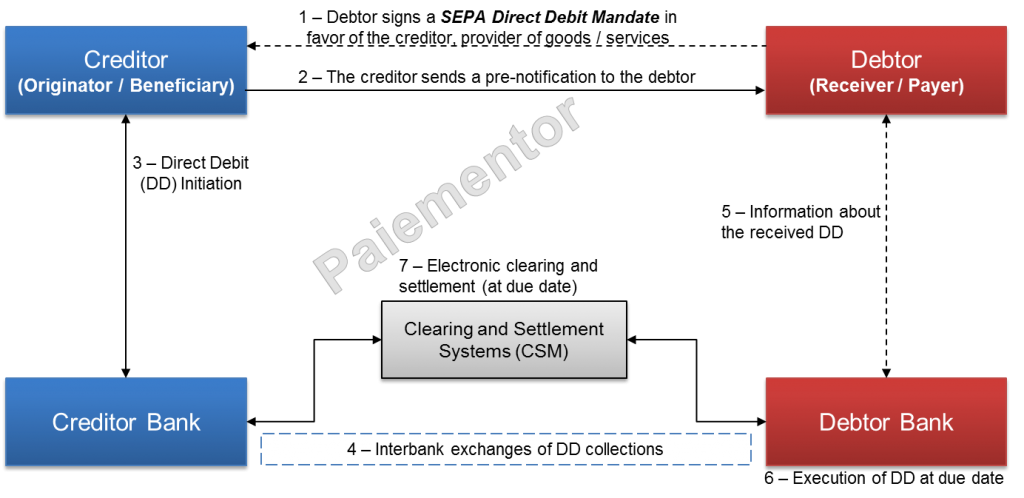

If you ever want to understand how a payment instrument works and specifically the SEPA Direct Debit, the place to start is to draw the Four Corner Model and to study it. In introductory articles, we analyzed the open loop model, which remains the most widespread payments system model in the world. The Four Corner Model is just an open loop model in its most simplified form. You get there by taking an open loop model and removing all the banks and their end parties except two banks. Two banks directly connected to their customers and interconnected through a Clearing and Settlement System make up the Four Corner Model.

This is the first article about the SEPA Direct Debit, a payment instrument used by companies (also called creditors or beneficiaries) to collect funds (receivables) from their customers (debtors). To quickly understand the SEPA Direct Debit and the underlying principles, the Four Corner Model will be presented as well as the main actors and their roles. The picture is depicted below.

On the left side, you see the Creditor and his Bank, the creditor Bank and the other side, there are the debtor and his Bank, the Debtor Bank. Both Creditor and Debtor banks are connected to the Clearing and Settlement Mechanism (CSM) in the middle. As mentioned in a previous article, the CSM plays a such a crucial role because of the importance of Clearing and Settlement in the interbank space.

The SEPA Direct Debit (SDD) is a pull transaction. The Creditor originates the transaction to take money from the Debtor. But when the creditor bank initiates the transaction, it does not know if the debtor has sufficient funds on his account to pay the creditor. As a result, the SDD can bounce, i.e. the debtor bank can reject it because of insufficient funds on the debtor account.

In the following we will look at the main steps involved in the exchange and processing of SDD and the roles of the different players.

1 – Debtor signs a SEPA Direct Debit Mandate in favor of the creditor, provider of goods / services

As first step, the debtor must sign a mandate allowing the creditor to collect funds from the debtor account. The Mandate is the formal approval given by the Debtor allowing the Creditor to collect future payments on his/her bank account. The signature can be provided either in written (paper-based mandate) or electronic form (e-mandate) and indicates that the debtor accepts to pay the Creditor for delivered goods and services.

A copy of the mandate must be kept as proof of the formal agreement given by the debtor. The mandate can be issued, kept and managed either by the Creditor (“creditor-driven” mandate flow) or by the debtor’s bank (“debtor-driven” mandate flow).

2 – The creditor sends a pre-notification to the debtor

The Creditor must inform the debtor upfront before debiting the debtor’s account. That is the pre-notification. In general, creditors send invoices and pre-notifications at the same time to save costs. Pre-notifications must reach the debtor many days before the first collection is presented. The timelines are defined in the SEPA Direct Debit Schemes. We will get back to that later.

3 – SEPA Direct Debit (SDD) Initiation

If the mandate is issued, signed and the pre-notification was sent on time, the Creditor can initiate the Direct Debit orders and send it to his/her Bank. This can be done through various means as agreed between the both parties: e-banking portal, batch files and so on. Small companies use phones or e-banking portals whereas large corporations send batch files to their banks.

4 – Interbank exchanges of SEPA Direct Debit collections

Both banks and the CSM are involved in this step. The Creditor bank receives the order from the creditor and performs some processing and controls. If everything is OK, the Creditor bank then forwards the orders to the CSM. The CSM, after receiving the order will do some check as well to ensure it can be processed. In case all the controls are positive, the order will be forwarded to the receiving debtor bank.

5 – Information about the received SEPA Direct Debit (DD)

The Debtor Bank may inform her/his customer (debtor) that it receives a direct debit to collect funds from his account. This step is optional. However, the pre-notification that was mentioned in Step 2 is mandatory. So the debtor knows upfront that the account will be debited. The debtor can then act upon that information and refuse the direct debit if necessary.

6 – Execution of SEPA Direct Debit (DD) at due date

The Debtor Bank executes the direct debit at due date. It simply means debiting the debtor account and making the funds available to the creditor bank. The creditor bank receives the funds through the CSM (after settlement at due date) and credits his customer, the creditor at due date as well.

7 – Electronic clearing and settlement (at due date)

The CSM does not process single Direct Debit collections, but many thousands and even millions on a specific due date. Note that the same bank can send collections (acting as Creditor Bank) and receive collections (acting as Debtor Bank) and the exchange of collections can happen with any bank that is connected to the Clearing System. At due date, the CSM computes the final position of all participants as result of the clearing mechanism. The final position can be either positive or negative. If it is positive, the participant will receive funds from the CSM. In case of negative position, the participant must transfer funds to the CSM. In any case, the sum of amounts exchanged among all participants is Zero.

This first analysis, that you can find in the first chapters of the SDD rulebooks, gives a high level view of the SEPA Direct Debit. But many questions remain unanswered: What type of information is exchanged between the different parties? What happens in case of exceptions? Which standards are applied? So we are only at the beginning of our journey and we still have many things to go through. Before going deeper, I think it is worth looking in detail at the creditor-driven mandate flow and debtor-driven mandate flow and then at the different SEPA Direct Debit Schemes. These will be the topics of the next articles.