As payments payments professionals, we are sooner or later confronted with this question: Do you know Cash Management and the payment messages involved? When I was asked that question the first time, I was a bit puzzled even if I later realized that it is not rocket science. In fact, if you are a payment professional, you already know quite a lot about cash management than you think.

To underscore that point of view, this article will present and explain the key concepts of Cash Management and provide definitions from perspectives of individuals, companies and banks. The main objective of this post is to demystify Cash Management and enable you to talk about the related topics with more confidence and clarity. So read until the end!

General definition of Cash Management

Simply put, Cash management is about the effective management of Cash in any entity or organization. Nowadays, Cash (or money) exists in physical form (notes and coins) and in electronic form on bank accounts. Cash is used as the counterpart in almost all exchanges of goods and services. That is why we all need cash and therefore must manage it. So every one, every family, every company, must do Cash Management. If done well, the individual or entity can prosper and even make a fortune. 🙂 If done poorly, bad things happen. Cash management is therefore a crucial topic. In the following, we present cash management and what it means for individuals, corporations and banks. This will allow us to highlight the needs and differences of these players and hopefully provide a pretty good introduction and understanding of the topic.

Cash Management for Individuals

How do you generate cash or simply how do you make money? Like the vast majority of people, you probably work for a company and get a salary every month. That money is credited on your bank account. After receiving the money, you use it to pay rent, food and other bills. If you spend more money than you get, sooner or later, you will fare badly. But If you manage your cash carefully (meaning you spend less money than you make), you will have a cash surplus that you can use for investment or for important projects like buying a house.

How many bank accounts do you have? One / two / three current account(s), one / two saving account(s), One / two share accounts … It seems that the more bank accounts you have, the better off you are financially. So be happy if that is your case. 🙂 But having many bank accounts does bring some challenges:

- You must generally pay fees for using bank accounts. The more accounts you have, the more fees you have to pay. So you don’t want to open an account unless you are sure you really need it.

- Your money is at different places and you need to look at all these places to get a consolidated view of your cash. In certain case, you may need to transfer money from one account to another, so that the balance does not become negative and for other purposes.

Despite all that, Cash management remains pretty simple for individuals compared to companies and banks. Individuals have a very limited number of accounts and they make and receive a limited number of payments. Things are very different for companies as we see in the next paragraph.

Cash Management for Businesses

The company you work for, like any other company, must generate cash. The cash is used to pay raw materials, taxes, salaries, rents and other charges. There are different types of companies :

- small-sized enterprise

- medium-sized enterprise

- big-sized or Large enterprise

Furthermore a company can operate in one country only or in multiple countries with potentially different currencies.

Companies, unlike individuals, can make money (so receive payments) every single day in exchange of goods and services they sell. They issue payments regularly, almost daily, to meet different obligations.

Basically, like individuals, a company must spend less money than it makes. But the amount of information to be processed for a business is much greater. A company can have dozens of accounts in many countries and in different currencies. Remember the issues mentionned above for individuals with many bank accounts. The companies have fundamentaly the same problems: Where is the cash? Does the company pay too much bank fees? How to reduce the fees? How can the company get a consolidated view of the cash easier and faster? If there is a cash surplus, what to do with it? How to optimize the usage of cash? and so on.

Companies check their cash status frequently, almost daily. If at any time, because of a lack of cash, a company cannot fulfill an obligation when it is due, then it is insolvent. Insolvency is the primary reason companies go bankrupt. Obviously, the prospect of such terrible consequence compels companies to manage their cash with extreme care.

Cash Management and the size of the business

When a company reaches a certain size, managing the cash manually become too cumbersome and risky. To pay on time and get the information necessary to manage their cash, companies rely on software solutions to send payment instructions to banks and receive payment reporting in a secure way. They implement Treasury Management Systems (TMS) and establish secure links to one or many banks. The Enterprise Resource Planning (ERP), where payment instructions are generated, is usually interfaced with the TMS. So Technology has a huge impact on Cash Management. And the bigger the size of the company, the more crucial Technology becomes.

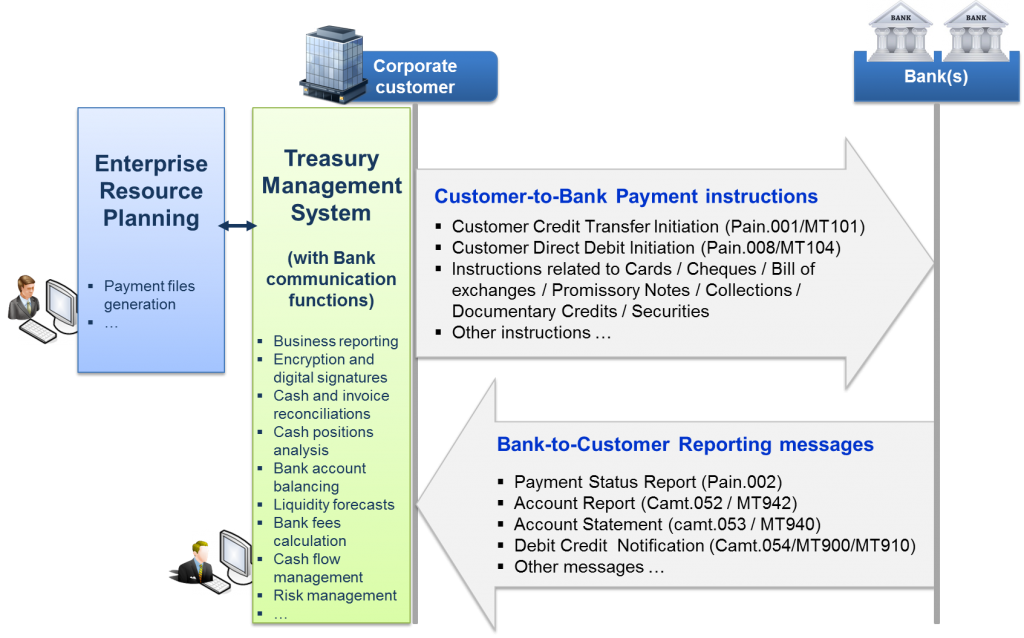

Below is a simplified representation of the inteconnections between banks and a corporate customer. The compnay has implemented a ERP and a TMS.

The ERP generates payments files like Pain.001 (SCT) or MT101 and Pain.008 (SDD) that go through the TMS and then to the banks. The TMS plays the role of a Bank communication software. It send payment instructions file to the banks and receive reporting messages from the banks (Camt.053, MT940 and Camt.054 for example). So we are in the the Customer-to-Bank Space and we realize that Cash Management payment messages are simply the messages exchanged in the Customer-to-bank space. That is pretty interesting and you probably knew it already.

[box type=”info” style=”rounded”]Cash Management payment messages are the messages exchanged in the Customer-to-Bank Space.[/box]

As Payments and Cash management professionals, we speak a lot about the messages exchanged between companies and banks. But it is important to remember that Cash Management is not about the exchange of payment messages. Exchanging messages is of course essential for controlling and managing cash, but it is not an end in itself. The company still have to make the right choices and decisions for the effective management of the cash. And as you can see on the above picture, there are many other functions in in the TMS that important for the Cash Management.

This brings us to the definition of Cash management for businesses. Cash management for companies has to do with the collection, concentration, and disbursement of cash including measuring the level of liquidity, managing the cash balance, and short-term investments. Companies implement the proper tools to carry out their Cash management in an effective way. Efficient cash management means more than just preventing bankruptcy. It should improve the profitability and reduces the risk the firm is exposed to.

Scope and objectives of cash management for companies

The cash management scope includes the following key processes and activities:

- Daily liquidity management – A consolidated view of the available liquidity is crucial for decision-making.

- Control of account balances – Negative balances should be avoided as they incur costs.

- Payments (current and future) – Payments must be instructed on time, not too early and not too late, to avoid possible late penalties and maintain a good relationship with suppliers and employees.

- Collections (current and future) – Account receivables must be collected as quickly as possible.

- Short-term investments (less than a year) – In case of cash surplus, the funds should be invested to avoid “idle cash”.

- Short-term credits (less than one year) – They are practical to avoid insolvency and must be anticipated.

An effective Cash Management should enable a company to achieve many objectives, among which we can cite:

- Liquidity risk management: being able to meet its deadlines

- Compliance with local and international regulation

- Cost savings: choose the cheapest means of payment by making the competition play between banks

- Strengthening the balance sheet: optimizing the Working Capital Requirement (WCR)

- Improving customer / supplier relationships: secure and timely payments.

Cash management matters to companies and banks have long understood that, but not as they do today …

Cash Management for Banks

As already mentionned above, the majority of money available is kept on bank accounts. Banks hold the accounts and provide the means of payments to credit and debit them. And if we consider Cash Management as the management of accounts and payment and collection flows, it is easy to say that cash management is ultimately as old as the bank itself. But nowadays banks consider those activities more as payments services than Cash management services.

Up until the early 2000, Financial institutions focused merely on providing technical solutions by adapting to the technical environment (Moving from paper to floppy disk, and then to electronic files exchanges). So the development of cash management services is pretty recent. It started when banks realized that their corporate customers had other needs and requirements that were not addressed if they solely provided payments services. Furthermore, by providing these value-added services, banks can develop a more intimate relationship with their corporate customers, generate more revenues and better manage the risks.

What is Cash Management for a Bank?

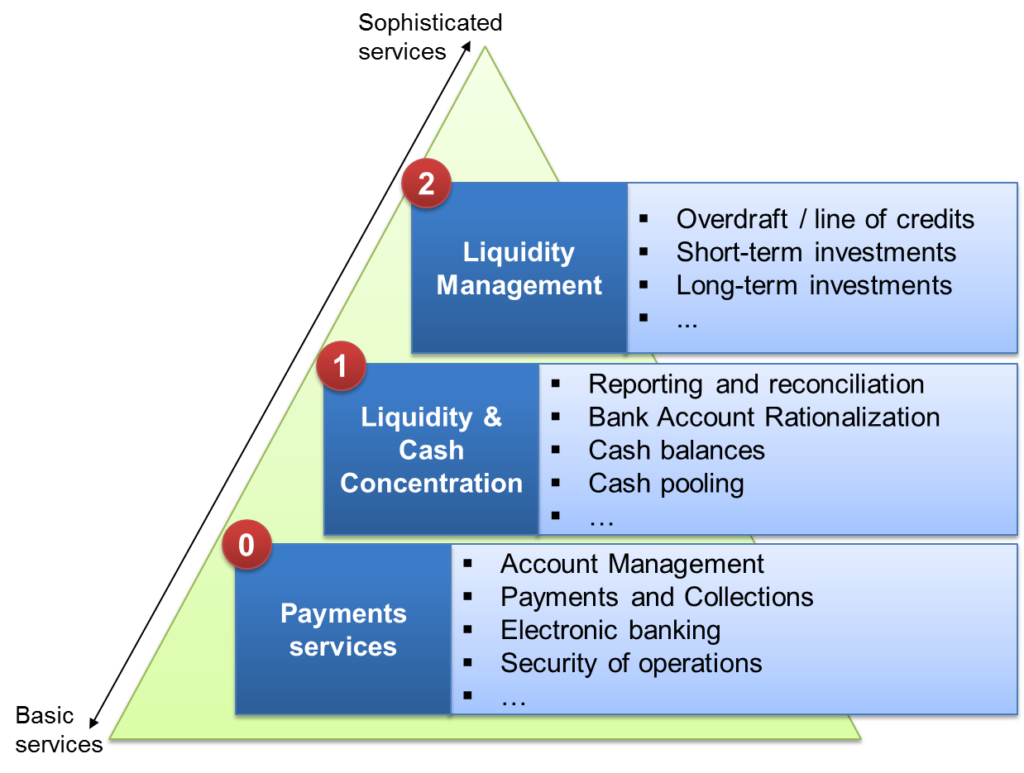

Cash Management, from the bank perpective, is the set of products and services that they develop to give corporate treasurers and chiefs financial officers (CFO) the means to control their payments flows and manage their liquidity. When bankers speak of Cash Management, they are referring to a specific line of business for the bank, which sells products and services to corporations to assist them in their cash management activities. Below is a diagram to illustrate the types of services that are part of a Cash Management offerings.

Payments services (Account management, effecting payments and collections) are considered as basic services. The customers expect to access these services anywhere and anytime through secure electronic banking channels. But that is not enough for businesses. Corporations want to know how much liquidity is really available and make sure it is where it is supposed to be. That is achieved through value-added services like customized reportings, cash balances and cash pooling. Cash balance is about moving liquidity to from an account with positive balance to an account with negative balance and therefore avoid overdraft fees. Cash Pooling allows companies holding funds at many financial institutions to combine their credit and debit positions in various accounts into one account, and includes techniques like Zero-Balancing, Target-Balancing or Notional Cash Pooling.

Once the liquidity position has been established, the money must be placed in the event of a surplus or the appropriate credit must be used in the event of a deficit.

Corporate treasurers: main customers of cash management services

Banks are the main providers of Cash Management services and their primary customers are the corporate treasurers. The corporate treasurer is at the heart of the activity of any business and must collaborate with many departments to carry out his duty: Accounting, Sales, Procurement, Human ressources, Compliance, Finance, Information Technology, etc. Each company is unique and has specific needs that the bank must understand to offer relevant services.

That is the reason why banks offering Cash Management services have employees, called Cash Management Consultant or Cash Management Sales, whose objective is among others:

- to perform an overall analysis of the organization of payments and liquidity management in a company

- to discuss ways of improving working capital requirement

- and to offer advice on diverse and varied issues impacting the corporate treasurer.

That customer intimacy has enabled banks to innovate and create more and more services.

In conclusion, Cash Management has different meaning for individuals, companies and banks. But it is grounded on a principle that we all know: You should spend less money than you make. Companies implement Treasury systems to securely exchange payment messages with the bank, so that they can gather the information faster and analyze it to make better management decision. Banks provide services for businesses to enable them to optimize and better manage their cash flow. In the following articles we look at some of these services.

Hello dear good article and as you mentioned, just wanted to check why you didn’t include the central bank cash management! I think this will be more comprehensive if don.

Thanks