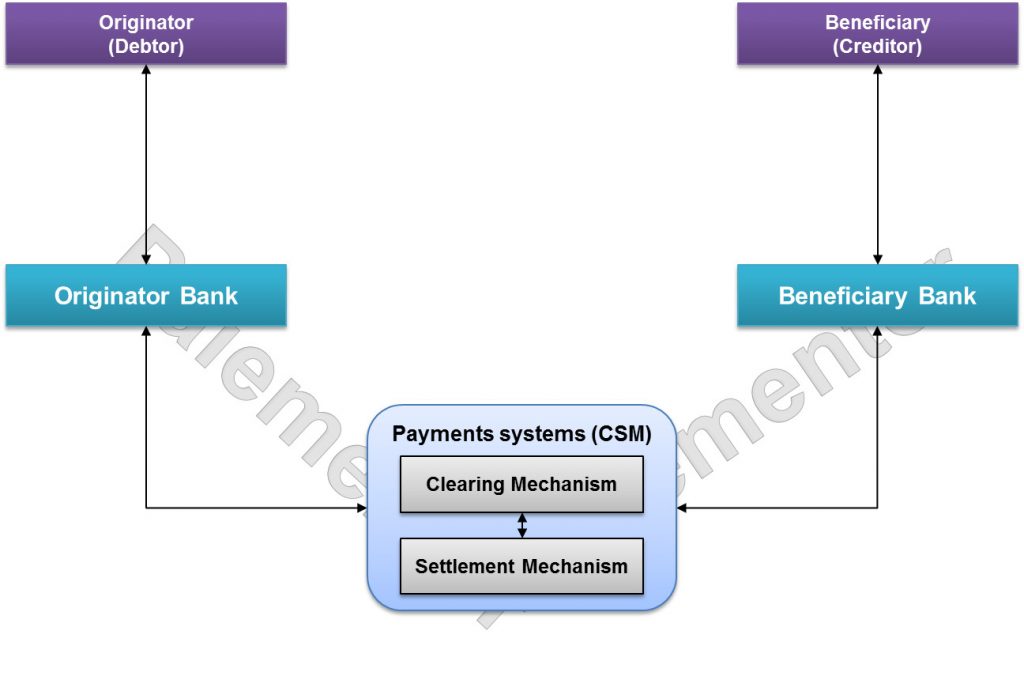

To easily understand this article, I would recommend that you go back to the previous article on payment systems models. Take one minute to reconsider the open loop payments system model. Look at the banks which play the roles of intermediaries between end parties and the payments system. Now remove all banks as well as their end parties from the diagram except two banks. For each of the two remaining banks, only one end party should be kept (the other ones should be removed). The result looks a bit like the picture below.

Here is what I want to underscore: The Four Corner Model is nothing but a simplified open loop model. The Four Corner Model is at the basis of the vast majority of traditional payments systems. It is called the Four Corner Model because four main actors participate in the processes of sending and receiving funds. In the following, we will consider the Four Corner Model for SEPA Credit Transfer (SCT). However the underlying principles remain the same for other types of payment instruments. For the SEPA Credit Transfer, the actors are: the originator or debtor, the originator bank, the beneficiary or creditor and the beneficiary bank.

The figure below depicts the Four Corner Model of the SEPA Credit Transfer with the main actors as it is presented in the SCT rulebooks. Here is briefly how it works: the Debtor originates a credit transfer by giving an order to his bank. The originator bank, after reception, makes the necessary checks to ensure that the order is complete and can be executed successfully. After the execution, the payment is sent to the clearing system (one of the payments systems), which after successful completion of its own checks and processing, forward it to the Beneficiary Bank. The Beneficiary bank informs its customer, the beneficiary, that his account has been credited.

We see that payment routing or switching is crucial in the network. When you have tens or hundreds of banks connected to the same payments system, it is important for each party to deliver the message to the correct recipient. Another critical feature is the payment verification. A payment message contains a lot of information. During processing, many checks should be performed to ensure that the payment is syntactically and semantically valid. If you regularly visit this blog, you will find out more about these checks later.

For now let’s consider the above diagram on the four corner model again. Doesn’t something draw your attention? What about the CSM box with Clearing and Settlement Mechanisms between the originator bank and the beneficiary bank? They seem to be completely overlooked in the model since they don’t belong to the “Four corners” mentioned before. However, they play a crucial role as we will see later.

Now let us look at the end parties: originator and beneficiary. The originator and the beneficiary are customers of the originator bank and beneficiary bank respectively. The same person can play the role of originator and beneficiary depending on him or her sending or receiving funds. This means that the same bank can play both the roles of originator bank and the beneficiary bank. The customers have different needs that banks must respond to by providing different kind of services. There are many types of customers: The private customer (also called consumer), the small and medium-sized business (SMB), the corporate customer (large company). Small banks may also be customers of bigger banks. Those customers are not playing on the same field and banks must adapt their products and services accordingly.

In conclusion, the Four Corner Model in itself is pretty simple and straight forward concept. There are four actors : the originator, the originator bank, the beneficiary bank and the beneficiary. Originator bank and beneficiary bank are connected through clearing and settlement mechanisms. Now the following questions arise: What are the Clearing and Settlement Mechanisms? What are the needs of the different types of customers and how do banks respond to those needs? These topics will be handled in the next articles.

For your information, I have published an ebook about SEPA Credit Transfer where the Four Corner Model and other topics like clearing, settlement, accounting, SEPA Payment messages, payment processing value chain, payment engines, … are handled in depth.

Below are the links on amazon (Check if the book is on the amazon site of your own country).

Kindle edition |

Paperback edition |

You can download the sample for free. Here is the link to download the sample of the SEPA Credit Transfer eBook.

You can watch the presentation and get the ebook on this page.

scope of gdpr / allied laws and sepa

t accounting implications and auddit procedures

[…] 4 corner Model […]