This is the second article where we are looking at a concrete example of MT103 serial payment. We already saw how the cover method is used to settle that payment. Read the series of articles I refer you to in the previous article if you want to learn more about the cover method.

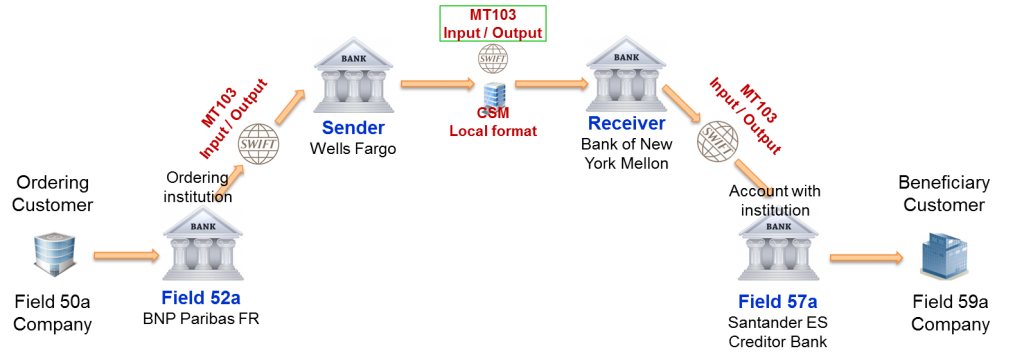

When the transaction is settled with the serial method, the payment moves from one party to the next in the payment chain until it reaches the beneficiary bank. The content of the first message was analyzed in detail in the previous article. Now we will analyze the second MT103 serial message exchanged between the different parties and their meaning. The following picture depicts the different parties involved and their roles in the second MT103. The third MT103 Serial will be considered in the next article.

The table below contains the fields that are transported in the second MT103 serial payment. An additional column (comments) provides further explanation, so that it is easy to understand each field and what it is used for.

Explanation Format Comments Sender PNBPUS3N The Sender BIC appears in header block (Block 1) in the MT103 Input and in the application block (Block 2) in the MT103 Output. Message Type 103 The message type is the second field of the block 2. Receiver IRVTUS3N The Receiver BIC appears in header block (Block 1) in the MT103 Output and in the application block (Block 2) in the MT103 Input. Unique End-to-end Transaction Reference 121:c95a7574-863a-494d-bfad-4084bf7704d4 This reference is provided in the user block (Block 3) and transported end-to-end. Message text This introduces the Text block (block 4). All the fields below are in the text block of the MT103 message. Sender's Reference :20:103REFPNBP8245 It is mandatory and of format 16x. See all the allowed charaters on this page. Bank Operation Code :23B:CRED It is mandatory and of format 4!c. Instruction Code :23E:PHOB/+34.91.397.6789 It is optional and of format :

4!c[/30x] (Instruction Code)(Additional Information)

Code PHOB means Phone Beneficiary. The sender requests the beneficiary bank to advise/contact beneficiary/claimant by phone when the funds will be received. Value Date, Currency, Interbank Settled Amount :32A:090829USD367554,90 It is mandatory and of format:

6!n3!a15d (Date)(Currency)(Amount)

One additional day was added to the initial value date (090828+1). Currency, Instructed Amount :33B:USD367574,90 Normally optional in the standard. It must be provided here because Sender has taken charges from original settlement amount. See field 71F below.

Format 3!a15d (Currency)(Amount) Ordering Customer :50F:/01234567890

1/Company France SAS

2/28 RUE DENIS PAPIN

3/FR/CRETEIL 94400 Ordering customer information is mandatory and can be provided in three different formats according to the options A, F and K. Option F is chosen in this case with format:

35x (Party Identifier)

4*(1!n/33x) (Number/Name and Address) Ordering Institution :52A:BNPAFRPP Ordering institution is provided, so the receiver knows it is the initial originator of the instruction. Account With Institution :57A:BSCHESMM Santander (BSCHESMM), the Bank holding the beneficiary account. Beneficiary Customer :59:/ES6300491800132710387658

Company Spain S.A.

Santa Hortensia 26-28

28002 MADRID

SPAIN Beneficiary customer information is mandatory and can be provided in three different formats: No letter option, Option A and Option F. No letter option is chosen in this case with format:

[/34x] (Account) here in IBAN format

4*35x (Name and Address) Details of Charges :71A:SHA It is mandatory and of format 3!a. It can takes 3 values: BEN, OUR and SHA. SHA means charges are shared between Ordering and beneficiary customers. Sender's Charges :71F:USD20, The sender (PNBPUS3N) has debited 20 USD from the amount he received. These charges are borne ultimately by the beneficiary customer. End of message text/trailer

Read this page on the SWIFT formatting rules and Character sets of MT Messages to get additional information and understand what 16x, 4!c and the format of the field options mean.

Narratives and notes on this SWIFT MT103 serial payment

As usual, we should consider this MT103 serial payment carefully. Have you noticed the party that becomes field 52a on the picture? The following narrative and notes allow to get a deeper understanding of the message content.

Narrative and note 1 (Main purpose of this SWIFT MT103 serial payment)

The Sender (PNBPUS3N) is instructing the Receiver (IRVTUS3N) to debit its account and credit the account of BSCHESMM (the account with institution).

Narrative and note 2 (Fields 53a and 54a are not in the SWIFT MT103 serial payment)

Fields 53A and 54A (Sender’s and receiver’s correspondents) are not present. This means payment does not go through any correspondent. PNBPUS3N has an account relationship with IRVTUS3N. The account relationship can be direct or through a local clearing system. In the second case, funds transfer happens through interbank clearing and settlement systems in the USA, the country where Ordering institution and account with institution (or simply the Beneficiary bank) have their correspondents.

The account with institution BSCHESMM (57A) is the next party in the chain. It will receive the funds from IRVTUS3N, the receiver of this message, for credit to the beneficiary’s account. Note that IRVTUS3N is US correspondent of BSCHESMM.

Narrative and note 3 (Ordering and account with institution in the SWIFT MT103 serial payment)

The ordering institution (52A) is provided in this message. That means the ordering customer is not customer of the Sender, PNBPUS3N. The sender added the field 52a in the message, so that the receiver is aware of this and can pass on the information.

An account with institution (57A) is present in the message. The Beneficiary customer account (:59:/ES6300491800132710387658) is not held by the receiver (IRVTUS3N) of this message, but by the provided account with institution.

Narrative and note 4 (Details of charges in the SWIFT MT103 serial payment)

Details of charges (71A) is SHA. The charges are shared between Ordering and beneficiary customer. Sender pays charges to ordering bank. Beneficiary pays to receiving and other intermediary banks.

A field 71F was added to this message (:71F:USD20,). The sender PNBPUS3N is indicating to the receiver and the next parties in the payment chain that he charged USD 20 fees for the transaction processing. Note that Interbank Settled Amount (USD367554,90) = Instructed Amount (:33B:USD367574,90) – Sender’s Charges (USD20,). So charges are taken from the initial instructed / settlement amount. That is how the beneficiary pays. The sender must provide the optional instructed amount field not only because he has taken charges, but also because it was in the MT103 message he received.

This ends our analysis of the second MT103 serial payment. In the next article, we will consider the third MT103 message exchanged between Bank of New York Mellon and Santander.

Will Receiver send a MT 900 to the Sender? If not, why?