Payment cards are part of our daily lives. Many of us carry one or more cards in the wallet and we can hardly imagine our lives without them. For us who want to understand payments, it is worth taking some time to look at a payment card thoroughly. That is the purpose of this article. Everything that you see at the front and back of a payment card will be presented in detail. But before that let’s me stress out an important point: almost everything that you see on a payment card is standardized. Simply stated, most of the card features must comply with certain norms defined by the International Standard Organization (ISO) or other associations.

Payment card features are subject to the following standards (The list is not exhaustive):

- Card dimensions (ISO/IEC 7810 ID-1 standard) – length 85,60 mm × width 53,98 mm on a thickness of 0,76 mm

- Card number (ISO/IEC 7812 standard),

- Embossed characters and Magnetic stripe (ISO/IEC 7811),

- Integrated circuit with contacts (ISO/IEC 7816-1)

- Integrated circuit without contacts (ISO/IEC 10536-1, ISO/IEC 14443-1, and ISO/IEC 15693-1)

-

Payment Card Industry Data Security Standard (PCI DSS)

- And so on.

So even if this article contains detailed information about a payment card anatomy, it does not cover everything about it. If you want to really deep into that topic, I strongly recommend you to read the standards. Now let’s look at a payment card.

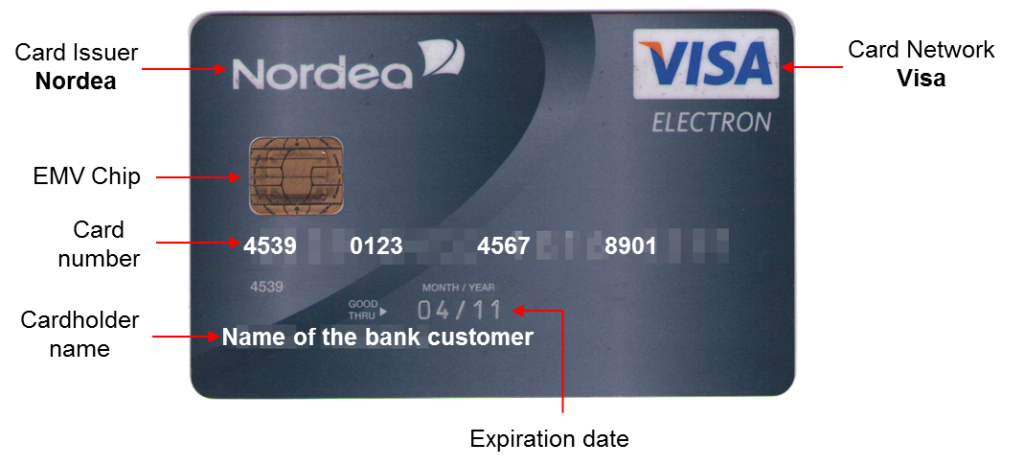

The front of a payment card

Let’s consider each element visible at the front of a payment card.

Card Issuer

This is the logo of the financial institution that issues the payment card. Very often, the issuer puts its name and logo on it. In some countries, cards can be co-branded. This practice involves placing two different brands on the front of the same card. A bank partners with another company (a retail store or online store) to issue a card. Brands of both the issuing bank and the other company are both visible on the card.

On a more practical level, the cardholder applies to the issuing bank to get the card or the bank after rating its customer proactively sells him the card. Co-branded cards are generally distributed by the retail or online store.

Chip

A card with a chip is called a chip card. The chip is an integrated circuit that consists of a microprocessor and a memory. The memory of the card is divided into two main parts: one part in public reading and one part in hidden reading. The classic card data (name, surname, card number, etc.) are present in the public part in clear form and in encrypted form. The unreadable part (to the public) contains the private key of the card to which it is theoretically impossible to access. Only the card can read it. The microprocessor enables to perform encryption operations when necessary.

The chip is a key element of the card security. Increasing the computing and storage capabilities of the chip has allowed more information and programs to be stored on a card. The chip provides a better alternative to keep the cardholder’s information since it offers better protection against fraud. As you will see below, that information is also available on the magnetic stripe on the back of the card.

In many countries today, all payment cards issued are equipped with a chip manufactured according to the Europay Mastercard Visa (EMV) standard, the international standard for payment card security. Some chips can be activated with or without contact for a transaction.

The EMV standard for chips allows two verification methods: Chip and Signature and Chip and PIN. With the first method, Chip and Signature, the cardholder swips the card through a magnetic-card reader and physically signs a receipt for identification purposes. In the second method, the cardholder must enter a personal identification number (PIN), typically of 4 – 6 digits in length, that must match with the information stored on the chip. Chip and PIN method is more secure since it is not sufficient to have a card to complete a transaction. You need to know the PIN as well and unlike the signature, the PIN cannot be forged. No wonder that Chip and PIN method is being adopted all over the world.

A note on the following three pieces of information: The card number, the cardholder’s name and the expiration date are highlighted on the card by a technique called embossing. That process, introduced since the early days of payment card, was initially introduced to allow merchants, who used manual payment card machines (Search Flatbed Credit Card Imprinter on google to see what it looks like), to retrieve the card information easily and keep it with accuracy during and after the transaction.

Card number

The card number is its unique identifier, but it is more than that. It is structured according to ISO / IEC 7812, which breaks it down as follows:

- the first six digits are the issuer number. Formerly identified as BIN (Bank Identification Number), they are now called IIN which stands for Issuer Identification Number. This indicates that issuing cards was reserved to banks and that is not the case anymore. The first digit identifies the card type: 3 for American Express cards, 4 for Visa cards, 5 for Mastercard cards.

- The following digits (9 to 12 digits) constitute the identifier of the card at the issuer and are allocated by the issuer himself.

- Finally, the last digit is a control key to verify that the card number is compliant with the standard. This control key is calculated according to Luhn algorithm.

Cardholder name

This is the name of the cardholder who can be a legal entity or a physical person. In the second case, the name of the physical person is written on the card. If it is a corporation, then it is the name of the company that is written on the card, and not the name of the physical person(s) who may carry the card.

Expiration date

The expiration date is in the following form: MM / YY. It is composed of the month and the year until which the card is valid. The day is never indicated on the cards, but always corresponds to the last day of the month. If you read 11/17, it means that the card is valid until November 30, 2017. November 30 may have fallen on a Sunday or a holiday. It doesn’t matter. Transactions can be initiated up to the last day of the month.

Physical cards have a validity period of 2 to 3 years. The renewal is mainly for reasons of security and dilapidation of the card. A few weeks before the end of validity, the cardholder receives a new card with new card number, new CVV / CSC (see below) code and new expiration date in two or three years.

Card Network – Visa

It is the Card Network logo to which this card belongs to: Visa. The card network connects all participants to a transaction and transports the information necessary for the payments processing. Merchants who accept Visa, put a (large) sticker with Visa logo in their store, generally on the door and inside near the cashier. A cardholder understands that the merchant accepts a card of the same network when he sees it on the sticker. If he does not see the brand of his card network, it probably means the merchant does not accept it and he has to use another mean of payment or look for another merchant.

American Express, China UnionPay, Discover, Japan Credit Bureau, MasterCard, Visa are the most popular card networks in the world.

Now let’s look at the back of the card.

The back of a payment card

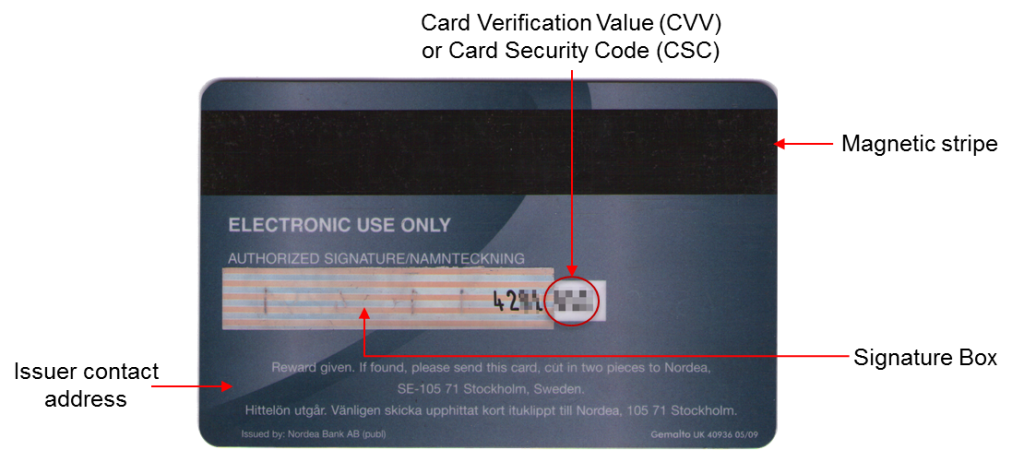

Magnetic stripe

The magnetic stripe stores information about the card, the identity of the cardholder visible on the front of the car and the PIN code in encoded form. The security of this information is quite limited, since it is not protected, neither in writing nor in reading. So it is very easy to copy it.

If so, then why do issuers continue to make cards with a magnetic strip? The reason is simple. The magnetic stripe makes it possible to use the card in countries where the chip is not used yet (And there are still quite a few). In very rare cases and for small amounts, the magnetic stripe can be used for practical reasons, for example at highway tolls.

Visual cryptogram

These are the last 3 digits on the signature panel. The set of figures whose cryptogram is generated by cryptographic tools of the issuing bank. The visual cryptogram is required to pay remotely over the internet or by phone.

Signature Box

This is the box where the cardholder must add his signature. In the case of payment with use of the magnetic strip, the signature makes it possible to verify the identity of the cardholder by comparing the one in this box with the signature on the receipt or another signature on an identity document. If the chip is used in conjunction with the PIN, then the signature verification is not necessary. It is worth mentioning that merchants seldom perform this verification.

Issuer contact address

This is the address where the issuer wants the card to be sent if it is found after a loss, a theft, the end of validity or other reason.

Holograms – Not available on this card

Holograms appear at the front or back of some payment cards. It is a security feature to prevent fraudsters from copying the card physically. It consists of reflective multi layer images changing with a 3D effect that is almost impossible to reproduce. It fulfills the same function as the holograms found on banknotes.

The hologram of Visa cards is a dove that seems to fly when the card is tilted. MasterCard’s hologram is composed of two globes representing the world. It is three-dimensional with a repetition of “MasterCard” printed in the background. Other elements invisible to the naked eye, appear when the cards are placed under ultraviolet radiation. A “V” and an “MC” printed in ultraviolet ink are visible on the holograms of Visa and MasterCard, respectively. Finally, these holograms reflect the light and seem to move when rotated.

Can I get a visa card with my name

The best app you can ever have

This post really breaks down the intricate details of payment cards! I never realized how much technology goes into something we use every day. The graphics were super helpful too—thanks for making this complex topic so accessible!

Good

This is a fantastic breakdown of payment card anatomy! I never realized how intricate the design is and what each part represents. It really enhances my understanding of how transactions work. Great job, Paiementor!

I hope you accepted my request for my card

This post is incredibly informative! I never realized how much goes into the design and functionality of a payment card. The breakdown of the different components really helped me understand how they work together to ensure security and convenience. Great job!

Tankes

Paymnt

ስለተሠጠኝ አመሰግናለዎ

no Comant

goodp

04/11

Tankeo Your Kard