The different parties involved in bills of exchange as well as their roles were presented in the previous article. In this article we consider two other parties that play an important role in bills of exchange: the drawer’s bank and the drawee’s bank. Banks are involved in the settlement of bills of exchange since they manage payment instruments. In certain countries, the payment must be carried out through banks if the amount of the bill is above a regulatory threshold. Since bills are used in commercial transactions, the amounts are usually pretty high and payments cannot be in cash.

The different parties involved in bills of exchange as well as their roles were presented in the previous article. In this article we consider two other parties that play an important role in bills of exchange: the drawer’s bank and the drawee’s bank.

Banks are involved in the settlement of bills of exchange since they manage payment instruments. In certain countries, the payment must be carried out through banks if the amount of the bill is above a regulatory threshold. Since bills are used in commercial transactions, the amounts are usually pretty high and payments cannot be in cash.

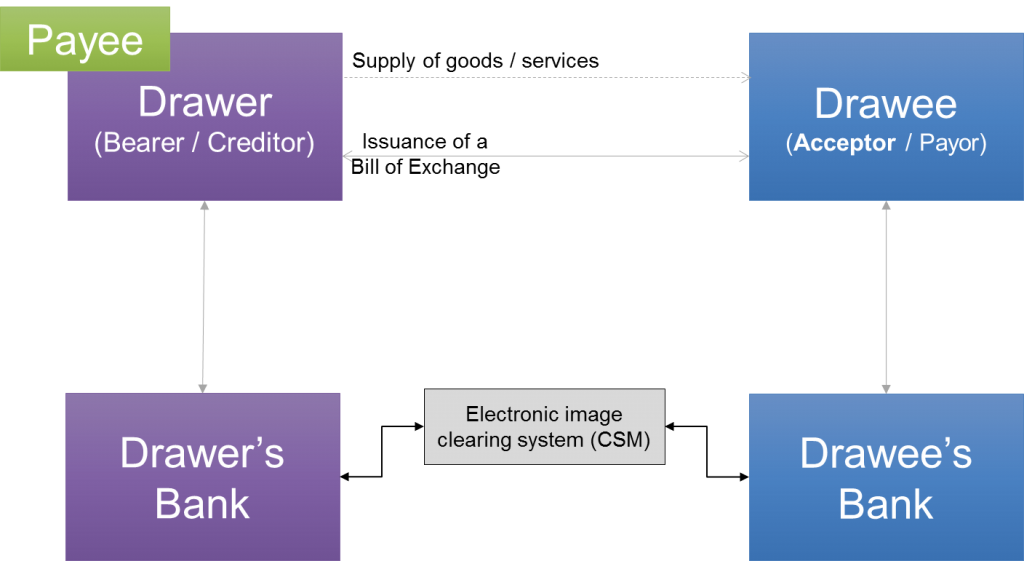

Banks as account holders therefore take part in the payment process and this brings us to the Four Corner Model of bills of exchange which involves four parties (“the four corners”): the drawer, the drawer’s bank, the drawee and the drawee’s bank. As we will see below, banks do not only come into play when the bill is settled. They can intervene before too.

[box type=”info”]The Four Corner Model is one the most powerful tool to analyze almost any mean of payment. [/box]

Dematerialisation of bills of exchange

Before we explain how the bills of exchange are exchanged and settled between banks, it is important to say something about dematerialisation of paper-based instruments in general and bills of exchange in particular.

A bill of exchange is a written document. Working with such paper documents is cumbersome and costly. That is why many countries all over the world have made the choice of dematerialisation. Dematerialisation is the process through which physical documents are converted into electronic format: the electronic image of the document and the electronic payment records (For bills of exchange, they include bank account details of both drawer and drawee). And the electronic format is the legal equivalent of the original document. Documents in electronic formats are called Image Replacement Documents or Substitute documents. To collect the funds for example, it is sufficient to use the electronic format, no need to present the paper documents. The purpose of dematerialisation is therefore to facilitate the processing and settlement of bills of exchange and negotiable instruments in general.

Many countries have set up electronic image clearing systems allowing interconnected banks to exchange electronic images and related payment records. In certain countries, it is enough to exchange the electronic payment records only.

The dematerialisation of bills of exchange can happen at different stages in the process:

- The drawer can directly create the note electronically (with electronic signature of course).

- The drawer can take the written and accepted document to his bank. And the bank will dematerialise it.

In any case, the bill of exchange is always settled as a pull payment. It is initiated by the drawer who instructs his bank to collect the funds from the drawee’s account.

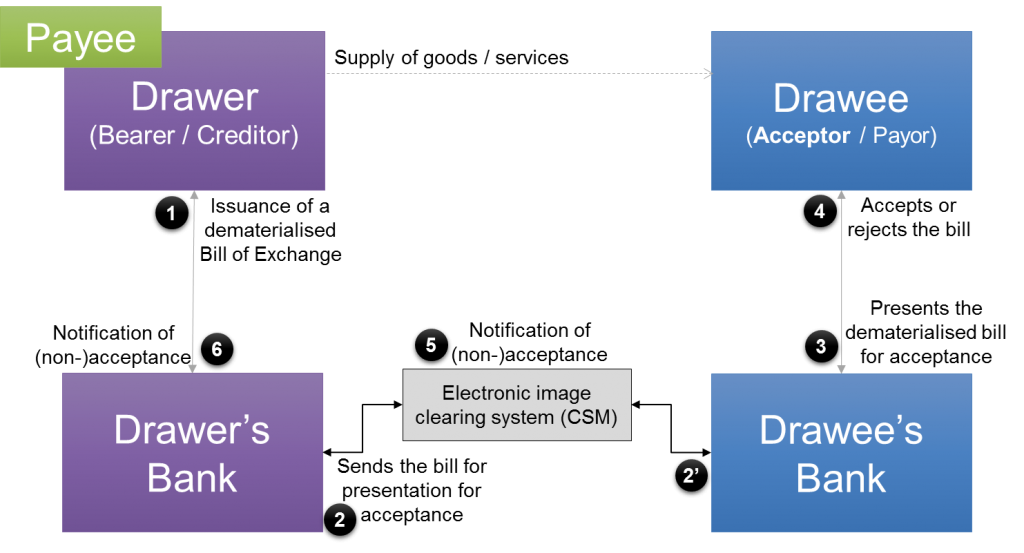

Acceptance of Bill of exchange created electronically

If the drawer directly creates a bill of exchange electronically and sends it to his bank, the bank must first present the bill for acceptance.

The drawer issues and signs the bill electronically. The drawer’s bank receives the dematerialised bill of exchange and performs the format checks to ensure that all the mandatory information is provided. The bill is sent to the drawee’s bank through the interbank exchange network. The BoE message contains specific information indicating that it is for the presentation for acceptance.

The drawee’s bank presents the dematerialised bill to its customer (the drawee) for acceptance. This generally happens through an e-banking portal provided by the bank. The drawee views and checks the bill information and decides to accept or rejects. Electronic signature is needed for acceptance and the date is recorded. After that, the notification of (non-)acceptance is sent to the drawer’s bank through the Interbank clearing system. The drawer’s bank informs its customer, the drawer. If the bill was accepted, everything is fine. The drawer will wait until the term to receive the payment collected by his bank. But if the bill was refused, then the drawer can fix it and sends another dematerialised bill or he can issue a paper bill and requests the drawee to accept it. The paper bill is necessary in order to take legal action (See paragraph dishonour of a bill of exchange in the previous article).

When the bill is issued electronically, the drawer cannot negotiate it to another party. After acceptance, he can perform the discounting or the factoring that were explained in detail in the previous article. We assume that none of this is done. The drawer’s waits until the term for the payment of the bill. If it is a sight bill, the drawer can obviously request the payment right after acceptance.

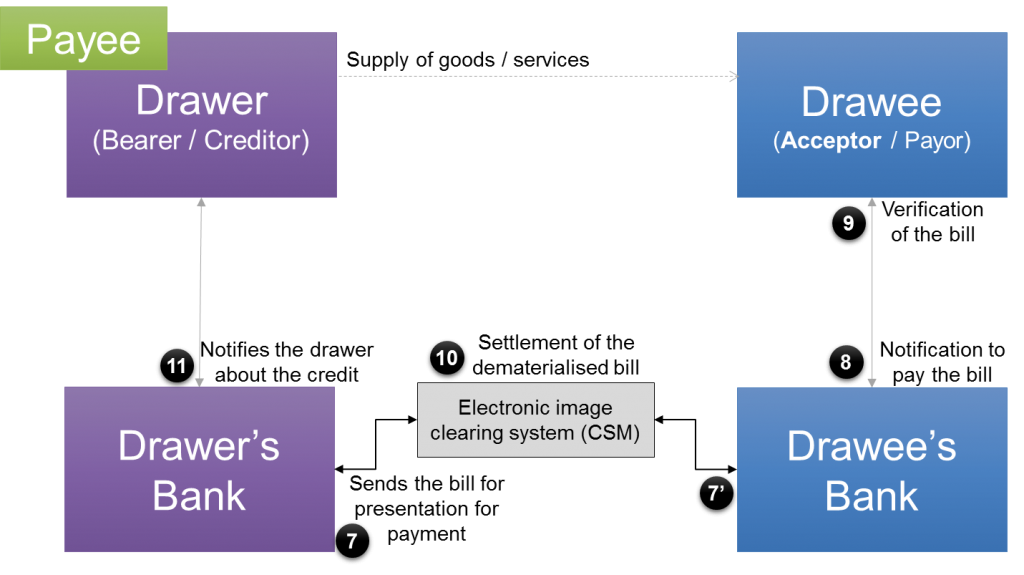

Settlement of Bill of exchange created electronically

The settlement of the bill of exchange is initiated by the drawer’s bank.

At due date or few days before due date, the drawer’s bank sends the instruction to collect the funds from the drawee account. This is also referred to as presentation for payment. The drawee’s bank informs its customer that the bill is to be paid. The drawee checks the bill to ensure that there is no mistake and gives his approval to pay. Usually, the approval to pay is implicit. The drawee does not do anything to accept the payment. However, if he wants to refuse the payment, he must clearly provide that information to his bank. We assume that everything is fine and the drawee is willing to pay.

Here we have 2 options: either the drawee has sufficient balance on his account or not. If he does not have enough money, the payment may be made partially in certain countries. In other countries, the bill is treated as rejected in case of non-sufficient balance. If a payment is done, the drawee’s account will be debited and the amount will be settled in the interbank space between the two banks. The drawer’s account will be credited and he will be notified about the credit. If the payment was made only partially, he will connect with the drawee and undertake legal actions to get the rest of the amount.

[box type=”info”]In certains countries, the drawer’s bank pays an interchange fee to the drawee’s bank. [/box]

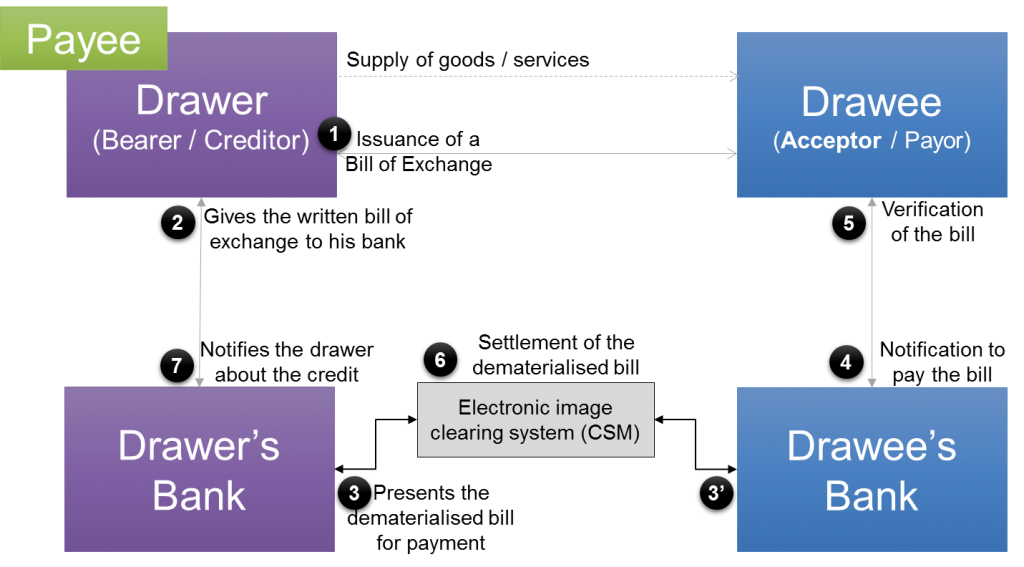

Acceptance and settlement of a paper bill of exchange

When the bill of exchange is issued in paper form, the drawer presents it to the drawee for acceptance. If the bill of exchange is not accepted, the drawer can immediately undertake legal actions. But let’s assume the bill was accepted.

A drawer can endorse and delivers the bill to someone else if he wants and this can happen as many times as necessary. There is no limit to the number of negotiations that can be performed. Any drawer can choose to perform the discounting or the factoring of the bill if he wants. We assume below that it is not the case.

The drawer (or the final endorsee) will then hand over the paper bill to his bank usually few days before the term. The bank will perform the dematerialisation of the bill and sends it directly for payment.

At reception, the drawee’s bank will notify his customer, the drawee and requests him to pay. This can happen through many channels (e-bank portal, mail, SMS). The drawee is the supposed to connect to the bank portal and verifies the bill. This step is important because mistakes are not totally excluded. A bill can be sent to the wrong drawee or the amount of the bill may be incorrect. A for the drawee’s bank it is a way to ensure that its customer really accepted the bill and wants to pay.

If everything is OK, the account of the drawee will be debited for the full amount and settled at due date. As already stated above, only a partial payment may be carried out if the drawee does not have sufficient balance on his account. In any case, when the drawer’s bank receives the funds, the account of the drawer is credited and the drawer is informed about the credit.

This ends our analysis of the Four Corner Model for Bills of exchange. Bills of exchange are used in trade finance. We will take a closer look at this topic in next articles.