There exists two direct debit models: the Creditor-driven Flow and the Debtor-driven Mandate Flow. The SDD Schemes are based on the first model, the CMF. This article will answer the following questions: What are the direct debit models? What are their main differences?

A direct debit model essentially tells us how a mandate is issued and who is responsible for the mandate management. Before SEPA, both Creditor-driven Mandate Flow and Debtor-driven Mandate Flow were used in the different SEPA countries. The CMF was already in use in a large number of EU countries and was therefore adopted as the standard. When you read CMF and DMF, you may think that the Creditor plays an important role in the Creditor-driven Mandate Flow and the Debtor plays an important role in the Debtor-driven Mandate Flow. In fact, it is the Creditor in the first case and the Debtor bank in the second as we will see in the following. Saying and writing Debtor Bank-driven Mandate Flow was a bit too heavy and lengthy. 🙂

In the following we will first analyze the CMF and then the DMF and then we will highlight the main differences.

Creditor-driven Mandate Flow (CMF)

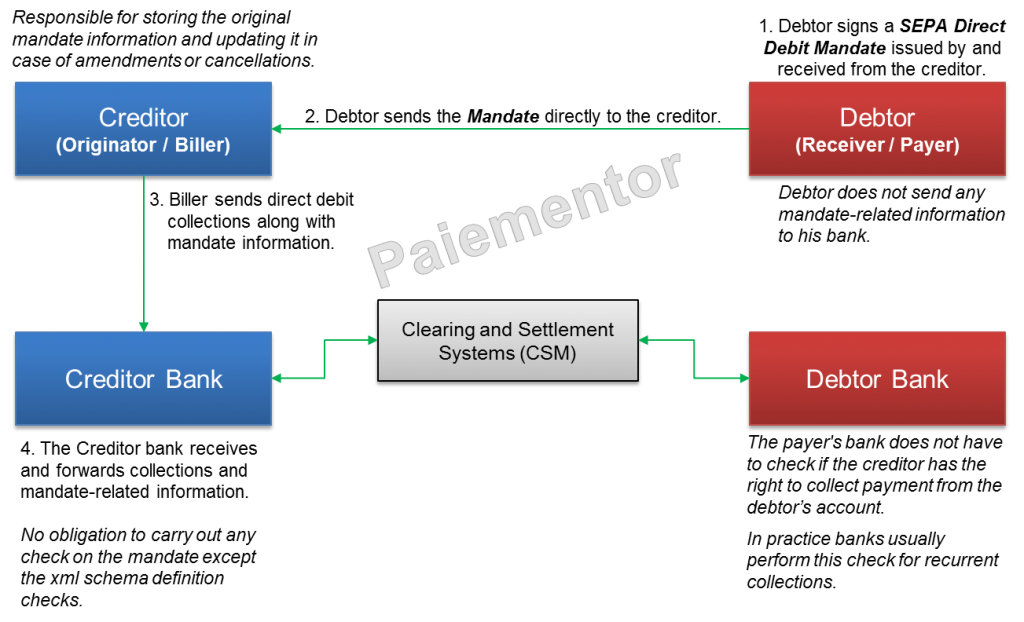

The picture below shows the steps leading to the issuing of the mandate in a CMF. Note that the creditor is responsible for the mandate management.

In the CMF, the creditor is responsible for issuing the mandate and managing it throughout its lifecycle, from the time the mandate is created (after customer fill-in and signature) till the time it is revoked or cancelled or it expires. In between, debtor or creditor may need to amend mandate related information (MRI). And the Creditor should ensure that all the changes are captured and the mandate updated accordingly.

The Creditor must provide mandate related information in the direct debit collections messages. That is required by SEPA Implementations guidelines. The Creditor Bank therefore receives MRI, but does not have the ability to determine the genuineness of a mandate. It does not have any relationship with the Debtor. So the CB can only trust that the creditor has received the formal approval from the debtor to create the mandate. But this does not mean that the Creditor Bank does not have anything to do. The EPC clearly require them to ensure that only trustworthy billers collect payments via SEPA Direct Debit. This is not straight-forward. The Creditor Bank must know its customer well enough before accepting and processing collections from him. If you work in Banking, this certainly reminds you of the (Know Your Customer) KYC compliance requirements. Therefore, some due diligence on its customer, the biller, is necessary from the Creditor Bank.

The Debtor Bank does not receive any MRI from the debtor (its customer), but does receive it in the direct debit collections messages. So it processes the direct debits more or less on trust basis like the creditor bank. The payer’s bank does not have to check if the creditor has the right to collect payment from the debtor’s account. In practice however, debtor banks generally create and store mandates at the reception of the first collection. Subsequent collections can then be rejected if the mandate has expired or was revoked by the customer. This helps to keep the customer happy.

Debtor-driven Mandate Flow (DMF)

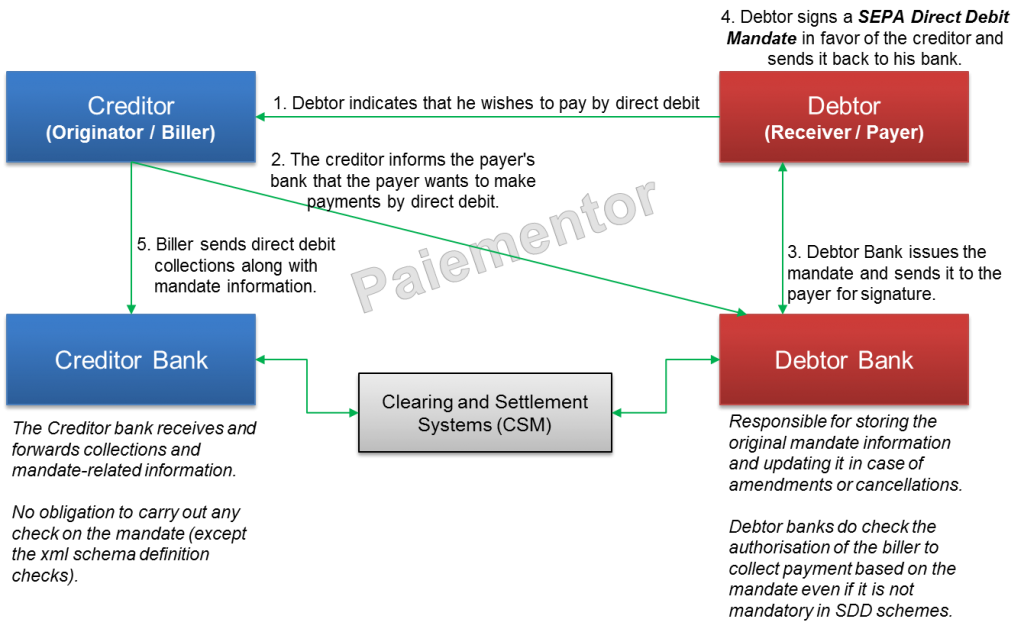

The picture below shows the steps leading to the issuing of a mandate in a DMF. Note that the debtor bank is responsible for the mandate management.

In the DMF, the Debtor Bank issues the mandate and manages it through its lifecycle. It is still the Creditor that sells products or services to the debtor. So how would the Debtor’s bank know a mandate has to be issued and sent to its customer? It is the Creditor which informs the payer’s bank to send the mandate to its customer. So the debtor’s bank must provide channels to the creditor for that purpose.

In addition, the Creditor must send collections to his bank along with MRI. Since the mandate was created by the Debtor’s bank, the biller does not have that information. The debtor’s bank must thus make the MIR available to the Creditor as well and this requires some specific set-up and processing too. We can already see here that the DMF is more complex than the CMF because additional steps are needed for the information exchanges between the actors.

Since the debtor bank creates the mandate, the MRI is already known even before the first collection is received from the Creditor Bank. The debtor bank is therefore able to check at reception of the first direct debit if the mandate already exists. For the subsequent collections, it can perform verifications on the mandate as well before processing it. The controls and verifications are not enforced by the SDD schemes. But debtor’s banks do perform them because they have greater responsibility towards the creditors and their customers as responsibles for mandate management.

Simplified CMF and DMF

The steps required to get a signed mandate are lengthy. In practice, billers and debtor banks have developed solutions to shorten them. They consist in two main steps:

- preparing the paper-based mandates forms with the address to which the debtor will send the mandates after completing it.

- Sending the mandate form along with offerings or invoices. In a subscription offering for example, the mandate form is provided. If the customer decides to subscribe, he can immediately fill in the mandate and send it to the creditor (CMF) or to the debtor’s bank (DMF). A company may also send an invoice to be paid in the future with mandate form to its customers.

For e-mandates, there are gateways between Creditor and Debtor’s bank Internet Applications to smooth and speed the MRI exchange.

So preparing the mandate forms and making them available upfront can help save precious time.

To conclude this article, let’s summarize the main differences between CMF and DMF.

| Topics | Creditor-driven Mandate Flow | Debtor-driven Mandate Flow |

| Process to get the signed mandate | Simple – only Creditor and Debtor are involved | More complex – In addition to Creditor and Debtor, the Debtor’s bank must be involved as well. |

| Responsible for Mandate issuing and management | The Creditor | The Debtor’s bank |

| Mandate verifications | The debtor bank does not have to check if the creditor has the right to collect payment from the debtor’s account.

|

Debtor banks do check the authorisation of the biller to collect payment based on the mandate even if it is not mandatory in SDD schemes |

As mentioned in the outset, the SEPA Direct Debit Schemes are based on the creditor-driven mandate flow. However, debtor banks may offer debtor-driven mandate flow as well as long as they remain compliant with the scheme. Both CMF and DMF can co-exist and are implemented by many financial institutions in the SEPA countries.

This ends our analysis of CMF and DMF. In the next article we will look at the different SDD schemes.

[…] have many things to go through. Before going deeper, I think it is worth looking in detail at the creditor-driven mandate flow and debtor-driven mandate flow and then at the different SEPA Direct Debit Schemes. These will be […]

Hi Jean,

Thanks for a very good article. One quick question. Is the BACS DD in the UK debtor or creditor driven?