The previous article was about the usage of the SWIFT MT101 by a parent company to pay from a subsidiary account. A parent company can also use the SWIFT MT101 to pay from its own account on behalf of multiple subsidiaries. In this article, we will see how this is performed and the information that must be provided in the SWIFT MT101 for that purpose.

The “secret” is in the field 50a Instructing Party. In the SWIFT standard, we read the following under the usage rules of that field: “This field must only be used when the instructing customer is not also the account owner.” We will consider an example to illustrate the usage of the field 50a Instructing Party.

The table below contains the fields that are transported in the MT101 Message. The last column (comments) provides further explanation about the fields. Read them carefully.

Explanation Format Comments Sender PUBGFRPP The Sender BIC appears in header block (Block 1) in the MT103 Input and in the application block (Block 2) in the MT101 Output. Message Type 101 The message type is the second field of the block 2. Receiver BNPAFRPP The Receiver BIC appears in header block (Block 1) in the MT101 Output and in the application block (Block 2) in the MT101 Input. Message text: General Information (Sequence A) This introduces the Text block (block 4). All the fields below are in the text block of the MT101 message. Sender's Reference :20:181029PBGR2001 This field is mandatory and of format 16x. It is a reference assigned by the Sender to unambiguously identify the message. See all the allowed characters on this page. Message Index/Total :28D:1/1 It is mandatory and of format :

5n/5n for (Message Index)/(Total)

If you send 5 messages for the same order, this field will take the value 1/5 in the first message, 2/5 in the second message, and so on. 1/1 means there is only one message sent for this order. Ordering Customer :50H:/FR7630004028370001095333394

PUBLICIS GROUP

133 Av. des Champs-Elysees

75008 Paris It is optional and can be provided in three different formats according to the options F, G, or H. Option H is chosen in this case with format: :

/34x (Account in IBAN format)

4*35x (Name and Address) Requested Execution Date :30:181030 Mandatory and of format 6!n (Date, a valid date expressed as YYMMDD)

It is the date on which all subsequent transactions should be initiated by the executing bank. Transaction Details 1 (Sequence B first occurrence) This introduces the Mandatory Repetitive Sequence B Transaction Details. At least one occurrence must be provided. Transaction Reference :21:PGR181030TRX01 This field is mandatory and of format 16x. It is a reference assigned by the Sender to unambiguously identify a unique transaction. See all the allowed characters on this page. Currency, Transaction Amount :32B:EUR82500,50 Mandatory and of format 3!a15d (Currency)(Amount) Instructing Party :50L:PUBLICIS GROUP SUBSIDIARY ONE The instructing party is the subsidiary of Publicis group. The head office pays from its own account on behalf of this subsidiary. Account With Institution :57A:POFICHBE The Account with Institution is provided because the beneficiary does not have an account with the receiver, BNPAFRPP. Beneficiary :59:/CH2209000000875006486

OTTO FISHER AG

Austrasse 46

8045 Zurich

SWITZERLAND Beneficiary customer information is mandatory and can be provided in three different formats: No letter option, Option A and Option F. No letter option is chosen in this case with format:

[/34x] (Account) here in IBAN format

4*35x (Name and Address) Details of Charges :71A:SHA It is mandatory and of format 3!a. It can takes 3 values: BEN, OUR and SHA. SHA means charges are shared between Ordering and beneficiary customers.This transaction is a SEPA payment. Transaction Details 2 (Sequence B second occurrence) This is the second occurrence of the Mandatory Repetitive Sequence B Transaction Details. Transaction Reference :21:PGR181030TRX02 This field is mandatory and of format 16x. It is a reference assigned by the Sender to unambiguously identify a unique transaction. See all the allowed characters on this page. Currency, Transaction Amount :32B:EUR50000, Mandatory and of format 3!a15d (Currency)(Amount) Instructing Party :50L:PUBLICIS GROUP SUBSIDIARY TWO The instructing party is the subsidiary of Publicis group. The head office pays from its own account on behalf of this subsidiary. Account With Institution :57A:IWBKITMM The Account with Institution is provided because the beneficiary does not have an account with the receiver, BNPAFRPP. Beneficiary :59:/IT70H0316501600000110175992

MILAN RECORDING STUDIOS

Viale Lancetti 29

20141 Milano, Italy Beneficiary customer information is mandatory and can be provided in three different formats: No letter option, Option A and Option F. No letter option is chosen in this case with format:

[/34x] (Account) here in IBAN format

4*35x (Name and Address) Details of Charges :71A:SHA It is mandatory and of format 3!a. It can takes 3 values: BEN, OUR and SHA. SHA means charges are shared between Ordering and beneficiary customers.This transaction is a SEPA payment. Transaction Details 3 (Sequence B third occurrence) This is the third occurrence of the Mandatory Repetitive Sequence B Transaction Details. Transaction Reference :21:PGR181030TRX03 This field is mandatory and of format 16x. It is a reference assigned by the Sender to unambiguously identify a unique transaction. See all the allowed characters on this page. F/X Deal Reference :21F:FXDEALID78685 There is an underlying foreign exchange deal to this transaction. This field specifies the FX deal reference between PUBGFRPP and BNPAFRPP. Currency, Transaction Amount :32B:USD227640, Mandatory and of format 3!a15d (Currency)(Amount). Note that the currency is USD. This is a cross-border payment. Instructing Party :50L:PUBLICIS GROUP SUBSIDIARY THREE The instructing party is the subsidiary of Publicis group. The head office pays from its own account on behalf of this subsidiary. Account With Institution :57A:WFBIUS6S The Account with Institution is provided because the beneficiary does not have an account with the receiver, BNPAFRPP. Beneficiary :59:/26351-38947

RIVERS PAPER COMPANY

37498 STONE ROAD

SAN RAMON, CA Beneficiary customer information is mandatory and can be provided in three different formats: No letter option, Option A and Option F. No letter option is chosen in this case with format:

[/34x] (Account) here in IBAN format

4*35x (Name and Address) Remittance Information :70:/INV/89892FR2787 Remittance information is optional and provided in format 4*35x if available (Up to 4 lines of up to 35 X characters each). It is usually used by the beneficiary for invoice reconciliation. Currency, Original Ordered Amount :33B:EUR200000, This field is provided in format 3!a15d. It specifies the original currency and amount as specified by the ordering customer.

Note that EUR200000, * 1,1382 USD/EUR = USD227640, Details of Charges :71A:OUR It is mandatory and of format 3!a. It can takes 3 values: BEN, OUR and SHA. OUR means charges are to be borne by the ordering customer. Charges Account :25A:/FR7630004028379876543210943 This is the ordering customer's account number to which applicable transaction charges should be separately applied by the debtor. Exchange Rate :36:1,1382 Mandatory since field 33B is present and 'amount' in field 32B is not equal to zero. Provided in format 12d. The integer part of Rate must contain at least one digit. A decimal comma is mandatory and is included in the maximum length.

Note that EUR200000, * 1,1382 USD/EUR = USD227640, End of message text/trailer

Read this page on the SWIFT formatting rules and Character sets of MT Messages to get the additional information and understand what 16x, 5n, 34x and the format of the field options mean.

Narratives and notes on this MT101 Message

As usual, there is more in this message than meets the eye. The following narrative and notes allow to get a deeper understanding of the message content.

Narrative and note 1 (Main purpose of this MT101)

The Sender (PUBGFRPP), Publicis Group, sends multiple transactions MT101 with a single debit account. The ordering customer account is therefore present in the sequence A. After execution, the funds for all the transactions are debited from the ordering customer account. Each sequence B occurrence contains the field 50a Instructing Party which specifies the subsidiary company on behalf of which the parent company, PUBGFRPP, sends the payment instruction.

[box type=”tick” style=”rounded”]In case the instructing party would not be present, the sender would be paying for itself.[/box]

Narrative and note 2 (Transactions 1 and 2 in this MT101)

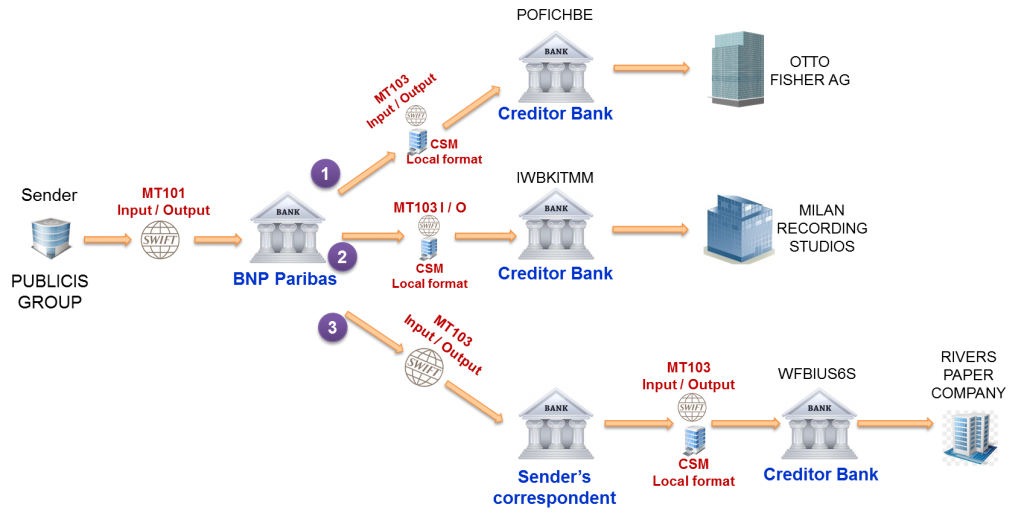

For the first two transactions, the beneficiaries are located respectively in Switzerland and in Italy. The two countries are in the SEPA Area and the transactions are in Euro currencies and with shared fees. So both transactions can be settled as SEPA Credit Transfers through a local clearing system like STEP2.

Narrative and note 3 (Transaction 3 in this MT101)

The beneficiary of the third transaction is in the USA. The amount of the transaction is in USD currency. Since the ordering customer account is in EURO, a currency exchange from EUR to USD is needed to carry out the transaction. There are two possibilities:

- The ordering customer can send the order to the bank and let the bank handle the FX Deal.

- The ordering customer can take care of the FX deal and provide the related information to the Bank. This second option was chosen and the ordering customer provided the reference of that deal in the instruction.

[box type=”alert” size=”large” style=”rounded”]To avoid currency conversion and the related fees, a company would rather pay using a USD account provided there is enough liquidity available. [/box]

The Debtor Bank then settles the transaction through its correspondent in the USA. It is assumed that a serial payment is used. But it is possible to use a cover payment too. In that case, the MT103 announcement is sent directly to WFBIUS6S and the MT202 COV is sent to the correspondent. SWIFT MT103 and 202 COV have been analyzed in depth in a series of articles. Read them if you want to know more.

To conclude, let’s consider this question: why would a parent company pay from its account on behalf of subsidiaries? There are many reasons, but the keywords here are centralization and concentration. When a company has multiple locations, it is usually not efficient to pay service providers from each location. By centralizing the payments handling and processing in one location (generally the parent company), the company saves time and money through increased productivity and efficiency. This practice is referred to as centralized accounts payable operations. Some companies go even further and concentrate group treasury cash management functions into one office.

The SWIFT MT101 can also be used to repatriate funds. That will be the topic of the next article.

Hi, Jean Paul! Thank you very much for the useful SWIFT examples. Your blog has helped me get a much better understanding of how payments work.

There is one thing which I am still not quite clear on with respect to payments made on behalf of a subsidiary. When the beneficiary receives the payment, who would they see as the sender of the payment – the parent company or the subsidiary?

Hi Andreas,

Thank you for your interest! The sender of the payment is the parent company. Instructing Party is the field that tells the beneficiary that the payment is from the subsidiary although it was sent by the parent company. Let me know if you have further questions.

Hi paul

Pls make me clear that incase of the sender differ with 50h, then we need an poa? Right

Jean Much Helphul thanks