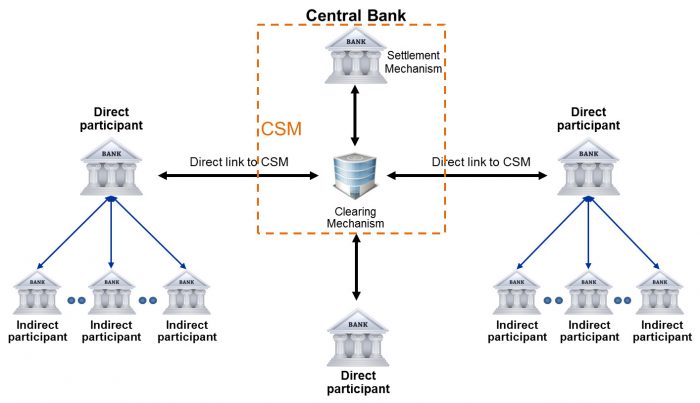

Banks can join a clearing system or a settlement system as direct participants (DP) or as indirect participants (IP). After reading this post, you will understand the differences between these two types of participants and why only direct participants settle in CSM. The following figure depicts direct and indirect participants and the relationship they have to the CSM.

Direct participants have a direct link to the CSM. They exchange payment transactions directly with the CSM. Indirect participants do not have a direct link to the CSM. They have a connection to a direct participant which exchanges transactions with the CSM on their behalf. When the CSM receives a credit transfer from indirect participants through the direct participant, it expects the direct participant to pay the money not the indirect participant. And when the CSM sends a credit transfer to the indirect participant through the direct participant, it expects the direct participant to receive the money not the indirect participant.

Funds transfer between direct participant and indirect participant

The funds transfer between DP and CSM always happens through the Settlement System. The direct participant takes money from the indirect participant and gives it to the CSM and receives the money from the CSM and gives it to the indirect participant. Therefore direct and indirect participants must have an account relationship. The indirect participant opens a so-called correspondent account with the direct participant, so that the DP can receive funds and make payments on behalf of the indirect participant. We will come back later to correspondent accounts. So just keep reading the posts and your patience will be rewarded. 🙂

Even if the CSM exchanges transactions only with DPs, it has the information about all indirect participants represented by a DP. The clearing system uses that information to route to the DP the transactions where the receiving bank is the IP. The payment transactions ultimately reach the indirect participant. The money however will be debited or credited by the CSM on the DP account. It is the DP responsibility to collect the funds from or give them to its IP.

Why become an indirect participant to a CSM?

Now why would a bank choose to be an indirect participant? In summary, there are two main reasons for that: cost and speed. First, becoming direct participant and setting up a connection to a CSM imply to carry out important projects. Without a minimal volume of transactions, there is no return on investment. Indirect participants are most of the time smaller banks which use the services of bigger banks to exchange their transactions. Thus they can save the costs for running and maintaining a direct connection to a CSM. But a big bank with multiple subsidiaries in many SEPA countries can choose to have one direct participant and many indirect participants to lower the cost as well. Subsidiaries of that big bank can be of important size. But they remain indirect participants because the Bank Group has decided to have only one direct participant. The other reason is that it is easier and faster to establish a connection to a direct participant than to a CSM. A big American bank which creates a subsidiary in a SEPA country for example, may choose to start as an indirect participant and only builds its own connection to the CSM later.

Since indirect participants use the services of direct participants to access the clearing system, direct participants have the opportunity to get some revenue from their direct connection. But a direct participant must ensure a good level of quality and service to gain indirect participants as customers. There is theoretically no limit to the number of indirect participants that a direct participant can have. This makes the competition even tougher.

To conclude this paragraph, I want to stress the importance of understanding that indirect participants are banks like the others. They have their own customers and channels. They have their own IT systems. And please do not associate indirect participants with small size or direct participants with big size. A small bank can become a direct participant and a big bank can choose to be an indirect participant. Keep in mind that an indirect participant can connect to a CSM only through a direct participant.

Now let’s come back to the four corner model which consists of End parties, Banks and CSMs. The last articles were about clearing and settlement. Now we will consider the end parties. Who and what are these end parties? What are their needs? Read the next articles …

For your information, we have created an online course where Clearing and Settlement and other important notions like Payments Systems Models, The Four Corner Model, Payment messages standards, Payment processing value chain, Basics of domestic and international payments, … are presented and explained in a very simple manner. Click here and get an overview of the Payments Fundamentals Course.

Jean, I have started reading your articles recently. Big kudos for your explanation.

Just a small query

1) how is the Liquidity and credit risks managed for the Indirect participants? Does the Direct participants is accountable to manage the risks which might occur from its Indirect participants or CSM?

Thanks,

Hi Venu, thank you for your appreciation.

The direct participant is accountable to manage the risk that might occur from its Indirect participants.

In practice, an Indirect participant opens an account with a direct participant and puts some money on it. Before sending debit transactions on behalf of the IP, the DP will take the money from that account. In case of Not sufficient funds on that account, the DP rejects the transaction. For credit transactions, the DP credits the IP’s account and forwards the transaction. I hope it clarifies.

Yes Jean its clear now. Appreciate your support.

Hi Mr.jean

I have enquire about what the type of risk that related to indierct participant in payment systems from central bank perspective?

Hi Hassan, the issue is the liquidity. How to make sure that the Indirect Participant has enough liquidity to fulfill its financial obligations? That is normally the business of the direct participant. The DP must ensure that the IP has enough fund before sending debit payments because the central bank sees the DP even if the payments is for the IP. The Central bank oversees the DP as a whole. It does not really handle with the IP. I hope this helps.

Hi Jean,

How does signing up for the scheme work with DP and IP?

If DP is signed up for cycle 00 in SCT and IP is not interested in cycle 00, how does it work?

can IP receive cycle 00 files from CSM even though they didnt sign up for that cycle?

and also will CSM accept cycle 00 files from IP (via DP) too?

Q: If DP is signed up for cycle 00 in SCT and IP is not interested in cycle 00, how does it work?

A: The DP will receive the cycle 00 transactions, but will not send anything to the IP. The time when the IP receives the files from DP is completely independent from the cycles. The DP can receive the files during the whole day and forward them to the IP only one time at the end of the day. Or two / three times a day.

Q: can IP receive cycle 00 files from CSM even though they didnt sign up for that cycle?

A: As far as I know, only the DP can sign up for the cycles. IP and DP agree on the times when the DP forwards transactions to the IP.

Q: and also will CSM accept cycle 00 files from IP (via DP) too?

A: In classic SEPA, only DP can send/receive files from CSM. In the SCT Inst, you have some IP that are directly connected to the CSM. But there is no cycle there as files are exchanged immediately.

Let me know if you have further questions.

Hi Jean Paul

Really great blog, easy to read and understand. I will not read the rule book, for me it is not readable 🙂

Thank you very much!!!

Hi Jean,

I have a question.

If a bank is an indirect participant in RTGS of the country where it operates, does this mean that the bank is not connected at all to the central bank of the country?

Hi Anjana, the answer is NO. All banks have an account with the central bank of their country. This is necessary for the central bank to play its role as overseer of the banking system. Direct participation just means a bank uses another bank to exchange transactions with the RTGS and for settlement.

Both direct and indirect participant generally exchange funds among themselves through their central bank accounts. Connecting to a RTGS requires to set up, manage and run a complex infrastructure. Unless a bank has enough volumes, it is not interesting to do that. So it prefers to use the services of a direct participant.

How we can identify pacs008 fields for the sending payment from one direct participant ? and same for sending payment from one indirect participant?

Hi Raviprasad,

In a Direct participant payment, Instructing Agent is the Direct Participant, Debtor Agent is the direct participant.

In a Indirect participant payment, Instructing Agent is the Direct Participant, Debtor Agent is the indirect participant.

hi Jean Paul

if im an indirect participant through a bank X, can I also make sepa payment through bank Y? technically it is allowed, but is it allowed?

many tnanks

fred

Hi Jean Paul,

Thanks for the great content! It really helps simplify many concepts. My query is around access to information:

a) Does indirect participant have access to information directly from CSM, even though funds flow may be through the DP?

b) Is it for this information that BIC becomes relevant? And is it mandatory for the indirect participant to have its own BIC rather than using DP’s BIC – in case of SEPA scheme?

Thanks!

Does the Indirect participant / correspondent bank (if addressable BIC in t2 directory) send the payment to the Direct Participant and Direct Participant forwards the payment to scheme (say T2)

Dear Jean,

I have a tough question. Is there a way for my bank as a correspondent bank to identify/distinguish payments from indirect participant clients versus correspondent banking clients? I ask because these are treated differently in terms of AML monitoring.

I would think that IPs only instruct in their own name with MT202s. Is this the case, or can they also send MT103/MT202COV payments on behalf of underlying clients?

Is there some kind of message formatting we can require from the IP that differs from CBK payments?

I always find your replies inciteful and easy to understand. This is the mark of a true expert.

Best regards,

Marc GORR

[…] Direct Indirect Participation […]