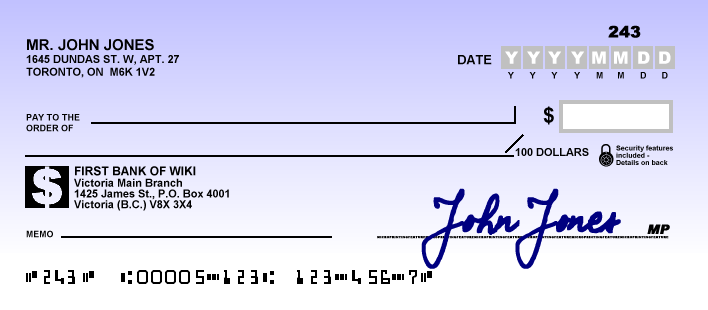

- drawer information: the person or entity who issues the cheque with the address of residence if it is a private person and the office address if it is a business.

- drawee information: it is the bank or financial institution where the cheque can be presented for payment. Address of the bank is generally indicated.

- payee: this is the beneficiary of the cheque. The drawer writes the beneficiary’s name in the space provided.

- date of issue: the date on which the drawer issued the cheque. The date is decisive for the cheque processing.

- place of issue: the city where the drawer made the cheque.

- amount and currency: it is the amount to paid by the drawer to the beneficiary. No erasure is allowed on the amount. An alteration usually invalidates the check and results in rejection by the bank.

- signature of drawer: it is the formal confirmation provided by the drawer that he has issued the cheque and is giving order to pay.

- Machine readable routing and account information (MICR): this information is crucial and allows the automation of cheque processing to some extent.