What are SWIFT and SWIFTNet ?

The strong growth of the traffic and the evolution of the needs of the users required the setting up of innovative and adapted solutions. In 1977, the SWIFT global network was created to replace the Telex network, which was considered too slow and unsafe. At first, it worked with the Binary Synchronous Communications (BSC) protocol introduced by IBM 10 years earlier. In 1991, SWIFT network migrated to the X.25 communication protocol. The network then took the name SWIFT II. The limitations of the X.25 protocol hampered the evolution and implementation of new services. To answer this, migration to the IP protocol started in 2004. The new name, SWIFTNet, is still valid. SWIFTNet is the SWIFT network based on an IP (internet) type protocol. According to SWIFT, the migration from X.25 to IP protocol is the biggest project ever undertaken and very well executed because the customers almost did not notice it.

SWIFT Messages

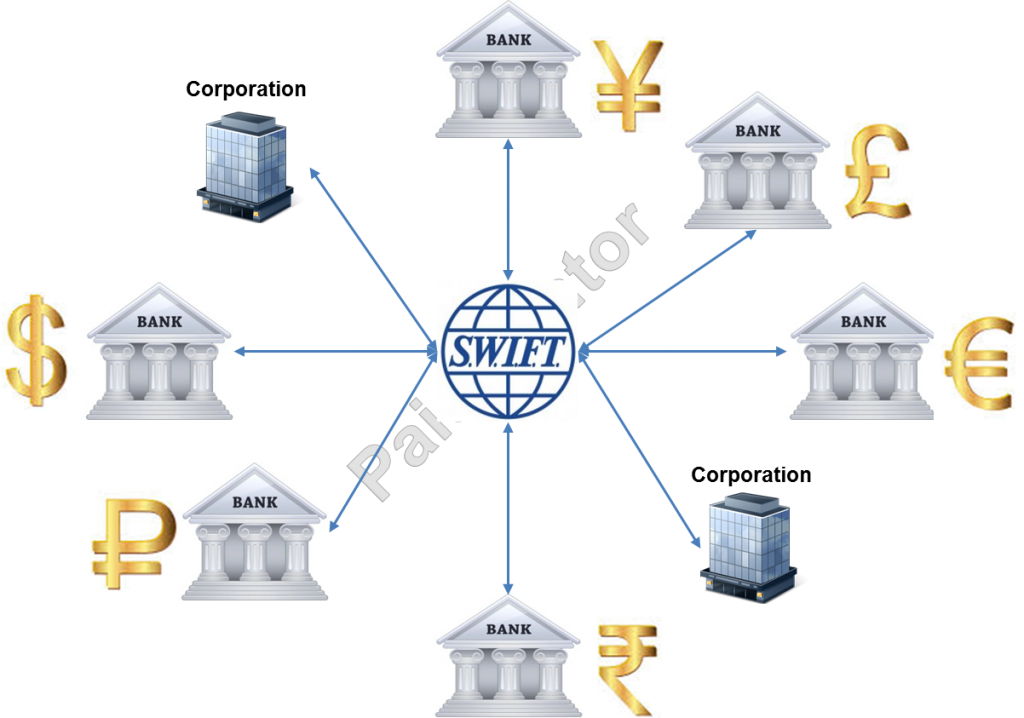

SWIFT allows all businesses and financial institutions to connect to their network to exchange financial messages. Each network member is identified by the BIC code, also known as the SWIFT code. You can get more information about the BIC code by reading the article about the SWIFT BIC code. It is thanks to this code that messages are routed from the sender to the recipient.

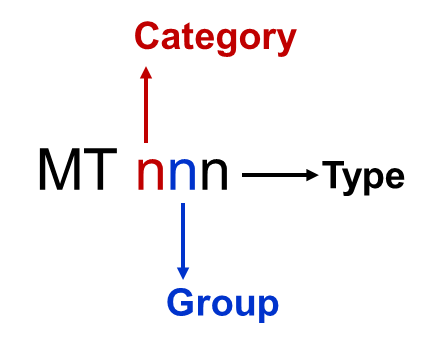

MT and MX messages are exchanged on the SWIFT network. MT messages are structured according to the specifications of the ISO 15022 standard and the newer MX messages according to the ISO 20022 standard.

Thanks to the standardization, the messages respect a specific formalism. This allows fast and automated processing.

The table below contains the list of SWIFT MT message categories:

Message category Description Examples of messages MT1xx Customer Payments and Cheques MT 101 Request for Transfer

MT103: Single Customer Credit Transfer MT2xx Financial Institution Transfers MT202: General Financial Institution Transfer

MT 204: Financial Markets Direct Debit Message MT3xx Treasury Markets - Foreign Exchange, Money Markets, and Derivatives MT300: Foreign Exchange Confirmation

MT321: Instruction to Settle a Third Party Loan/Deposit MT4xx Collection and Cash Letters MT400: Advice of Payment

MT450: Cash Letter Credit Advice MT5xx Securities Markets MT502: Order to Buy or Sell

MT537: Statement of Pending Transactions MT6xx Treasury Markets - Commodities MT600: Commodity Trade Confirmation

MT604: Commodity Transfer/Delivery Order MT7xx Documentary Credits and Guarantees MT700: Issue of a Documentary Credit

MT707: Amendment to a Documentary Credit MT8xx Travellers cheques (T/C) MT800: T/C Sales and Settlement Advice [Single]

MT802: T/C Settlement Advice MT9xx Cash Management and Customer Status MT940: Customer Statement Message

MT942: Interim Transaction Report MTn9x Common Group Messages (to all previous categories) MTn92: Request for Cancellation

MT n99 Free Format Message MT0xx FIN system messages MT012: Sender NotificationMT020: Retrieval Request (Text and History)

Here is the page with exhaustive list of all SWIFT messages types. There is a search function included to help you easily find the information you are looking for.

Below are the links to posts where specific SWIFT messages are analyzed.

SWIFT Message Identifier

- When the group takes the value “0” like in MT10X, it means the message is a about transfer.

- When the group takes the value “1” like in MT11X, it means the message is a about a cheque.

- When the group takes the value “9” like in MT19X, the message belongs to common group messages that are used for cancellations, queries, advices, answers and to handle other exceptions.

The picture below depicts the identifier a SWIFT Message MT.

For MX, things are different. The identification of messages is based on the name IS0 20022. Thus the MT103 becomes MX Pacs.008 and not MX 103. You find the SWIFT MT to MX equivalence for MT1xx, MT2xx and MT9xx on the following page. The logic to name the messages identifier is different in the two standards.

The exchange of MT messages is done via the FIN service that Swift introduced at the very beginning. Over time, SWIFT has expanded its offering and now offers solutions such as InterAct or FileAct for exchanging messages and files. These protocols will be presented and analyzed in future articles.

Hi Jean, Thanks for your articles and it clears my head in some way.

Do you mind also to explain the difference between SWIFT FIN and SWIFT FIN-Copy?

And under what circumstances MT205 is used instead of MT202?

It will be great if you could also give some introduction in MT204.

Many thanks and have a nice weekend.

Regards,

Cat

Hi Cat,

Thank you for your interest to my blog. I take note of your request and will try to address in the future.

Subscribe to the newsletter (if not already done), so that you can be notified when new articles will be published on the blog.

Kind regards,

Jean Paul

Hil Jean,

Can you please clarify the scrnarios when MT 101 is used and in which scenario MT103 is used and why?

Same case with MT202 and MT202 COV.

Thanks.

Musaddiq_usman@hotmail.com

Hi, just read the articles on the blog about MT101, MT103, MT202COV. Thanks

Hi Jean,

I wanted to understand the difference between the General Purpose Application and FIN Application. How are the two different.

Would you be able to shed some light on it.

Hi Uday,

General Purpose Application allows only system messages. These are messages from a user to SWIFT or from SWIFT to a user, but not from one user to another.

Financial Application allows to send messages from one user to another. It is the user to user service which includes the system messages MT0xx, the User to User Messages MT1xx through 9xx and other Service Messages such as Acknowledgements.

Hi Jean,

Could you please explain more on FileAct and InterAct.

Hi Madhuri,

Thanks for reaching out!

I take note of your request and will write about FileAct and InterAct in the future.

Hi JP,

Your Articles are always contentful and full of knowledge. Thanks for that!

Could you please help understand a detailed difference between MT and MX ?

Hello JP,

Is it possible to transfer a SWIFTNET message to SWIFTCOM ? and yes how best to do that? thank you

Hello Salih,

Sorry I don’t know what SWIFTCOM is. Could you please tell me more about it?

Thanks

Hi Jean,

can you please explain on Swift FileAct and Interact, their usage and differences. Thanks

This article is very helpful, please explain MT109 to me. Thanks

Hi Jean,

Please can you explain FIN message type MT012 andMT019. maybe point me to a message format page.

thank you.

Excellant Blog. I never knew that infromation on payment domain is freely available.

Hi Jean,

Thank you for all the information about the SWIFT messages and it’s functionalities.

could you please explain how SWIFT network is connected to it’s banks, gateways and hubs?

Thank you.