SWIFT category 4 messages (part 1) are about payment collections. In the SWIFT standards documentation, we read that these messages are exchanged between the collecting bank and the remitting bank. And unless you know what is a collecting bank and what is a remitting bank, it is not easy to understand those messages. So the purpose of this article is to explain what these banks are, which messages they send and receive and the role they play in the collections processes.

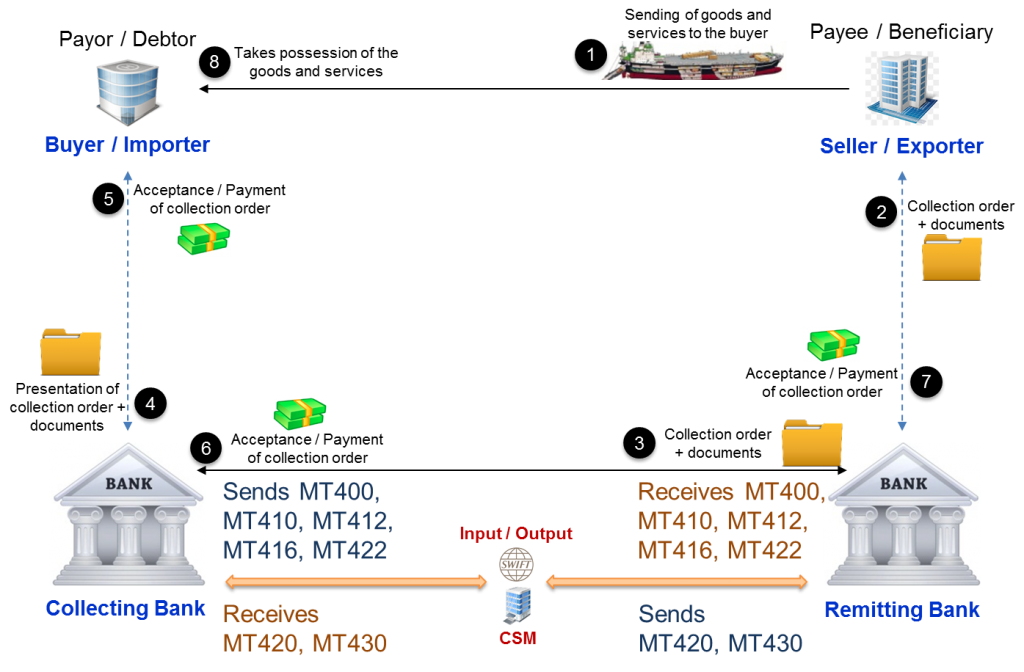

Let’s begin with a picture to illustrate the banks and how payments are collected in national or international trade.

On the picture, we see:

- On the left side the buyer or importer and his bank that is called the collecting bank.

- On the right side the seller or exporter and his bank that is called the remitting bank.

- 8 steps in a process from the time the seller sends goods and services to the buyer until the buyer takes possession of them.

- The SWIFT MT messages that each bank sends and receives in this context

Before looking at the roles of each bank, let us first consider the process. What is depicted on the picture is a payment technique called documentary collection or documentary remittance. A documentary collection is a transaction whereby an exporter/seller entrusts collection of a payment to the remitting bank (exporter’s bank), which sends the shipping documents to a collecting bank (buyer/importer’s bank) together with payment instructions.

In short, this is how it goes: Buyer and seller make a business transaction and to secure the payment, the seller asks his bank to collect the funds against shipping documents. The buyer and seller as well as their banks are usually located in different cities/countries. The seller after sending the goods and services hands over all the related shipping documents to his bank. The remitting bank forwards the documents to the buyer’s bank, the collecting bank. The buyer must accept the collection order (usually a bill of exchange) or pay before the collecting bank releases the title documents required for the buyer to take possession of the goods. After payment, the collecting bank delivers the payment received to the remitting bank for final delivery to the seller.

[box type=”info” style=”rounded”]The Remitting bank is the bank that, in documentary collections, forwards a seller’s shipping documents to the collecting bank and receives the payment from the collecting bank on behalf of the seller. It is called remitting bank primarily because it remits the documents (habitually through national or international shipping and courier delivery services).[/box]

[box type=”info” style=”rounded”]The collecting bank is the bank that, in documentary collections, presents the documents received from the remitting bank to the buyer and collects the payment from him. It is called a collecting bank primarily because it collects the funds.[/box]

The collecting bank is usually the correspondent of the remitting bank in the buyer’s country, but that may not be the case. In practice also, the collecting bank may not be the buyer’s bank and the remitting bank may not be the seller’s bank. So our example is really simple. Things might be more complex in the reality. But this example is good to grasp the main concepts.

Now that we understand what collecting banks and remitting banks are, let’s consider the SWIFT messages that they exchange.

The collecting bank sends SWIFT MT400, MT410, MT412, MT416, MT422 messages and receives SWIFT MT420, MT430 messages. Consequently, the remitting bank does exactly the opposite. It receives SWIFT MT400, MT410, MT412, MT416, MT422 messages and sends SWIFT MT420, MT430 messages. All the messages except the MT400 must be exchanged directly over the SWIFT Network without going through a clearing system (CSM). In other words, the MT400 can be exchanged, cleared and settled through a CSM but not the other messages. The MT400, when it transports funds, can be settled through correspondent banking or a clearing system. In the coming paragraphs, we will consider each message and see when it is sent/received by the involved parties.

Messages sent by the collecting bank (so received by the remitting bank)

In the following, we look at the messages sent by the collecting bank and briefly explain why it sends each of them. As much as possible, they are presented in the order in which they are very likely sent during the collection process.

The collecting bank sends the MT410 Acknowledgement (Remitting bank receives it)

This is the first SWIFT message sent during the documentary collection. When the documents and collection order arrive, the collecting bank issues this message to inform the remitting bank that it has received them. It contains references assigned to the collection by both banks as well as the collection amount. In the optional field 72 (Sender to Receiver Information), the collecting bank can specify if it does not intend to act in accordance with the collection instruction.

The collecting bank sends the MT412 Advice of Acceptance (Remitting bank receives it)

After receipt of the documents and collection order, the collecting bank presents them to the buyer for acceptance or payment. A collection order can contain one or many drafts (also called bills of exchanges) for the settlement of the transaction. When the buyer accepts the drafts, the collecting bank sends the MT412 to the remitting bank to inform them about the acceptance. In addition to the references and amount, the MT412 contains the maturity date of the collection.

If you want to know more about acceptance of bills of exchange, you can read the article Bill of exchange – Definition and parties involved

In case the buyer does not accept one or more drafts, the next message comes into play.

The collecting bank sends the MT416 Advice of Non-Payment/Non-Acceptance (Remitting bank receives it)

The collecting bank sends this message to inform the remitting bank that the buyer has not accepted or does not want to pay one or many drafts under the collection order. The remitting bank informs its customer, the seller, so that they can take the necessary actions. You may wonder why a difference is made between non-payment and non-acceptance. It is related to the nature of bills of exchange. A draft (bill of exchange) can be accepted today and paid only later in 2 or 3 months for example. Acceptance just means agreeing to pay. But the actual payment happens later. I refer you to the article Bill of exchange – Definition and parties involved if you want to deepen this topic.

Contrary to MT410 anf MT412, the SWIFT MT416 can transport a lot of information. It contains a sequence A and a sequence B parts which both have a field (77A) where Reason for Non-Payment/Non-Acceptance can be specified. Other interesting fields can be provided too. You can read the SWIFT 416 format specifications in the SWIFT standards.

The collecting bank sends the MT422 Advice of Fate and Request for Instructions (the remitting bank receives it)

The SWIFT MT422 is sent to remitting bank in response to a SWIFT MT420 Tracer that it sent. The collecting bank advises the remitting bank of the fate of one or more collection documents; usually accompanied by one or more questions or requests.

In addition to references and amount, the sender can optionally provide the Sender to Receiver Information, Queries and Answers.

The collecting bank sends the MT400 Advice of Payment (Remitting bank receives it)

The SWIFT MT400 is sent by the collecting bank after receiving the payment from the buyer right after the presentation of the document and collection order or later (for term bills of exchange). In case the buyer pays only partially, the collecting bank still sends this message to the remitting bank. The SWIFT MT400 is usually used to transfer the funds (settlement of proceeds) between collecting and remitting banks when they have a direct account relationship or are interconnected through a clearing system. The proceeds are the collection amount deducted from all commissions, expenses, fees, and taxes. When both banks do not have a direct account relationship the settlement of proceeds must go through their correspondents. That means that additional banks are involved in the payment. That might sound a bit complex, but the underlying principles presented in SWIFT MT103 202 articles are the same as we will see in future articles. In this case, the SWIFT MT400 can be seen as “an announcement”.

The SWIFT MT400 is the most interesting of all these messages since it is the one used to transfer the funds or inform that funds have been collected. We will analyze the SWIFT MT400 in depth in the coming articles.

Messages received by the collecting bank (so sent by the remitting bank)

This paragraph is about the two messages received by the collecting bank. We will also see why the remitting bank sends them.

The Remitting bank sends the MT420 Tracer (Collecting bank receives it)

It may happen that the remitting bank, after receiving the MT410 Acknowledgement from the collecting bank, does not hear anything about the acceptance in the expected timeframe. It then sends the SWIFT MT420 Tracer to enquire about the documents sent for collection.

This message contains references assigned to the collection by both banks as well as the collection amount. The sender can optionally provide the Date of Collection Instruction, the drawee and the Sender to Receiver Information.

The Remitting bank sends the MT430 Amendment of Instructions (Collecting bank receives it)

The SWIFT MT430 is sent by the remitting bank in case it wants to amend instructions contained in the collection (Collection amount, Term of the bill, and so on). This message contains a sequence A and a sequence B parts and can carry a lot of information related to the amendments of the instruction. The amended maturity date and amount can be provided in the field 33A. Additional amendments can be conveyed in the Amendments field 74.

The next article will be about the SWIFT MT400 Usage for the settlement of proceeds.

Hi Jean,

Could you please explain the difference between category 4 and category 7. Category 4 is used for collection and cash letters, while category 7 is used for guarantee and Documentary credit. But, if i read about collections and documentary credit, they seem to be same.

In the documentary collections the collecting and remitting banks act only as intermediate between the drawee and the drawer. Meaning the collecting bank isn’t obliged to pay the drawer when the documents are respected unlike the documentary credit.

The collecting bank instead gives the documents to the drawer when the drawer pays what it is due.

Hi there,

Could you please tell me about prices of some swifts such as MT420, 422 and 942 it doesn´t need to be exactly price, I just need to have an idea, because three different bank officers charged me also different prices to offer same service!

Thanks,

Netto, ANTONIO

Hi Jean,

I am interested about an exemple of situation when collecting and presenting bank is not the same bank. When does it happen?

Thanks, Ivan