Clearing and settlement mechanisms play a major role in the interbank exchanges of payments. They can be considered as the cornerstone of payments systems in a monetary zone. Therefore it is important to understand what they are and why they are so crucial. In this article and the next, I will present you these concepts step by step so that you can easily understand them and teach them to others.

Although generally mentioned together, Clearing and Settlement are two completely different things. In the following, we first define clearing and illustrate it with some examples.

What is (bilateral) Clearing?

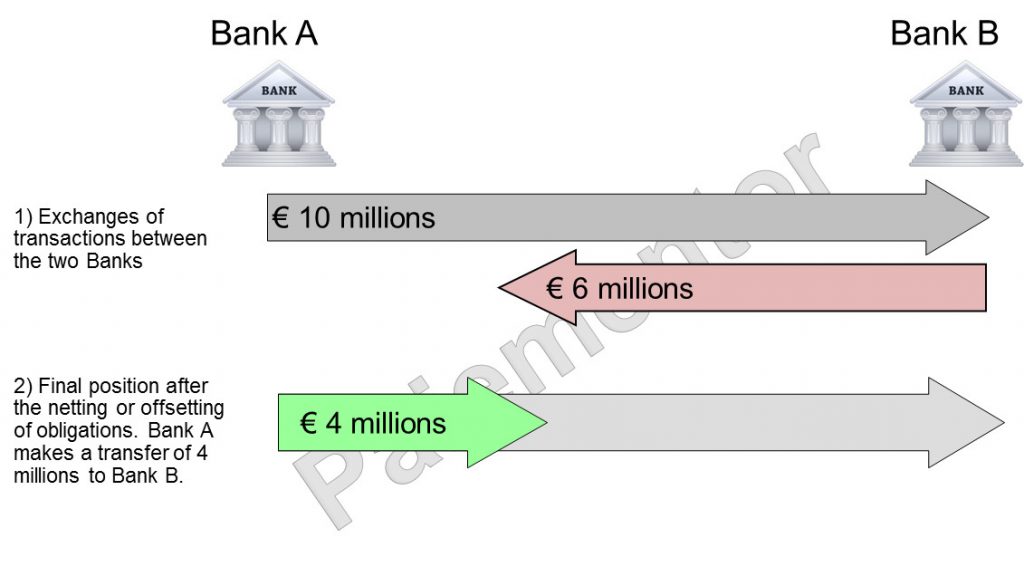

The Bank for International Settlements (BIS) defines the term clearing as the process of transmitting, reconciling and, in some cases, confirming transactions prior to settlement, including the netting of transactions and the establishment of final positions for settlement. The key word in this definition is the word netting, which is seen by the BIS as the offsetting of obligations between or among participants in the netting arrangement, thereby reducing the number and value of payments or deliveries needed to settle a set of transactions.

It takes at least two actors for the establishment of a clearing mechanism and the required netting process. When there are exactly two participants, we talk about bilateral clearing. If there are more than two participants, it is called multilateral clearing. Two Banks or a group of banks may decide to establish clearing among themselves without going through an interbank system.

To start with the basics, we will take the example of bilateral clearing. Bilateral clearing is the simplest case, since only two participants are involved. Imagine that the two participants are you and me and we have to originate credit transfers because we live far away from each other. If you owe me 100 € and I owe you 25 €, then there are two options to resolve our debts with credit transfers:

- You can make a transfer of 100 € from your account to my account and I can make a transfer of 25 € from my account to your account.

- Or you can make only one transfer of 75 € (100 € – 25 €) to my account and everyone will be happy. 75 € is the final position after the netting. The final position is made by neutralizing the reciprocal commitments between you and me. That is the offsetting of obligations.

In the first option, two credit transfers are made. In the second option, only one transfer is made. And it is possible to make only one transfer because we first do the netting of amounts. Therefore we can save one transaction. If we consider a netting process with a very high number of participants, we immediately see that clearing contributes to significantly reduce the number of transfers needed to settle a set of transactions.

Now if we transpose this example to two financial institutions, the number of transactions they exchange among each other may amount to hundreds of thousands or even to millions every day. The clearing allows them not to make a transfer each time a transaction is sent from one bank to another. They can decide at the end of each day for instance to do the netting and then the party which owns money to the other will make a single transfer.

This example shows that bilateral clearing is already quite efficient. If the clearing is done for more than 2 banks, it will be even more efficient. The higher the number of banks involved in the clearing process, the more effective it is. We will discuss those benefits in detail by analyzing the multilateral clearing in the next article.

For your information, we have created an online course where Clearing and Settlement and other important notions like Payments Systems Models, The Four Corner Model, Payment messages standards, Payment processing value chain, Basics of domestic and international payments, … are presented and explained in a very simple manner. Click here and get an overview of the Payments Fundamentals Course.

Hi JP ,

Your payment blogs are very informative and the way you present your knowledge on payments is highly commendable.

Thank you Deepa for your nice comment. I am glad you can easily understand the content.

You will surely spread the word so that other people can benefit from my articles as well! 🙂

Best regards,

Jean Paul

Lovely articles Jean..awesome and easily explained ..

You are real educator

Thank you Meera for your comment. It is good to see that my content is valuable.

Your Blog is amazing. Crystal clear explanations, structured knowledge, top down attitude, precious definitions. Unmatched teaching skills. Thanks Jeans!

Thank you very much Alberico for your nice comment. It is really touching and I appreciate that.

It is great to see that the content provided on this blog is valuable and help many to move faster in their payments journey.

All the best, Jean Paul

Hi Jean, your article(s) are clear and easy to understand. Without much background in this area/domain I am able to understand the system easily. I appreciate your contribution.

Thank you John for your comment. Making things easy is one of my goal.

I think everyone can learn payments pretty quick if it is explained in clear and simple manner.

Thanks again 🙂

Hi Jean, Thank you so much your articles are very clear, i have 1 query,

is there any charges on SEPA Payments at the time of transaction.i am not much clear for clearing & settlement

Hi Dilip, Bank may charge a customer for sending a SEPA Credit Transfer or a SEPA Direct Debit.

But the clearing system does not charge interchange fees for processing the transaction.

Let me know if you have other questions.

Hi jean

Just i want to thank you for your articles.

great articles

Hi Jean-Paul,

Thank you for this very interesting article. Would you say that bilateral clearing is frequently used? Would you have some examples in which it is used? Or is multi-lateral clearing the most frequent?

Thanks

Hi Marie,

Thank you for your nice comment! Multilateral clearing is the most frequent and most interesting since it enables to save a huge number of transactions. The bigger the banks involved, the more interesting bilateral clearing is. But it is seldom. The banks involved have to connect to the CSM anyway to reach the other banks in the country. So why maintaining two connections? You just build one connection to the CSM to reach all the banks. Furthermore, the CSM manages credit risk for all the banks.

Best regards,

Jean Paul

Hi Jean Paul, Thank you for explaining this topic so well. I have a question- is there any other type of clearing as well apart from bilateral and multilateral? What is central clearing?

Many thanks…very valuable

Thank You So much Jean, For your valuable contents to explain subject in the simplest way…

It’s very informative 💝

[…] Payment Clearing Bilateral […]