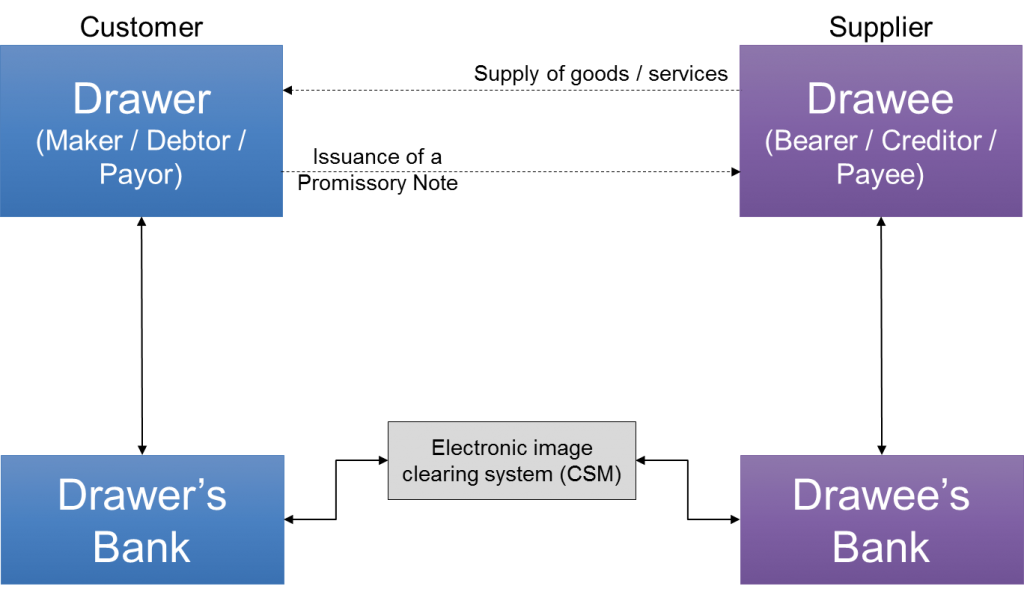

We saw in the previous article that numerous parties are involved in promissory notes. The different parties were presented as well as the role they have. In this article we consider two other parties that play an important role in promissory notes: the drawer’s bank and the drawee’s bank.

At the end of the day, a payment must be carried out to settle a promissory note and banks manage the means of payment. In certain countries, cash payments are not allowed above a certain amount. There is a threshold above which electronic payments must be used. As results, promissory notes of certain amounts have to be settled through electronic payments between the bank of drawer and the bank of the drawee. That brings us to the Four Corner Model of promissory notes which involves four parties (“the four corners”): the drawer, the drawer’s bank, the drawee and the drawee’s bank.

[box type=”info”]The Four Corner Model is one the most powerful tool to analyze almost any mean of payment. [/box]

Dematerialisation of promissory notes

Before we explain how the promissory notes are exchanged and settled between banks, it is important to say something about dematerialisation of paper-based instruments in general and promissory notes in particular.

A promissory note is a written document. Working with such paper documents is cumbersome and costly. That is why many countries all over the world have made the choice of dematerialisation. Dematerialisation is the process through which physical documents are converted into electronic format: the electronic image of the document and the electronic payment records (For promissory notes, they include bank account details of both drawer and drawee). And the electronic format is the legal equivalent of the original document. Documents in electronic formats are called Image Replacement Documents or Substitute documents. To collect the funds for example, it is sufficient to use the electronic format, no need to present the paper documents. The purpose of dematerialisation is therefore to facilitate the processing and settlement of promissory notes and negotiable instruments in general.

Many countries have set up electronic image clearing systems allowing interconnected banks to exchange electronic images and related payment records. In certain countries, it is enough to exchange the electronic payment records only.

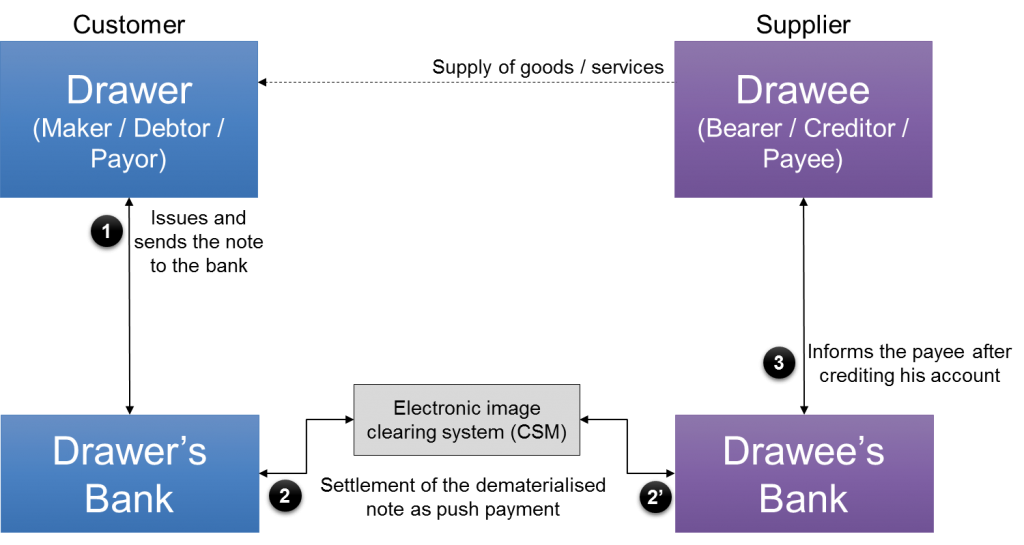

The dematerialisation of promissory notes can happen at different stages in the process:

- The drawer can directly create the note electronically (with electronic signature of course).

- The drawer can take the written document to his bank that will dematerialise it.

- The drawee, who receives the written document from the drawer, can dematerialise it and send it to his bank.

- The drawee, who receives the written document from the drawer, can deposit it with his bank. And the bank will carry out the dematerialisation.

In the first two options, the promissory note is settled as a push payment. In the third and fourth option, it is settled as a pull payment. All options are not possible in every country. Check the laws in your country to see what is allowed. All the options are presented to make you aware of the possibilities that exist.

Promissory notes settled as push payments (Transfers)

Promissory notes settled as pull payments (Collections)

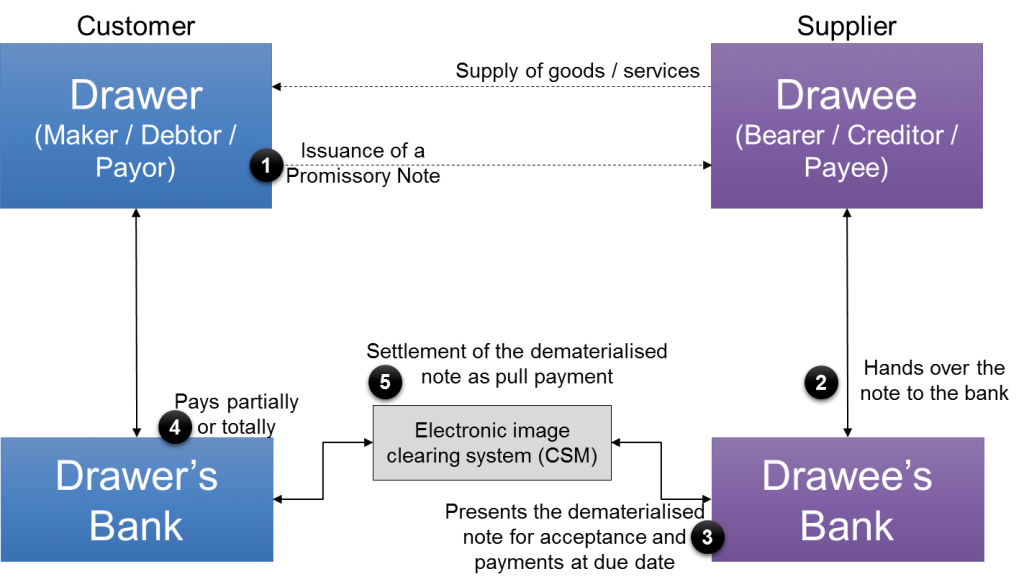

In the standard process the promissory is created in paper form and delivered to the payee. The payee performs the dematerialisation himself or hands the note over to his bank. And the bank dematerialises it. Obviously, the payee we are talking about is the final payee after possible negotiations that have happened before. If a payee endorses and delivers the note to another party, that party becomes the payee.

The dematerialised promissory note is equivalent to a collection. It is sent by the drawee’s bank to the drawer’s bank at due date and presented for acceptance and payment.

[box type=”info”]In certains countries, the drawee’s bank pays an interchange fee to the drawer’s bank. [/box]

One may wonder why the note is presented for acceptance. A note is not accepted since it is issued by the payor. Acceptance of a note may be required in this context for two reasons:

- Allow the drawee’s bank, which may not have seen the signed paper Note, to collect evidence that the drawer agrees to the payment of the note

- Give the option to the drawer to reject the note if it was wrongly issued by the beneficiary (duplicate or erroneous bank details for example).

At due date, the drawer’s bank checks that the drawer has enough balance on his account before making the payment. In certain countries, the bank may decide to partially or totally reject the promissory note in case of insufficient balance. In other countries, the payment must be made in full or not at all.

In this option, the payee can do the discounting of the note if he wants to. He then receives a short term credit less the fees and he pays back when the amount of the note is collected at maturity. If for some reason the payment is not received in full at due date, the bank can use his recourse right and turn against his customer, the drawer and all other endorsers to enforce the promissory note.

This ends our analysis of the Four Corner Model for Promissory Notes. The next article will be about Bills of exchange.