After going through the four key strategies to understand how cross border payments work, we can now take a closer look at the SWIFT MT messages. We will start with a basic SWIFT MT103 message. It is a message used in the case where sender and receiver have a direct account relationship. Only mandatory fields are provided as you can see that in the detailed specifications of the SWIFT MT103 message.

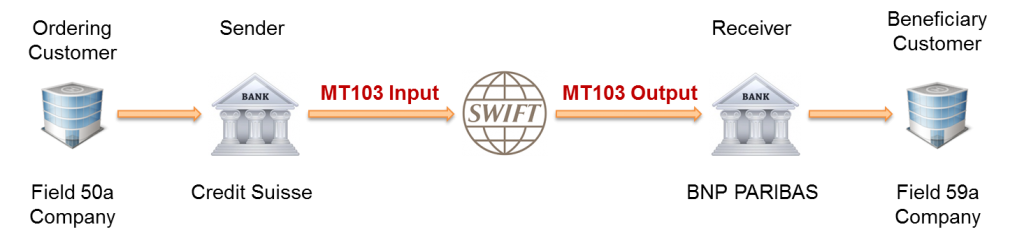

The picture below shows the main actors and how the messages flows from sender to receiver.

The table below contains information that is highlighted in the examples provided in the SWIFT Message Reference Guide. An additional column (comments) provides further explanation on the fields to make the things easy to understand.

Explanation Format Comments Sender CRESCHZZ80A The Sender BIC appears in header block (Block 1) in the MT103 Input and in the application block (Block 2) in the MT103 Output. Message type 103 The message type is the second field of the block 2. Receiver BNPAFRPP The Receiver BIC appears in header block (Block 1) in the MT103 Output and in the application block (Block 2) in the MT103 Input. Unique End-to-end Transaction Reference 121:180f1e65-90e0-44d5-a49a-92b55eb3025f This reference is provided in the user block (Block 3) and transported end-to-end. Message text This introduces the Text block (block 4). All the fields below are in the text block of the MT103 message. Sender's reference :20:UniqRefOfTRSX16x It is mandatory and of format 16x. Bank operation code :23B:CRED It is mandatory and of format 4!c. Value date/currency/interbank settled amount :32A:180724EUR735927,75 It is mandatory and of format

6!n3!a15d (Date)(Currency)(Amount) Currency/Instructed Amount :33B:EUR735927,75 Normally optional in the standard. It is mandatory because country code of Sender is CH and country code of receiver is FR. See Rule C2.

Format 3!a15d (Currency)(Amount) Ordering customer :50K:/CH5704835098735711000

GALLMAN COMPANY GMBH

RAEMISTRASSE, 71

8006 ZURICH

SWITZERLAND Ordering customer information is mandatory and can be provided in three different formats according to the options A, F and K. Option K is chosen in this case with format:

[/34x] (Account)

4*35x (Name and Address) Beneficiary customer :59:/FR7630004008180001236749327

DUPONT SARL 21 RUE DU COMMERCE

PARIS Beneficiary customer information is mandatory and can be provided in three different formats: No letter option, Option A and Option F. No letter option is chosen in this case with format:

[/34x] (Account)

4*35x (Name and Address) Details of charges :71A:SHA It is mandatory and of format 3!a. It can take 3 values: BEN, OUR and SHA. End of message text/trailer

I refer you to this page on the Field formatting rules and Character sets of SWIFT MT Messages. It is helpful to understand what 16x, 4!c and the format of the fields options mean.

Narratives and notes on the Basic SWIFT MT103 Message

There is more in this message than meets the eye. 🙂 The following narrative and notes allow to get a deeper understanding of the message content.

Narrative and note 1

With this SWIFT MT103 message, sender (CRESCHZZ80A) is asking receiver (BNPAFRPP) to debit sender’s account and credit beneficiary account. Note that the sender’s account is not specified in the message. So there are two possibilities :

- Sender has opened one single account with receiver in EUR currency or

- The preferred account should be used in case the sender has open many accounts with the receiver.

Narrative and note 2

There is no ordering institution (Tag 52a) in the SWIFT MT103 message. That means implicitly that the ordering customer is customer of the Sender.

Narrative and note 3

No correspondent is used neither on sender side (Tag 53A) nor on receiver side (Tag 54A) and No reimbursement party (Tags 56a and 57a) is indicated in the SWIFT MT103 message. It means

- there is a direct account relationship, in the currency of the transfer, between the Sender and the Receiver. Money will be taken from sender’s account and credited to the beneficiary.

- Beneficiary customer account (:59:/FR7630004008180001236749327) is hold by the receiver.

You may wonder: what does the guy mean? This part is really not easy to understand when you start. You will get a better understanding with the next examples. I promise!. So just come back to the blog and check the new articles.

Narrative and note 4

Details of charges (Tag 71A) is SHA. That means charges are shared between Ordering and beneficiary customer. Sender pays charges to ordering bank. Beneficiary pays to the receiving bank.

If you are interested in the sample SWIFT MT103 messages sent to SWIFT by the Sender (Credit Suisse) and received from SWIFT by the receiver (BNP PARIBAS), fill in the form below and submit. You will then receive a mail in your mailbox with the link to download the two sample files and get regular updates when new posts or videos are published.

Excellent explanation – one stop shop for payments knowledge – you are doing an amazing job

Can you help me with an answer to this questcion? For an international transaction involving the Nostro debit is CSM ‘always’ involved ? In other words – even in direct relationship should the message indicating transfer be sent to the CSM? In your example does any communication go to epc for this transaction?

Waiting for a similar crystal clear explanation for senders correspondent , receivers correspondent, intermediary and third reimbursement institution with scenarios and the awesome notes

My main doubts are around the following areas

When which party is used?

What are the allowed and disallowed combinations for usage?

Hi Balaji,

Thanks for your interest. I feel curiosity and passion in your comment. 🙂

Let me answer your question: For an international transaction involving the Nostro debit is CSM ‘always’ involved ? In other words – even in direct relationship should the message indicating transfer be sent to the CSM?

The answer is clearly No. The decision to go through the CSM is taken by the receiving bank most of the time. It is not indicated in the SWIFT message. So the CSM is not always involved. Let’s say a bank in India is sending Euro to a major bank in France with which it has an account relationship in EUR. The Nostro account of the indian Bank will be debited in any case. But on the credit side, there are many possibilities: The beneficiary can be

1) either customer of the major bank

or 2) customer of another bank belonging to the major bank group

or 3) a customer of bank which is indirect participant of the major bank

or 4) a customer of a bank not belonging to the major bank and not indirect participant either.

I made a video recently on my youtube channel paiementorTV to explain what direct and indirect participants are. You can check it out if that is not clear for you.

Here is what will happen for the beneficiary to receive the funds.

1) The major bank will just debit nostro account of Indian Bank and credits beneficiary account. This is a book transfer.

2) The major bank will forward the transaction directly to the other bank belonging to the bankgroup. This does not happen through a CSM generally. Settlement happens through accounts between major bank and the other bank.

3) The major bank will forward the transaction directly to its indirect participant. This does not happen through a CSM generally. Settlement happens through accounts between major bank and its indirect participant.

4) Only in this case, the major bank will send the transaction to the CSM. And Funds will be settled in the european RTGS system : TARGET2.

Next question: In your example does any communication go to epc for this transaction?

Under the narrative and note 3, I wrote this: Beneficiary customer account (:59:/FR7630004008180001236749327) is hold by the receiver.

If the beneficiary account is with another bank than the receiving bank, then the field 57 muts be provided in the message.

I will share an example in a next article.

Just keep coming to the blog and you will answers to other questions.

Enjoy the rest of the week-end,

Jean Paul

This is the best site on Payments

Thank you Anil

Thanks a lot, Jean. This clarifies

I hope we get to discuss and connect more 🙂

You have a great weekend too 👍🏼

So only in this case no. 4 ” When a beneficary customer of a bank not belonging to the major bank and not indirect participant either” the payment will be routed to CSM. That is how i interpreted your above mentioned explaination.Please correct me if i am wrong .

Thanks

Karan Koul

But while reading again the Case no. 4 :which talks that if beneficary is not belonging to any major bank and not indirect participant either” then in that case who will route the payment to CSM for that beneficary?

As per ur comment its some major bank which means there must be some direct or indirect relationship between them. which becomes the case no.3 . I got bit confused

Karan,

A major bank with its subsidiaries usually exchange payments directly without going through a CSM. Same thing with its indirect partipants. The bank can send the payments to its indirect participants since they have an account relationship anyway.

When the bank does not have a direct connection to another bank, they connect through a CSM of the country. Therefore case N°4.

I hope it clarifies the things. Let me know if you still have doubts.

Thanks Jean for quick response. So the only case when both the PSP’S doesn’t have any kind of relationship between them will transfer swift messages through CSM. I hope my understanding is correct now.

When the messages is to the CSM, local formats are used. The initial question was: do we always need to go through a local CSM to settle a SWIFT Transaction? My answer is NO.

When the correspondent bank receives the instruction from SWIFT (through MT103 or MT202), it sends a message to the CSM only if the ultimate receiver is neither the correspondent bank itself or one of its subsidiaries nor an indirect participant. If things are still unclear, please let me know.

Got it Jean Thanks

really appreciate your efforts for the community … keep up the good work

Thank you for your appreciation!

Hi Jean, I am learning so much from your posts. I have a question: How does the beneficiary approach the recipient with this basic SWIFT message and press them hard to give credit. For example, if the value date is today on this basic swift message, can the beneficiary approach his bank ( the receiver ) and claim crediting of his account? In reality what is happening is that, the receiving bank is just mentioning that they have not received the funds. Please guide as to what should the beneficiary do in such a case. What are his rights ….the only armoury he has in hand is this basic swift message. Thanks.

Hi Raj, Thank you for your comment. I can understand your frustration.

Now back to the date: The date provided in the SWIFT message is the value date where the settlement amount is to be booked at interbank level, so not the date where funds are supposed to be available on the beneficiary account. Banks may add float and make the funds available generally one or two days later. The bank applies float when it debits the sender’s account today and credits the beneficiary only tomorrow or later. In Europe, the float is now strictly regulated. I do not know how it is in the country where you live. But if the bank tells you (and it is really basic SWIFT message) they have not received the funds yet, it is probably because there is not enough balance on the sending bank account. Otherwise they are lying if Funds are already there on the Sender’s account and should just be debited and credited to the beneficiary account. So check if the bank applies float and how many days the regulation allows. If your payment was received many days back, either they should reject it and say to the sender, we cannot execute it because of Insufficient balance, or they should credit the beneficiary account immediately as requested by the law. I hope everything is clear. Good luck.

Hi Jane,

I am new to payments domain, however after reading your blog I have understood about the different blocks of the swift messages.

I wish to know about payment investigation process, hope you can help me, why do international payment fail, what are the different types of case (Swift message) involved and how do banks resolve them along with little explanation on terms below, for me few of them looks to be meaning is same and different regions uses different terminology

Debit party,

Credit party

Sending bank

Remitting bank,

Correspondence bank

Intermediary bank

Receiving bank

Correspondence bank

Receiving bank

Beneficiary bank,

Correct party,

Cover thru,

Third reimbursement bank

Return account

Debit party account officer

Credit party account officer and

Last assignee

Hi Yash,

Thank you for your comment! I think you already have a lot of articles on the blog that can help you to understand many of these topics.

Go through them. And if not done yet, join the newsletter to receive notifications when new articles are published on the blog!

Hi Jean,

Really appreciate for putting these information together. I have no doubt this is going to be a one-stop-shop for all people seeking knowledge on payments related topics!

I have the following clarifications:

1) In situations such as a bank is issuing a cross boarder loan to a customer, I assume it can send it using MT103 (even though the ordering party is a bank here). I assumed this because the credit leg of this transaction involves a customer. Is my understanding right? or should it transfer be via MT 202?

2) For the above case, which option (A, F, or K) and what information will the field 50a carry?

Hi Chandru,

Thank you for your appreciation!

My answers to your questions:

1) You are absolutely right. The bank can send it using the MT103 because a customer is involved. But the sending bank may have a agreement with the receiving bank located in the country of the customer (This is often the case). The receiving bank knows the local specificities and can manage the customer relationship much better. The sending bank may then send the funds to the receiving bank first using a MT202 since it is a interbank transfer and instructs the receiving bank to release the funds to the customer only if certain conditions are fulfilled.

2) The field 50a contains the ordering customer information. The options F and K are generally used, but there is no rule. As far as I know, the only constraint is that the information provided must comply with the SWIFT Standards.

Thanks Jean!

But, here is what confuses me a bit: Lets take Supply Chain Financing as an example. Assume that an importer in USA works with Bank-A (in USA) to offer financing to his supplier in India. Now, Bank-A issues financing (in USD) and sends MT103 to supplier’s bank (Bank-B) in India. To keep it simple, assume that there is correspondent relationship between these banks.

Now, here is my question: Since Bank-A itself is the ordering customer (as well as the sender) of MT103, I assume field 50a should represent Bank-A. Is that correct? If yes, looking at specifications of 50a option F and K, I am not sure how (in what form) we can provide Bank-A details in 50a. Mind providing an example for field 50a (representing Bank-A in this field)? It would help me better understand it.

Again, thanks for help!

Hi Chandru,

Yes you are correct. A bank can send funds to an end party on its own behalf. As far as I know, the bank will fill in the field 50a like any other ordering customer.

See the example below. You provide the bank name and address information. The account may be provided as well, but is optional.

:50K: Wells Fargo Bank

299 Main Street #2275

Location City, UT 84111

I hope this helps. 🙂

I made a swift transfer today to HEC Paris. However, in the MT103 sent by my bank does not show the baneficiary name. In beneficiary field, only IBAN and address are mentioned and they are correct. The swift code is also correctly mentioned. I am apprehensive about the missing beneficiary name. Please advise.

Hello Jean Paul,

Hope you’re doing well. Thank you for the interesting blog.

I have a question hope you help me understand more the usage of field 50 or 52 as ordering institution. In case of a third party settlement, i give the example below:

1- Bank A receives a deposit from Customer X

2- At maturity date, Customer X asks to not be the beneficiary himself and another customer Y to be the beneficiary (Customer Y holds his nostro account at Bank B)

In that case, Bank A will send MT103 to Bank B to credit customer Y’s account.

In the MT103 sent, is the field 50 mentioned i.e. 50: Customer X name and address

Your feedback is much appreciated.

Thanks,

Johnny

Hi Johnny,

The field 50 specifies the customer ordering the transaction. It is a mandatory field and must be mentioned. In the MT103, tag 50 should contain Customer X name and address. Options F and K allow to provide Name and Address. The field 52 should contain Bank A information since Bank A is the ordering institution.

Please let me know if you have further questions.

Thanks, Jean Paul

Jean, I need you to specify the exact field code required to send 103 correctly without sending wrongly, Also, i think where the fields codes are not properly set before sending the swift, it might affect the swift not to deliver to the Receiving Bank. Please i need answers .

Thanks. you can put answer on my email. michaelmoses845@yahoo.com

Hi Michael,

Do you mean the filed 23B (Bank operation code)?

It is a mandatory field and Four codes can be used in Production according to the SWIFT standards (CRED, SPAY, SPRI and SSTD).

You can consult the SWIFT MT specifications to see how they can be used.

I hope this help.

Regards,

Jean Paul

what is the use of Bank operation code :23B:CRED in MT103

This field 23B identifies the type of operation. CRED is used for the Normal credit transfer.

Hi Jean,

first of all thanks for the great explanation, it is really awesome.

i have one query regarding Tag71: SHA

Here Sender pays charges to ordering bank. Beneficiary pays to the receiving bank but i am seeing in the field that both :32A:180724EUR735927,75 and :33B:EUR735927,75 have same amount, so when sender and beneficiary would pay the charge to their respective bank?

Please suggest?

Hi Harry,

The sending bank is the one that sends the MT103. It does not know how much the receiving bank will charge to the receiver. But it puts tag71:SHA in the message to inform the receiving bank that the charges are to be paid by the receiver. So what happens is: the receiving bank gets the whole amount (EUR735927,75) and takes the charges (EUR150 for example). But that is not visible in the SWIFT message itself. If you have Tag 71:OUR, then the receiving bank cannot take charges from the receiver and will request the charges from the sending bank, which itself will ask the ordering customer to pay. I hope this clarifies.

Good day Jean Paul ,

Can you please explain what the letters in front of each Tag mean , e.g. Tag 71A , and why are some in capital letters, and some are not. I noticed with MT103 – STP , there is Tag 54A , but a normal MT103 , there isn’t. Currently, on the project I am working, we are using a normal MT103, and Tag54 is included. May you kindly explain.

Thank you in advance.

Hi, In a MT message, a field can take many formats. The capital letters tell you which format is used. For example the Field 50a (Ordering Customer) can take three formats. The capital letters A, F and K specify which formats are used as you can see in the SWIFT specifications. Let me know if you have further questions.

Good day Jean Paul ,

Can sender correspondent, receivers correspondent and intermediary exist in one SWIFT message only?

Hi Alan,

The answer is yes. Please read this article and the following. And let me know if you have further questions.

Hi Jean,

First of all let me thank you for all the effort you put in creating such easily understandable and informative post and videos.

I have a question incase of incoming MT 103 from Swift what will be the first in debit chain flow?

Thanks

Hi Priti,

For an incoming MT103, the first you do is to debit incoming settlement account.

Best regards,

Jean Paul

This may be a simple answer, but what does the ! mean in this format: Value date/currency/interbank settled amount – 6!n3!a15d

Thank you!

Hi Alex,

In SWIFT, ! means fixed length. Now for 6!n3!a15d.

6!n means that exactly 6 numeric characters (the n) are expected (The date).

3!a means that exactly 3 uppercase letters (the a) are expected (The currency).

15d means that up to 15 numeric characters, comma included (the d) are expected (The amount).

Kind regards,

Jean Paul

Hi Jean

can a beneficiary name be changed after a swift transfer has been done ? I sent a payment but the beneficiary name is not correct and payment is not received yet .

Hi Debbie,

I hope your problem is fixed now. Once the payment is executed, you cannot change the beneficiary name anymore. Now it is up to the beneficiary bank to decide what to do with the payment depending on what is implemented in their systems. Some banks do check if the name provided in the payment matches with the name in their own systems and some banks do not. If you just misspelled the name, they will usually fix it. But if the name is totally wrong they may reject it because it can be flagged as a fraudulent payment.

Hi Jean,

My friend sent me a transfer from HK to my student account (Barclays)in UK. However, I haven’t received it within the dates they promised(14 days already). I asked for the MT103, but sender’s bank said they can’t give it unless something went wrong…And they explained that the delay is because of the protest in HK currently, so they have to shut the bank sometimes. Does all their explanation make sense? And why they can’t give the MT103?

Thank you!

Hi Jean Paul,

Thanks for the wealth of info & the SCT book. Can you please shed some light on the cases when field 51A could be used in MT103? i.e. in which scenario is this valid?

Hi KK, Thank you for your nice comment and your appreciation.

your question is interesting because the sender of the MT103 is available in the Header.

The answer is found in the SWIFT documentation: Field 51A is only valid in FileAct.

So that field is used only when you send a File on the SWIFT Network using the fileAct protocol.

MT messages are normally exchanged with SWIFT FIN service and field 51A is not required in those cases.

BR, Jean Paul

As a bank if we only support SHA charging and if we receive MT103 with BEN or OUR, what should we do with payment instruction – Reject ?

I would say, you can always choose to reject a transaction. It is surprising that you support SHA and not BEN.

In BEN and SHA charging, you deduct charges from the transactions amount. So it is almost the same processing as far as I know.

For OUR charging, it is not allowed to take charges from transaction amount. So the process is more cumbersome.

Hi,

Can you tell me what is MT103 Global ACK FTP manual download transaction, And once they initiate this mode of transaction SWIFT copy will get generated or not?

Dear Mr jean

can you help me how TO KNOW IF I receive a real or a fake swift of payment (mt 103) from our client ?

Thank you so much

Dear Hanen, Thanks for connecting.

I just explain how things work.

Unfortunately, I do not provide that service.

I would suggest you connect with your bank.

Hi Jean-Paul,

I know that we can use field 23E: INTC on a single MT103.

But can we use it on a MT103 direct and cover method ? does it make any sense as a MT202cov is sent making sure that amount is applied on beneficiary account with same value date.

Thanks for your help.

Hello Jean,

In the ‘Narrative and note 2’ scenario – where the MT103 received by the ‘Sender’ does not have a 52 tag, will the ‘Sender’ be the ‘Ordering Institution’?

Thanks

Praneeth.K

Hello, Yes that is correct. In this case, the ‘Sender’ is the same as the ‘Ordering Institution’. That is why there is no need to mention the F52.

Hello Jean,

When and how F55 is used? Is that used in MT103 Direct only OR can it be used in MT103 Serial as well? Thanks.

Regards…Pulkit

Hi Jean Paul, nice to talk to you again!

I´ve a doubt about field 20, is it usually generated by the bank that issues the payment or is informed directly by the issuer?

HI Jean,

I am confused regarding use of 33B , you have mentioned that “Normally optional in the standard. It is mandatory because the country code of the Sender is CH and the country code of the receiver is FR. See Rule C2.”

but in the other article for MT103 where you have explained with optional tag there, you have not used 33B even though sender and receiver is having a different country. can you please elaborate?

Hi Jean, Please can you explain the different options we have in some some the MT103 text fields. eg, 50A, F or K. 52A or D. 53A, B or D.

When do we use a particular option and why.

Thanks

Hi Jean

Your Website has been most helpful in understanding more about MT103 swift transfer, however, I have an inquiry to make, is it possible for a sender to redirect MT03 swift to a different receiver after it has been sent?

Hi Jean,

Could you please share the index page of your website where I can navigate step by step to learn about SWIFT?

Thanks.

Dear Jean,

I find your information quite valuable. I had a question, in case there is an ultimate debtor which is a subsidiary, and the payment is being made by the head office from the account (IBAN) of the head office held with the sender bank, then how do the ultimate debtor (subsidiary) and debtor (head office which owns the account) get tagged in the MT103 that is sent by the sender bank?

ich brauche Hilfe um Heraus zu Finden wo mein Geld eine summe von 2000 Euro auf einer Ausland Bank Pollen ist meine Hausbank ist mir da nicht end gegen gekommen haben kein Interresse mir zu helfen

Please send me the sample SWIFT MT103 messages sent to SWIFT by the Sender (Credit Suisse) and received from SWIFT by the receiver (BNP PARIBAS)

Hi Jean-Paul

what are the options to to ensure that all account holders of a joint account are mentioned as order givers in the field 50, as it contains only 35 characters?

Thanks,

Dan

Hello,

We offer Swift MT760 BG/SBLC, FC MTN, BCL, DTC, KTT, EUROCLEAR, Bank Draft, Letter of Credit (LC), MT103 Etc.

N/B : Provider’s Bank move first.

Let me know if you have any need for the above offers.

Name: Paul Harrison

Email: paulharrison809@gmail.com

Thanks

Receiver or Mandate needed for MT103 direct cash transfer

Ratio:

Receiver:45%.

Mandate: 10%

Sender: 45%

First trenche: $1 million dollars

Total amount: $100 million dollars

Please note: Senders only need real and genuine Receiver and Mandate (USA, Canada, China, Singapore, Malaysia, Indonesia, South Africa, Philippines, etc)

Interested receiver must send CIS for due diligence after that receiver will be sent the DOA contract.

Message on email: witchapastang@gmail.com

Hello,

We offer Swift MT760 BG/SBLC, FC MTN, BCL, DTC, KTT, EUROCLEAR, Bank Draft, Letter of Credit (LC), MT103 Etc.

N/B : Provider’s Bank move first.

Let me know if you have any need for the above offers.

Name: Paul Harrison

Email: paulharrison809@gmail.com

Hello,

We offer Swift MT760 BG/SBLC, FC MTN, BCL, DTC, KTT, EUROCLEAR, Bank Draft, Letter of Credit (LC), MT103 Etc.

N/B : Provider’s Bank move first.

Let me know if you have any need for the above offers.

Name: Paul Harrison

Email: richardhugo1973@gmail.com

I am interested in the sample message