After introducing the cheque (check in US english) in the previous article, the next question to explore is: how does cheque payment work?

To answer this question, we will use one of the precious tools to analyze a mean of payment: the Four Corner Model.

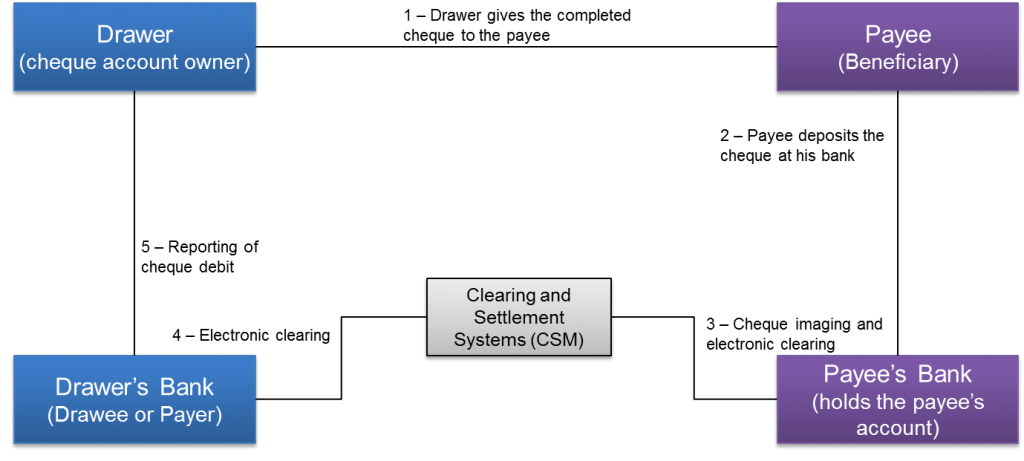

The diagram below shows the Four Corner Model for cheque payment. On the left side, you see the drawer and his bank and on the right side, the payee and his bank. One additional actor that was not mentioned in the cheque definition (See previous article) appears: the beneficiary’s bank. It plays a major role in the cheque processing circuit, as we will see below.

Now let’s look at what happens from the time the cheque is issued by the drawer until it is paid to the beneficiary.

1- The drawer fills in the cheque form by writing the name of the payee, the amount, the date and place of issue. Then he signs it and hands it to the payee.

2- The beneficiary endorses the cheque by adding his name, account number and signature on its back and deposits it with his bank for collection. If it is allowed by the country regulation, the beneficiary may create an image of the cheque with a mobile banking app, saving a trip to the branch.

3- The payee’s bank checks, sometimes manually, that the cheque is correctly filled in before processing it. It usually credits the payee’s account the same day or the next day depending on the time when the cheque was received. The payee’s bank then performs the cheque imaging which consists in taking electronic images of cheques and capturing related information electronically for the purpose of presentation to drawee banks and clearing. In some countries (France for example), the captured information is enough for the cheque clearing. In others (Hong Kong for example), both image and captured information are required. In any case, Cheque imaging avoids the need to make physical presentation of cheques to drawee banks thereby making the clearing and settlement process faster and more efficient. The payee’s bank presents the image of the cheque to the drawee (drawer’s Bank) through a national cheque clearing system. Since the payee’s account is credited on the same day or a day later, the payee’s bank clears the cheque to recover of the funds already credited to the beneficiary.

Remark: If drawer and payee are customers of the same bank, there is not need to go through a clearing system. An internal book transfer is sufficient.

4- The drawee (drawer’s bank) receives the image of the cheque to be collected, carries out a number of controls including the balance check and debits the drawer’s account for the amount indicated on the cheque if all the controls are OK. The cheque can bounce if there is insufficient balance on the drawer’s account. In that case, the drawee informs the beneficiary bank by sending him a reject message. The payee’s bank then debits the funds initially credited to the beneficiary. A cheque rejection can have drastic consequences in certain countries and even lead to suspension of banking privilege.

Remark: Depending on the case, a bank may reject the cheque immediately or waits for many days before initiating a rejection. The deadline for cheque rejection differs per country. The funds are definitely for the payee only when the rejection deadline is passed and the payee’s bank has not received any rejection.

5- The bank informs the drawer that his account has been debited for the payment of the cheque. It can be through e-mail, SMS or account statement. It depends on the agreement between the bank and his customer.

Before ending this article, a few more words on cheque imaging. Cheque imaging has become the standard in many countries because it reduces the cost of cheque processing and clearing significantly. Before image clearing, the physical cheque has to be presented to the drawee bank to collect the funds. This required sending the cheques through the post and could take many days before a cheque is presented. Nowadays a cheque can be issued, presented and clear the same day thanks to cheque imaging.

Now that we know how a cheque payment works, we can look at the different types of cheques that exist. That will be the topic of our next article.

Hi Jean,

May I know how does the drawer present the cheque to the drawee, is it normally done by cheque imaging ?

Hi Peter, You are right.

it is the beneficiary bank that presents the cheque to the drawee. In many countries, it is not required to present the physical cheque anymore.

The beneficiary bank presents just an image of the cheque to collect the funds.

Can we get a real business scenario for cheque and how it’s clearing happen . I have worked in high value and low value payment side .I want to get some insight for cheque processing as well . Also which format file is used for image processing , i believe its x9?