Up to now, we have considered the messages exchanged in the SCT scheme between sending and receiving banks. In this article and the next, we will zoom in on a bank and particularly on the specific role that they take in the exchange of messages.

There is a trap to avoid at the beginning of your journey in the exciting world of payments. Beginners tend to think that:

- the Debtor Bank only sends credit transfers to move the funds from the debtor to the beneficiary. And it is not supposed to receive any message.

- the Creditor Bank only receives messages with the funds from the debtor bank and credits the beneficiary account. It is not supposed to send any message.

One reason why beginners tend to think that way is because they have probably skipped that part in the SEPA rulebooks (it comes a bit far in the document) or they have not received proper training on what SEPA Credit transfer is about and the different messages involved. Another reason, I think, comes from beginners’ personal experience with credit transfers that they make or receive. People give instructions to the bank to move the funds and that is what happens almost all the time. Or their account is credited when a credit transfer arrives and they have never received a cancellation request to return the funds. As originators or beneficiaries, customers barely see the exceptions. The reality is different though. After reading this article, everything will be clear and you will easily overcome these beginners’ issues.

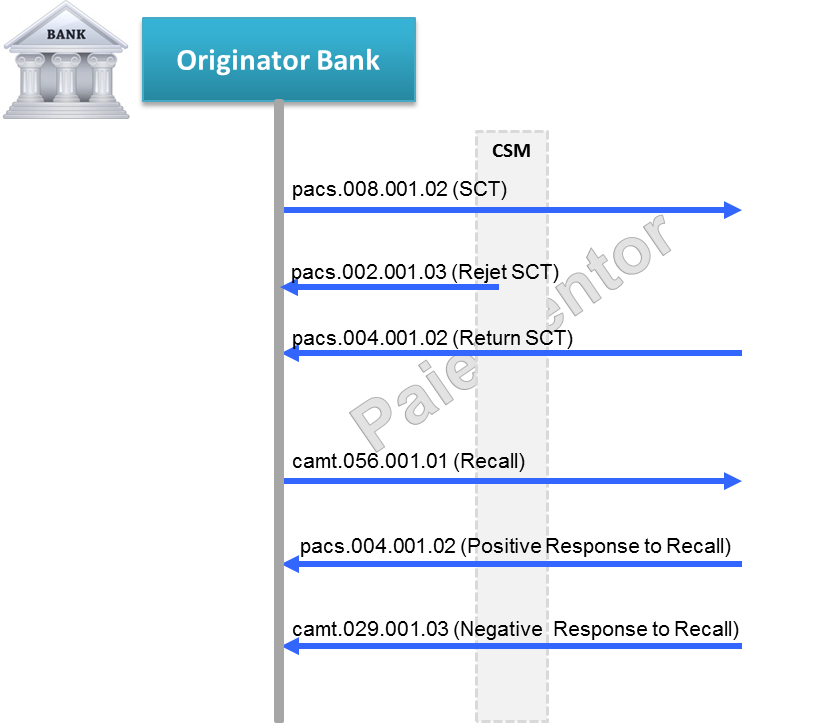

Yes, the originator bank sends the credit transfer to move the funds. But it does much more as we can see in the picture below. It receives all the messages resulting from exception handling like the reject from the CSM, the payment return, or the responses to a cancellation request. The debtor bank must evidently send a cancellation request before it can receive the related responses.

So as a debtor bank, it is not sufficient just to send the credit transfer. The debtor bank must be able to send and receive all the other messages. Remember that all the messages are mandatory in the interbank space. A bank that can only send credit transfers, but not receive payment returns is not SEPA compliant and cannot adhere to the Scheme. The banks must have the ability to process all the messages to become member of the SEPA community.

This seems obvious. But believe me, understanding this rapidly can make all the difference when you begin with a SEPA Credit Transfer project. If you work on a project whose scope is the debtor bank in the interbank space, then you know which messages must be covered. Having all the messages in mind is helpful to get the full picture of your project. And when you perform an impact analysis for new features, be careful not to look at one single message like the pacs.008. You should always consider them all together.

For your information, I have published a book about SEPA Credit Transfer where one full chapter is dedicated to the messages exchanged in SEPA Credit Transfer Scheme.

Below are the links on Amazon.

Kindle edition |

Paperback edition |

You can download the sample for free. Here is the link to download the sample of the SEPA Credit Transfer eBook.

You can buy the ebook and get free access to a content-rich webinar on this page.

In the next article, the focus will be on the beneficiary bank messages in the interbank space.

Hi Jean,

This site is a blessing to learn about the Payments. You have explained the payments in a simple to understand language and after a single read the concepts get fit in to the mind.

Do you also have a sample project case studies related to payments… If you can share that would be icing on the cake.

Thanks

Thank you Meenu for your comment!

a sample project case studies related to payments … That is very broad.

There are so many things you can do on payments.

https://upvir.al/58670/lp58670 – link to the book doesn’t seem to work.