The MT101 is a payment initiation message that can be used for many purposes and in various ways. An overview of how corporations use it was provided in the introductory article of this series. We saw in the previous article the meaning of using the field 50a in the MT101 sequence B. In the following, we will see how parent companies use the MT101 SWIFT Message to pay from their subsidiaries accounts. This is a feature that is very useful for multi-subsidiary corporations.

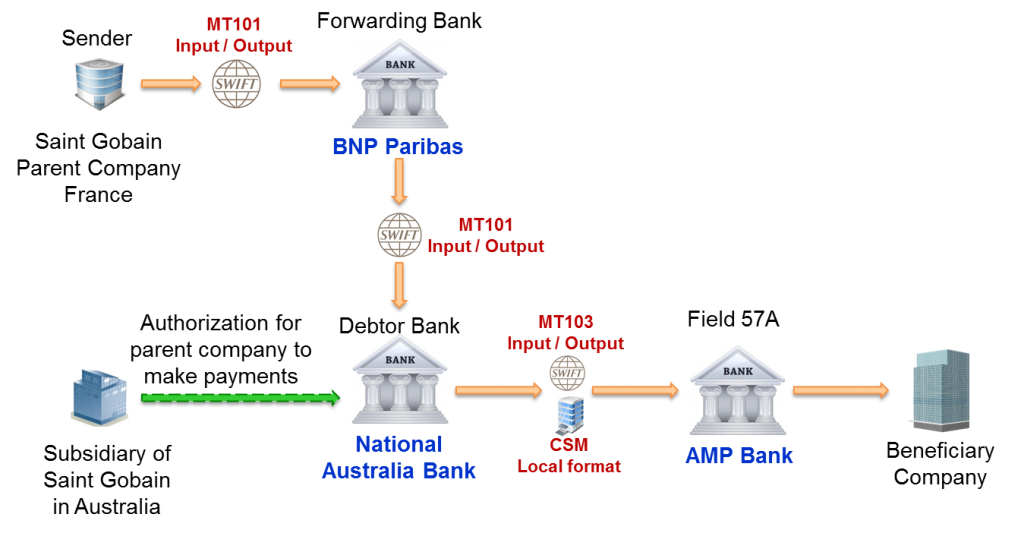

The example we consider here is illustrated with the following picture.

The parent company is Compagnie de Saint Gobain located in France. Saint Gobain France received an invoice for goods or services provided by a company located in Australia that we call Beneficiary Company. Saint Gobain France wants to pay the invoice from the account of its subsidairy, Saint-Gobain Abrasives, which operates in Australia. There can be many reasons for that. The parent company may not have a bank account in Australia or simply it may decide to use the subsidiary account to optimize liquidity usage.

The table below contains the fields that are transported in the MT101 SWIFT Message. As usual, we have added a column (comments) to provide further explanation and ease the understanding for you.

Explanation Format Comments Sender SGOBFRPP The Sender BIC appears in header block (Block 1) in the MT103 Input and in the application block (Block 2) in the MT101 Output. Message Type 101 The message type is the second field of the block 2. Receiver BNPAFRPP The Receiver BIC appears in header block (Block 1) in the MT101 Output and in the application block (Block 2) in the MT101 Input. Message text: General Information (Sequence A) This introduces the Text block (block 4). All the fields below are in the text block of the MT101 message. Sender's Reference :20:ORDERREF7275 This field is mandatory and of format 16x. It is a reference assigned by the Sender to unambiguously identify the message. See all the allowed characters on this page. Customer Specified Reference :21R:AUSUPPLIERPAY28 The field is optional and of format 16x. It is a reference to the entire message assigned by either the instructing party, when present or by the ordering customer, when the instructing party is not present. See all the allowed characters on this page. Message Index/Total :28D:1/1 It is mandatory and of format :

5n/5n for (Message Index)/(Total)

If you send 5 messages for the same order, this field will take the value 1/5 in the first message, 2/5 in the second message, and so on. 1/1 means there is only one message sent for this order. Requested Execution Date :30:181030 Mandatory and of format 6!n (Date, a valid date expressed as YYMMDD)

It is the date on which all subsequent transactions should be initiated by the executing bank. Transaction Details 1 (Sequence B first occurrence) This introduces the Mandatory Repetitive Sequence B Transaction Details. At least one occurrence must be provided. Transaction Reference :21:SGHREFOFTRX This field is mandatory and of format 16x. It is a reference assigned by the Sender to unambiguously identify a unique transaction. See all the allowed characters on this page. Currency, Transaction Amount :32B:AUD125000, Mandatory and of format 3!a15d (Currency)(Amount) Instructing Party :50L:Compagnie de Saint Gobain

118 Rue Lauriston

75016 Paris Compagnie de Saint Gobain instructs the payment but does not own the account to be debited. It is authorised by its subsidiary to pay from the ordering customer account provided below. Ordering Customer :50H:/1234567000

Saint-Gobain Abrasives

60 Hume Hwy,

Somerton VIC 3062,

Australia The field 50H is optional but must be present either in sequence A or B. In this case it is generally provided in sequence B since the receiver does not hold the ordering customer account. Account Servicing Institution :52A://083098

NATAAU33 The subsidiary of saint Gobain has an account with National Australia Bank. The BSB (Bank State Branch) code and the BIC are provided. Even if it is not mandatory in the SWIFT standards to use the BSB code preceded by a double slash '//', many australian banks impose it. Account With Institution :57A://939400

AMPBAU2SXXX The Account with Institution is provided because the beneficiary does not have an account with National Australia Bank, the debtor bank. The beneficiary account is with AMP Bank. The BSB (Bank State Branch) code and the BIC of AMP Bank are provided. Beneficiary :59:/7654321000

Beneficiary Company

385 Bourke St,

Melbourne VIC 3000,

Australia Beneficiary customer information is mandatory and can be provided in three different formats: No letter option, Option A and Option F. No letter option is chosen in this case with format:

[/34x] (Account) here in IBAN format

4*35x (Name and Address) Remittance information :70:Payment from

Compagnie de Saint Gobain

/INV/7828728292 Remittance information is optional and provided in format 4*35x if available. Up to 4 lines of up to 35 X characters each.

The name of the parent company is provided here, so that the beneficiary can see it is the parent company that is paying. Details of Charges :71A:SHA It is mandatory and of format 3!a. It can takes 3 values: BEN, OUR and SHA. SHA means charges are shared between Ordering and beneficiary customers. End of message text/trailer

Read this page on the SWIFT formatting rules and Character sets of MT Messages to get additional information and understand what 16x, 5n, 34x and the format of the field options mean.

Narratives and notes on this MT101 SWIFT Message

As usual, there is more in this message than meets the eye. The following narrative and notes allow to get a deeper understanding of the message content.

Narrative and note 1 (Main purpose of this MT101 SWIFT Message)

The Sender (SGOBFRPP), Saint Gobain wants to pay an invoice to a company in Australia from its subsidiary’s account in that country. SGOBFRPP instructs the Receiver (BNPAFRPP), to forward the payment to the Bank that will execute the instruction. This is generally done with a SWIFT MT101 containing multiple sequence B transactions details. We consider a MT101 with one sequence B occurrence to make things simple.

Narrative and note 2 (BNPAFRPP, forwarding bank in this MT101 SWIFT Message)

The Receiver (BNPAFRPP) of this message does not hold the account to be debited for the payment. Therefore it plays the role of a forwarding bank. It forwards the MT101 SWIFT Message to National Australia Bank, the debtor bank that holds the ordering customer account and can execute the instruction.

The debtor bank executes the payment and sends a SWIFT MT103 or a local clearing system message to the beneficiary bank.

Narrative and note 3 (Field 50L in this MT101 SWIFT Message)

The field 50L is crucial in this message. It is the field where the instructing party information is provided. The instructing party, SGOBFRPP, can do this only if it has an authorization from its subsidiary to make payments from its account. That means the debtor bank knows the parent company and has a formal approval from its customer, the subsidiary.

In some countries, the parent company must own at least 50% of the subsidiary company. Otherwise it is not considered as a subsidiary and therefore cannot pay from the subsidiary’s account. In other countries, paying from a subsidiary’s account is not allowed even if the parent company owns more than 50% of the subsidiary.

Narrative and note 4 (BSB codes in this MT101 SWIFT Message)

The field 52A specifies the national clearing code (called Bank State Branch code in Australia) and the BIC of the bank holding the Ordering Customer account. The BSB code unambiguously identifies the branch which is supposed to receive the instruction. However, note that the forwarding bank uses to BIC code to route the MT101 to National Australia Bank, the debtor bank, over the SWIFT network.

Certain Australian Banks request senders to provide the BSB codes in the format AU123456, so preceded by the country code.

The BSB code is also indicated in the field 57A.

Narrative and note 5 (Field 57A in this MT101 SWIFT Message)

The field 57A specifies the Bank that the beneficiary has an account with. If the beneficiary account was held by National Australia Bank, the field 57A would not be needed. Since it is different, it must be provided.

Narrative and note 6 (Remittance Information in this MT101 SWIFT Message)

Saint Gobain, the parent company, is the one who received the invoice. So the receiver may not know the subsidiary at all. And note also that the subsidiary may have a name that is completely different from the one of the parent company. For these reasons, the name of the parent company must appear in the remittance information (Field 70). The beneficiary can then easily make the link between the payment and its customer, the parent company.

This ends our analysis of this MT101 SWIFT Message. It is always fascinating how many things we can say about one message. But the SWIFT MT101 has not revealed all its secrets yet. In the next article, we will see how a parent company can use the MT101 to pay from own account on behalf of its subsidiaries.

zHello Jean,

Could you please tell why Saint Gobain doesnt sent MT101 directly to National Bank since it has subsi account with National australian bank, Why should it route via BNP Paribas when it has direct relationship

Regards,

Srini

Hi Srini,

Saint Gobain can prepare and send one single MT101 to BNP and BNP will take care of forwarding the MT101 to all the other banks.

It makes things easy for Saint Gobain. Otherwise, it must prepare N MT101 files and send to each party.

The SWIFT Standards allow to do that and large corporates do appreciate the service.

I hope it clarifies.

BR, Jean Paul

Thanks Jean, it helps.

So Saint Gobain prefer to use BNP for all its MT101 communications (Though its not mandatory to do so ), Also I guess there will be some small charges from BNP to forward the MT101?

Regards,

Srini

You got it right! And yes the service to forward the MT101 is charged. That is a true value added service.

For Electronic Payments for both domestic and foreign vendors, is it possible to support country specific characters as of part of an MT 101 (say for example, Japanese characters or Thai characters)

Hi,

Sorry for the late response.

As fas as I know, the answer is No. You have a set of characters that are allowed in SWIFT MT messages. See this post.

Very useful information thanks Jean,

Dear Jean,

How about subsidiary using parents BIC and sends MT101 to the debtor bank to use own account to further make the payment ?

Is this case 50L or 50H is referring to subsidiary or only 50H is viable since ordering and instructing both is pertaining to subsidiary in this case however the sender is parent BIC.

Please enlighten on this piece.

Hi,

In this case, an authorization is required for the subsidiary to make payments from the parent account. The Instructing Party (50L) is the subsidiary and the ordering customer is the parent company (50H).

The subsidiary sends the MT101 to his own bank which forwards it to the bank of the Parent company. The field 50H identifies the account owner whose account is to be debited. The subsidiary does not own the account. It is using the parent account to pay.

Best regards,