The previous article was about a SWIFT MT101 where the field 50a (Ordering Customer) is present in the Sequence A. As a result, the account provided in sequence A is debited for credit of all the beneficiaries mentioned in the sequence B transactions details. However, as you can see in the SWIFT MT101 definition, the field 50a can be present either in the sequence A or in the sequence B of the message.If you want to read the SWIFT MT101 definition, click on the link before or go this page.

Rule about the usage of the field 50a Ordering Customer

Now why would an ordering customer choose to put the field 50a in the sequence B? We find the answer in the MT101 Network validated rule C3. You find the rules in the SWIFT standards along with the SWIFT MT101 definition. It states: “If there is only one debit account, the ordering customer must be identified in field 50a (option F, G or H) in sequence A. Conversely, if multiple debit accounts are used, they must be identified for every transaction in field 50a (option F, G or H) of sequence B. Consequently, field 50a (option F, G or H), must be present in either sequence A (index 5) or in each occurrence of sequence B (index 15), but must never be present in both sequences, nor be absent from both sequences (Error code(s): D61).”

You may wonder what is index 5 or index 15 the rule is referring to. You find the index in the last column (No.) of the SWIFT MT101 definition / format specifications.

In other words, if the ordering customer wants funds to be debited from different accounts, then he must provide the field 50a in each occurence of the sequence B transaction details. The account provided in each transaction details is then used as debit account for that specific instruction.

SWIFT MT101 with field 50a Ordering Customer in sequence B

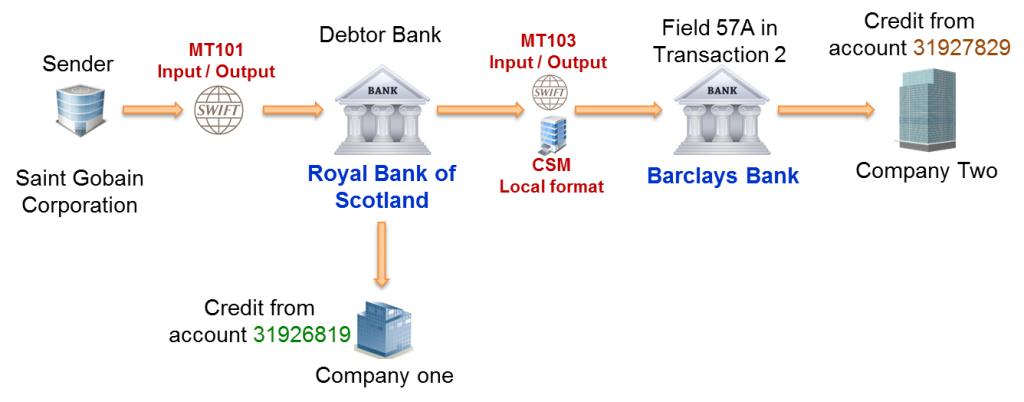

The picture below is similar to the one we had in the previous article. We have two domestic transactions: the first beneficiary has an account with the receiving bank. And the second beneficiary has an account with another Bank. As required in the SWIFT MT101 definition, the MT101 therefore contains two occurences of the sequence B.

Let’s take a closer look at the message content (To easily understand it, read the SWIFT MT101 definition if not done yet). This MT101 contains two domestic transactions.

Explanation Format Comments Sender SGOBFRPP The Sender BIC appears in header block (Block 1) in the MT103 Input and in the application block (Block 2) in the MT101 Output. Message Type 101 The message type is the second field of the block 2. Receiver RBOSGB2L The Receiver BIC appears in header block (Block 1) in the MT101 Output and in the application block (Block 2) in the MT101 Input. Message text: General Information (Sequence A) This introduces the Text block (block 4). All the fields below are in the text block of the MT101 message. See the SWIFT MT101 definition. Sender's Reference :20:ORDERREF8765 This field is mandatory and of format 16x. It is a reference assigned by the Sender to unambiguously identify the message. See all the allowed characters on this page. Customer Specified Reference :21R:GBSUPPLIERS5668 The field is optional and of format 16x. It is a reference to the entire message assigned by either the instructing party, when present or by the ordering customer, when the instructing party is not present. See all the allowed characters on this page. Message Index/Total :28D:1/1 It is mandatory and of format :

5n/5n for (Message Index)/(Total)

If you send 5 messages for the same order, this field will take the value 1/5 in the first message, 2/5 in the second message, and so on. 1/1 means there is only one message sent for this order. Requested Execution Date :30:181025 Mandatory and of format 6!n (Date, a valid date expressed as YYMMDD)

It is the date on which all subsequent transactions should be initiated by the executing bank. Transaction Details 1 (Sequence B first occurrence) This introduces the Mandatory Repetitive Sequence B Transaction Details. At least one occurrence must be provided. Transaction Reference This field is mandatory and of format 16x. It is a reference assigned by the Sender to unambiguously identify a unique transaction. See all the allowed characters on this page. Currency, Transaction Amount :32B:GBP15000, Mandatory and of format 3!a15d (Currency)(Amount) Ordering Customer :50H:/31926819

Compagnie de Saint Gobain

118 Rue Lauriston

75016 Paris The field 50H is optional. It is provided in the transaction details because the ordering customer wants to make payments out of different accounts it maintains with the receiver. Beneficiary :59F:/10078074

1/Company One

2/CITY STREET 50

3/GB/LONDON Beneficiary customer information is mandatory and can be provided in three different formats: No letter option, Option A and Option F. Option F is chosen in this case with format:

[/34x] (Account) here in IBAN format

4*(1!n/33x) (Number/Name and Address) Details of Charges :71A:OUR It is mandatory and of format 3!a. It can take 3 values: BEN, OUR and SHA. OUR means charges are to be borne by the ordering customer. Transaction Details 2 (Sequence B second occurrence) This is the second occurrence of the Mandatory Repetitive Sequence B Transaction Details. Transaction Reference :21:8730REFOFTRX2 This field is mandatory and of format 16x. It is a reference assigned by the Sender to unambiguously identify a unique transaction. See all the allowed characters on this page. Currency, Transaction Amount :32B:GBP20000, Mandatory and of format 3!a15d (Currency)(Amount) Ordering Customer :50H:/31927829

Compagnie de Saint Gobain

118 Rue Lauriston

75016 Paris The field 50H is optional. It is provided in the transaction details because the ordering customer wants to make payments out of different accounts it maintains with the receiver. Account With Institution :57A:BARCGB22XXX The Account with Institution is provided because the beneficiary does not have an account with the RBS, the debtor bank. The beneficiary account is with Barclays Bank. Beneficiary :59:/00072583

Company two

Bridge STREET 52

LONDON, UK Beneficiary customer information is mandatory and can be provided in three different formats: No letter option, Option A and Option F. No letter option is chosen in this case with format:

[/34x] (Account) here in IBAN format

4*35x (Name and Address) Details of Charges :71A:SHA It is mandatory and of format 3!a. It can take 3 values: BEN, OUR and SHA. SHA means charges are shared between Ordering and beneficiary customers. End of message text/trailer

For the narratives and notes on this message, read the ones of the previous article. The usage of the field 50H is the only difference since it is provided in the sequence B and not in the sequence A. And as we saw, the ordering customer does it when payments are to be performed out of different debit accounts.

One key take-away from this article is that Network Validated Rules provide valuable information and reading the SWIFT MT definitions only is not enough. In the next article, we will see how a parent company uses the SWIFT MT101 to pay from a subsidiary account.

:28D:1/1 .. I need a explanation for this as i could not able to understand

Yes I am also a bit confused . as per explanation given “If you send 5 messages for the same order, this field will take the value 1/5 in the first message, 2/5 in the second message, and so on. 1/1 means there is only one message sent for this order.”

Why would 5 messages be sent for same order ? Can you please elaborate with a business case ?

can someone show me the sample message with 50F with 7/ and 8/

can someone show me the sample message with 50F with 7/ and 8/