Well, year 2019 has just passed on the baton to 2020 and we have wrapped up the decade with a lot of technological advances. Past decade has seen a considerable phase shift in terms of technology; and I have to say Blockchain is one the biggest breakthrough that has been achieved. Although invented in 2008, industry has realised its true potential in this decade. And the question is – have we even unlocked 10% of it? I will let that question unanswered as its parallel to our area of focus in this blog, but it surely will lead us to a better view of the untapped Blockchain potential.

This blog aims at simplifying the terminologies and operation of a Blockchain and serves as a platform to understand the basic usage of Blockchain in Transaction Banking. Welcome to Blockchain explained and its application to payments.

Blockchain explained: what is a Blockchain?

A lot of my friends and colleagues have recently asked me to explain them Blockchain in the simplest way possible. So, let us start with a basic definition of Blockchain.

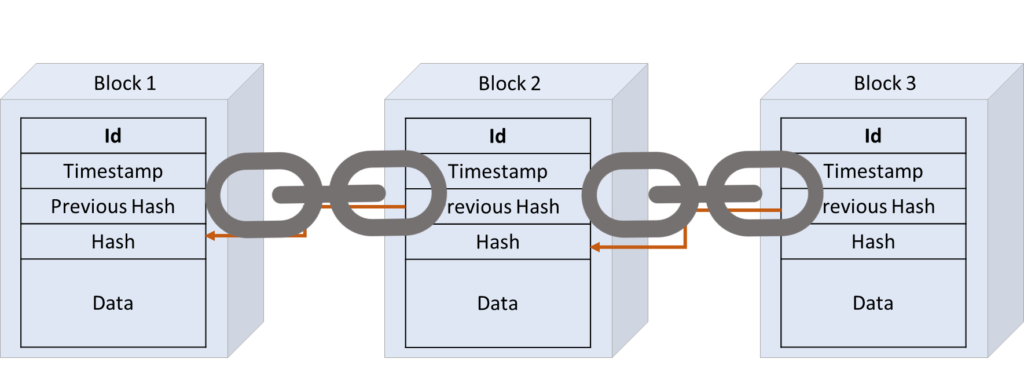

[box type=”tick” size=”large” style=”rounded”]Blockchain, simply put, is a chain of records which are called blocks that are linked to each other with secured encryption methods. These blocks keep on growing while maintaining cryptographic information, timestamp and actual data. This feature makes the Blockchain a series of immutable records.[/box]

A Blockchain at an initial stage is a closed group of participants who agree to share data which is always transparent and known to all of them. These participants share the information on the network which is accessible by all the other participants at the same time. Thus, making Blockchain a collection or database of information chunks or blocks which are linked to each other in a secured manner. Information recorded can be of any form; It can be a simple money transfer (transaction) between two parties, an agreement for goods transfer between 2 parties, addition of police records for citizens, transfer of titles or even as small as information about one particular flavour of Ice cream for a multinational dairy chain. So, what distinguishes Blockchain from the traditional data management systems? This can be easily understood with the following characteristics of a Blockchain:

- Information is always added with Secured Hash (linked to the previous block), Unique identity and Timestamp.

- Any participant on the Blockchain can view the ledger (or blocks) of transactions.

- Information added cannot be altered by anyone at any point of time.

Now that we have defined a Blockchain and we are “somewhat” aware of the basic terms, let us move on to understand how it is useful in the world of financial payments.

Blockchain explained: the application to cross-border payments

Financial data is considered to be one of the most valuable data in the world. We don’t want our bank balances to be scattered over internet, do we? One such key application in Financial services that can prove to be a gamechanger if utilising Blockchain is – Transaction Banking or simply put Payment transfers.

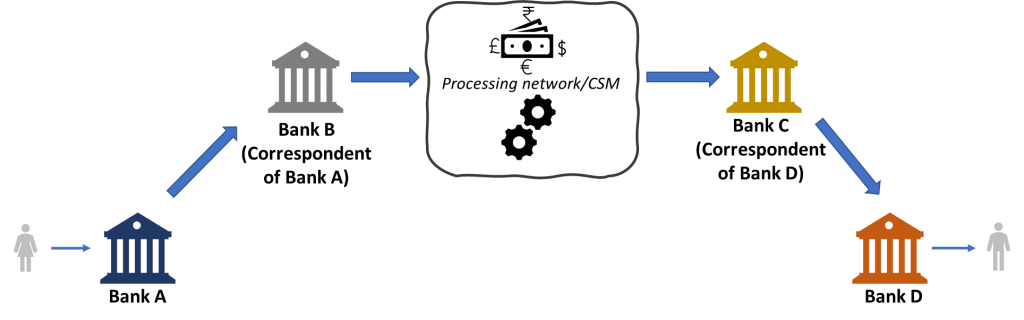

The current model for effecting cross-border payments involves many intermediaries.

Traditional cross-border payments usually take 1 or more days to finally credit the beneficiary customer since it involves several intermediary agents. With Blockchain – it can be achieved in seconds!

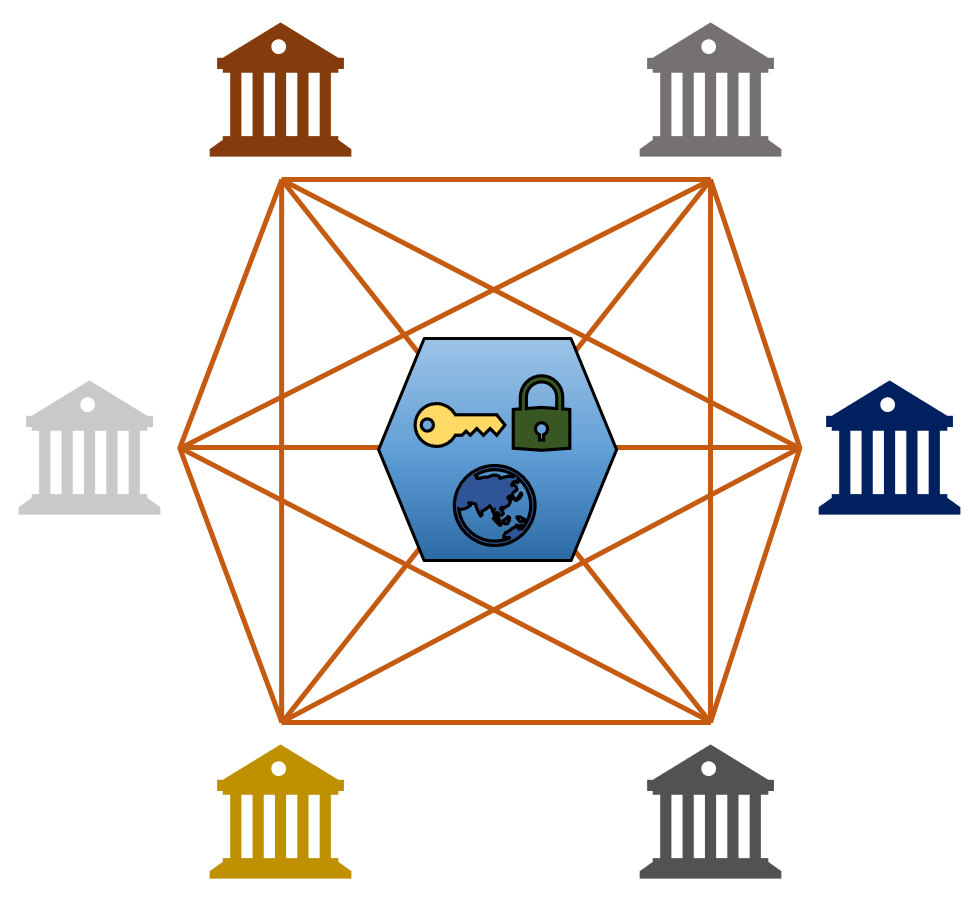

A blockchain network is a meshed network.

With Blockchain, each participant will be connected to the blockchain network and will be able to connect/talk to every other participant.

Now let us go a little bit further and understand how a payment will be processed via Blockchain and how it will be different to the traditional approach. In this step we will also try to shed some light on the term “Distributed Ledger”.

Distributed Ledger refers to secured, replicated and synchronised digital data that is spread across geographies (multiples countries, sites or institutions). In simple terms it means everyone on the network has a real time copy of the data and is able to witness any change on the data instantly. When distributed ledger term applies to transaction baking or payments – it refers to information related to accounts, account balances and account transactions. Now it will make more sense to imagine how a Blockchain can help achieve a distributed ledger. DLT – Distributed Ledger Technology.

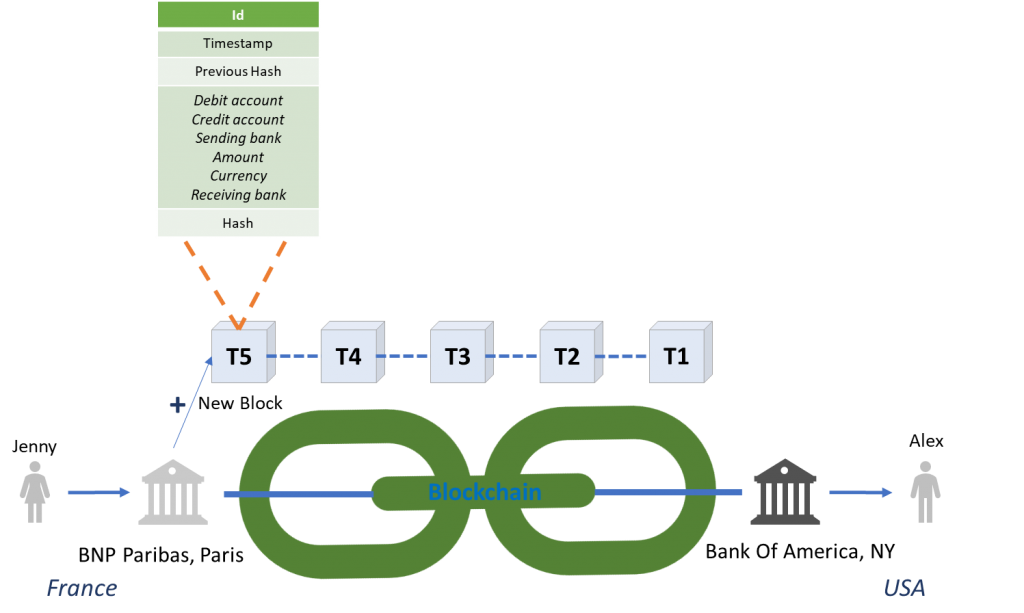

Blockchain explained: How a payment would be done using Blockchain/DLT?

Let us take a simple example where Jenny form France is trying to send 1000,00 EUR from BNP Paribas, Paris to Alex who has an USD account with Bank of America, New York Branch. Using a traditional approach, this payment would ideally be sent by BNPP Paris to its Correspondent in USA which would then forward this payment BofA via the Fedwire/CHIPS system. Thus, the time taken for settling this payment would indeed be affected by the multiple hops involved in the process.

Switching on to a Blockchain, where both BNP Paribas and BofA are part of the Secured Blockchain and hold a Distributed ledger, its just a matter of new transaction being added to the chain. Now, as Jenny requests BNP for the transfer, BNP creates a record of this transaction which has details like:

- Timestamp

- Debit account

- Credit account

- Sending bank

- Amount

- Currency

- Receiving bank

Then BNP places this record on to the chain with required encryption (hash). As soon as the record is added on to the chain, its validated by each node (participant) with their key for integrity and the block is finalised. Block now contains the information that is accessible by all participants and denotes that Jenny from BNP Paris, is trying to send money to Alex who has account with BofA. In turn the receiving bank – BofA instantly initiates the accounting at their end where in customer account is credited with the required amount. Thus, finalising this payment within 5-6 seconds.

After a block is added, the immutable property of a Blockchain makes it impossible to alter any information on the block thus making it highly secured and uncompromised.

Talking about robustness, a Blockchain relies heavily on the underlying algorithm, which is basically the foundation that controls the complete functioning. There are a variety of different algorithms currently in market that help us build a robust Blockchain. Consequently, making a Blockchain capable of handling huge volumes easily with 100% accuracy – all this in a secured environment. Some key advantages of using Blockchain for payments are listed below:

Advantages of using Blockchain for payments

- Realtime – Payment transfers are completed within seconds, in turn helping the beneficiaries with early access and better utilisation of funds.

- Low cost – Reduction in number of intermediaries reduces the Fees applied on the payment and hence is beneficial to the customers and Financial institutes.

- Secured – Immutable nature of Blockchain makes the transaction tamper proof- eliminating the risk of any cyber-crime.

- Unambiguous – Since Blockchain stores unique records, there is no ambiguity or duplicate data present on the chain.

- Transparent – One of the key advantages which enables all the participants to view all the records without any concealment of information.

Current market status

Blockchain for payments adoption has already begun with a lot of FinTechs jumping the DLT bandwagon. IBM has already introduced a Cross-Border payments solution using Stellar Protocol, called as IBM WorldWire. Major banks like Bank of America, HSBC, RBC, Rabobank, ANZ, SBI and Barclays have already planned/begun initial trials of their Blockchain based payment systems. Tech companies like Ripple Labs Inc. have already placed their Ripple protocol-based payment RTGS systems in the market. Ripple makes use of their cryptocurrency XRP to achieve a decentralised ledger.

Thus, looking at the immense potential that Blockchain has, it becomes imperative to include more and more use case for its application in different work areas. Feel free to share the different scenarios that you think can really be a great use cases for Blockchain based usage. Also, we appreciate any review comments, queries or any additional discussions that you would like to have regarding payments and Blockchain.

This article is a great contribution of Praveen Bhosale, a Blockchain enthusiast. Thank you.

Well it is interesting to know about block chain and thanks for sharing the information, i have few queries below

1.Is there BKE (Bilateral key exchange) is done?

2.How the settlement is done?

3.How the compliance check is done if payment is credited within 5-6 seconds

Regards,

Irfan Mujawar

Thanks Irfan. Please find my response below:

1.Is there BKE (Bilateral key exchange) is done?

Similar to BKE, all the participants (called the nodes) in the Blockchain network are validated and have cryptographic keys to encrypt/decrypt the transaction information. Hence, all the participants in the network are aware of each other and if a new participant is added, everyone on the network becomes aware of it too.

2.How the settlement is done?

As mentioned in the article, there is a distributed ledger of transactions that is maintained by each participant and is updated upon processing of each transaction. Now, similar to current cross border settlements, accounting can done on the respective participant accounts that are maintained in the ledger. In case of CSM controlled Blockchain, the settlement will be handled by CSM. Settlement can be achieved in various ways – depending upon the Blockchain design.

3.How the compliance check is done if payment is credited within 5-6 seconds.

Good question! Currently the regulatory aspect of Blockchain is still under discussion and it remains a more private area for the participants. However, as the technology adoption will increase, regulatory checks like Sanctions would be in place similar to current behaviour. This again still wont affect the real time or near real time behaviour of the transaction processing.

Hope this answers your queries.

Thanks Praveen for your response..it really helps to understand the block chain.

Keept it up!!

well articulated information at one place… Keep it up

Thanks Pramod for the encouragement.

Who are actually participants in block-chain. specially in case of payment processing.

Hi Vikas,

The participants are Financial institutions (for e.g. Banks, CSM, Insurance firms etc.). All the participants will act as nodes of the network and will participate in transaction processing.

Good article. Thanks.

Few points want to understand.

(1) How is the confidentiality ensured in Blockchain, when each node gets to know about every single transaction?

(2) From a transaction point of view where debit and credit account are normally maintained directly/through correspondents, Does blockchain assumes that each node/participant has a business relationship with every other node/participant?

(3) Today there are multiple messaging formats in existence, but when blockchain is adopted, will it be one single structure/format or there would be variations region/country wise?

(4) Whether blockchain eliminates boundaries and have one single platform catering to local and global payment needs?

Thanks Deepak,

Please find my response below:

1. Transparency is one of the key attributes of a Blockchain. As a result, as you have already said, each node will know the details of the transaction. Although its not a limitation, work is currently going on in order to achieve control over confidential details present in the transaction.

2. Yes, in a Blockchain each node has a business relationship with every other node or participant. This makes the work easier w.r.t maintaining a distributed ledger. Accounting as I said in earlier comments, can be achieved in multiple ways using this distributed ledger, with each participant maintaining respective accounts of the fellow participants.

3. Very interesting question. Since Blockchain relies on the fundamentals of algorithms they use for processing, it will differ based on which algorithm is being used. Although we can universally maintain a standard format of transaction details to be shared and a standard format of the ledger, it will be a challenging task to bring everyone on the same page. It is ambitious, but not impossible.

4. Currently the usage restricts to the area of implementation and the readiness of participants. Partly answered in the above response, it is possible to have a widespread implementation (even involving Cross border and domestic payments). However, it is still a challenge. Organisations like SWIFT can take up this role in standardising the Blockchain networks for payments. Initially, SWIFT took some time as well, but its now the carrier for majority of the Cross Border payments. We can hope that the need for real time payments pushes this implementation at a higher pace.

Thanks,

Praveen

Hi Praveen and Jean Paul,

Thank you for your efforts in sharing knowledge.

My query is more on the adoption of blockchain by FI’s. How it’s been implemented within financial institutions and how are they coming together to form a blockchain network to make it happen?

For example if any banks wants to try testing payment transfer through blockchain what steps do they take and how do they do it?

Thanks for this articles. Its really helpful.

I have few questions though –

1. How will the scenario of confirmations (like MT199) or reversal transactions will be handled in blockchain ?

2. Will it mean that every bank (or a node) will have a direct relationship with another bank in some other part of world without having any need to have correspondent bank in between?

If yes, then will it be like one bank (suppose BNPP in Paris) will have to maintain lots of records or ledgers, even if they are not going to have frequent transactions with each other? hope i am clear with this question 🙂

If no, then how the information will reach the final bank?

Nice read Jean and Pravin

Hello Praveen, Team,

thank you very much for the very clear example detailed above. My question is around fees that banks currently charge on international payment (both for commercial and treasury flow). How would these model be impacted in terms of :

-how do bank charge their fee via bloackchain? Same as current model under OUR,SHA, BEN?

-Are balances still held at banks or would a Blockchain environment require a digital wallet held with these banks?

many thanks