The SWIFT MT950 is an account statement sent by a Bank to its customer. We are all familiar with account statements, so it is easy to understand the content of a SWIFT MT950 Statement message. An account statement contains an opening balance, the debit and credit entries booked to the account and a closing balance. Generally the opening balance is the closing balance of the previous statement and the closing balance is the opening balance of the next statement.

The SWIFT MT950 message carries account statement information provided in a specific format. We will look at the SWIFT MT950 in the context of our studies. But that doesn’t matter. What you will see below is valuable for any other situation.

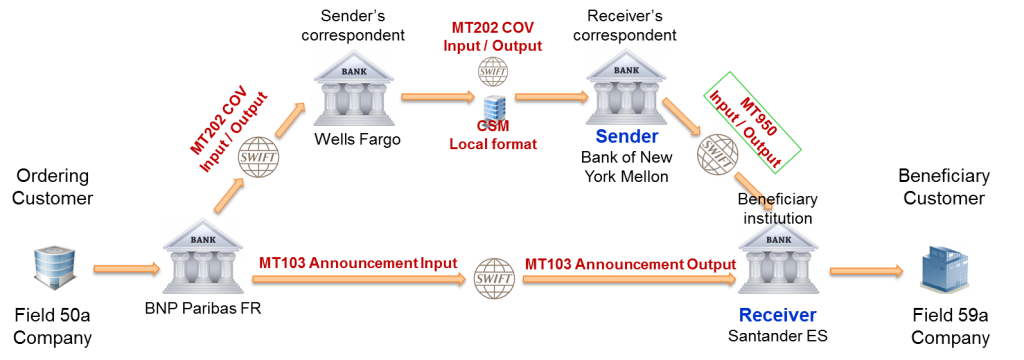

The following picture reminds the context and highlights the key players in the cover payment we have analyzed so far.

In the previous articles, we did the following (Click on the links below to learn more about a specific topic):

- Detailed analysis of a MT103 announcement sent by the BNP Paribas to Santander

- Study of the SWIFT MT202 COV sent by BNP Paribas to its correspondent

- Examination of the second SWIFT MT202 COV sent by BNPP’s correspondent to Santander’s correspondent

- Analysis of the SWIFT MT910 Confirmation Credit sent by Bank of New York Mellon to Santander

Now we are considering the SWIFT MT950 sent by Bank of New York Mellon to Santander. It is another possibility for Santander to get the cover. The SWIFT MT950 is highlighted in the green box above.

The table below contains the fields that are transported in the SWIFT MT950 message. An additional column (comments) provides further explanation, so that it is easy to understand each field and what it is used for.

Explanation Format Comments Sender IRVTUS3N The Sender BIC appears in header block (Block 1) in the MT950 Input and in the application block (Block 2) in the MT950 Output. Message Type 950 The message type is the second field of the block 2. Receiver BSCHESMM The Receiver BIC appears in header block (Block 1) in the MT950 Output and in the application block (Block 2) in the MT950 Input. Message Text This introduces the Text block (block 4). All the fields below are in the text block of the MT950 message. Transaction Reference Number :20:REFMT950IRVT983 Mandatory and of format 16x. It is the Sender's Reference specific to this MT950. The Sender IRVTUS3N generates it. Account Identification :25:835-162-85 Mandatory and of format 35x. It is the account number of BSCHESMM. IRVTUS3N is the account holder. Statement Number :28C:2562 Mandatory and of format 5n[/5n] for statement number/sequence number. Since no sequence number is provided, only one message is sent for this statement. Opening Balance :60F:C180830USD20000, Mandatory and of format 1!a6!n3!a15d (D/C Mark)(Date)(Currency)(Amount).

In D/C Mark, C for Credit Balance and D for Debit balance. 1st Transaction :61:180830C367574,90F202103REF405775//IRVTOWNREF2756

Company Spain S.A. Optional and provided in format

6!n[4!n]2a[1!a]15d1!a3!c16x[//16x]

[34x] - The last element supplementary details must be on a new line.

Here we have the folowing elements

180830: Value date

C: Credit entry

367574,90: Amount of the entry

F202: F since entry is a first advice. In the next statement, it will take the value S for SWIFT Transfer. 202 is the Message Type received.

103REF405775: For a credit entry, the Reference for the Account Owner is the field 21 related transaction reference. In this case the F21 of the MT202 COV received from Sender's correspondent. That reference will be used by BSCHESMM to reconcile this entry with the MT103 Announcement.

IRVTOWNREF2756: Own reference assigned to the transaction by IRVTUS3N. It is not the F20 of the MT202 COV that IRVTUS3N received.

Company Spain S.A.: Name of the beneficiary provided as Supplementary Details. Something else might be provided here, it depends on sender's choices. 2nd Transaction :61:180830D1000,S103ORIGREF531892//IRVTOWNREF2684

INVOICE 2787738 Optional and provided in format

6!n[4!n]2a[1!a]15d1!a3!c16x[//16x]

[34x] - The last element supplementary details must be on a new line.

Here we have the following elements

180830: Value date

D: Debit entry

1000: Amount of the entry

S103: S for SWIFT Transfer, 103 for the Message Type sent.

ORIGREF531892: For a debit entry, the Reference for the Account Owner is the field 20 Sender's Transaction Reference Number (or its equivalent) of the original instruction. The original MT103 was initiated by another institution, not by IRVTUS3N.

IRVTOWNREF2684: Own reference assigned to the transaction by IRVTUS3N. In case IRVTUS3N initiated the transaction, this would be populated in the preceding field and this one could remain empty.

REMITTANCE INFORMATION (INVOICE 2787738) is provided as Supplementary Details. Something else might be provided here, it depends on sender's choices. 3rd Transaction :61:180830D24578,69NCHK25REF9TRX//IRVTOWNREF2524 Optional and provided in format

6!n[4!n]2a[1!a]15d1!a3!c16x[//16x]

[34x] - The last element supplementary details must be on a new line.

Here we have the following elements

180830: Value date

D: Debit entry

24578,69: Amount of the entry

NCHK: N for Non-SWIFT Transfer, CHK for Cheques.

25REF9TRX: For a debit entry, the Reference for the Account Owner is the field 20 Sender's Transaction Reference Number (or its equivalent) of the original instruction.

IRVTOWNREF2524: Own reference assigned to the transaction by IRVTUS3N. In case IRVTUS3N initiated the transaction, this would be populated in the preceding field and this one could remain empty.

No Supplementary Details provided. Closing Balance :62F:C180830USD361996,21 Mandatory and of format 1!a6!n3!a15d (D/C Mark)(Date)(Currency)(Amount).

The C at the beginning means it is a Credit balance. Otherwise it would be a D for Debit Balance.

Closing Balance = 20000 + 367574,9 - 1000 - 24578,69 = 361996,21 End of Message Text/Trailer

Read this page on the SWIFT formatting rules and Character sets of MT Messages to get additional information and understand what 16x, 35x and the format of the field options mean.

We have three entries in the statement. The first one is of particular interest because it is the entry that IRVTUS3N booked on BSCHESMM’s account when it received the MT202 COV.

Narratives and notes on this SWIFT MT950 message

Below we provide some narratives and notes about the SWIFT MT950 statement message to better understand its meaning and content. Read them and review the table above to grasp the details. The devil is in the details.:-)

Narrative and note 1 (Main purpose of this SWIFT MT950)

With this message, Bank of New York Mellon (IRVTUS3N) is providing an account statement to Santander (BSCHESMM) with all the debit and credit entries booked on the account.

Narrative and note 2 (The SWIFT MT950 is a cover)

The MT950 is also “a cover” like the MT910. When the Beneficiary institution receives the MT950, it has confirmation that its account has been credited with the funds related to the announcement. So the final beneficiary can be credited as well. No need to receive a MT202 COV. This explains why an MT103 announcement can be reconciled with an MT950.

Narrative and note 3 (The entries in the SWIFT MT950)

Statement lines (F61) are probably are the most complex and most interesting fields in the SWIFT MT950. You have to be careful with the references and how they are populated. Some rules are provided in the standard MT. But in practice, it is better to ask the correspondent which rules it applies to populate the references. You will sometimes have surprises.

Narrative and note 4 (Reconciliation of SWIFT MT950 with the MT103 announcement)

To reconcile the announcement with the cover, sender of the SWIFT MT950 (F54 of the MT103 Announcement), date, amount and references provided in the accounting entry are used. Date and amount are not 100% reliable. They might be different than the ones received in the MT103A. References can be provided in Subfields 7 or 8 of the statement line. They are both of format 16x like the format of fields 20 and 21. In general the receiving bank extracts these two fields and check if one matches with the reference of the MT103 announcement. In some case a manual reconciliation can be performed.

The information available in the SWIFT MT950 statement is poor compared to what we have in the SWIFT MT910. The SWIFT MT950 does not contain Date/Time Indication. Information like ordering or intermediary institutions is missing as well. The related reference can be easily extracted from a MT910. That is why banks generally request their correspondent to send a SWIFT MT910 Confirmation of Credit.

To continue with our analysis of statement messages, the next article will be about the SWIFT MT940.

Hi Jean,

Is it the case that MT910 is generated per transaction whereas MT950 will be sent as a End of the day statement between a correspondent and the beneficiary bank?

Hi Ankur, Thank you for your nice comments!

You are correct! The MT910 is sent when the nostro is credited, so for every transaction, but provided the Beneficiary bank asks for it. The service is not free.

The MT950 is an account statement. The Beneficiary Bank receives from its correspondent according to a frequency they agreed upon, generally daily. But account statements can be sent every two days or on a weekly basis also.

Thanks for the clarification,it’s really helpful.

Hi Jean,

What are the requirements for the MT950 file name? What is the maximum file name size?

Hi Jelena,

Unfortunately I am not aware of any requirement about the MT950 File Name and the maximum file name size. There is a requirement about the maximum file length of 2000 characters. If you find anything about the file name, please do share it. Sorry!

Please can you explain on Tag 86 pouplation.

Hi, The Tag 86 is available in the SWIFT MT940, not in the MT950. I refer you to the post about the MT940.

The Tag 86 is called Information to Account Owner and consists of up to 6 lines that cna have up to 65x each.

How can i recognize the several part of a message in in input MT s!?

For example in MT950

Dears,

Thanks for this intresting Blog,

One more question please, did exist any file length restriction on MT950 file.

Regards.

Grizli.

Hi, Thank you for your comment!

The maximum message length for an MT950 is 2,000 characters. In case the 2000 characters are not enough to convey a statement, you can use multiple messages for the same statement. See field 28C of the MT950.

Regards, Jean Paul

What is Smart and Non-Smart Message?

Hi Jean Paul,

Will the receiver of an MT950/MT910/MT940 always receive an MT103? Trying to understand situations where the receiver may only receive ordering customer etc information from a statement like message in field 61 for example and not from the MT103.

Kind regards

Nick

Hi Nick,

In the context of a cover payment, the receiver of the MT103 annoucement also receives MT950/MT910/MT202 COV. One of these messages (the cover) is needed for the reconciliation with the announcement. But the MT950 is an account statement. A correspondent bank may receive many payments (MT103 serial or MT202 serial, cheques, etc.), credits the account of the beneficiary (another bank) and then forwards an account statement to the beneficiary with the details of all the credited transactions. It is not required that the receiver gets the MT103 for each statement line.

Regards,

Jean Paul

I’m getting Maximum Length Exceeded error for MT950.

What is the maximum length of an MT950 message.

The maximum length of a SWIFT MT940 or MT950 message is 2000 characters.

Thanks, Paul

Hi paul,

Could you please let me know which field in Camt.053 differentiate that MT940 and MT50. I mean where its differentaite its bank statement or customer statement.

Thanks, Paul

Hi Paul,

These articles are really very helpful. thanks for putting them up.

you mentioned in the previous article to go for that since UETR is not available in MT910 the workaround is to use MT950.

Where can we introduce the UETR here?

My second question is for the beneficiary bank. Once payments are agreed between banks, beneficiary bank sends MT210 (notice of receipt) to the correspondent / receiver bank. How can a MT210 be reconciled with MT910?

Hi

I am looking for such resources, for Gurgaon Location,for one of the Multinational Company, if anyone interested or have friends looking for change can email me there resume

Payment Centre – only grads with minimum 18 months of relevant experience keywords are international payments experience, swift messages exp MT102, 103, 202, 201, 203 or inward outward payment experience.

Reconciliation- experience into MT940 and 950 minimum 18 months experience.

Regards,

Deepak Mittal

9925224455

Hi Jean,

I want to know if the response for an MT191 is an MT202. in other words, the MT191 is just a request, not an order.

Thank you

I believe some banks post credits to customers on the basis of MT 950 account statement without receipt of MT 103. Is the same safe from AML angle and acceptable to Regulators worldwide. Shall be happy to have a reply. Thanks.

Is there a way to Link a MT 920 to a MT 950

Hello Sir, I want to know about validation of Tags which present in SWIFT format.

Hi Paul,

I I’m getting a NACK({405:C03004}) back for the MT950 messages, but when I try to process them without any decimal value it gets processed without any NACKS and this is happening only with the JPY but not with the other currencies. Not sure what the issue is.

NACK’s

:60F:C211105JPY20000003,8

Processes no issues

:60F:C211105JPY20000003,

I would really appreciate any help on this.

Hi Rakesh,

JPY Currency don’t have Cents/Paisa hence when you are giving amount as JPY20000003,8 it is failing.

Regards,

Prabhat

Hi Rakesh,

JPY Currency don’t have Cents/Paisa hence when you are giving amount as JPY20000003,8 it is afiling.

Regards,

Prabhat

Hi Jean Paul,

Thanks for this explanation it’s very useful.

I had a question on future dated transactions that appear in an MT950 message (example – the statement balance value date is 09/03 but a transaction on this statement has a value date of 10/03).

I understand that for an MT940 you have the 65 tag available to populate a future available balance but this is not available in MT950s.

How would you expect to view these transctions in the MT950 statement for value date 09/03?

Thanks

Team – Can anyone of you share me the screenshot of how MT950 file looks..

does anyone know if mt950s are sent at EOD or can they be sent intra day