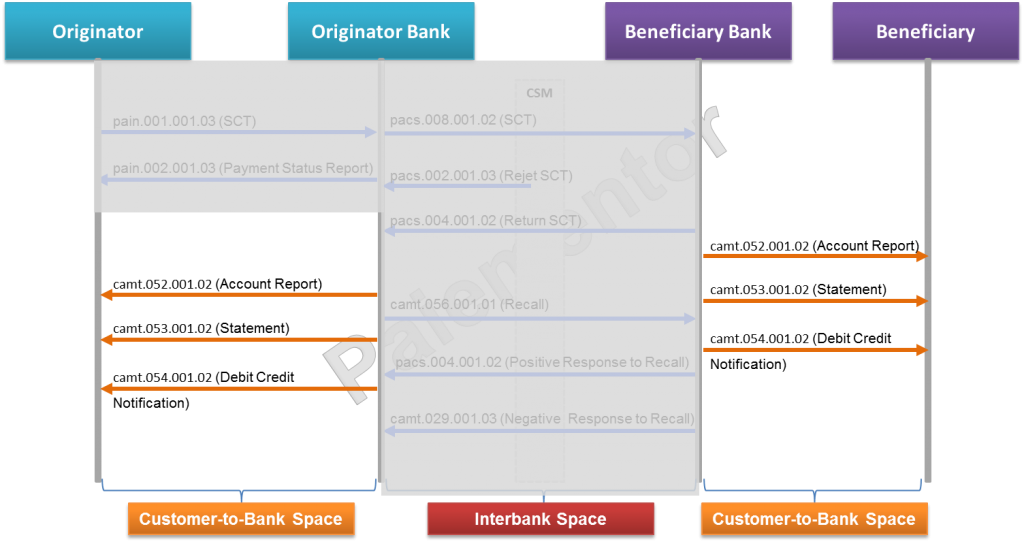

The EPC recommends three messages for the customer reporting. The bank can use one or many of them, according to client’s needs, to provide account reports, account statements and debit/credit notification. It is important to understand that these reporting messages are for customers which can integrate and process them in own IT systems. They are not supposed to be read by humans. Therefore Banks deliver these reporting messages almost exclusively to corporate customers or important nongovernmental organizations.

Camt.052.001.02 (Bank To Customer Account Report): The account report is generally used for reporting intra-day transactions and balances. If you know customer reporting in SWIFT MT format, it is equivalent to MT941 Balance Report, and MT942 Interim Transaction Report. The term intraday needs some clarification. Intraday basically means “within the day”. Intraday reportings give information to the customer about what has happened on his account during a period of the day. It can be from early in the morning to 10:00 am, then from 10:00 am to 2:00 pm and so on. Some companies ask their banks to send many of these intraday reportings because managing their business requires it. They can thus have a view on what is happening on the short term and make better financial decisions.

Camt.053.001.02 (Bank To Customer Account Statement): The Bank-to-Customer statement message is created by the bank to report balance data, debits and credits booked on the account. Debit or Credit transactions are specified in the statement. In the SWIFT MT world, it is equivalent to MT940 Customer Statement Message and MT950 Statement Message. An account statement contains an opening balance and a close balance. The difference between those balances is the sum of all credits and debits on the account during the timeframe considered for the statement. The debits and credits may come from the execution of credit transfer instructions or from other kind of transactions (direct debit, international payments and so on). The bank relies on account management applications to provide all the information. In general, corporate customers will receive the statement each day. The periodicity is set in a bilateral agreement. Some customers may want to receive them on a weekly or biweekly basis.

Camt.054.001.02 (Bank to Customer Debit Credit Notification): The Bank-to-Customer Debit / Credit Notification includes transactions and related amounts, but no balance data. The customer gets information about the transactions which debited or credited his accounts and can act upon if needed. For customer reporting in SWIFT MT format, it is the equivalent of MT900 Confirmation of Debit and MT910 Confirmation of Credit. However, many debits and credits information can be bulked in the same camt.054 message. This report is generally delivered to the customer on an ad hoc basis.

If you look for these messages definition in the ISO 20022 Website, go to the archive page. They are all available under Second version of the Bank-to-Customer Cash Management messages. When this post is written, the standard has already evolved up to version 6. But the EPC keeps recommending the version 2 messages because the information available inside is or should be enough for the companies in the SEPA Area. However, if a company is not happy with it, it can approach its bank and asks for another version, provided of course that version contains the information it wants. It is not mandatory to use the version 2 of the messages. It is just a recommendation.

In the interbank space, the type of messages to use are mandatory. Why is that the case ? You will get the response to this question and many others in the next articles.

Hi Jean,

Is it generally accepted for a camt.054 to be sent to the sender of a pacs.008. In MT speak must the recipient of a MT103 respond with a MT900? In practice I have seen both but I would like to know if there are any rules governing this?

Many thanks,

Quinton

Hi Quinton,

Thanks for reaching out!

The sender chooses in which format he wants to receive the debit/credit notification (Either MT format or XML format).

No there is no rule governing it. A bank may be able to send pacs.008, but can process only the MT900.

But in the future, when SWIFT moves to SWIFT MX, the banks will have no choice but to receive the camt.054.

I hope this helps.

Regards,

Jean PauL

Hi Jean,

The camt.054 is very useful for a Customer to receive all Debit/Credit activity happening on the Customer’s bank account. They can tell the Bank to send all activity for a particular bank account using the camt.054. My question is: For this to happen, the Customer has to first request this service from the Bank, i.e. the customer has to first register with the Bank that from a given date going into the future, they want the notifications to be sent to them using camt.054. How does the Customer request for this? Or, how does the Customer register for this service?

Regards,

Gibson