not the rest because of the 13 MONTH RULE.

In SEPA DD Core, the Creditor Driven Mandate process is applied. It means the bank does not have to verify the mandate. The Scheme assumes that creditors are trustworthy guys. And the debtor bank does not have to check that for each transaction, the underlying mandate is valid.

Now I have few questions:

Were the debits visible on your account after the DD from SFAM were processed?

Did you have the information that SFAM debited your account on your statements?

Were the references clear enough?

Best regards,

Jean Paul