In the Four Corner Model for card payments, the main players are the Cardholder, the Issuer, the Merchant and the Acquirer. Often you read or hear about other players like Payment Gateways or Payment Processors which are not listed among the main four. You may then wonder what they are and what roles they play in card transactions.

This article is about payment processors. A previous article was written on payment gateways (Click on the link if you want to know more about that topic). In the following, we will focus on payment processors. First, we will define what they are and then we will see when and how they are involved in card payment transactions. Pictures will be used of course. 🙂

A processor is a company providing payment services, that is chosen by a merchant to handle his payment transactions from stores or e-commerce websites. As we saw already, merchant bank generally offers payment acceptance solutions to their customers. Merchants may not want to use solutions provided by their bank. They are not obliged to and that is good since competition sometimes has cheaper and more suitable solutions for their particular needs. Merchants will then turn to a payment processor.

A payment processor usually equips the merchant by providing the payment card machines and other equipment necessary to accept card payments. To an e-merchant, the payment processor may provide a payment gateway or connect to a gateway selected by the merchant. In any case, the payment processor executes the transaction by transmitting data from the merchant to the card network, issuing and acquiring banks and clearing systems when necessary.

Let’s consider a card present transaction initiated in a shop. The merchant has an agreement with a payment processor to accept and process card transactions.

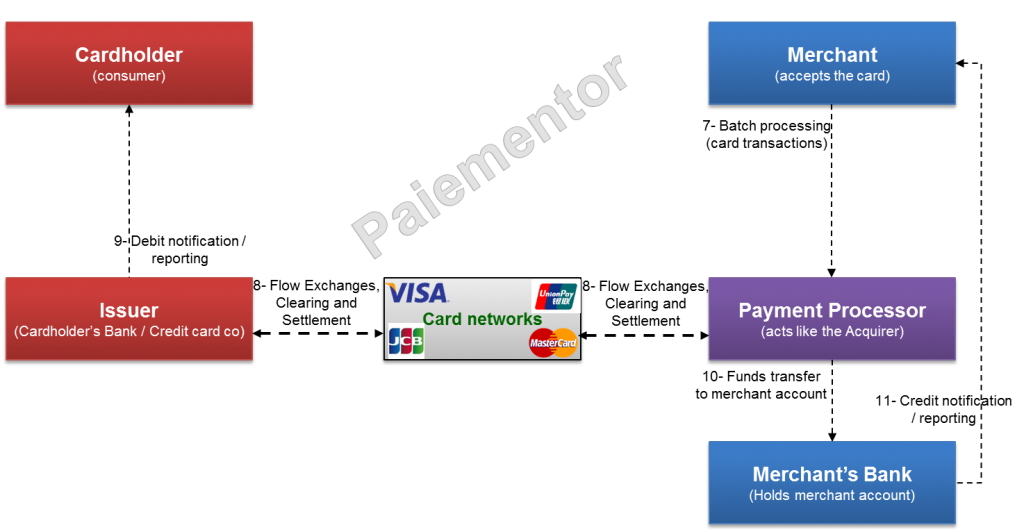

Steps 1 to 6 are explained in detail in a previous article. What do we observe? The payment processor acts like the acquirer for the authorization. The authorization request is transmitted from the POS Terminal to the Payment Processor, which then forwards it to the issuer through the card network. The issuer sends the response back to the payment processor through the card network and the payment processor forwards it to the merchant’s POS terminal. Take note that the merchant’s bank is not involved at all in the process. How then will the money end up in the merchant account?

Let’s consider the second part of card transaction processing: the settlement and transfer of funds. Here there are two possibilities: Either the payment processor clears and settles the transactions itself or it forwards the transactions to the merchant bank which then takes care of clearing and settlement.

Option 1 – Payment processor clears and settles the transactions itself

The merchant sends all transaction records that have been stored in the POS terminal to the payment processor. The payment processor forwards them to the issuing banks through the different card networks to collect the funds. After settlement, the payment processor’s account (with a bank generally) is credited. The Payment processor takes the fees and initiates a transfer to credit the merchant account with his Bank. It is interesting to note that some payment processors keep the money in their system and let the merchant initiate the transfer himself when he likes.

We see that the merchant’s bank almost does not intervene in the transaction. It is involved really at the end when the payment processor moves the money from his account to the merchant account. So the payment processor carries out all the duties of the acquirer in this configuration. Things are quite different in the second option.

Option 2 – Payment processor forwards the transaction to the merchant bank which then takes care of clearing and settlement

In this configuration, the merchant bank takes the acquirer’s role. The payment processor forwards the transaction records received from the merchant to the acquirer. The merchant’s bank performs the clearing and settlement after which it credits the merchant’s account.

In option 1, the payment processor perceives more fees since it does more by collecting and transferring the funds. In option 2, the payment processor negotiates specific conditions with the merchant bank based on the volumes of transactions that it can deliver. But the merchant bank does deduct some fees on transactions amount as well. So the fees and commissions paid by the merchant are shared between the processor and the merchant’s bank.

Hi, this is a nice article.

I’d like to ask where a payment gateway exists in the diagram for option 2 in online transactions. For example, when a customer makes an online purchase, will the initial flow of data be like:

Merchant -> Payment Gateway (acts as the POS terminal), eg PayPal -> Payment Processor, eg. PayPal -> Merchant’s Bank -> Card Network -> …

Hi, Thank you.

You are right. But Paypal’s model is the option 1. So Paypal sends the card transactions over the network itself.

If it was working like option 2, then what you wrote is completely right.

Some new questions also are, in the other articles you mentioned that a multilateral clearing takes place at a “CSM” twice a day.

1) In Option 2, does the Payment Processor wait until the next multilateral clearing? Doesn’t it act as a bank in that way?

2) If the clearing at the “CSM” (eg. ACH) happens twice per day, when is the settlement happening then? Right next to the clearing?

Thank you

Hi, answers to your questions

1) In option 2, the payment processor forwards the transactions and the bank takes cares of the clearing.

In option 1, the payment processor takes care of the clearing. So it must be participant to the Interbank clearing network and therefore acts like a bank.

2) The settlement always happens after clearing. Otherwise there is no interest to clear.

I hope it clarifies.

Thank you

Is Payment gateway & payment processor same