After the introduction of negotiable instruments in the previous article, we will now focus on two instruments that are extensively used in business transactions in numerous countries: the promissory note and the bill of exchange. This article is about the promissory note and will handle the following topics:

Parties involved in a promissory note

Endorsement of a promissory note

Discounting of a promissory note

Factoring of a promissory note

What is a promissory note?

A promissory note is a negotiable instrument in which one party (the drawer, maker or issuer) promises in writing to unconditionally pay a determinate sum of money to the other (the drawee, payee or beneficiary), either at a fixed or determinable future time or on demand of the payee. A (promissory) note can be payable to bearer or payable to order:

- Payable to bearer means payable to the holder or presenter. When a promissory note is payable to bearer, it means whoever holds the note can receive the payment due on it.

- Payable to order (or payable to the order of) means the drawer is agreeing that he will repay the money to the payee or the person the payee designates to receive the payments. For instance, the payee can supply goods or services to the drawer and then direct the drawer of the note to make the payment to another person / company that the payee owes money to. A promissory note payable to order gives the payee flexibility in designating who will receive the funds.

Simply put, a promissory note is a “promise to pay” given by the maker. But the maker can fail to deliver on his promise and the payee may not get the money at the specified time. Many payees (Lenders particularly) therefore request the drawer to issue or sign a secured (promissory) note. A secured note includes a form of collateral. In the event the maker fails to pay the promised amount, the payee can legally seize and sell the collateral to recoup its losses. When an unsecured note goes unpaid, the payee can pursue legal action and file a judgment, but if the maker does not have the means to repay, the payee will end up taking a loss.

Contents of a Promissory Note

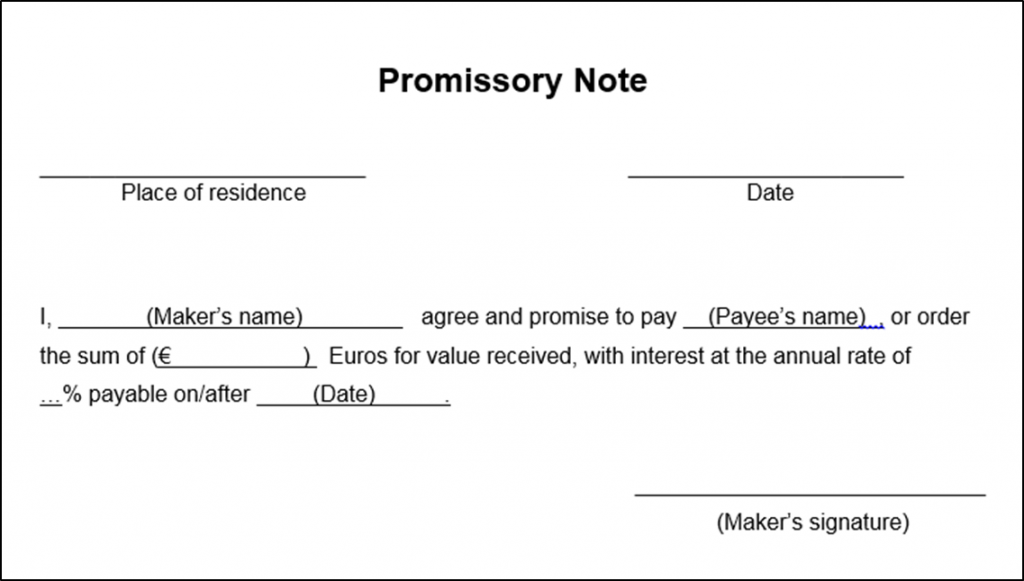

A promissory note complies with the Characteristics of Negotiable Instruments presented in the previous article. Issuer of a promissory note must stick to strict rules related to both form and substance of the document. In many countries, a promissory note document must contain some of the following elements (Read the commercial laws of your own country to find out which elements are mandatory):

- Maker of the Promissory Note: This is the individual or entity (company) that promises to pay the sum of money. Name and address are generally requested.

- Beneficiary / Payee of the Promissory Note: This is the person or entity to whom or in the order of whom the payment is to be made. Name is generally requested. However, a promissory note can be payable to the order of bearer. This means that anyone bearing the note can present it to the maker for payment.

- Creation date and place of the Promissory Note: The date and place where the Promissory Note is created.

- The unconditional promise to pay: In certain countries, the phrase “promissory note” must be visible on the document. In other countries, it is enough to use a language that clearly undertakes payment.

- Amount of the Promissory Note: The sum of money that the payee will receive must be clearly featured on the document. The amount of a promissory note is called the face value or the maturity value. A best practice in many countries is to write the amount twice on the Promissory Note.

- Maturity date / due date of the promissory note: this is the date on which the note is to be paid. If the exact due date is not explicitly indicated on the note, information should be available allowing to calculate the payment date. If a promissory note is payable after one month, then it means 30 days after it was issued. Note : A Promissory Note may not contain a date at all. That is the case for promissory notes payable on demand (mentions “At sight” or “On presentment” on the note), or after presentment for sight (mention “After sight” on the note).

- Signature of the maker of the promissory note: the signature (handwritten or electronic) is the binding force of the promissory note. It is the formal proof that the maker agrees to the content of the document and is promising to pay. In some cases, the signature of the payee might be on the document too. But that is generally not mandatory.

In certain cases when the promissory note is issued for a loan contract between a borrower and a lender for example, the document contains some or all of the following elements:

- Interest Rate of the Promissory Note: This is the amount of interest rate due on the amount of loan that the borrower pays.

- Dates when First Payment and Subsequent Payments are due: payments may be due every 5th of each month beginning in 3 months from the date of issue.

- Date the Promissory Note ends: This is the date after which the total amount due will have been paid. After this date, this promissory note is not valid anymore provided the borrower has paid the total amount due.

- Terms of the Prepayment Penalties of the Promissory Note: These terms are foreseen by the lender in case the borrower wants to make Prepayments and reduce the amount of interest to pay. The lender takes “penalties fees” to still perceive a (smaller) rate of return despite that.

Below is an example of what a simple promissory note looks like.

Additional elements can be added like signatures of the payee, witnesses or even a notary public. But the drawer and particularly the payee must ensure that all mandatory information are featured on the note.

Parties involved in a promissory note

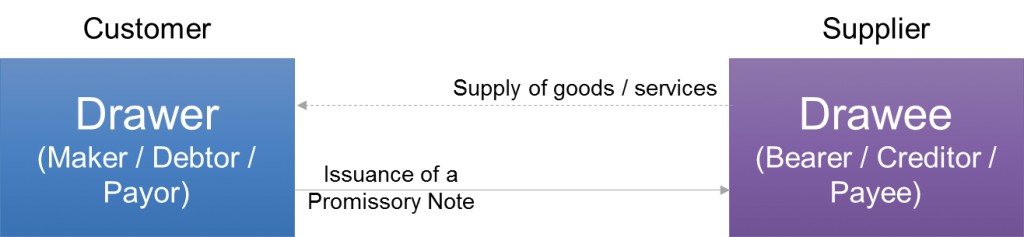

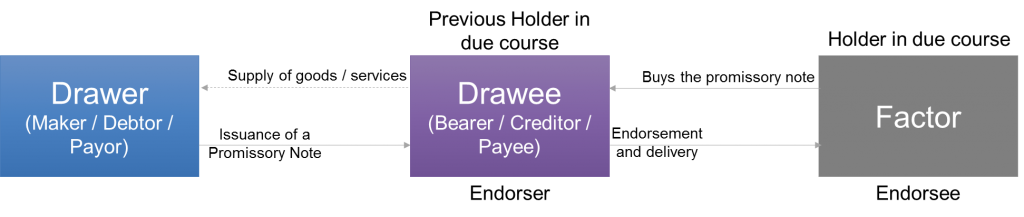

Two main parties are involved in a promissory note: the drawer or maker and the drawee or payee. But depending on how it used, other parties listed below might be involved too (and the list is not exhaustive as we will see). In this paragraph, we will see when they come in and which role they play.

- Drawer: the person who makes a promissory note. He is also called the promisor, the maker, the payor, the debtor.

- Drawee: the person in whose favor the promissory note is drawn and who is meant to receive the payment. He is also called the promisee, the payee, the creditor.

- Bearer: the person who holds a promissory note. He is also called the holder. The bearer and the payee is usually the same person, but they can be different.

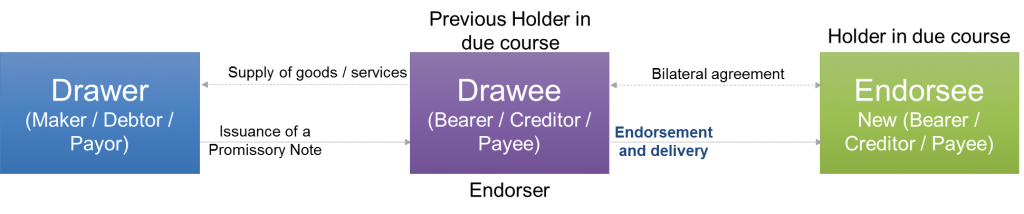

- Endorser: the person who endorses a promissory note.

- Endorsee: the person in whose favor the promissory note is endorsed and who receives it after endorsement. He becomes the new bearer and payee after endorsement.

Now let us consider the different parties and when they step in from the time the promissory is written and issued. We begin with the drawer and the drawee.

Drawer: The drawer of a promissory note is the maker and the debtor. The drawer issues the promissory note and promises to pay a certain amount to the drawee (payee). He is also called the promisor. The drawer of a promissory note can theoretically consist of 2 or more parties. In that case, the promissory note can be made payable jointly (the debt is divided by the number of drawees) or alternatively (the drawees pay in turn one after another, if there several payments deadline).

Drawee: The drawee is the other main party involved in the promissory note. It is the payee or creditor who would receive the money from the maker/debtor. He is also called the promisee. The word drawee for a promissory note can be a bit confusing since money is not drawn from him. He is actually the one who receives it. Therefore it is better to say payee or creditor.

It is important to say here that a promissory note is not an order to pay and does not require acceptance like a bill of exchange. Rather it’s a promise made by the drawer to the payee through a written contract. The drawer primarily sees the promissory note as an instrument of credit or a deferred mean of payment, a promise to pay in 30, 60 or 90 days for example. If the payment is made immediately, then it is not interesting to use a promissory note.

After drawing the promissory note, the drawer does not keep it, but hands it over to the payee who becomes the first bearer or holder. The payee now has many options between the following:

- He may decide to wait until maturity and present the promissory note for payment.

- He may decide to negotiate the promissory note to another person.

- He may decide to receive a short term finance by performing a discounting of the promissory note.

- He may decide to receive a short term finance by performing a factoring of the promissory note.

Endorsement of a promissory note

For option 2, the payee must endorse the promissory note and delivers it to the next party. Endorsement consists of a mandatory signature and (optional) words qualifying that act. The payee, who is then using the note as a financial instrument, becomes the endorser and the party receiving the note is the endorsee, the new holder of the promissory note. He is also called the holder in due course. Below is a figure showing what happens (the right part).

Why would the first holder negotiate the note to another party? There are several reasons. He may have a debt with that party that he wants to resolve. He may agree with the next party to negotiate the note in exchange of a sum of money. The negotiation is generally carried out to fix a financial problem. Otherwise, it is of no interest.

The negotiation process can happen as many time as needed. There is no limit to the number of endorsements that may be made on a promissory note. A Bearer is not obliged to inform the initial drawer or any previous party that the note has been negotiated. At maturity, the holder in due course presents the promissory note to the maker for payment.

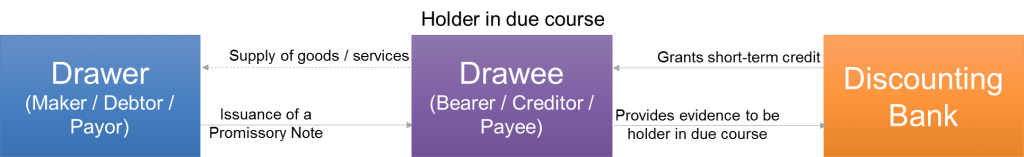

Discounting of a promissory note

If the payee chooses option 3, then he must perform the promissory note discounting. Discounting is the arrangement in which a bank grants a short term credit on the basis of a promissory note to his holder, for less than the value shown on it before it is due to be paid. The holder, after providing evidence that he is in possession of a promissory note, receives the promissory note amount less administrative charges, fees and interest. The holder uses the note in this context as a credit instrument.

To compute the total fees, the bank takes into account the following elements: the amount and maturity date (due date) of the promissory note and the interest to apply. The longer the maturity, the higher the interest rate. The interest rate is referred to as the bank discount, or simply the discount rate. It usually includes the nominal interest rate and other charges. The period of discount is the period from the date of discount to the maturity date. The difference between the promissory note amount and all the charges, fees and interest is called the proceeds. The bank expects to receive the face value (total amount of the promissory note) as reimbursement amount at maturity date, generally in 30, 60 or 90 days. This explains why discounting is a short-term credit.

In general this is how Bank Discount and proceeds are computed:

- Bank Discount = Maturity Value x Discount Rate x Period of Discount

- Proceeds = Maturity Value – Bank Discount

The bank discount is what the bank earns in the process.

Note that the holder remains responsible for collecting the promissory note amount after this arrangement. That means in case the promissory note is dishonoured, the holder may get into big trouble, because he must pay back the credit to the bank anyway.

Factoring of a promissory note

The final option listed above is the factoring agreement. Factoring means an arrangement between a factor and his client where the factor buys a debt from its client. In Factoring, accounts receivable are highly discounted in order to allow the buyer, the factor, to make a profit when the debt is settled later. Discount rate are much higher in factoring than in normal discounting (explained above). Factoring transfers the ownership of accounts receivable to the factor that then chases up the debt.

In factoring the holder negotiates the promissory note to the factor. He is not responsible for collecting the promissory note amount anymore and therefore does not care that much if the promissory note is later dishonoured. The risk of non-payment (at maturity date) is completely transferred on the factor. That is why rates applied by factors are generally much higher than for those applied by discounting banks. And furthermore, the factor sometimes pays in two installments to limit the risk: one advance payment after endorsement and delivery of the promissory note and a final payment when the face value is collected.

Dishonour of a promissory note

A promissory note can only be violated by non-payment. There is no need of acceptance since the payor is himself the maker of the note. A promissory note is dishonoured by non-payment when the drawer or maker makes default in payment of the sum partly or totally.

When this happens, the holder must give a sign or notice of dishonour to all the earlier parties to make them accountable. A notice of dishonor is simply a notice given by the holder of the promissory note to previous endorser(s) to inform them that payment has been refused. The maker does not need a notice since he is the payor and is aware that the promissory note was dishonoured. Only after giving due notice of dishonour, the holder can sue the liable parties for the recovery of amount due on the instrument.

To provide a notice of dishonour, the holder takes the note to a notary public who presents it again for payment. In case the maker refuses again, the notary public records the refusal on the note. Thus ‘noting’ means recording the fact of dishonour on the dishonoured instrument or on a paper attached thereto for that purpose. It is recommended not to wait too long before doing noting. It should be done in the next 24 to 48 hours. Noting should specify the following on the instrument:

- Identification (Initials) of the notary

- A minute indicating that the instrument has been dishonoured and why; if the instrument has not been expressly dishonoured, the reason, why it is being treated as dishonoured

- The date of dishonour;

- The noting charges;

- The noting reference to the notary’s register.

In certain cases, noting may not be suitable to sue the previous endorser(s) and the maker. The holder can then request the Notary public to draw a certificate of protest or certificate of dishonor.

Despite all that, the holder may still not get its money back. The holder can then choose to turn the delinquent debt over to a debt-collection agency or a company that buys such debt and then tries to collect the debt. He then sells the note for a cheap price.

We analyzed the promissory note in this article and saw that many parties can be involved in the related processes. There are other players with a major role that we did not mention at all: the drawer’s bank and the drawee’s bank. We will have a closer look at their roles in the next article: the four corner model for promissory notes.

hi I have been trying to pay off my car loan with a PM and nobody at the bank or the finance company understands what it is and say they dont take them because they have never deal with them. Im so frustrated, who at the bank and what position will they hold as someone who knows about PNs and how to process them..

Hi,

I can understand your frustration. In certain countries (like France), promissory notes can be issued only by businesses.

In other places, even if the law allows private individuals to issue them, banks do not communicate about them. They would rather people take/use bank loans simply because it is legally and financially more interesting for them. Good luck.

Thanks so much ur work was really helpful. I now understand it better

Hi, I have a query related to Promissory Notes.

It says that a note cannot be made payable to the maker himself. It will be invalid.

But if the drawer endorses the note, then it is valid.

Could you please explain what does it mean?

So by endorsement, how the maker making the PN payable to himself a valid case now?

schick mal Email adresse…

Hi Dirk Suckow, an anderer Stelle hatte ich von dir einen Kommentar gelesen, dass du weißt, wie man ans Kollateral bei der Bundesbank rankommt, also an sein Konto, um es zu verwalten. Hab deinen Kommentar an der anderen Stelle nicht wiedergefunden, stattdessen hier. Zum Kollateralkonto: Das scheint ja wohl irgendwie online zu gehen, das zu verwalten, aber nicht ohne User ID und Passwort. Wie kommt man da ran? Könntest du mir da privat vlt weiterhelfen an ds2u-ät-greve-punkt-org-punkt-in? Danke schon mal im Voraus. Gruß, Fabia Gräfer

What if lender dies, and the joint venture of property is whose name is left on deed. but promisory note goes into estate. but the now living owner is disabled and has no money. now what. they let the other person die of family.